Lucille Jones, Analyst, Deals Intelligence, Refinitiv comments: “Rivian’s IPO could make its debut on Nasdaq as early as next week and could raise in excess of US$8 billion. At US$8 billion the IPO would be the 7th largest US company IPO of all time, the largest since Uber raised US$8.1 billion in 2019. It would also be the 2nd largest listing on Nasdaq of all time, after Facebook which raised US$16.0 billion in 2012.”

Q3 2021 hedge fund letters, conferences and more

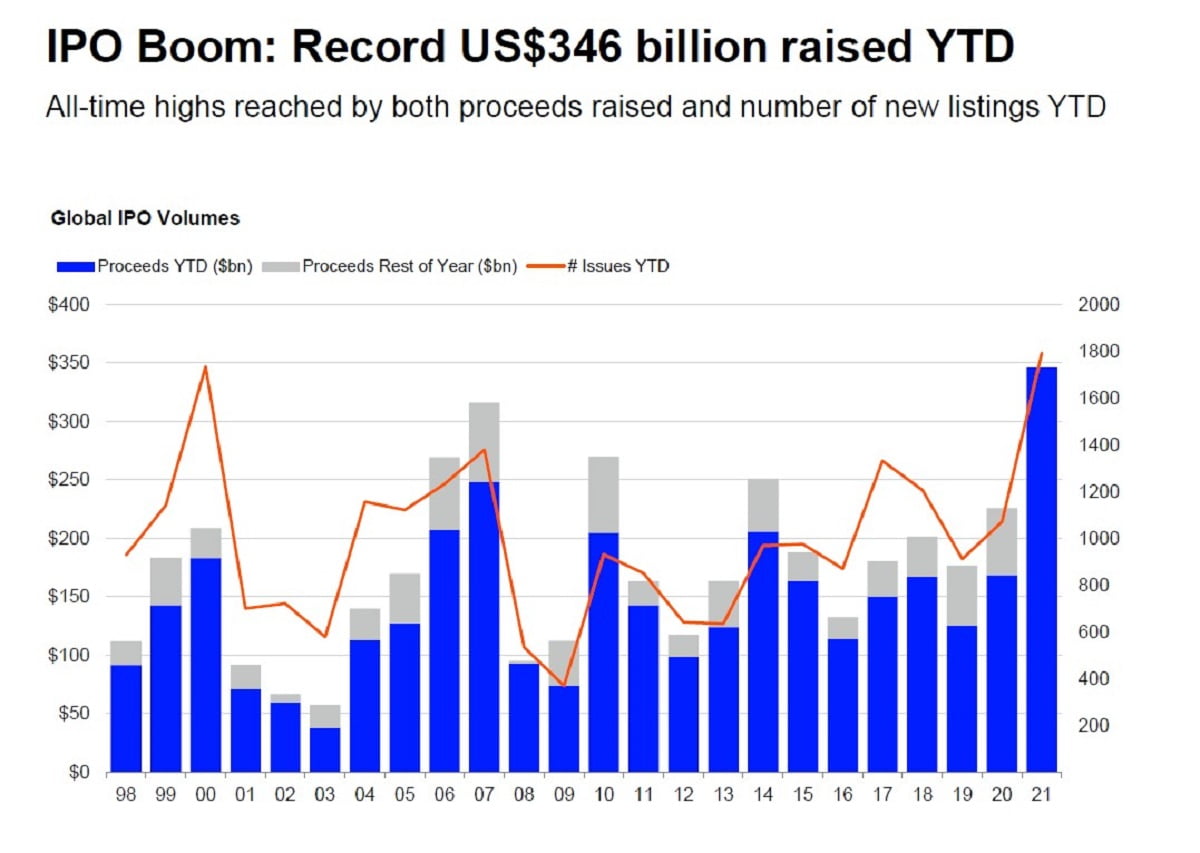

A Record Pace Of IPOs

- A total of 1,793 initial public offerings have been recorded globally so far during 2021, 67% more than the number recorded during the same period in 2020 and the highest year-to-date tally since our records began in 1980.

- Together these stock exchange debuts raised a record US$346.1 billion, more than double the proceeds raised during the same period last year and already exceeding the all-time full year record of US$316.0 billion, set in 2007.

- These figures do not include listings of special purpose acquisition companies, which have raised an additional US$144.5 billion globally so far during 2021.

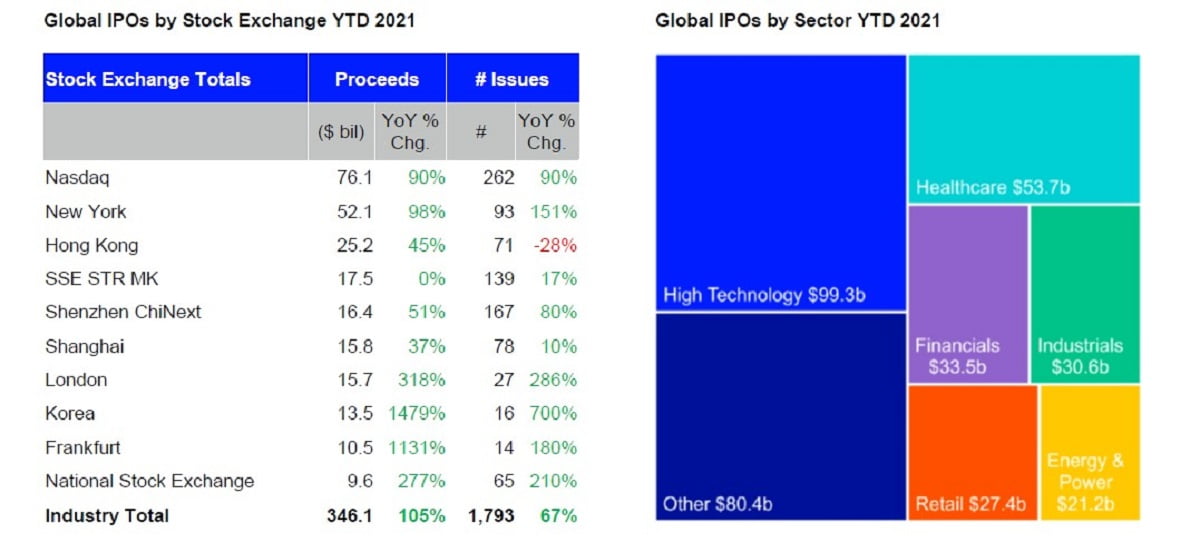

- Nasdaq is the most popular venue for IPOs by both proceeds and by number of deals. A record $76.1 billion has been raised on Nasdaq so far during 2021, already 42% more than the proceeds raised during the whole of 2020 and higher than any full year total since our records began in 1980.

- A total of 262 new listings have been recorded so far during 2021, a 90% increase in the number of listings from this time last year and a number last exceeded 21 years ago during the dot-com boom.

The Most Popular Venue For IPOs

- New York is the next most popular venue for IPOs by proceeds so far this year.

- $52.1 billion has been raised from 93 new listings so far during 2021, a seven-year high by both proceeds and number of listings.

- Hong Kong follows with 266 IPOs raising US$69.6 billion. The number of flotations increased 220% from this time last year, while the dollar value more than quadrupled to a fourteen-year high.

- Technology was the leading sector with 360 tech companies going public so far during 2021, more than any other year-to-date period since 2000.

- These companies raised a combined US$99.3 billion, accounting for 29% of total IPO proceeds raised so far this year.

Sources: Data - “Refinitiv Deals Intelligence” | Commentary - “Lucille Jones, Analyst, Deals Intelligence, Refinitiv”