Qualivian Investment Partners letter to investors for the fourth quarter ended December 31, 2019.

“The best time to buy a compounder was ten years ago. The second-best time is today”

Q4 2019 hedge fund letters, conferences and more

Overview

The Qualivian Focus Fund is an investment partnership focused on long-only public equities. We own a concentrated portfolio (15 -25) of understandable companies with wide moats, long reinvestment runways, and outstanding capital allocation. We expect them to compound capital at a mid-teens rate and hold them for an extended period. We have a private equity approach to public equities. We are seeking investors that are aligned with our long-term horizon. We do not short securities. We do not take on leverage. We are not macro investors. The fund primarily focuses on US companies of all sizes but can have 20% of its portfolio outside the US.

We buy carefully. We sell rarely. As per Warren Buffett, we believe the stock market is a mechanism to transfer wealth from the impatient to the patient. High quality assets with durable and growing cash flows are rare in a world awash in low and negative interest rates. When they are run by able management teams with excellent capital allocation, they are rarer still. We are quite comfortable sitting back, holding on, and watching the power of compounding work. The big money is made in the waiting not in scratching the itch to “do something”. We don’t mind watching paint dry.

Our formula:

Long-Term Orientation+ Long-Term Investors + Focused Portfolio + Quality Compounders = Maximizing Chance for Outperformance.

Our investors should understand how we invest so they make the right decision (both for them and us). We are not right for all investors. We would encourage shareholders aligned with our long-term horizon and philosophy to contact Aamer Khan ([email protected]) at 617-970-9583 or Cyril Malak ([email protected]) at 617-977-6101.

This letter discusses our Q4 and full year 2019 performance, recaps our core beliefs and thinking, and discusses an existing and a potential portfolio holding.

Qualivian Investment Partners: Performance of the Fund in 2019

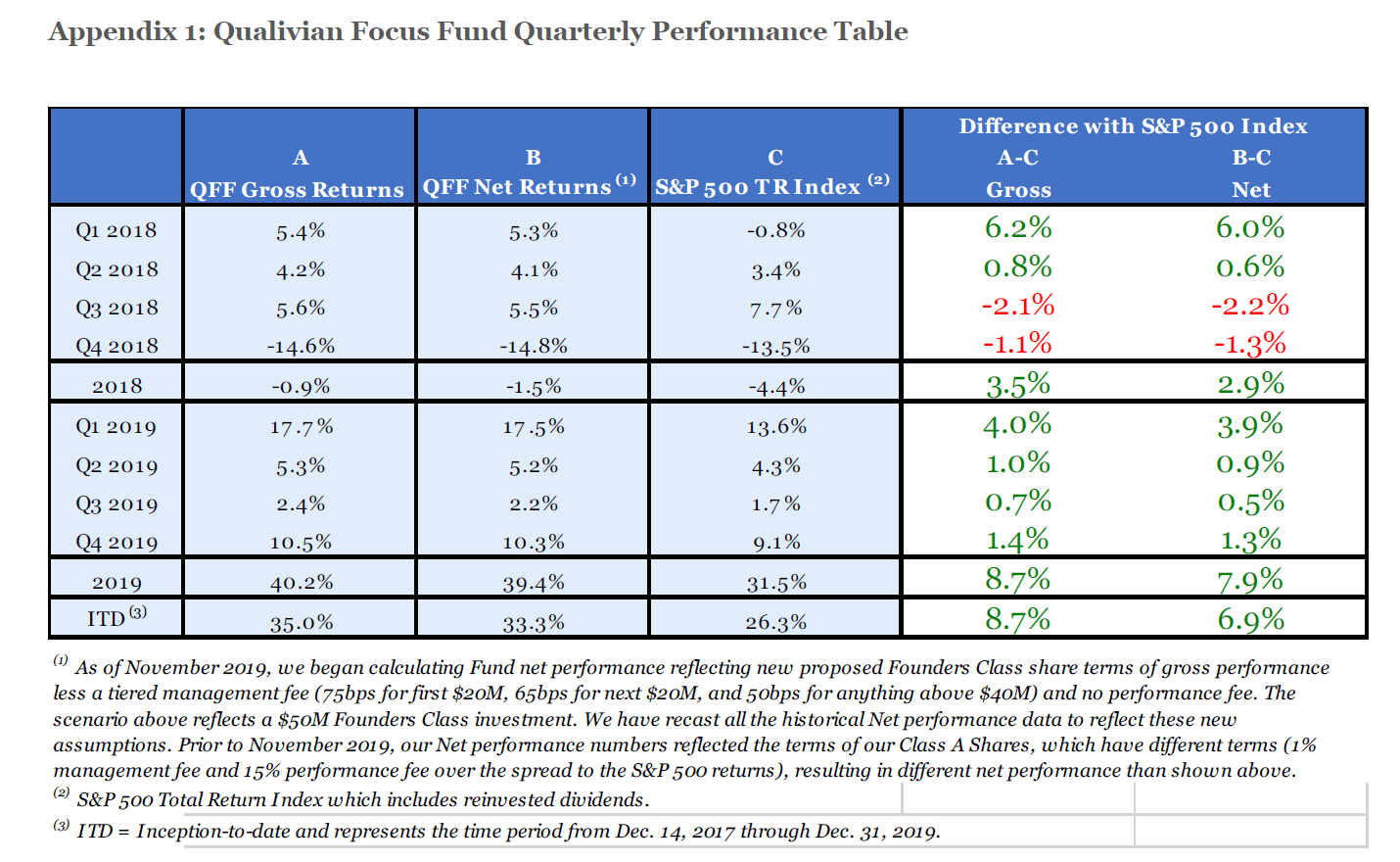

In 2019 we finished up 40.2% and 39.4% on a Gross and Net basis respectively, versus the S&P 500’s performance of 31.5%, or an outperformance of 8.7% and 7.9% respectively. We have outperformed the S&P500 each quarter in 2019: in Q1 our outperformance on a Gross and Net basis was 4.0% and 3.9%, in Q2 it was 1.0% and 0.9%, in Q3 it was 0.7% and 0.5%, and in Q4 it was 1.4% and 1.3% respectively.

Since inception of our fund in December 2017 through December 31, 2019, we returned 35.0% and 33.3% on a gross and net basis. The S&P 500 returned 26.3% in the same period. Appendix 1 contains a detailed quarter by quarter performance table.

Happy as we are with these results, we would caution our investors that smooth, quarter by quarter outperformance is unlikely to be repeated in the future. Even if it is successful, the desire to manipulate portfolios to have smooth quarterly outperformance is the enemy of long-term outperformance. Remember - no winner of the Tour de France has ever won every stage. We think you should judge us by our cumulative results over a 3 to 5-year period in line with our anticipated average holding periods for our stocks. Quarterly results will be lumpy.

In 2019 the number of holdings has fluctuated between 15-17. Some of our top contributors are well known large cap names in whose long-term competitive advantage we have confidence, and which we think will outperform the S&P 500 over the next 3-5 years. We prefer buying what we can understand well over buying esoteric names with trendy business models that are harder to figure out. Regarding investment candidates, what should matter is the quality of their franchises, and not their novelty. Sometimes the two get confused, because there is a link in some areas, like art or poetry. We don’t think there is a link in investing.

Our top 3 contributors in 2019 were Mastercard (MA), Moody’s (MCO), and Apple (AAPL). Our bottom three contributors were Altria (MO), Booking Holdings (BKNG), and Nordson (NDSN). It is interesting to note that our bottom 3 contributors were still positive contributors to the fund. Since inception our turnover has been low, averaging 20% per year. Names we added to during the year were Brookfield Asset Management (BAM) and Broadridge Financial (BR). Names we exited were Nordson (NDSN), Alibaba (BABA), Altria (MO) and Booking Holdings (BKNG).

Qualivian Investment Partners: Sold Positions

The names we exited in 2019 were:

NDSN: a fine industrial company which we highlighted in our Q2 2019 investor letter suffered from an extended down cycle in its high margin mobile electronics segment that sells adhesive dispense and chip testing equipment into the mobile handset market. This in combination with the change in the long-term CEO at the helm, Mike Hilton, in mid-2019 reduced our confidence in our ability to forecast NDSN’s long-term growth trajectory. We continue to monitor NDSN and await to understand the new CEO’s strategic priorities for the company going forward. We used the proceeds from NDSN to largely fund our position in Brookfield Asset Management, which we think has a more sustainable long-term earnings growth and greater potential upside in the stock.

BABA: This was a stub position since we exited much of the position in 2018. We were attracted by the strength of its platform, its scale, and its founder-led mentality. However, we felt that BABA’s legal form, a variable interest entity (VIE), combined with uncertainty in the US China business and trade relationship, diminished our confidence in looking out 3- 5 years.

MO: This was a mistake to begin with, in retrospect. We were attracted by its high returns on capital, plentiful cash generation, and oligopoly position. Its acquisition of JUUL, which it had to write down, demonstrated poor capital allocation.

BKNG: We owned Booking since the fund’s inception as we were attracted by the attractive virtual cycle generated by the company’s two-sided network in travel, and especially its core holding, Booking.com, which had a stronghold on the attractive European travel bookings. Booking exhibited superior growth, margins, and returns on capital but we became increasingly concerned that the growth and margins were being increasingly assailed by Google, historically BKNG’s largest search ad distribution platform.

Continue reading the Qualivian Investment Partners article here.