Qualivian Investment Partners commentary for the month ended December 31, 2020.

Q3 2020 hedge fund letters, conferences and more

Dear Friends of the Fund,

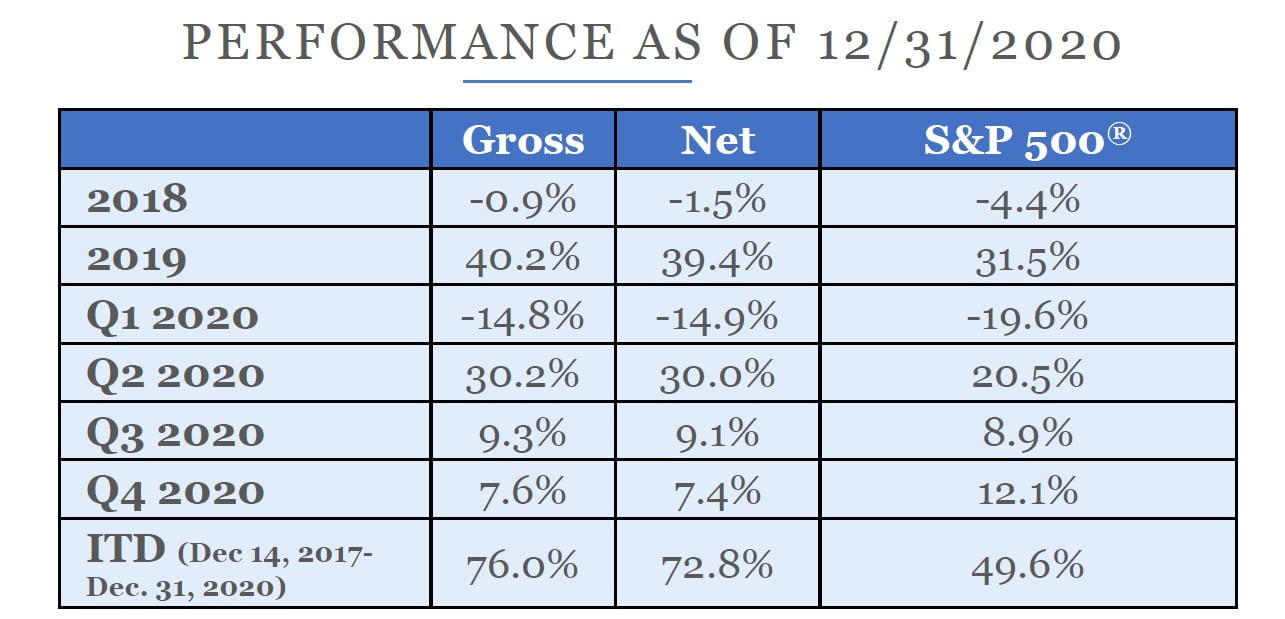

First and foremost, we hope that you and your families are staying safe and well. Please find our December 2020 performance report below for your review. Qualivian reached its three year track record in December 2020 and is comfortably ahead of its benchmark. We are actively weighing investment proposals.

Starting in November 2019, we proposed new more beneficial terms for Founders Class shares and we have recast the Net performance numbers to reflect a Founders Class share investor with these new terms. Please refer to the footnotes for the specific assumptions used.

We have included an overview of our fund, investment strategy and process below for your review. These have been updated for the new terms.

To summarize, Qualivian employs a "private equity approach to public markets" by owning a concentrated portfolio of high-quality businesses for the long term, benefiting from the compounding of intrinsic value over time. In brief:

- Concentrated (15-25 holdings), best-ideas equity strategy with 3 to 5+ year holding periods

- Launched in Dec. '17 by Aamer Khan, CFA, and Cyril Malak; both experienced investors (Eaton Vance, Putnam, Principal), strategy consultants (Bain, Gemini/MAC Group), and Wharton MBAs

- Seek stocks that are "Quality Compounders," with wide moats and shareholder-friendly management teams that rationally deploy capital at rates of return well in excess of their cost of capital

- The fund is designed to offset issues that typically mute investment performance returns at larger asset managers (e.g. over-diversification, excessive trading/frictional costs, information loss, and short-termism)

Review Cumulative Performance:

We are attaching Qualivian's performance through December 31, 2020. We are pleased to report we have outperformed the S&P 500 by 26.44% and 23.19% on a gross and net basis inception-to-date (ITD). In 2019, the fund exceeded the S&P 500's 31.49% by 8.73% and 7.88% on a gross and net basis respectively. Finally, in 2020, the fund outperformed our benchmark by 11.99% and 11.24% respectively.

View Our Deck:

Click here to review our marketing deck and familiarize yourself with our strategy and process.