The outlook for precious metal prices by Craig Hemke, founder TF METALS REPORT

The year 2019 saw a resumption of the bull markets for both gold and silver. After a nearly seven-year period of lower prices and consolidation, the price of gold broke out in June of 2019.

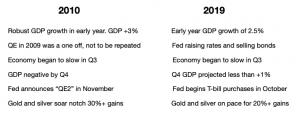

This is almost precisely what we forecast back in January. (https://www.tfmetalsreport.com/blog/9151/2010-9) In a post titled “2010+9”, we laid out the case for why a renewed bull market would begin this year. We suspected that the year 2019 would unfold in a similar manner to 2010, and it has.

As this all came to pass, our forecast was for the best annual gains for the precious metals since 2010 and we’ve been correct. Both gold and silver are up more than 15% year-to-date.

So what happens next for precious metal prices? Will 2020 be like 2011?

In 2020, global interest rates will head even lower and the central banks, led by the US Federal Reserve, will institute overt and direct debt monetization programs before year end. This will lead to a continued surge in demand for precious metal in all its forms…physical metal, futures contracts, ETFs, unallocated accounts and mining shares. Once above $1550 on a weekly closing basis, the dollar price of gold will first move toward $1650/ounce and then, once that level is bested, the next target will be $1800.

But it’s not just precious metal prices that are set to rise in 2020. Next year will very likely bring tremendous upside gains to the mining shares, as well. Why?

This 2019 rise in the price of gold from $1280 to $1550 has allowed the large, producing mining companies to post incredible gains in their quarterly profits. For the third quarter of 2019, many miners reported year-over-year EPS growth of 100-400%. This brought some attention to the sector however, as prices continue to rise and EPS rise with them, the focus on the sector’s improving fundamentals will increase.

Precious metal prices and asset allocation

At present, the total global asset allocation to the precious metals is under 1%. At its peak, this allocation reached 8% in 1980 and the median allocation over the past forty years is close to 2.5%. Therefore, one can deduce that even a small shift in global sentiment toward the sector will produce a seeming avalanche of funds looking for investment opportunities.

From there, it’s simply supply versus demand. If investment demand (cash) increases two or three fold while the supply of investment opportunities (publicly-traded companies) remains constant, the only solution is higher prices.

How high? Already in 2019, we’ve seen the large-cap mining ETF, the GDX, soar by over 30%. However, if higher precious metal prices lead to a surge in demand for mining shares in 2020, it’s quite possible this ETF could fully double in price from its current $27/share price to $55 or even higher.

In summary, the year 2019 has been a great one for precious metals investors as a renewed bull market has begun. But the year 2020 has the potential to produce the type of gains not seen since 2011 as central banks lower interest rates and monetize debt in their attempts to manage an impending global economic slowdown and recession.

Thus, the time is now to prudently add to your portfolio at least some exposure to precious metals.

Bio

Craig Hemke is the creator and producer of TF Metals Report, an online newsletter, blog and podcast that tracks daily news, trends and analysis of the precious metals space.

Hemke received a degree in economics from the University of Nebraska and has spent the past three decades in the financial services industry. The financial crisis of 2008 challenged Hemke’s views of the markets and prompted a new interest in precious metals. He conducted extensive research in the space and shared his views in online forums with other financial advisors. His voice on the global metals market grew, and in 2010, he launched the TF Metals Report online community.

Through blog posts and podcasts, he provides a unique analytical perspective on the intersecting forces that impact metals prices. Hemke uses this perspective to predict market moves and offer an alternative viewpoint.

To reach him, please email, [email protected].