Introduction

In his best-selling book “One up on Wall Street” Peter Lynch included this subtitle on his cover: “How to use what you already know to make money in the stock market.” And later in the book he talks about “the power of common knowledge.” Stating it over simplistically, Peter Lynch often talked about getting his best ideas from observing his family’s shopping habits.

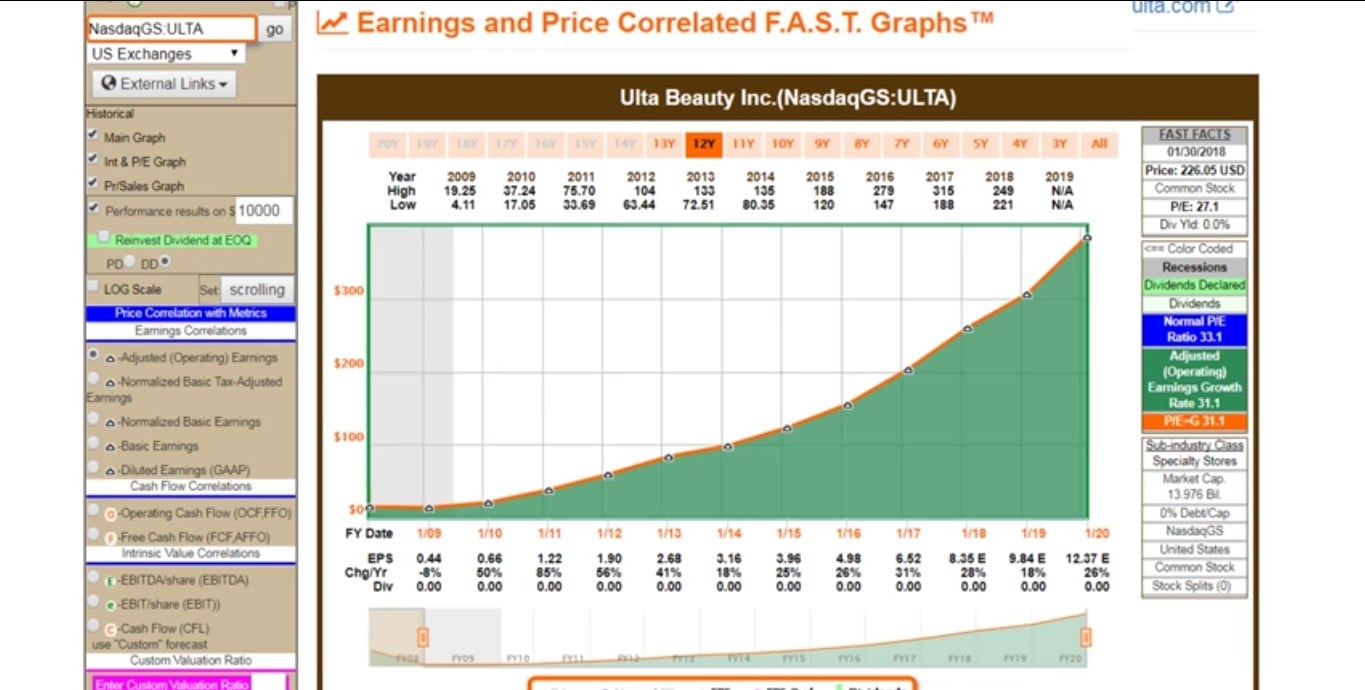

Last weekend, I had a Peter Lynch “invest in what you know” experience of my own. My daughter came to visit, and she and my wife went out shopping. When they returned, they had a large bag full of makeup and cosmetics from Ulta Beauty Inc (ULTA). So of course, in the spirit of my respect for Peter Lynch’s wisdom, I immediately turned to FAST Graphs and brought up an earnings and price correlated graph on Ulta Beauty Inc.

What I found was a very pleasant surprise. Ulta Beauty Inc. has a fabulous history of consistent historical earnings growth averaging 35% per annum since 2009. But best of all, this consistent growth stock appears to be trading at a low valuation relative to its high historical growth. On the other hand, the company appears fully valued based on future expectations for growth. Nevertheless, the company also generates consistent and strong operating and free cash flow growth, and has a pristine balance sheet with only 0% debt to capital.

Personally, I have a great deal of respect and admiration for Peter Lynch and his teachings. However, I also have too much respect for Peter Lynch to simply purchase Ulta Beauty solely because my wife and daughter like to shop there. You see, it’s true that Peter Lynch often got ideas from observing his family’s shopping habits. On the other hand, it’s also true that Peter Lynch believed in conducting comprehensive fundamental research and due diligence.

MarketWatch published an article on Dec 28, 2015 titled: “Peter Lynch, 25 years later. It’s not just “invest in what you know.” The following excerpt validates and elaborates on Peter Lynch’s philosophy:

“Peter Lynch wants you to know that his ideas are being misquoted widely.

“I’ve never said, ‘If you go to a mall, see a Starbucks and say it’s good coffee, you should call Fidelity brokerage and buy the stock,’” Lynch says, some 25 years after his retirement from running Magellan Fund was front-page news.

Following the market still at age 71, he instead explains his philosophy this way:

Use your specialized knowledge to hone in on stocks you can analyze, study them and then decide if they’re worth owning. The best way to invest is to look at companies competing in the field where you work. Someone with deep restaurant-industry experience would have predicted the success of Panera Bread Co. and Chipotle Mexican Grill Inc., he says: “If you’re in the steel industry and it ever turns around, you’ll see it before I do.

What’s wrong with the popular-wisdom version of his ideology, which is usually cited as “invest in what you know”? It leaves out the role of serious fundamental stock research. “People buy a stock and they know nothing about it,” he says. “That’s gambling and it’s not good.”

In summary, just like Peter Lynch, I have often got my best growth stock ideas from observing what family and friends are buying and what they like. On the other hand, just like Peter Lynch, I believe in conducting comprehensive fundamental research and due diligence before I invest. This is important, because often what is popular with the public is also simultaneously what is overpriced by the market.

Ulta Beauty Inc. At a Glance

Note: my series of articles for 2018 will be written to present what appear to be attractively valued research candidates that also reflect a timeless value investing principle. Therefore, my secondary objective for 2018 articles will be to provide pre-screened and apparently attractively valued research candidates available for different investment objectives. I decided to do this because one of the biggest complaints I’m hearing from investors today is that it’s hard to find attractively valued investments in this overheated market. Keep in mind that in every market – whether it is a bull market or a bear market – there will be attractively valued stocks to be found. To learn more about my plans for 2018 checkout my blog post here.

Consequently, my 2018 articles will be oriented toward providing a “by the numbers” fundamental evaluation of each candidate presented. Therefore, my goal is to screen and provide attractively valued common stock investments that investors can research deeper on their own. Importantly, many of these candidates will be presented prior to my conducting a comprehensive research and due diligence process. As a result, I will be able to provide loyal readers with many more opportunities than I could if I waited to write the article after I spent the time and effort to conduct extensive research.

Zacks published a research report on January 30, 2018 that nicely summarizes Ulta Beauty’s current operating results. The report was titled “Can Ulta Beauty’s Robust Strategies Offset Hurdles?

“Ulta Beauty Inc. has been gaining from its effective marketing initiatives, loyalty program, sturdy e-commerce business, superb salon operations and strength in prestige cosmetics. Additionally, favorable traffic is driving comparable store sales (comps) growth. The company’s notable growth in e-commerce sales has also helped it stand out amid intense online competition. However, declining margins and stiff competition remain impediments. The company shares have declined 13.6% in the past three months, underperforming the industry’s growth of 19.8%.”

“About Ulta Beauty from their website:

Ulta Beauty (NASDAQ: ULTA) is the largest beauty retailer in the United States and the premier beauty destination for cosmetics, fragrance, skin care products, hair care products and salon services. Since opening its first store in 1990, Ulta Beauty has grown to become the top national retailer providing All Things Beauty.

The Company offers more than 20,000 products from approximately 500 well-established and emerging beauty brands across all categories and price points, including Ulta Beauty’s own private label. Ulta Beauty also offers a full-service salon in every store featuring hair, skin and brow services.

Ulta Beauty is recognized for its commitment to personalized service, fun and inviting stores and its industry-leading Ultamate Rewards loyalty program. As of October 28, 2017, Ulta Beauty operates 1,058 retail stores across 48 states and the District of Columbia and also distributes its products through its website, which includes a collection of tips, tutorials and social content.”

Value Investing Principle: Higher Growth Is Worth a Higher Valuation

In Part 1 found here I discussed how even companies with no growth had value worth more than one times their income stream. I also pointed out that 15 times earnings as a norm was more or less a reasonable valuation derived from a base line multiple of a non-growing fixed income interest rate. This also relates to investing only when the company’s earnings yield is equal to or greater than typical yields available from quality fixed income instruments (15 P/E ratio equals 6.67% earnings yield).

It should also be noted that when growth was 5% or lower, dividends became more prevalent and important. From 5% growth to 15% earnings growth, dividends continued to play an important role. For these mid to approaching high growth ranges, the current dividend yield is typically less, but grows faster. Of course, these are generalizations that apply prominently but not in all cases.

Today we move to the third category of pure growth of 15% or better. When earnings growth rates are at, above, or near 15%, you will often find characteristics that are similar to the 5% – 15% category. However, as rates get higher, dividends become rarer and P/E ratios increase to reflect the higher growth. Much of this can be attributed to the reality that a fast-growing company needs to utilize all or most of their available capital to fund their growth.

At these higher growth rates, the concept of the PEG ratio (P/E = Growth Rate) comes into play. The PEG ratio is a reliable indicator of intrinsic value for fast growing businesses up to a point. There are no hard-and-fast rules here, instead, common sense principles that are based on mathematical realities. Coincidentally, Peter Lynch is also widely considered the originator of the price-earnings ratio equal to the company’s growth rate as a valuation indicator. Peter’s ideas have morphed into what is commonly called the PEG ratio (P/E ratio equal to EPS growth).

Due to the power of compounding, a faster growing business will generate a significantly higher level of future earnings than a slower growing business. Consequently, with companies that are growing very fast (15% or better) you end up paying a much lower future valuation for the significantly higher level of future earnings. However, it’s implicit that those higher forecast earnings levels actually become real. Nevertheless, because a faster growing company generates such a high level of future earnings, its implied current intrinsic value level will naturally be higher than a slower growing business. On the other hand, it’s very difficult for a business to grow fast. Therefore, higher growth stocks also carry greater risk. Note: at the end of the video in this article I will illustrate just how risky growth stocks truly are with a look at Stericycle.

Furthermore, when I am trying to determine the intrinsic value of fast growing businesses, other factors come into play. Things like the current size of the businesses, under the concept that it’s easier to grow faster off of a smaller base. Also the predictability of the future growth or at least the perception of future growth will affect valuation. The quality of the company and the industry it’s in are also important factors. An additional important factor would be the total size of the market the company’s business operates in, etc.

There are many other factors, but hopefully you get the point. Due to the power of compounding, fast growth generates a much larger future income stream, and therefore higher potential future returns. The concept of capitalizing a future income stream is the key factor that determines true worth for all investments, especially stocks. And very fast-growing companies generate a lot of future earnings for the market to capitalize.

The important takeaways from this article are that valuation coupled with earnings growth are important investor considerations. Given the correct valuation, the rate of change of earnings growth is the primary factor that generates the magnitude of future returns. But remember, it’s also important to acknowledge that higher growth is harder to achieve and therefore more risky. Therefore, growth stocks naturally command a higher valuation than slower growing companies.

There is less mystery in the investing process when these concepts and principles are understood. Investing should never be a mere guessing game, nor should investors be purchasing a “pig in a poke.” Investors that have a working knowledge and understanding of valuation and its relationship to the company’s growth will have realistic and intelligent expectations regarding their future returns and the risk they are taking to achieve them.

FAST Graphs Analyze Out Loud Video: ULTA

There are many so-called investors who eschew reviewing historical fundamental operating results on the notion that history is merely rear-view mirror thinking or 20/20 hindsight. I believe they are drastically short-changing themselves. Although it is true that we can only invest in the future, it is equally true that we can learn a great deal from carefully examining the past. Because, as Sir Winston Churchill so eloquently put it: “Those who fail to learn from history are doomed to repeat it.”

Furthermore, they say that a picture’s worth 1000 words, but if true, then how many words is a video worth? I don’t have an exact answer, but I assure you that a well-produced video analyzing a company’s fundamental strengths and weaknesses is worth many many more. With the video format and the utilization of FAST Graphs (the fundamentals analyzer software tool) I know that I can provide a more comprehensive fundamental evaluation and analysis than I could with a long article comprised of thousands of words. Therefore, the following video highlights the attractive valuation of Ulta Beauty, Inc.

Summary and Conclusions

Ulta Beauty Inc. is a classic example of a true or pure growth stock. The company has consistently increased its earnings at double-digit rates exceeding 25% per annum since 2009. Furthermore, Ulta Beauty is currently available at a valuation that is low by historical standards. Additionally, the company has a strong balance sheet and is forecast to continue growing earnings in excess of 20% per annum over the longer run.

However, even though Ulta Beauty’s current valuation is low by historical norms; it is currently higher than its forecast growth rate. Therefore, from the perspective of future returns, it could be argued that Ulta Beauty is moderately overvalued on that basis. On the other hand, if the company does continue to grow earnings at a 20% rate or better, then future return expectations would still be double-digit.

Nevertheless, based on future expectations, I would consider Ulta Beauty moderately overvalued at the worst, and fully valued at best. Consequently, I would prefer picking it up at a lower valuation. However, I believe valuation is sound enough to start nibbling, and certainly sound enough to be worthy of conducting the time and effort for a full research and due diligence process.

Disclosure: No position.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.

Article by F.A.S.T. Graphs