Perritt Capital Management commentary for the second quarter ended June 30, 2019, titled, “Whac-a-Mole.”

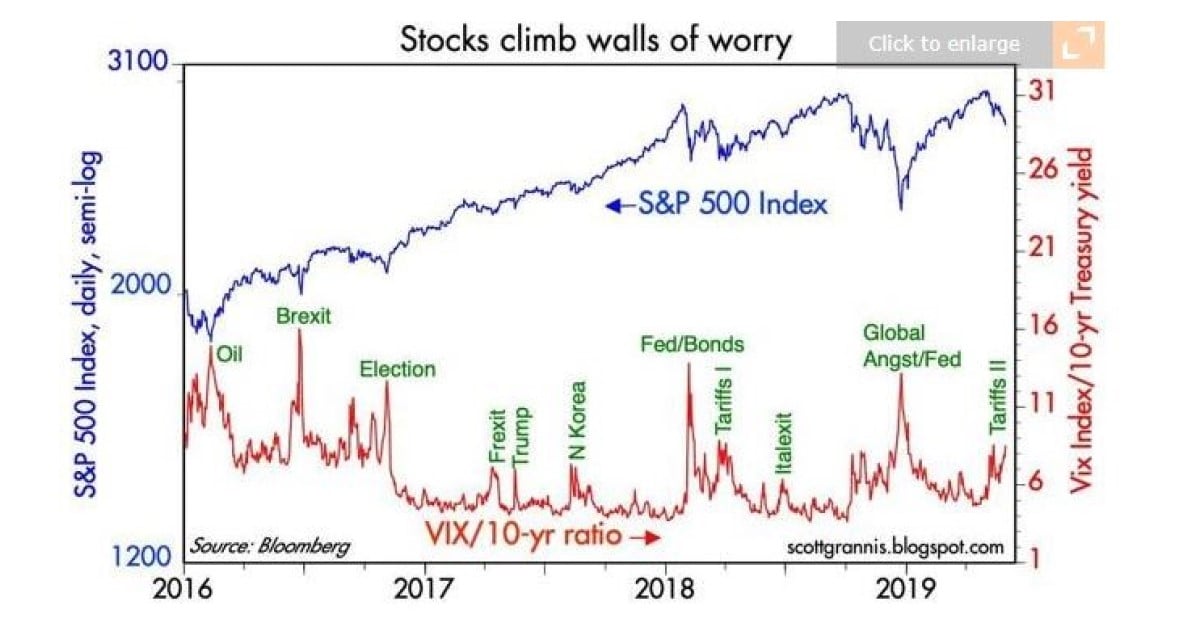

Lately it feels like the market has been playing a game of Whac-a-Mole. The moles (market worries) pop up from their holes at random and the market moves down accordingly until the mole goes back into its hole, or the worries have been placated. There are many types of “moles”: recession, longevity of this bull market, interest rates, Trump, Iran, tariffs, and rising levels of debt to name a few. We can see some mole events in the following chart as indicated by the red spikes and the market reaction to them.

Q2 hedge fund letters, conference, scoops etc

The biggest threat may be the Fed and interest rates. In May, Powell said it was unlikely the Fed would cut rates. As soon as a month later, he indicated that the case for a rate cut was strengthening. The market and the Fed seem to be at odds though. Futures trading points to four cuts in the next year. We could see a big drop in the market if the Fed doesn’t acquiesce. The case for cutting rates does seem stronger though: global economic data is mixed, tax-cut stimulus is finished, and the trade war is taking a toll.

This has all resulted in many nervous investors. They have turned to bonds and other vehicles, such as low volatility ETFs and Quality ETFs to minimize a downfall in the market. Individual investors are on track to buy a majority of the U.S. government’s newly issued longer term debt. This is a first since the Treasury Department began publishing data from its auctions. The 10-year Treasury note has fallen to multi-year lows. An investor recently stated, “What they’re yielding right now doesn’t matter – I’m looking for downside protection.” Are we headed the way of Europe and Japan? Negative interest rates in Europe and Japan have left investors effectively paying governments to hold their money when they purchase 10-year government securities. Funds that focus on low volatility have also become popular taking in nearly $12 billion year to date, more than double that of any other factor this year and the most for a six-month period since 2016.

While the overall stock market continues to play this game of Whac-a-Mole, we have noticed a new trend emerge in the past few months within the micro-cap space. We have seen a waive of merger and acquisitions as well as significantly positive news items from micro-cap companies. Not only did five of our companies get buyout offers, ten companies made accretive acquisitions themselves. Below are just a few of the positive news we saw from our portfolio companies in the past three months.

News:

- Medicine Man Technologies (MDCL) announced that the company signed a letter of intent to acquire two cannabis cultivation facilities. This is part of the company’s expansion plans within the legal cannabis space and is being financed with a portion of the proceeds from the announced strategic investment of up to $14 million from Dye Partners.

- New Age Beverage Corp. (NBEV) announced the launch of a portfolio of products in the CBD space with plans to roll out their line in 60 different countries throughout 2019. The company is launching through five channels made up of direct-toconsumer, direct-store-door, traditional retail, e-commerce and medical channels. Additionally, they have signed agreements to market CBD enhanced drinks under their currently held license for the Bob Marley brand.

- ASV Holdings, Inc. (ASV) announced a definitive merger agreement with Japan based Yanmar for a total of $70.7 million in proceeds for ASV, which came out to $7.05 per share of stock. This represented a premium of approximately 330% over the previous day’s closing price of $1.68 per share.

- Rudolph Technologies, Inc. (RTEC) and Nanometrics Incorporated agreed to combine in a merger of equals transaction. Rudolph shareholders will receive stock and own 50% of the combined company. The resulting entity will provide complementary products and increased scale.

- PCM, Inc. (PCMI) Insight Enterprises entered into an agreement to acquire PCMI for $35 per share, representing a 36% premium to its 1-month average closing price.

- Global Brass and Copper Holdings, Inc. (BRSS) was acquired by Wieland-Werke AG for $44 cash per share representing a 27% premium to its closing price at the time of the announcement (4/10/19).

- Several additional portfolio companies announced meaningful contracts or distribution agreements.

This article first appeared on ValueWalk Premium