If the past year was dominated by the huge human costs of COVID-19, the next few years will be about its economic aftermath, including the alarming rise of US debt. What’s needed is multilateral cooperation – a new ‘Grand Alliance.’

Q3 2020 hedge fund letters, conferences and more

On Friday, Congressional leaders failed to secure a bipartisan deal on a $900 billion pandemic relief package. A government shutdown was avoided only with a 2-day extension.

A protracted shutdown would amplify the risks for pandemic escalation and economic crisis, amid the long-awaited vaccine rollout. Bipartisan tensions are compounded by the impending Georgia Senate runoff races in January that will determine control of the chamber in the Congress.

In 2019, the Congress suspended the debt ceiling until after the 2020 presidential election. While it sought to avoid a repeat of the 2011 and 2013 debt crises during an election year, new spending contributed to Trump’s new military rearmament drive.

The new Congress must decide the future of the debt ceiling by summer 2021.

High US Debt Burden

By the year-end, COVID-19 cases worldwide will be close to 80 million. As a result of utter mismanagement, US figure will be close to 20 million.

While the pandemic continues to spread and the health system is overwhelmed, the Trump White House has taken record amounts of debt in record pace.

During his campaign, Trump pledged to eliminate US national debt in 8 years. At the time, total public debt was $19.6 trillion. In the past 4 years, it has soared to more than $27 trillion, by almost $8 trillion. It was an achievement of sorts. What former President Obama achieved in 8 years, Trump did in just 4 years.

Of course, all major Western economies have taken record amounts of debt during the global pandemic. But United States is not like other economies. First, it has more COVID-19 cases relative to all other major economies. Second, US remains a world anchor economy. Third, US dollar dominates international transactions. As a result, excessive US debt will have disproportionate global spillovers.

How will the Democrats cope with the debt burden?

Instead of focusing on the size of US debt, says Jason Furman, Obama’s former head of the Council of Economic Advisers, “policymakers should assess fiscal capacity in terms of real interest payments, ensuring they remain comfortably below 2 percent of GDP.” That, Furman believes, would ensure adequate fiscal support and needed public investments, while maintaining a sustainable public debt.

Here’s the logic of the argument: As a share of GDP, the cost of servicing US debt has fallen since 2000, even as federal debt has increased. An environment of low interest rates makes it easier to pay off debts.

So, Furman argues, the Biden administration can manage primary deficits (noninterest spending minus revenue) without “an unlimited explosion of debt.”

Short-Term Gains, Long-Term Challenges

That’s likely to be the stance of the Biden administration’s proposed economic team, which will stress both growth and equity.

The team includes former Fed chief Janet Yellen as the new Secretary of Treasury, her former right-hand man Jerome Powell as current Fed chair, and labor economist Cecilia Rouse as chair of the Council of Economic Advisers (CEA). CEA members feature Jared Bernstein, Biden’s chief economist in the Obama era, and Heather Boushey, the cofounder of the Washington Center for Equitable Growth.

Nevertheless, the likely policy stance, whether implicit or explicit, is predicated on unsustainable debt-taking in the future.

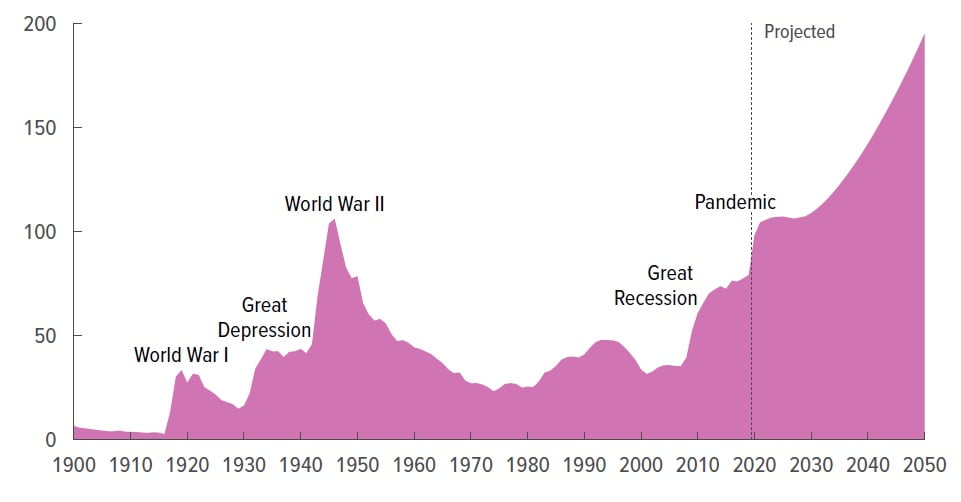

According to the recent projections by the nonpartisan Congressional Budget Office, federal debt held by the public will surpass its historical high of 106% of GDP in 2023 and will continue to climb in most years thereafter. By 2050, debt as a percentage of GDP will amount close to 200% of the GDP. Despite peaceful conditions, it is already at the level of World War II; by 2050, it could be twice as high (Figure 1).

Figure 1 - US Debt Held by the Public, 1900 to 2050 (as % of GDP)

Source: Data from CBO (Sept 2020)

Worse, US debt is likely to increase faster than anticipated. Current projections do not include the full costs of the pandemic stimulus packages, or the “needed public investments” that the Biden administration will seek to promote.

What will be good to the US economy and global prospects in the short-term could prove highly detrimental to both in the long-run.

Here’s why: Deficits will more than double from an average of 4.8% of GDP from 2010-19 to 10.9% percent 2041-50 driving up debt. As a result, net spending for interest will account for much of the increase in total deficits in the last two decades of the projection period.

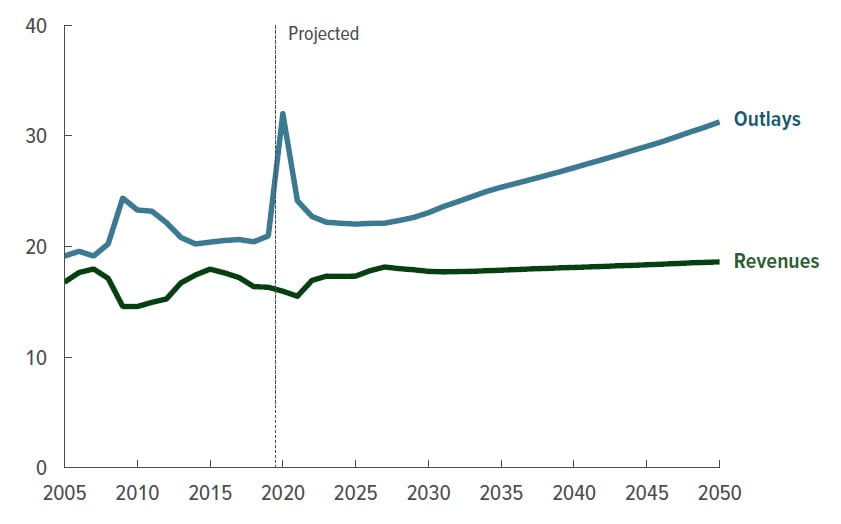

Markets plan on quarterly basis. Presidential terms have barely a 4-year perspective. As a net effect, long-term perspective is lost in the translation. In CBO’s projections, growth in outlays will continue and accelerate to outpace growth in revenues, resulting in larger budget deficits over the long run (Figure 2).

Figure 2 - Percentage of GDP: Outlays Vs Revenues

Source: Data from CBO (Sept 2020)

So, what about those “sustainable” real interest rates? Measured as a share of GDP, net spending for interest could nearly quadruple over the last two decades of the projection period.

From overreach to new 'Grand Alliance'

In addition to US banks and investors, the Fed, state and local governments, mutual funds and pension funds, foreign governments hold a third of the US public debt. The largest holders include Japan ($1.3 trillion), China ($1.1 trillion), and UK ($430 million). To cope with its soaring debt, US will depend on these contributions.

However, Japan is the world’s most indebted major economy (government debt to GDP exceeds 238%). Due to maturing, aging and population decline, its burden will continue to increase, while the Brexit costs will penalize UK economy for years.

Biden administration has promised to be tough on China, Russia and several other countries, which could translate to rising defense and security allocations - which, in turn, would further amplify soaring debt, twin deficits and real interest rates.

When great powers fail to balance wealth and their economic base with their military power and strategic commitments, they risk overextension, as historian Paul Kennedy warned in the late ‘80s. In the coming decades, that will be a key US risk.

Nothing is inevitable in life, however. There is a great opportunity amid the rising threats. That’s multilateral cooperation across all political differences among the world’s largest economies. It has been achieved before, and it could be achieved again, as evidenced by F.D. Roosevelt’s ‘Grand Alliance’ during World War II.

In the 1940s, war threatened to result in excessive debt. Today, excessive debt risks wars that will have no winners.

About the Author

Dan Steinbock is the founder of Difference Group and internationally recognized expert of the multipolar world economy. He has served at the India, China and America Institute (US), Shanghai Institute for International Studies (China) and the EU Center (Singapore). For more, see http://www.differencegroup.net/