Open Finance is not just considered to be an extension but the next big step in the fintech journey. Over the past decade, Fintech companies have been quite successful in digitizing financial services that improved both access and user experience with low concentration risks.

Q2 2021 hedge fund letters, conferences and more

Fintech companies emerged to give a more balanced competition to traditional banks in two areas; accessibility and convenience of financial services. Back in 2018, the global fintech industry was worth $127.66 billion and is forecasted to reach $309.98 billion by 2022.

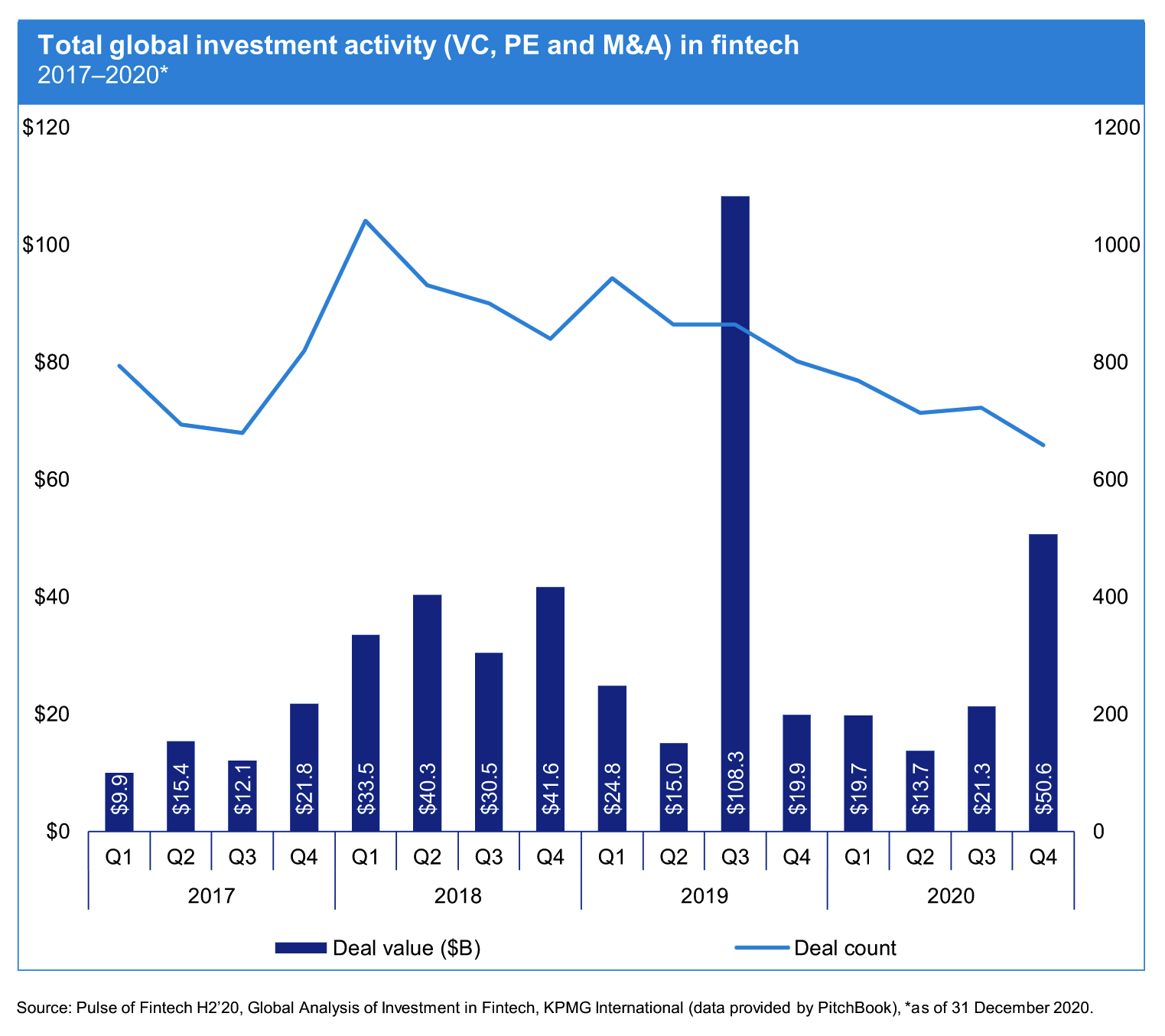

Amidst the pandemic, the VC investments in fintech have gone down from $168 billion in 2019 to $105 billion in 2020. However, the last quarter of 2020 has been great as $71.9 billion were invested in the second half of 2020, more than double the $33.4 billion investment we saw in the first half of the same year.

This rapid growth and increasing competition have pushed traditional banks to develop better infrastructure, products and use integrative protocols to share financial data with fintech companies that will enable them to collaborate and develop new consumer-focused financial products and services. This dual-sided collaborative process results in a new set of financial services known as Open Finance.

The Opportunities

The collaboration between traditional banks and fintech companies in Open Finance presents major opportunities, as it provides greater transparency and convenience to encompass investments, savings, credit, lending, and mortgages for both individuals and businesses. Let's discuss how Open Finance helps create a better and transparent ecosystem for both lenders and consumers.

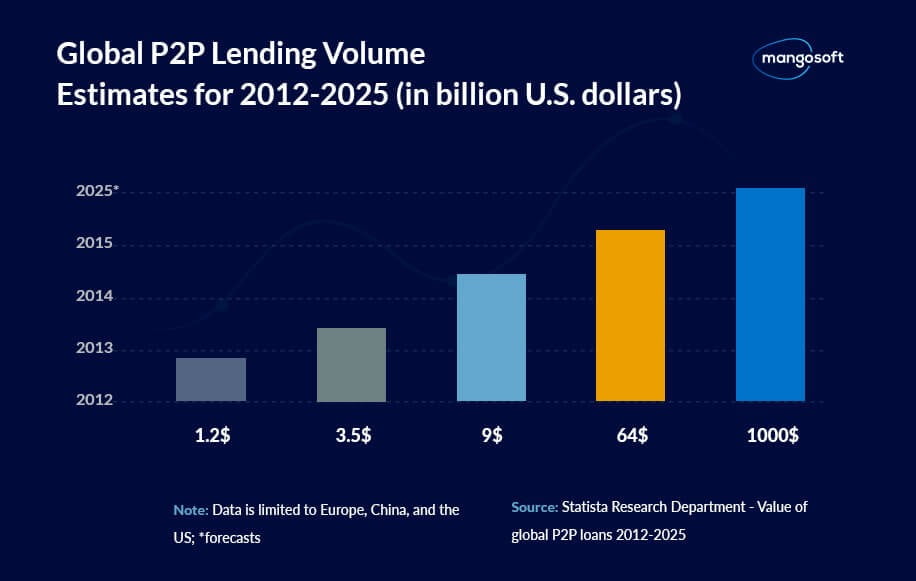

Consumer P2P lending through fintech companies is expected to reach a volume of $100 billion by 2023. However, the third-party lenders cannot accurately assess the creditworthiness of each consumer because of the lack of data held by traditional banks, which results in siloed and disparate business operations.

In an alternative ecosystem of Open Finance where traditional banks and fintech companies share their data, third-party lenders can accurately assess consumers' creditworthiness by analyzing their financial situation. Third-party lenders can offer better and customized credit products to their customers by using various machine learning algorithms for in-depth insights.

Fintech companies can also empower their customers by offering personal finance management (PFM) tools where customers can analyze their financial position by looking at a complete picture of their personal finances. This holistic personal finance exposure can be a great value-add for customers that were previously unaware of their financial position.

The Challenges And How DeFi Is Emerging As An Innovation Hub

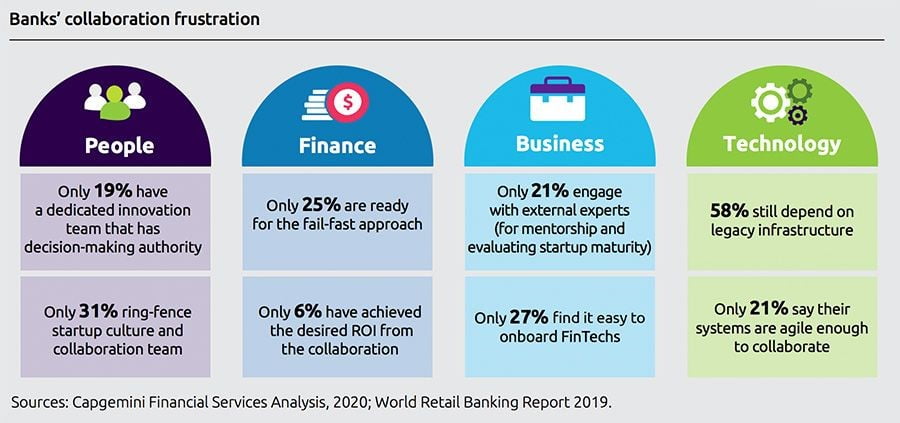

Open Finance presents major opportunities, but the collaborative process isn't very straightforward. The proper implementation of Open Finance has many challenges that need to be addressed for a better, interconnected financial ecosystem. Some of the biggest challenges are integration with legacy infrastructures, data security, and compliance.

When we talk about interoperability and interconnected financial ecosystem, we have to consider the two extremes. Traditional banks and financial institutions still use legacy infrastructures, while fintech companies are ahead of the technology curve.

This lack of collaboration between banks and fintech companies due to legacy infrastructure is one of the many reasons why most of the Open Finance innovations today are happening in the blockchain and Decentralized Finance (DeFi) space because it is open, borderless, and uses advanced technologies.

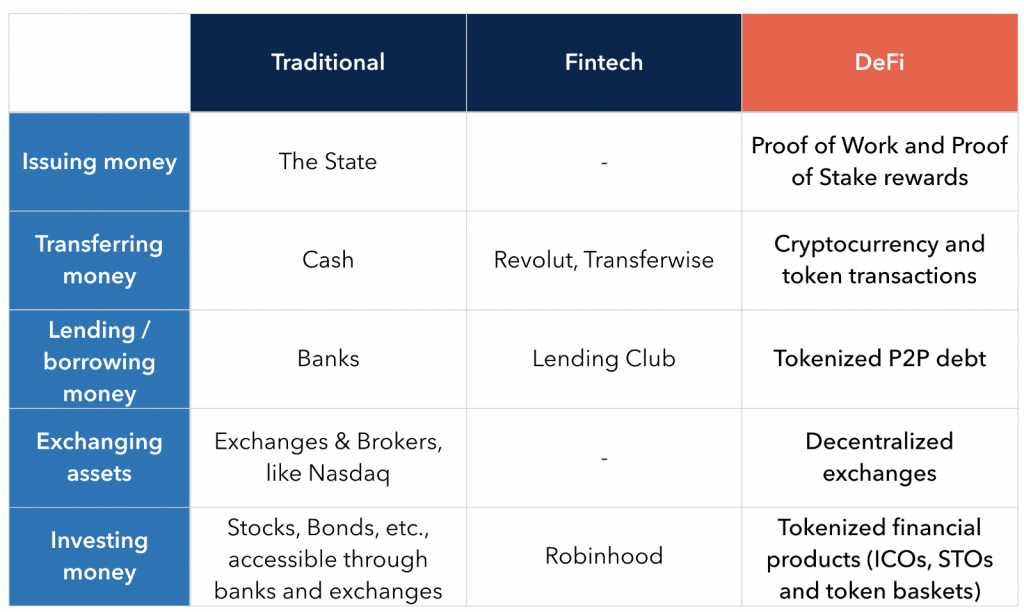

Decentralized Finance is a blockchain-based financial system that doesn’t rely on any central authority like a bank or a financial institution. The DeFi space has a variety of different applications for lending, borrowing, payments, and investments.

According to Future Today Institute's 2021 Tech Trend Report, “Decentralized financial (DeFi) technologies will be adopted by the enterprise, and large cryptocurrency holdings will catalyze innovation in 2021, as bitcoin is used to collateralize new or experimental decentralized finance (DeFi) instruments”.

Fintech companies are now emerging in the blockchain space to actualize the vision of Open Finance with decentralized technologies. Kira Network, a fintech company, uses blockchain as a financial hub to bring together DeFi applications hosted on various public blockchain networks. Think of it as an App Store but for DeFi applications.

Traditional banks such as JP Morgan are experimenting with private blockchain solutions to bring efficiency and security when it comes to transferring money abroad (remittances). Unlike fintech companies, a lot of these banks can’t use the public blockchains due to data security concerns. However, fintech companies can integrate with private blockchain infrastructure used by banks and enterprises using Wanchain, a fintech company that interconnects all the major public and private blockchain platforms, offering a gateway to financial institutions to easily integrate and take advantage of the seamless security and openness offered by various blockchain-based DeFi platforms.

Is DeFi The Future Of Open Finance?

DeFi is emerging as the hub of innovation in the Open Finance space because it is open, trustless, borderless, censorship-resistant, and doesn't rely on any central authority. Over the last few years, DeFi has grown to become a $73 billion industry.

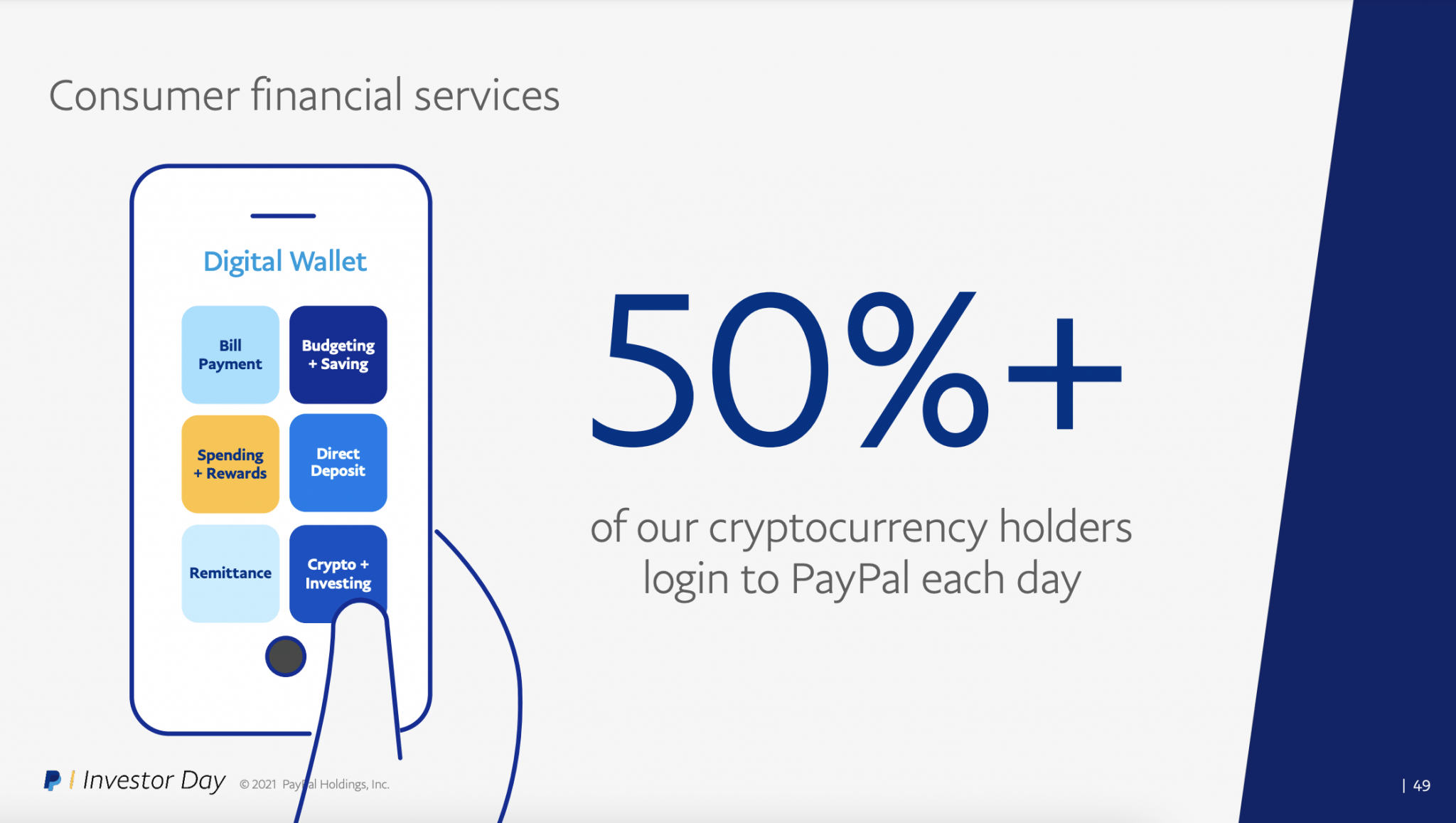

We have plenty of DeFi protocols offering various solutions such as lending, payments, derivatives, and decentralized exchanges (DEX). Defi represents the true meaning of Open Finance, and many fintech companies like Robinhood and PayPal have realized the potential of DeFi and started integrating crypto assets in their apps.

PayPal Investor Day 2021 Presentation | SourceL PayPal

Open Finance will undoubtedly bring financial inclusion to the masses, facilitating both the fintech companies and traditional banking institutions to build and deliver better, data-driven financial products for the consumers.

Blockchains and DeFi will set a cornerstone for Open Finance where institutions can leverage borderless and trust-less technology to tap into some of the bigger market segments such as payments and remittances, with more efficiency and lower costs.

It will be exciting to see the new innovations built on this new world of Open Finance.

Is Traditional Banking Trembling At The Fintech Wave?

Global finance is bound to see its greatest transformation, in which digitization will enhance mutual trust and take on greater inclusiveness efforts. But, how will traditional banking –JP Morgan Chase & Co (BYSE:JPM), Goldman Sachs Group Inc (BYSE:GS), Morgan Stanley (NYSE:MS), etc.– deal with the upcoming fintech wave? Will they adapt or get nudged out?

The Perfect Stage

Back in 2018, the global fintech industry was worth $127.66 billion and is forecasted to reach $309.98 billion next year. Fintech was expected to take years to be adopted on a large scale and now is gradually becoming the standard.

It even has taken place in countries where the majority of the population lives in rural areas, as more people adopt the digital approach to meet their banking needs due to strict social distancing measures.

While the digital environment is becoming essential, traditional finance companies are looking for ways to digitize their operations and mitigate the impact of a post-pandemic world.

“They find in the fintech industry a facilitator for existing services such as factoring, credits, and insurance, and the creation of new services like digital payments, electronic wallets, digital assets, etc.,” says Michael Wood, analyst at Accenture.

The adoption of fintech around the world has made it possible for any type of industry to find ways of digitization and thus be able to connect with their physically-distanced consumers again.

During COVID-19, venture capital investments in fintech had plunged from $168 billion in 2019 to $105 billion in 2020. Still, Q4 2020 was a positive one since $71.9 billion were invested in the second half that year, twice as more than the $33.4 billion investment seen in the previous first half.

Reshaping Digital Services

According to the Future Today Institute's 2021 Tech Trend Report, financial institutions and payment providers are merging with tech platforms and e-commerce to obtain more customers and fend off competition.

“Central banks are issuing and regulating blockchain-backed tokens called digital state currencies - or central bank digital currencies - which could modernize some of the most antiquated areas of global finance.”

This way, the fintech industry is a fundamental actor that builds bridges to eliminate access barriers, supporting responsible innovation and enabling any type of service to be maintained and overcome.

“Whether competing, cooperating or supporting, the fintech system is reshaping digital services for a world in real-time and in high demand.”

So, traditional finance is not going to disappear overnight, but it will start adapting and acquiring fintech companies in a way to embrace the future.

Banks will go through this new fintech wave, the same way they embraced previous challenges; at some point, Goldman Sachs was hesitant to take the plunge into the junk bond market, but once it did it scaled by hiring the right people.

What Is At Stake?

Today, trends like Open Finance allow financial users to share their data with trusted third-party providers. This gives them access to a broader range of financial products and services, and have more control over their data while making better financial decisions.

Those services are complemented with tools that range from the integration of payment methods –contactless card payments– to AI or cloud computing, which are now widely used in the control and management of any service provider.

Fintech offers an improved user experience and promoted versatility and immediacy in an environment of change. In this way, customers show a special inclination for new digital payment methods, whose prominence is increasing.

In this line, according to Business Insider, WhatsApp Pay is capitalizing on the trend by improving user experience, by “adding a new shortcut button for users to send payments through WhatsApp Pay in the beta version of the app.” While it is currently a beta-only feature, it will likely roll out in a stable build in a future update. entering the payment space

The Open Finance trend is spawning collaboration between traditional banks and fintech firms, yielding enormous opportunities for more transparency and suitability to encompass investments, savings, credit, lending, and mortgages for both individuals and businesses.

This is pulled by sheer consumer P2P lending through fintech, which is expected to reach a volume of $100 billion by 2023.

One of the challenges, however, is the inability of third-party lenders to accurately assess the creditworthiness of each client since data is held by traditional banks. The result is siloed and disparate business operations.

On the other hand, traditional banks such as JP Morgan are testing private blockchain applications to offer efficiency and security when it comes to –for example– transferring money abroad. This means that, unlike fintech companies, many traditional banks cannot use public blockchains due to data security concerns.