By TimeMoney.com

With the S&P 500’s total return positive for 14 months, some investors don’t think a bear market is possible. There are faulty beliefs that justify the notion that stocks can only go up. When professional money managers start a position, they’re supposed to look for the downside and let the upside take care of itself, but we’re far from that. We’re at the weird stage of the sentiment cycle where cryptocurrencies can increase hundreds of percent in a few days.

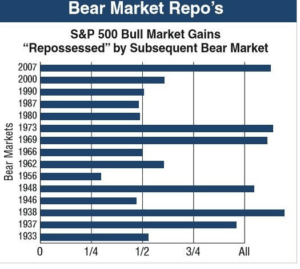

With the Shiller PE above the 1929 peak, now is a great time to revisit what bear markets can do to your portfolio. A bear market often repossess almost half the gains acquired in bull markets, as evidenced by the chart below. Hopefully this quells your fear of missing out (FOMO) so you raise cash on upswings instead of doubling down into the riskiest momentum names. This is a great indicator to show how you don’t need to perfectly time your exit from the market before the bear market occurs. Even if you miss some of the gains at the end of the bull market, you’ll probably still come out ahead if you avoid the losses in the bear market.

Source: David B Collum Twitter

Output Gap Helps Forecast Recessions

As you read about bear markets, you’re probably wondering when the next one will occur. While timing them precisely is impossible, we can review the likelihood of when one might occur. One surefire trigger of a bear market is a recession. The output gap is a great tool to figure out what point the economy is in the business cycle to see when the risk of a recession is the highest. The output gap is the difference between actual and potential economic output.

You can think of the output gap in terms of a factory. If a factory’s potential output is 100 products per day, but its only producing at a rate of 85 products per day, it’s at 15% below potential. If the rate of production in a factory is at 115 products per day, it is 15% above potential. In a factory, running below potential would mean missing out on potential profits and operating at above capacity would result in deteriorating quality control. In the economy, running below potential means the economy is missing out on potential growth and growing above potential means inflation is coming as demand exceeds supply.

Inflation is often the catalyst of recessions, and there are multiple indicators suggesting that inflation will increase in 2018 and beyond. The 10 year breakeven inflation rate (TIPS minus treasury yield) bottomed at 1.18% on February 11th, 2016. As of January 10th, it was 2.05%. It’s still below the cycle peak of 2.64%, but it’s in an uptrend. The higher it goes, the more the Fed will have to raise rates which will tighten financial conditions eventually causing a recession.

Liquidity Drives Markets

Valuations drives returns over the long term, but money flow drives performance in the short term. One way to contextualize this is by reviewing the liquidity situation in terms of monetary policy, stock prices, and economic movement. The economy was in the best shape aka Goldilocks in 2017 because demand was strong and there was liquidity pumped into the system through low rates and a heightened Fed balance sheet. This meant the economy strengthened, inflation increased, financial conditions were easy, central banks thought about tightening policy, and most assets did well. The only major difference between this framework and actual results was inflation missed expectations for most of the year. The ECB pondered tightening while the Fed actually raised rates twice and started unwinding its balance sheet slowly. In 2018, the Fed will be more hawkish by unwinding more of its balance sheet and the ECB will end its bond buying, thus draining the liquidity from the system. The slide shows in 2018 economic growth peaks, inflation spikes, the Fed tightens further, bonds selloff, and credit spreads widen. The monkey wrench in this situation is the tax cuts. That might push off a recession for another year as economic growth exceeds 2017 levels. Furthermore, emerging markets are just coming out of a malaise which should help the global economy pickup steam.

Conclusion

Bear markets can hurt returns. The only reason bear markets devastate investors is because they speculate with reckless abandon at the end of the market cycle. This is what creates melt up scenarios as everyone drinks the metaphorical Kool Aid. It’s not fun to be conservative while the party is at its height, but missing some of the returns at the end of the rally can save you from increased losses after it ends. The output gap signals the business cycle will end in the next 2-3 years on average. The liquidity drain from the Fed might drag stocks down in 2018, but the tax cuts and emerging market growth might counteract that drag, making for one more year of excessive gains.

Disclaimer: This content is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer first on TimeMoney.com.