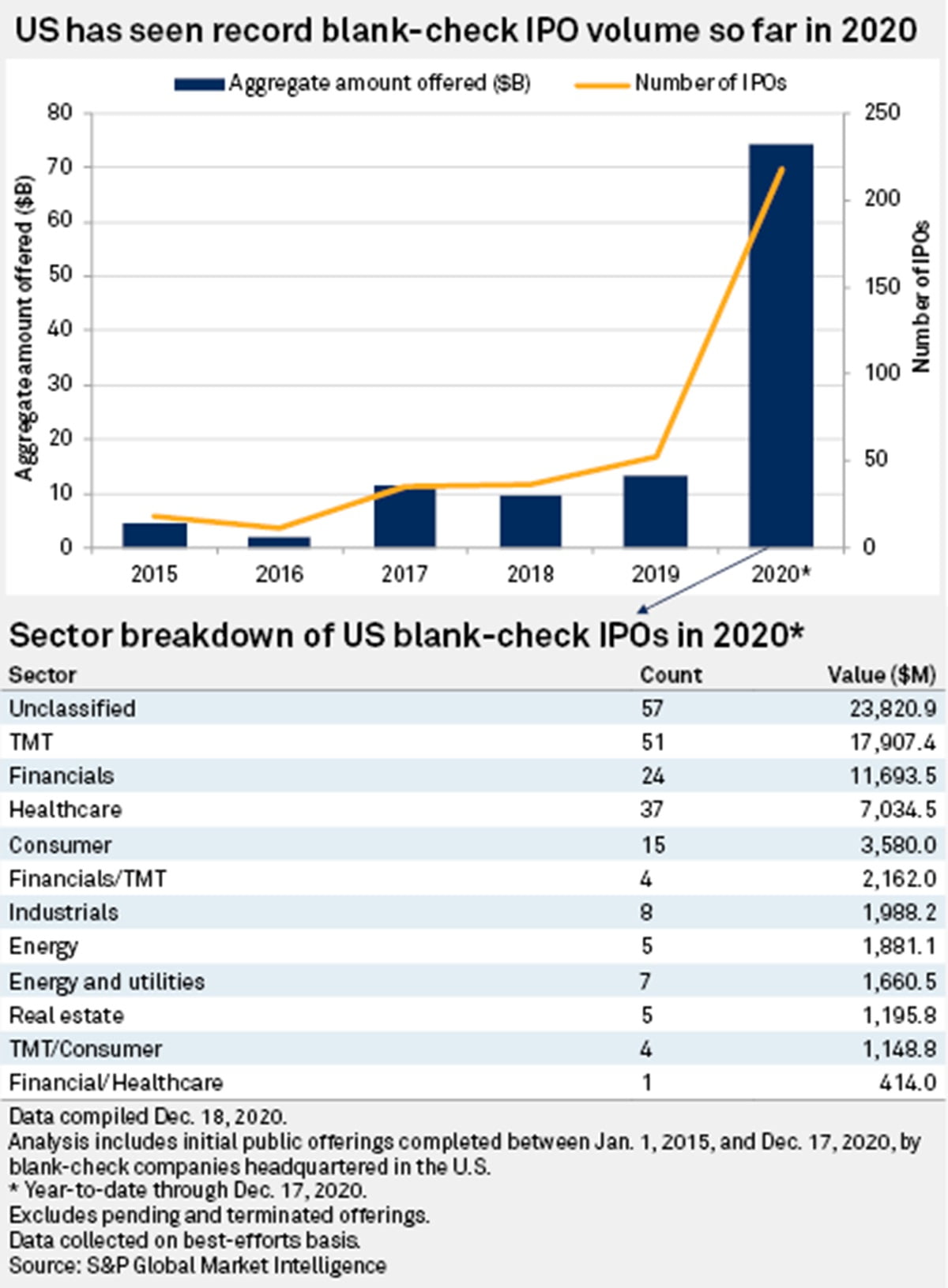

According to a recent S&P Global Market Intelligence analysis, a record of 218 new SPACs debuted in the U.S. in 2020 (as of Dec. 17). SPACs, which are skeleton organizations that launch with the intention of buying and reverse merging with a private company, raised $74.49 billion in the process.

Q3 2020 hedge fund letters, conferences and more

Key highlights from the analysis include:

- The prior record for SPAC IPO proceeds was set in 2019 when 52 blank-check companies went public and raised $13.31 billion.

- Among the companies that went public via a SPAC were DraftKings Inc., Global Blue Group Holding AG and Fisker Inc.

- Of the 218 SPACs that launched in 2020, 51 intended to look at companies in the technology, media and telecom industries, 37 planned to go after healthcare companies and 24 were pursuing financial companies. There were 57 SPACs that launched with no expressly stated target industry.

New SPACs Head Into 2021 With Deal Markets In Sight

Hundreds of blank-check companies are heading into 2021 on the hunt for a deal after yet another record-breaking year.

Once viewed as last resorts to take a company public, special purpose acquisition companies have entered a renaissance with private market investors and executives looking for more alternatives beyond the traditional initial public offering.

The awakening reached a new high in 2020 when SPACs stampeded into the public markets after the COVID-19-induced equities downturn of March and April. A record 218 SPACs, some backed by the likes of hedge fund billionaire Bill Ackman, former Speaker of the House Paul Ryan and Chicago Cubs Executive Chairman Tom Ricketts, debuted in the U.S. in 2020, according to S&P Global Market Intelligence data as of Dec. 17. SPACs, which are skeleton organizations that launch with the intention of buying and reverse merging with a private company, raised $74.49 billion in the process, Market Intelligence data show. The prior record for SPAC IPO proceeds was set in 2019 when 52 blank-check companies went public and raised $13.31 billion.

Now, Wall Street is readying itself for a barrage of SPAC-led deals in the coming years that could bring scores of private companies public and cement the vehicle's place as a credible alternative to the IPO.

Read the full article here by S&P Global Market Intelligence