New S&P Analysis: Fintech M&A 2020 Deal Tracker – Nasdaq‘s software pivot, Stripe enters Nigeria

Q3 2020 hedge fund letters, conferences and more

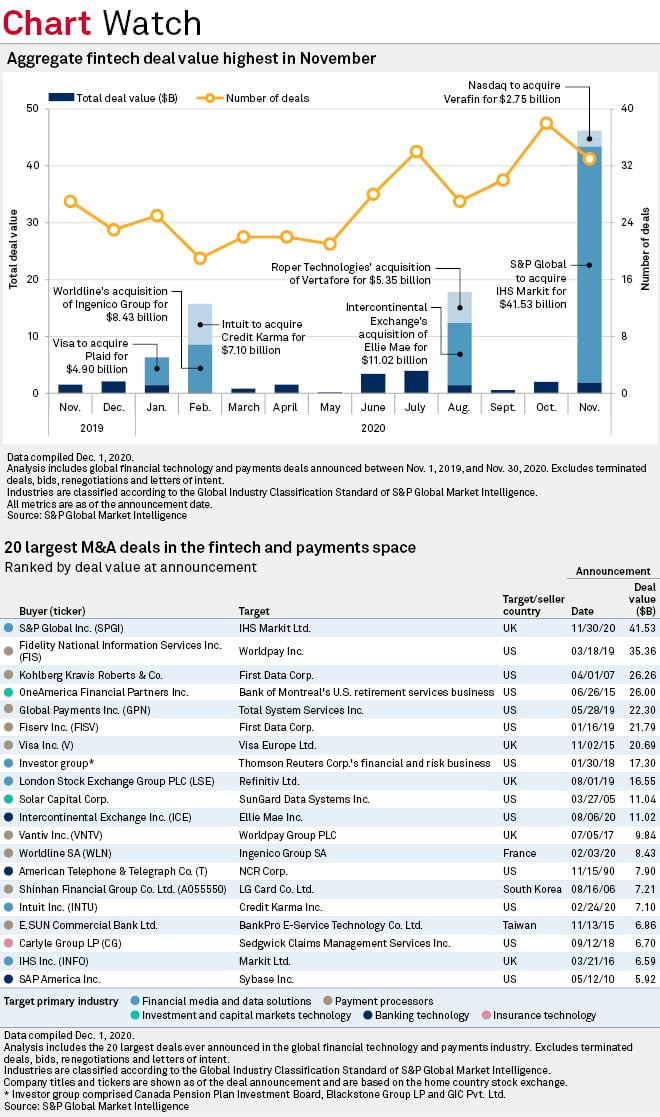

According to a new S&P Global Market Intelligence analysis, with global financial services companies buying financial technology companies to bolster their positions in the data provision, software-as-a-service, or SaaS, and buy-now-pay-later, or BNPL, markets, there was no shortage of M&A activity in the final months of 2020, with more deals expected in the SaaS and BNPL space.

Fintech M&A 2020 Deal Tracker: Nasdaq's software pivot, Stripe enters Nigeria

With global financial services companies buying financial technology companies to bolster their positions in the data provision, software-as-a-service, or SaaS, and buy-now-pay-later, or BNPL, markets, there was no shortage of M&A activity in the final months of 2020, with more deals expected in the SaaS and BNPL space.

Nasdaq Inc agreed to buy anti-money-laundering specialist Verafin Inc for $2.75 billion; Alliance Data Systems Corp. struck a deal to bought BNPL fintech Bread, also known as Lon Operations LLC, for $450 million; and Stripe Inc agreed to buy Nigerian payments company Paystack Payments Ltd. for $200 million.

S&P Global Inc.'s deal to buy IHS Markit Ltd. eclipses all other fintech deals this year in terms of size, with a deal value of more than $40 billion. The merger, subject to regulatory approval, is set to unite two of Wall Street's biggest financial data providers.

In the meantime, one of the most high-profile mergers of 2020, Visa Inc.'s acquisition of data aggregator Plaid Inc., hangs in the balance after the U.S. Department of Justice filed an antitrust lawsuit citing competitive concerns in November.

Nasdaq branches out

Nasdaq's purchase of Canada-based Verafin, which provides software that helps banks to detect money laundering, will help the company grow its position in the SaaS market, analysts say.

Read the full article here by S&P Global Market Intelligence