An industry founded with the words “Chancellor on Brink of Second Bailout for Banks” etched into the Bitcoin genesis block tends to attract a certain type of macro thinker. At the time, the concern was that the size of support measures from global governments and central banks would eventually create persistent inflation. Twelve years later, after the COVID-19 pandemic struck, policymakers made the 2008-era stimulus look like child’s play, prompting f2pool, a large mining pool for PoW cryptocurrencies, to inscribe “With $2.3T Injection, Fed’s Plan Far Exceeds 2008 Rescue” into a block near the 2020 Bitcoin halving. The sheer scale of the fiscal and monetary effort combined with rising price indices again have many worried about impending inflation wreaking havoc on the economy and the value of fiat currency. We, however, see risks skewed to the downside, not the upside, for both growth and inflation in the coming months.

Q1 2021 hedge fund letters, conferences and more

So how will a macro regime shift affect digital asset performance? To properly assess, we need a framework that is more robust than a fervent belief that the money printer will go brrr. We need an adaptable view of the macro landscape that recognizes that the various economic environments can affect digital assets differently, and look to history to help guide our beliefs on how different assets may perform in future economic regimes.

The Four Economic Regimes

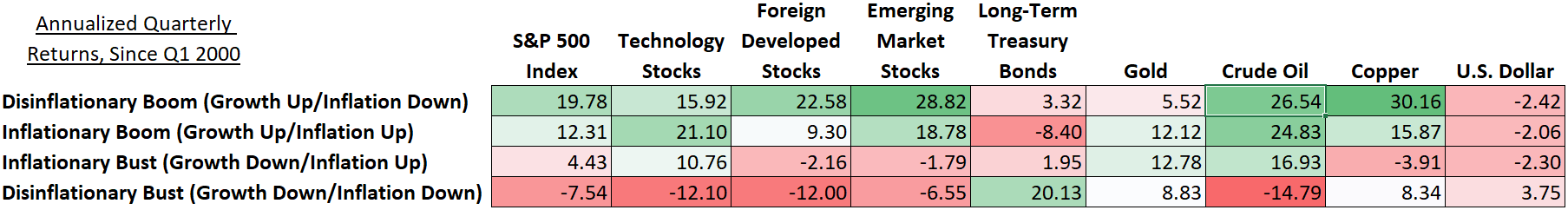

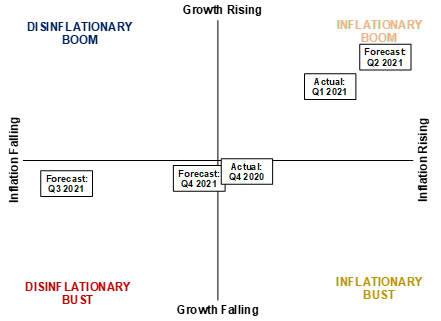

At the highest level, nearly every macro decision or event comes down to two key factors – growth and inflation. Historical backtesting shows that the rate-of-change in these factors is a primary driver of the performance of major asset classes.

With this knowledge, we can divide the business cycle into four distinct regimes representing the four directional combinations of growth and inflation.

- Disinflationary Boom (Growth Up/Inflation Down): Risk assets’ paradise. The best environment for equities, high yield credit, and some cyclical commodities.

- Inflationary Boom (Growth Up/Inflation Up): A pro-risk environment. Cyclicals in the stock market (energy, financials, materials, technology) and commodity market (crude oil and copper) outperform.

- Inflationary Bust (Growth Down/Inflation Up): Also known as stagflation. Gold tends to rise as real interest rates fall. While stocks (especially technology) can do well, this is not the optimal environment for equities.

- Disinflationary Bust (Growth Down/Inflation Down): Watch out. In a Disinflationary Bust, the U.S. dollar and Treasury bonds are the only assets that consistently outperform. This is where we typically see increased volatility, weakness in most stock sectors, commodities, and risk assets broadly.

Source: Bloomberg / Arca Internal Research

Bitcoin is a Macro Asset (Just Not the One You Think)

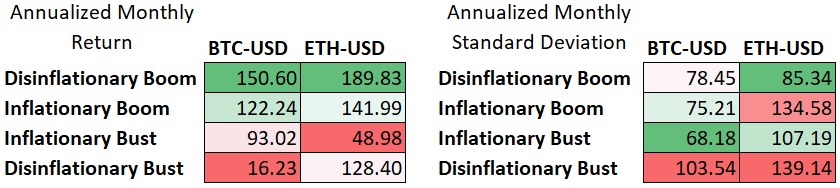

Economic regimes also appear to be major drivers of digital assets. Though it may spell doom for my Twitter direct message inbox, I want to emphasize the role digital assets currently play in the macro ecosystem. While many of the most enthusiastic Bitcoin and ethereum adherents believe their preferred asset to be a risk-off store of value, both assets have historically traded more like stocks than gold through the business cycle. While the rapid pace of adoption of these assets means that they have realized positive returns in every environment, we can see that Disinflationary Bust periods have historically provided lower returns with higher volatility, especially for Bitcoin.

Sources: Bloomberg, Yahoo! Finance; Data since assets achieved ~$10 billion market capitalization: BTC-USD data since 1/1/2014, ETH-USD data since 5/1/2017

It should be no surprise that two of the biggest digital asset market crashes of the past few years (November/December 2018 and March 2020) occurred during periods of Disinflationary Bust. These periods were value-at-risk (VaR) shocks, catalyzing cascading liquidations in risk assets of all kinds and digital assets were no exception.

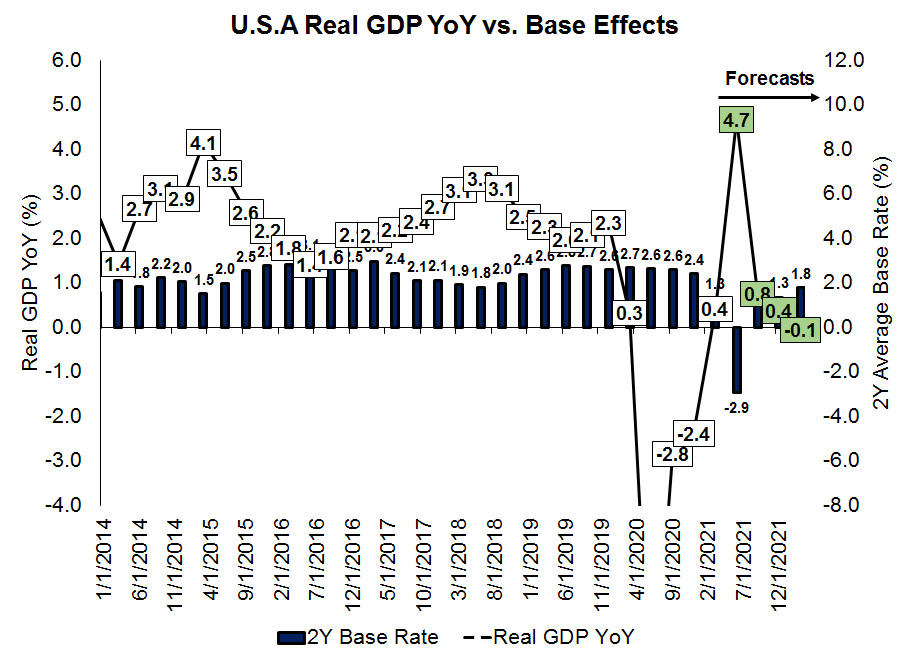

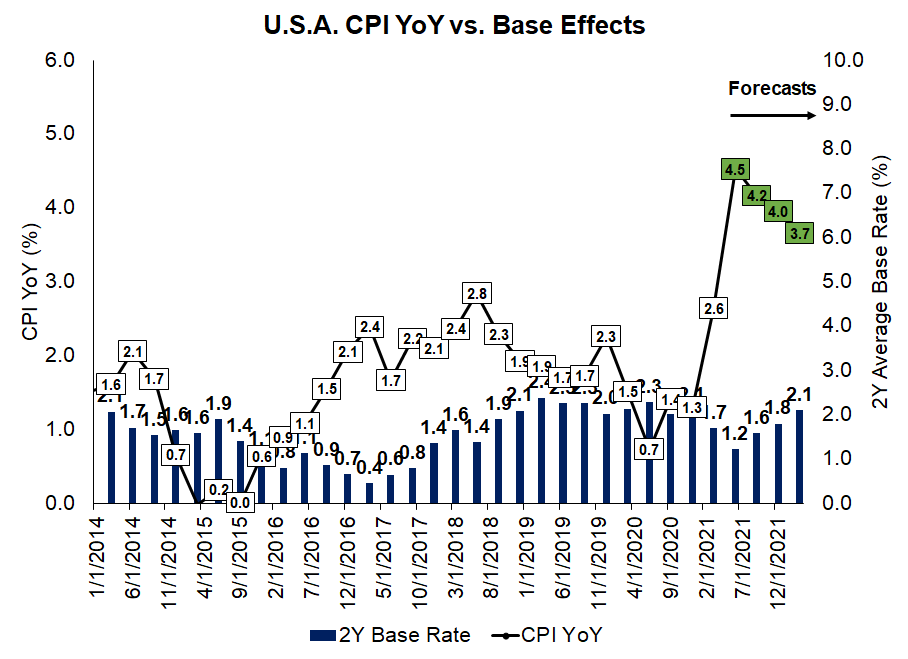

After enjoying a year of boom times, primarily of the inflationary variety, the global economic recovery is likely nearing its zenith. While economic reopenings, fiscal aid packages, and large-scale central bank accommodations have stimulated the economy to this point, it’s unlikely we will be able to rely on these for an incremental boost. A significant portion of global GDP has already reopened, while creeping inflation rates have raised concerns among governments and central banks about adding to stimulus programs. Remember, what matters here is the rate-of-change. Even another $1 trillion infrastructure package in the U.S. would still be a step down from the support provided in 2020 and earlier this year. Easy base effects in the year-over-year economic data have also bolstered numbers to record heights with the softest comparisons behind us (in the case of China), underway (U.S.A.), or fast approaching (much of the rest of the world). As the proverbial mountain gets harder to climb going forward, both growth and inflation numbers are likely to slow sharply from their April-June heights.

Source: Bloomberg

Source: Bloomberg

Source: Bloomberg

The global economy is strong and it’s unlikely the slowdown will manifest anything like a global recession (negative growth) or outright deflation (negative inflation). However, since markets tend to trade on the rate-of-change of these economic variables, don’t be surprised to see asset prices respond accordingly to the changing economic winds. I believe the coming environment calls for a reversal in many of the reflationary trends we have seen, with many of the best reflationary performers historically making dismal showings in a Disinflationary Bust. If we begin to see the U.S. dollar rise, the yield curve flatten, commodities fall, and defensive stocks outperform cyclicals, these will serve as likely warning signs that markets are starting to sniff out the economic pivot.

Will We See Digital Asset Dispersion?

While backtesting shows that digital assets’ largest stalwarts generally underperform in a Disinflationary Bust environment, it remains to be seen how the rest of the digital asset ecosystem will perform. Decentralized Finance (DeFi) as we know it today largely came of age in the last year and has not yet been tested in a Disinflationary Bust regime. It is still unclear whether this asset class has matured to the point where investors differentiate between the macro asset that Bitcoin has become, the decentralized businesses that make up the DeFi and gaming/fan engagement spaces, and the assorted asset-backed tokens, NFTs, application platforms, and more. Will the market throw the baby out with the bathwater as everything trades together in one big beta trade? Or will the historically cheap valuations and strong fundamentals in select digital assets provide a cushion against the adverse macro conditions? The answer to these questions will be critical in selecting the assets best positioned to weather the incoming macro storm.

Article by Arca Macro Research Analyst, Nick Hotz

Disclaimer: This commentary is provided as general information only and is in no way intended as investment advice, investment research, a research report or a recommendation. Any decision to invest or take any other action with respect to the securities discussed in this commentary may involve risks not discussed herein and such decisions should not be based solely on the information contained in this document.

Statements in this communication may include forward-looking information and/or may be based on various assumptions. The forward-looking statements and other views or opinions expressed herein are made as of the date of this publication. Actual future results or occurrences may differ significantly from those anticipated and there is no guarantee that any particular outcome will come to pass. The statements made herein are subject to change at any time. Arca Funds disclaims any obligation to update or revise any statements or views expressed herein.

In considering any performance information included in this commentary, it should be noted that past performance is not a guarantee of future results and there can be no assurance that future results will be realized. Some or all of the information provided herein may be or be based on statements of opinion. In addition, certain information provided herein may be based on third-party sources, which information, although believed to be accurate, has not been independently verified. Arca Funds and/or certain of its affiliates and/or clients hold and may, in the future, hold a financial interest in securities that are the same as or substantially similar to the securities discussed in this commentary. No claims are made as to the profitability of such financial interests, now, in the past or in the future and Arca Funds and/or its clients may sell such financial interests at any time. The information provided herein is not intended to be, nor should it be construed as an offer to sell or a solicitation of any offer to buy any securities. This commentary has not been reviewed or approved by any regulatory authority and has been prepared without regard to the individual financial circumstances or objectives of persons who may receive it. The appropriateness of a particular investment or strategy will depend on an investor’s individual circumstances and objectives.