With Europe’s Markets in Financial Directives (MiFID II) approaching its one year anniversary this January 3, the concerns that the sweeping regulations designed to increase transparency and diversity are, paradoxically, going to disrupt markets has thus far been proven unfounded. It has added complexity in some regards and attempted to detach investment research cost from investor gains, among other goals. What also has happened, however, is not quite what regulators had anticipated. A new report from Greenwich Associates speaks to a bifurcated market in investment research, with the fates of independent research providers and big banks moving in different directions.

A key MiFID II objective was to unbundle research costs from the brokerage commissions charged to fund managers. When research was paid through commissions, essentially the cost came out of investor profits.

While it remains unclear exactly how much of today’s bank research is paid for at a rate that recoups the full cost of this endeavor, the impact of engaging in the unbundling of research costs, measured in a new report from Greenwich Associates titled “MiFID II at the Midpoint,” reads like a tale of two cities.

Q3 hedge fund letters, conference, scoops etc

The MiFID II expectation was that the buy side would reduce spending with the largest investment banks. With European research budgets being cut by 19% on a year over year basis, representing a $300 million hit, large sell-side institutions have not felt the cuts to the same extent as smaller brokerage or otherwise independent research providers. In response to budget cuts, institutional fund managers increased their allocation percentages to the largest global banks, the report found.

The average number of research providers to large European institutions has dropped from 20 in the second quarter of 2015 to 15.7 two years later. Nine of the largest global banks currently lay claim to 54% of research spending, while 69 of the midsized banks and regional brokerages are allocated 45%. Independent research providers are allocated 1% of the research budget.

While much of the spending has been pre-determined, as directed under MiFID II, nearly 30%, or close to $300 million, remains unclaimed heading into year-end. This, in part, is leading to a sharpening of competition.

“With so many hands in a smaller cookie jar, this unallocated budget will be incentive enough for global investment banks to provide exceptional service to their clients,” the Greenwich report noted. “The next few years will serve as a rebalancing period for investment managers in Europe, and drastic cuts in budgets mean that portfolio managers now have less stock research informing their investment decisions.”

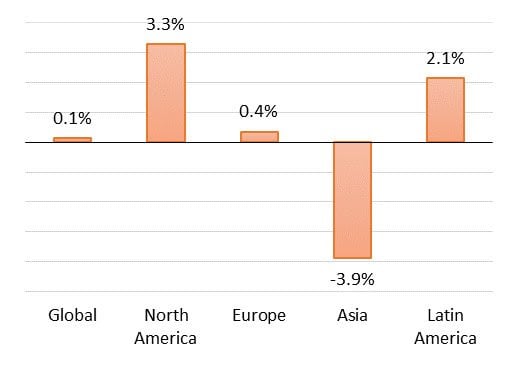

Is this lack of research impacting performance? European hedge funds are up 0.4% year to date, according to the latest data from Eurekahedge. US fund managers, many who are not directly impacted by MiFID II when conducting business here, are up 3.3% on average. EU fund managers have been comparing positively with the European stock markets, most of which are generally lower on the year. The London FTSE, for instance, is down near 7.12% year to date.

“At the end of the day, returns are the most important barometer for investment manager performance,” the report noted. “Time will tell whether or not the buy side can create alpha for their clients with a research budget 15–20% lower than a year before.”

In addition to research being a factor in brokerage decisions, another issue, liquidity is a factor, particularly during times of market crisis. While equity trading rules in Europe have become more complex, due in part to caps on dark pool trading and increased waiver usage, there are signs the regulations are having a positive impact.

“Despite these hurdles, respondents in the study have signaled some improvement overall in the pursuit of liquidity and best execution,” the report noted. One benefit of the regulation is for brokerage firms that have adopted the systematic internaliser (SI) regulatory designation, which allows a broker to trade directly with a client using their own capital. “Pre-MiFID II, SIs were never in fashion, as broker-owned crossing networks were the venue of choice for matching orders. In a move to promote trade transparency, regulators used MiFID II to limit dark pool usage, which, in turn, boosted the appeal for brokers to register as an SI.” Nearly half of the survey respondents are positive about this end result of the regulation.

This article first appeared on ValueWalk Premium