Updated by Quant on 1/18/18

Launched into effect on January 3rd 2018, we are going to see a shake up in more than one area of asset management as a result of the European Union’s second Markets in Financial Instruments Directive – MiFID II. The new legislative framework enforces a more targeted approach to incorporating investor protections and goals in everyday operations. The emphasis on increased investor prioritisation in asset management will ensure higher levels of efficiency, resiliency and transparency. Less than a month under way, let’s take a look at some of the key themes to expect from the impact of MiFID II early doors.

A Squeeze on Fees

The most pervasive theme will be intensified competition. The stricter terms of operation mean than money managers will need to sharpen their game in the fight to attract investor capital. Fees will be driven lower by this competitive pressure and we will see improved pricing transparency across the industry to facilitate more effective fund comparisons. MiFID II enforces strict disclosure rules for costs for investment products and funds. 1 Specifically, recent research from Moody’s Investor Services estimates that asset managers' effective fee rates could fall 10% to 15% over the next three years.2

Consolidation as Competition Heats Up

As competition across the industry intensifies we will inevitably see consolidation as smaller players fail to keep pace. The adoption of MiFID II protocols brings at the very offset a large one-off implementation cost and then on top of this there are the ongoing compliance expenses. On top of this there is the tougher terms of generating investor returns and the reform forcing asset managers to pay for broker investment research. The bigger players will be left standing, scooping up market share with their advantageous economies of scale and bulging balance sheets behind them.

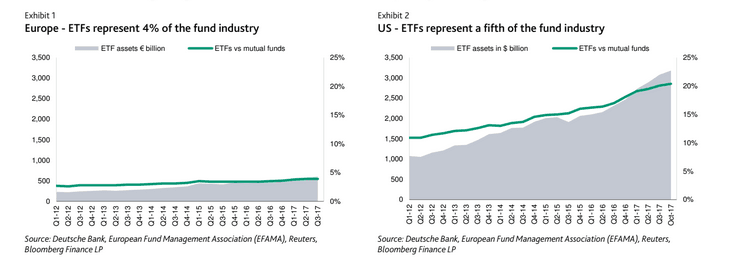

Increased Allocations to Passive

Cheaper, passive funds will become more attractive. ETFs offer superior cost transparency to investors. The new regulation has implemented a ban on commissions payments to independent financial advisors. 1 This will drive demand for passive vehicles for retail investors.

ETF trades themselves are not exempt from changes from the regulation – for the first time since inception, ETF trades are required to be reported. Also trading volumes and liquidity figures will have to be disclosed. This enhanced transparency clears the way for increased allocations from intuitional investment.

Demand Driven Refinement

With competition building on more than one front asset managers will shift their focus towards providing specific solutions to meet investor needs rather than manufacturing investments products and operating under supply-driven business models. MiFID II has set up rules to ensure asset managers provide investment products that specifically meet the needs of investors with the risks properly communicated.1 This will change focus from benchmark outperformance to creating refined solutions to meet financial goals.

Overall, the directions of these changes will not come as too much of a surprise to market participants –we have been nudging, albeit very slowly, in each of these directions for the past few years. The tide is taking a positive turn for investor protection, while smaller funds may very well be dragged under.

In related news, the following news on Mifid II developments hit the wires this morning:

Visible Alpha, an investment research technology firm founded by some of the world's leading investment banks, today announced that it has secured an additional $38 million of equity financing. Visible Alpha will use this investment to fuel its explosive growth and maintain its leadership position among firms driving efficiency, transparency and alpha generation in the institutional research process and helping solve for the research valuation and budgeting requirements of MiFID II.

This recent round is led by Goldman Sachs (NYSE: GS) with additional participation from Banco Santander through its VC arm, Santander InnoVentures, Exane BNP Paribas, Macquarie Group, Royal Bank of Canada and Wells Fargo, and from Visible Alpha's existing investors, Bank of America, Citi, Jefferies, Morgan Stanley and UBS.

Source:

1 ESMA, https://www.esma.europa.eu/policy-rules/mifid-ii-and-mifir

2 Moody’s Investor Service, 15th January 2018, Asset Management - Europe MiFID II is credit negative, intensifying fee competition, shift to passive funds

.............................

When Barclays asked $455,000 per year for its research, testing a market valuation system, did it mark a top? As sweeping MiFID II regulations are finally a reality, an initial result has been brokerage firms, and bulge bracket providers are mainly giving it to clients without cost. While it may take some time for research consumers to get accustomed to new rules – a Greenwich Associates report says “it will likely be many months until the market coalesces around standards, best practices, and operating models” – the outcomes and implications of the rule changes are becoming apparent early.

Bullish for Bernie?

MiFID II Impact: As expected, institutions don't want to pay for research

Research providers are living in a world where business models are in a state of flux. Bulge bracket banks that at one point provided analysis to institutional investors instead of higher trading commissions are largely changing tact.

This past August ValueWalk reported that institutional investment managers were prepared to do without brokerage research. This is largely occurring.

“An increasing number of firms have publically announced they will take investment research costs onto their own P&L in lieu of charging clients,” a first quarter report on MiFID II from Greenwich Associates observes. “For these institutions, the good publicity and client satisfaction outweigh the potential drag on their portfolios.”

Nearly six days after the sweeping MiFID II regulations discouraged institutional brokerage firms from providing research to clients paid for out of commissions – which is subtracted from client profits rather than the hedge fund’s bottom line – compliance to the new rule is coming to pass.

40% of European buy-side institutions participating in the recent Greenwich study said they would pay for equity research out of the investment managers P&L rather than commissions, which under MiFID II, while 34% continue to use client commissions and 26% charge clients separately.

While the majority of U.S. investment managers and 64% of U.S. study respondents in the Greenwich study didn’t fall under the purview of MiFID II, its impact is wide-ranging and at times surprises fund managers.

“Here I thought I was going to be a MiFID II spectator, then all of a sudden, I’ve been thrown into the thick of things,” one US trader told Greenwich. “I believe it’s inevitable that eventually, every global manager will pay for research out of their own P&L … I just didn’t expect the wheels to be turning this quickly.”

MiFID II impact: Buy-side managers demanding accountability for their research budgets

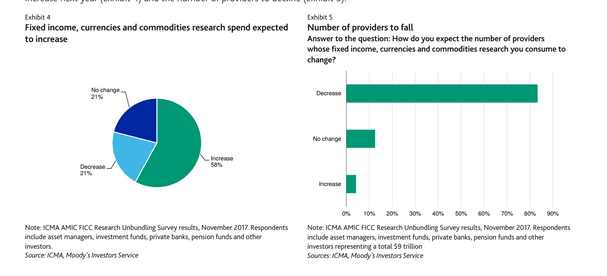

The changes in research payment protocol come at a time when buy-side institutions are mainly cutting back on the amount they consume – and adding accountability protocols that measure the effectiveness of research they are consuming. MiFID II is being credited as a catalyst to a degree.

Greenwich Associates points out European-based buy-side managers have reduced their 2018 research/advisory budgets by 20% year-over-year, or near $300 million, leaving the European research/advisory market at $1.35 billion.

In the United Kingdom, average research budgets at investment managers have dropped from $5.9 million to $4.9 million, while in continental Europe they have decreased from $1.9 million in 2017 to an estimate of $1.3 billion in 2018.

While budgets might be cut, it will not impact everyone:

A still significant percentage of managers’ equity research budgets will remain unchanged from 2017. Overall, a third of respondents will pay research providers the same amount as last year. Managers express concern about the message it would send to their investors if they made sudden and substantial cuts. Any sign that managers have been wasteful in their spending in the past would resonate poorly. This could explain why over one-third of investment managers that plan to continue passing on research costs to clients aren’t adjusting their budgets in 2018.

With a culling of the research herd, the number of brokerage counterparties has also changed, dropping by 20% across Europe and 15% in the UK.

“Despite these cuts, there is good news for research providers,” Greenwich noted. “Since both budgets and provider lists have been reduced to a similar degree, the amount budgeted for each provider/broker will remain relatively flat year-over-year. A negligible 2% decrease is expected, amounting to just over $100,000 being budgeted per counterparty.”