Let’s face it, for most, achieving decent returns from investing can be remarkably difficult at times. Achieving consistent returns is even more so, and outperforming the markets over the long term is harder still. Few investors can do it. Francois Rochon is one of those who can and has; his Rochon Global portfolio1 (that serves as a model for clients at Giverny Capital) has delivered a 15.3%2 annual compound return for nearly three decades, outperforming the benchmark3 by more than five percent per annum. By 2020’s year end, the Rochon Global portfolio’s cumulative return since inception in 1993 stands at 4,969% versus the benchmark’s 1,103%.

Q1 2021 hedge fund letters, conferences and more

Francois Rochon's Rational Composure

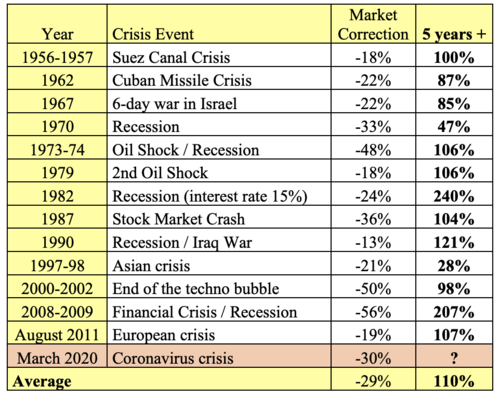

While Francois carries a relaxed demeanor, it masks the emotional fortitude he possesses that is required to navigate challenging market conditions. No better example of his rational composure comes to mind than during the pandemic induced collapse of global financial markets last year. In the midst of the crisis, Francois penned a 2-page memo to his partners reminding them that their portfolio of companies had the capacity to weather the crisis and he implored them not to be influenced by stock market fluctuations. In the eye of the storm, it was a lighthouse guiding investors; the Giverny portfolio had been crafted to survive the most treacherous swells, provided investors could avoid the rocks of emotion. A recount of the most important market corrections of the last sixty years and their subsequent recoveries made clear that smooth sailing ahead was inevitable [see table below].

“It is only those who sell in panic in declines who become the real losers of the volatility inherent in financial markets.” Francois Rochon - March 16, 2020

Giverny Capital Letter - 16 March 2020.

Sage advice indeed.

Francois’ genuine humility is evident in everything he does. A few years back, after reaching out to him about content for the MastersInvest site, Francois invited us to meet with him in Omaha while we were attending Berkshire’s AGM. He willingly gave us his time while we were there, and we were able to discuss a wide range of topics and learn more about his thinking, his investment philosophy and the practical art of investing.

A few weeks ago we had the opportunity to chat with Francois once more, and gain his insights into how he sees the world, some opportunities he’s finding attractive and collect some timeless investment wisdom4.

Market Crises [Covid 19]

“When valuations are low and pessimism is high and you have a long term horizon I think you have to at least stay invested. If you have available capital you just have to have faith and invest.”

Current Valuations

“I always say, high valuations, most of the time, translate into lower returns. You have to accept that. You can justify paying 50 or 60 or 70 times earnings, as some stocks trade today, by expecting many years of high growth and discounting them with a very low interest rate. But that also means that you'll have lower returns if you discount them with a lower discount rate. I believe that there are many stocks that are expensive and many quality names are trading at pretty high ratios. You have to accept that if you want to own those names you'll probably have lower returns going forward. I’m not saying negative returns but for the S&P 500 in general, I think it's going to be hard to earn a total return in the next five years of more than let’s say 6% annually, which is okay but not as high as it's been in the last decade, that's for sure.”

Opportunity Set

“We still, as always, can find great companies that trade at reasonable valuations. If you build a portfolio of such securities, I think you can do better than the average. I take the example of Markel for instance. I think Markel is a great company and the market doesn't really see it that way. I think that's one example of a company I don't believe it's trading at high valuation at all.”

Financials

“In general, everything that is seen as interest rate sensitive or financial, has come back [up] a little bit but is still out of favor. Banks or insurance companies, they're not what young and dynamic investors want to own because that's not really exciting. But you know I always say, I'll favor stable, durable, competitive advantaged, great management, good return on equity, lower valuations and I will live with the ‘dull’ nature of the business.”

“We own two banks, Bank of American and JP Morgan. I think those two banks are very well managed, they have solid balance sheets. Their stocks have rebounded lately but I still think if you own them for the next five years you'll do okay.”

Tech Stocks

“I'm not against owning technology names. I mean I've owned some of them for many, many years. If I go back to the first years like 1994, I think back then I owned Intel and Sun Microsystems. One lesson I learned is that if you look at Sun Microsystems for instance, it was a great company in 1994, I bought it at very reasonable valuation and I had a very good return. While the company still exists, as part of Oracle now, it's not as dominant. It's far from as dominant as it was 20 years ago.”

Facebook & Google

“I think the situation with Facebook and Google is a little different. I don't really see them as technology companies, they offer a service and they've built this incredible network. I think they've got an extraordinary brand. I don't see them as sensitive to technology change as a company that sells hardware or software.”

“If you look at Facebook, it's trading at around 25 times this year’s earnings. It's still growing pretty fast. I think it can grow between 15 to 20% a year going forward for the next five years. It's a very reasonable valuation. These are clean earnings, meaning that everything that has to be expensed has been expensed - like stock options for instance. That's not the case with many companies that even trade at 40, 50 times earnings [non-GAAP, without stock options expensed earnings which I'm not a big fan of. I'll do my own calculation of earnings and adjust them for the stock option expenses]. If you look at Facebook, I think the valuation is very reasonable for such an outstanding company.”

Progressive

“If you look at Progressive, the auto insurance company, they've gained market share in the last 20 years and they're as strong, their model is as strong today as it was 20 years ago. There's many technology companies you can't say that at all. How durable is the competitive advantage is a key question you have to ask when you invest in any security.”

Apple

“I think Apple is more than just a hardware product. It's really an ecosystem where there's the phone, there's all these services and the fact is today, compared with 20 years ago, your cell phone is much more important to your daily life than it used to be. So many little things in your daily lives are built into your phone. It's a big thing to change your phone today. It wasn't a big thing 15 or 20 years ago to change a phone but today it is. I think Apple’s dominance is great. The thing you have to ask yourself, once you're so dominant, how are you going to come up with a lot of growth going forward. That's a question I think you have to ask with any already dominant businesses.”

Finding Opportunities

“I love baseball and so I watch, I don't know how many games a year. I don't do it because I want to learn about baseball or be a better baseball connoisseur, it's really because I enjoy watching the game. After a while you kind of know almost all the important players, the best players, the best pitchers, and the ones that have a better batting average. You know about those players because you're interested in this game. It's similar with an art collection. I'm interested in everything in the history of art, I try to go to every major show and visit the museums in Montreal, New York City, Chicago, Los Angeles. After a while I know a lot of artists and great artists. I think I can have a general view on which ones are the most important artists, the ones I believe are really the outstanding ones that will still be considered important in 50 years.

It's a similar process when you invest in companies. You look at almost every company, even private ones, but you're more interested in the public ones so you want to learn about every important public company in the world. When you find something, a company that looks exciting, that looks like they've got this great business, you want to understand why its so great, and what's the source of their greatness. You find CEOs that you admire like Mark Leonard at Constellation Software. When you've read a lot of annual reports I think you can find, you can see when there's something special about a company because you've seen so many of them; you can find one that really stands out. It's really a daily process for the last, in the case of investments, 28 years. Just looking daily at a lot of companies because I enjoy the process. I enjoy discovering companies and learning about the history of companies and I am always on the quest of finding new companies because finding a new company is exciting.”

“When I travel in the US, I'll go to a new restaurant chain I've never heard about and try it. If I like the food, if I like the experience, I'll say lets look at the stock. But sometimes just reading a friend’s annual letter and, "Oh, my friend bought this new company and I don't know about it so I'll read about it." I know how he thinks so since I share a similar investment philosophy as him, it might be at least worth reading. That's one source of ideas of course.”

Investment Edge

“I think a lot of opportunities in the stock market arise not because we have more insights into understanding businesses. I think a lot of people can pretty quickly identify the great businesses. I think our edge as investors is really our behaviour, it’s not to focus too much on the short term but really we're there for the next five to ten years. So even a great company can have some periods of uncertainties in their business or short term problem or if there is a recession and that makes the company growth rate be a little lower for a while; if we think the fundamentals over the long term are intact, it can be an opportunity for us. So our edge is really our behaviour and our long term horizon which is so rare today because people want good results in a very short time period. Of course, people can do whatever they want as an investment style; but we believe that the short term horizon of others is probably at the source of many of our investment opportunities because we have a longer term horizon than most people.”

Autohome

“There's some opportunity in the internet and technology sector, Facebook is one. We own a Chinese company called Autohome, which is by far the leader in China, a website where you can do some research about buying a new car or some car related products. It's a great company and I think Wall Street is a little worried about a Chinese company listed in the US so the stock has gone down at least 10 to 15% recently. If you look at Autohome’s valuation, I think it trades at something like 20 times this year's earnings. I think it can be a 15, 16, 17% grower going forward. It’s very well managed, the balance sheet is very good and the valuation is very reasonable. It's at a discount to the S&P valuation ratio.”

“Where did I find Autohome? I like to read annual letters from great managers. I think it was a top holding of a money management firm I admire in the US. I'd never heard about that company so I read the annual letter; I went to the website. I thought it was a good company and we talked to management and we did all the research and decided to buy shares.”

On Berkshire

“Warren Buffett is such a good steward of capital, he doesn't do anything risky. He doesn't use debt, he doesn't acquire companies by paying very high ratios. So of course in the last five years it's been hard for him to acquire companies because many other acquiring entities are using debt, are paying high ratios - the competition has been much less prudent than he is. Knowing Warren, that won't change his approach. Preservation of capital I think is still a cornerstone of his approach. He used to say that the first rule is don't lose money and rule number two rule is don't forget rule number one. He still is very prudent. This prudence has been probably one reason he has so much cash on the balance sheet, I think it's something like 140 billion dollars. That's a lot of capital because I don't know exactly the numbers but it would represent something, at least a quarter of the equity. So when a quarter of the equity is invested in something that yields close to 0%, it's hard for the whole thing to earn 10 to 12%. The rest has to compensate and it's very hard to compensate that much. That's been a drag on the return of Berkshire.”

“At some point I think until [company] valuations come back a little bit to more reasonable levels, I think the best thing he can do is buy back stock and return the excess capital to shareholders. If he continues to do that, and he's been doing that for the last two quarters very aggressively, I think it's nine billion per quarter in the last two quarters. From what the annual letter said he’s still doing this in the first quarter of 2021. That's $36 billion a year so that's about 7% of the market value of Berkshire. Well if you return 7% per year going forward, I think it's going to be a better stock than it was in the last few years, at least relative to the S&P 500 so I still think the whole thing can continue to grow at 5 or 6% annually at least. But if you add a 7% buyback, it's really a good return of capital to the shareholders. I think that Berkshire can do something like 12% going forward.”

Evolving

“The world is always changing and you have to evolve with it. If you don't evolve you'll probably stay behind, very slowly but surely. You have to accept that you have to always rethink everything and do postmortems on investments on what went well and what went wrong. We're doing that on at least a yearly basis with our yearly medals for the top three mistakes.”

Mistakes & Margin of Safety

“Year after year what I realise is most mistakes I've made is not paying perhaps a higher price than I should have for great companies. I think I probably have already evolved on that. I'm ready to pay 20 times earnings for good growth companies but sometimes there's not that much difference between 20 times and 25 times. There is between 20 and 60 but between 20 and 25, perhaps I'm trying to be a little too precise, or to prudent, and sometimes miss the big picture that if you find a great growth company and it doubles its earnings every five years, well perhaps valuation to some degree should be flexible a little bit. So I probably have evolved a little bit over the years with that.”

“You have to be careful because how much do you stretch? You can stretch to 25 and then 30 and then 40, I mean it never ends. You have to accept you still want a margin of safety and I think that's the key element in The Intelligent Investor and when you read Ben Graham’s writings. Seventy years later, I believe that the key lesson from Ben is still the importance of margin of safety.”

“The margin of safety is not just in the price you pay, it's also in the quality of the business, it's in the balance sheet of the business and the accounting and also in terms of the quality of top management. When we bought shares of Constellation Software, I don't remember how much we paid but we paid a reasonable valuation, I think 18 or 19 times earnings. To us the real margin of safety was Mark Leonard. We thought he was a great investor, a great manager and I mean to us it was not the valuation that was the key criteria it was really because of management.”

Portfolio Companies

“I think if you look at the portfolio, there's some differences in the style of the businesses but they all have similar themes. They are all great business, already profitable, already dominant in their industry, that have good growth prospects - not 40% a year - but between let's say 8 and 20% more or less. They have good balance sheets, we like the management and we think they're good capital allocators. All the companies we own, we believe share those characteristics. They're in different industries, they're different sizes. We own some small companies and some very large ones, but they have a similar style of businesses.

I know that I have some colleagues that would say, ‘Well, I invest in this young company that is not profitable yet but if everything goes well it can increase 10 times.’ Well to me that's a little risky. I've seen so many companies disappear over the years and I don't want to own a company that needs to go to the capital markets on a regular basis because either it has too much debt or is not profitable. You never know when there's going to be a financial crisis. I've seen a few of them in the last 28 years. I mean in 2000, 2001, and 2002 when the tech bubble burst it was very, very hard for those technology companies to get new financing. If you look at 2008 or 2009, there were some companies that had some debt and went to the financial markets and couldn't find capital at all. So I don't want to own companies that if there's a crisis or a recession, could be in the weak position of having to raise capital at very bad levels for shareholders or through expensive debt.

To avoid that I just avoid companies that are not profitable or have too much debt on the balance sheet. Even though I see that there is some upside potential, I see the downside in case of a recession or financial crisis because I've seen and I’ve lived through them. So I know they can happen and they will probably... I don't want to use the word conditional because it's not a conditional situation. There'll be recessions, there'll be crisis and I want the portfolio to survive them. We want the companies to be survivors not ones that will need to go to the capital markets at the worst possible time.”

Partner with Management

“There's all sorts of reason why some companies are not properly valued by the stock market. Sometimes it's just because it's non-exciting; a little dull business or a low profile manager. Some CEOs speak very well, they're good salesmen. That’s fine, that’s business. I like to see CEOs as partners because that's really what you are doing when you are buying shares; you're becoming a partner with the top management CEOs. I want partners that are low profile, are really focused on building something for the long run, ideally that are humble. They're not trying to pump up their stock. They want to build wealth over the long run, they're trying to build solid businesses and they know that in the end if the company does well the stock will eventually reflect that. They know that.”

Book Recommendations

“There's the classics of course like the books of Ben Graham, Peter Lynch and Philip Fisher. John Train wrote two good books in the 80’s, ‘The Money Masters’ and ‘The New Money Masters,’ which I liked. William Thorndike wrote the ‘Outsiders’ which was one of my favourite books over the last few years. Larry Cunningham wrote a few books on Warren Buffet and Berkshire Hathaway which I think are very interesting. My friend Guy Spier wrote the book, 'The Education of a Value Investor’.

There's older books such as John Paul Getty’s book, ‘How to be Rich’. It contains a chapter on stock market investing which I think is very good. You can read biographies or autobiographies by great business builders. Many years ago I read the book by David Packard which was very good and Ken Iverson’s, the guy that built Nucor. Bill Gates’ book from 1994 when the internet was just starting called ‘The Road Ahead’ was very good. I’d also recommend a book by S. Cathy Truett who started Chick-fil-A, the chicken burger chain. I thought that book, ‘How did you do it Truett?,’ was really good. I've been hoping that Chick-fil-A becomes a public company since then.”

Summary

Francois’ passion for investing is as obvious as his humility, and is mirrored in his deep interest in both baseball and art. His returns have been nothing short of outstanding over the years and are the envy of many. We’re very grateful to Francois once again for his insights and thoughts on matters. Truly he has painted a masterpiece of his own and we expect that his batting record will only continue to climb in the years to come.

Article by Investment Masters Class