Low-value deals dominated global VC funding landscape in Q4 2020, finds GlobalData

Q3 2020 hedge fund letters, conferences and more

Majority Of Global VC Investment Volume Were Low-Value Deals

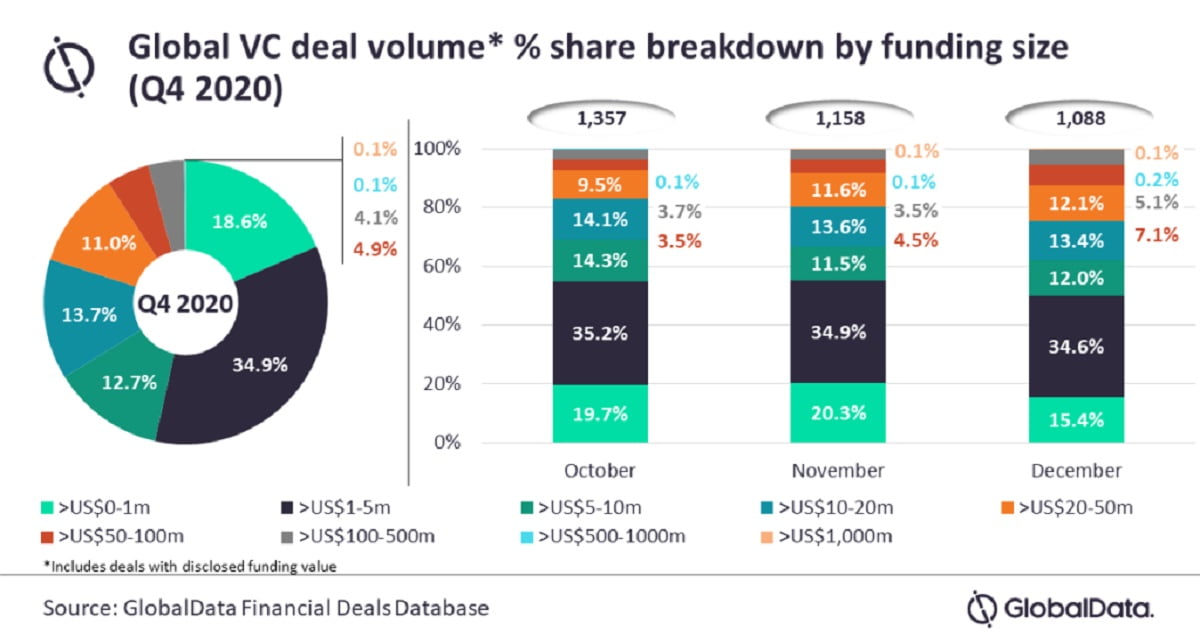

Big-ticket, billion-dollar deals were mostly non-existent during Q4 2020, as low-value deals (where the investment was less than or equal to $10m) accounted for the majority of global venture capital (VC) investment volume, according to GlobalData, a leading data and analytics company.

Of the total 3,603 global deals during the quarter that disclosed deal value, 66.2% were low-value deals, while those valued more than $100m stood at just 4.2%.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “With tough market conditions and uncertain business environment, cautiousness prevails among investors while committing big-ticket investment. Investors are, therefore, turning towards low-value deals.”

VC Investment Volume Decreased By 6% In December

VC investment volume (deals with disclosed deal value) decreased by 14.7% from 1,357 deals in October to 1,158 in November and further shrank by 6% to 1,088 in December 2020. In October 2020, low-value deals, as a percentage of the total deal volume, stood at 69.1%, while the share of deals valued more than $100m stood at just 3.8%. This month did not see announcement of any deal valued more than $1bn.

Similarly, the share of low-value deals, as a percentage of the total deal volume in November, accounted for 66.7%, while the share of deals valued more than $100m stood at 3.7%. This month witnessed announcement of one deal valued more than $1bn.

Finally, in December the share of low-value deals accounted for 62%, while the share of deals valued more than $100m increased to 5.3%. This month saw announcement of one deal valued more than $1bn.

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make timelier and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.