LISI Investment Services commentary for the month of September 2018, titled, “Emerging Or Fading Contagion?.”

Summary Points

- Analysts first applied the term “contagion” to financial markets in 1997 to describe the external effects of the Thai currency devaluation on other Asian Tigers and beyond, an event that buffeted global markets and tanked oil prices to such an extent that a year later Russia defaulted on $72 billion in sovereign debt. Observers now wonder if contagion may arise from one of several difficult situations facing emerging markets (EM) countries including Turkey, Argentina, South Africa and Venezuela

- Advances in global supply chains and a shift in the nexus of manufacturing do potentially raise the specter of another financial pandemic originating in EM. Greater interdependence through trade and migration may heighten the risk of contagion, though a number of shock absorbers now exist that, while not able to prevent another crisis, are likely to soften the blow. For example, systemic risk is reduced through stricter “Basel” capital requirements for banks, and fewer currencies are now pegged to the US dollar

Q2 hedge fund letters, conference, scoops etc

- Still, a persistently strong dollar combined with trade pressures can create liquidity problems for highly leveraged EM countries. Venezuela, Turkey and Argentina have headlined the recent tumult, yet investors have not hesitated to apply a wide brush to paint the tape red at signs of possible contagion, caused this time both by fundamental factors and the threat of trade wars

- Sovereign and corporate defaults result more from liquidity than from solvency issues. Adept management of near-term debt maturities affects the risk calculation greater than leverage. Other factors include fiscal discipline and the effects of upcoming elections, currency shocks that make debt service more expensive, commodity price swings, and the effects of protectionism on trade. For Argentina, Turkey, and South Africa, leverage is not very high, but current account deficits have reached worrying levels

- While we do not view Emerging Markets contagion to pose a significant threat to global asset values, we do want to remain vigilant for signs of possible Fed rate hike overshooting, this despite low current rates and steady, slow pace of Fed interest rate increases. Two more hikes would take the Fed Funds rate to 2.5%, well below the 5.5% as of June 2006, a year before cracks appear in the foundation of the US housing market

- The LISI Investment Committee voted in late August to maintain its current Tactical Asset Allocations. Based on US strength and a weakening outlook for international developed markets, we continue to favor US equities and high yield within the context of a well diversified portfolio. Stats include a sequential 2Q18 GDP reading of 4.2%, jobless claims at a 49-year low, and business/consumer confidence touching peaks, while core inflation appears to be under control. Still, we are wary of potential shocks from an escalating trade war and possible geopolitical flare-ups, and favor broad diversification

- Contagion by any other name would sting just as sharply. Yet the virulence of isolated financial troubles among a handful of EM countries appears to be contained by stronger global financial institutions, a functioning early warning system, and willingness to permit quicker multilateral and bilateral interventions

Analysts first applied the term “contagion” to financial markets in 1997 to describe the external effects of the Thai currency devaluation on other Asian Tiger countries and beyond, an event that buffeted global markets and tanked oil prices to such an extent that a year later Russia defaulted on $72 billion in sovereign debt. Observers now wonder whether a bout of contagion may arise from one of several difficult situations facing emerging markets (EM) countries including Turkey, Argentina and South Africa, among others.

Of course, spillover crises occurred before the Asian Financial Crisis, but the last two decades have seen greater interconnectedness due to expanding global supply chains and a shift in the nexus of manufacturing that does potentially raise the specter of yet another financial pandemic originating in EM. Yet, a lot else has happened over the last 20 years. While greater interdependence through trade and migration may suggest a heightened risk of contagion, in our view the international community has constructed a number of shock absorbers that, while not able to prevent another crisis, are likely to soften the blow when the next one does occur. We review the EM situation below, as well as upcoming Fed rate hike decisions and the LISI Investment Committee's recommendations. At its late August meeting the Committee voted to keep steady its current Tactical Asset Allocations. We see support for equity valuations from strong corporate earnings, particularly in a US market helped by tax cuts and a cautious Fed. Still, we are wary of potential shocks from an escalating trade war and possible geopolitical flare-ups, and favor broad diversification.

1. Contagion a Threat but Unlikely to Challenge Broad Global Growth

The risk of financial contagion travels through several vectors including trade, financial connections, investor confidence and capital flows. Since the 2008-09 financial crisis, many of the largest problem situations occurred in the developed markets, e.g., Portugal, Ireland, Greece and Spain. Those challenges were successfully navigated and throughout this time many countries have taken steps to reduce systemic risk. Certainly, greater acceptance of improved capital requirements for banks (the “Basel” agreements) have helped countries to solidify the foundations underlying their economies. Fewer countries now peg their currencies to the US dollar and the multilateral institutions have enjoyed greater success in helping to guide, via both advice and emergency financing, governments that find themselves under extreme financial pressure.

We are back to the Emerging Markets as a source of volatility. Investors are left wondering whether contagion may again result in widespread market pain and a threat to the economic stability that has characterized the last few years in most major markets. Venezuela, Turkey and Argentina have headlined the recent tumult, yet investors have not hesitated to apply a wide brush to paint the tape red at signs of possible contagion, caused this time by a number of fundamental factors and the threat of trade wars.

Rising US interest rates have contributed to an investor shift away from EM and back to developed markets. A persistently strong dollar combined with trade pressures can contribute to liquidity problems for highly leveraged EM countries. The recent Turkey volatility arises in that context, yet conditions in other EM countries are particular to each. In Argentina, the asset selloff and currency weakness are due in part to a gradualist approach to fiscal discipline by the Macri administration, yet is amplified by uncertainty over the incipient investigation into corruption in the “notebook” scandal. But Argentina has support, with the IMF reiterating its commitment, even if Argentina must change its fiscal targets, perhaps acknowledging the prospect that the “notebook” investigations could result in lasting public institutional strengthening. Meanwhile, South Africa appears to be slipping into recession alongside a rising current account deficit, and Venezuela's troubles have intractable political roots.

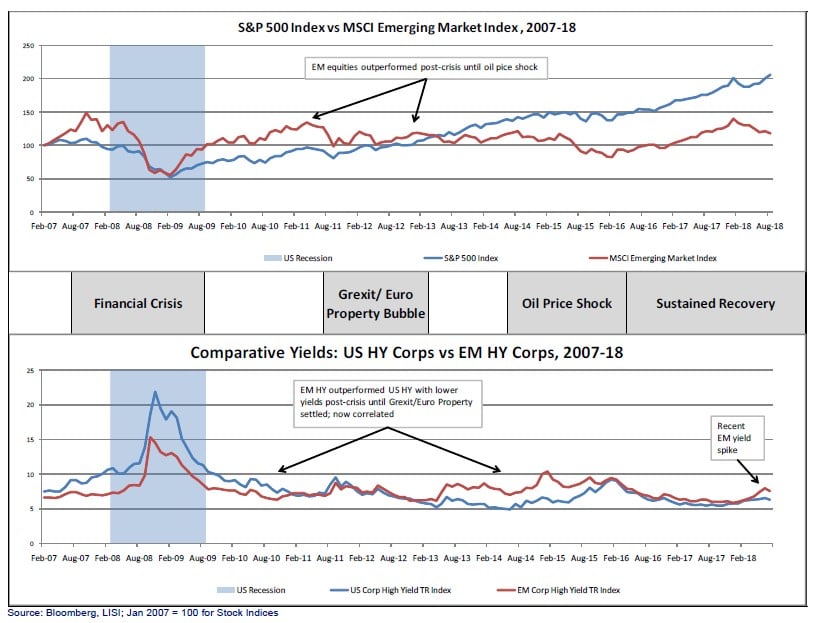

Relative Performance Since Great Recession. The performance of US equities and high yield compared to those of emerging markets has vacillated since the 2008-09 financial crisis. Perceptions of the relative safety of riskier assets in the US and in EM tend to correlate fairly closely, but then deviate during periods of global financial instability when flight to quality shuts the door on EM, particularly in those markets heavily reliant on basic commodity prices.

Mapping relative returns since the beginning of 2007, four main periods mark changes in the perception of risk between US high yield bonds and Emerging Markets high yield. These are the Financial Crisis of 2008-09, the Grexit/Euro Property crisis in 2011-12, the Oil Price Shock of 2014-early 2016, and the full Recovery period from 2016 to the present. Since the main triggers of the Great Recession derived from the US and European property and financial sectors, markets there suffered initially, while aftershocks affected EM with the stark drop in trade and commodity prices. The US equities market recovered and began to outperform EM by mid-2013, and high yield spreads showed a similar pattern. Our charge is, of course, to try to gauge current conditions in the context of historical events and judge our best course of action going forward. Based on this overview and a weakening outlook for international developed markets, we continue to favor US equities and high yield within the context of a well diversified portfolio.

US vs. EM Equity and High Yield Market Performance, 2007-18

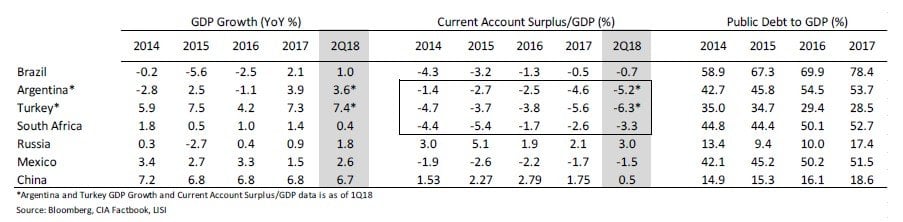

Focus on Liquidity. Sovereign and corporate defaults result more from liquidity issues than from solvency, so the adept management of near-term debt maturities affect the risk calculation greater than the leverage, or Debt-to-GDP, ratio. Elevated leverage does lead to high debt service that can boost current fiscal expenditures. Other factors also come into play: fiscal discipline and the effects of upcoming elections, currency shocks that make debt service more expensive, commodity price swings determined by international markets, and trade fluctuations resulting from protectionism abroad.

In the case of the countries currently viewed as the most vulnerable – Argentina, Turkey, South Africa in particular – the relevant statistics show that leverage is not very high at about 50% debt-to-GDP or less, yet the current account deficits have reached worrying levels (see chart below).

Growth, Leverage and Liquidity in Major EM Countries, 2014-2Q18

2. Fed on Track to Hike Rates at September Meeting

While we do not view Emerging Markets contagion as a significant threat to global asset values, we do want to remain vigilant for signs of possible Fed rate hike overshooting. At the same time, we note that despite the steady, slow pace of Fed rate hikes, the absolute level of interest rates remains quite low. For comparison, the Fed Funds rate stood at 5.5% as of June 2006, about a year before cracks began to appear in the foundation of the US housing market.

Continued strong economic readings in the US give the Fed ample reason to keep hiking rates, with a highly probable 0.25% boost at its September 25-26 meeting that would take the target Fed Funds rate to 2.00%-2.25%. Currently, Fed Funds futures place the probability of a further hike in December at just over 60%. We are encouraged by the recent spate of strong economic numbers: a sequential 2Q18 GDP reading of 4.2% (2.8% YoY), jobless claims at a 49-year low, and business/consumer confidence touching peaks. Amid this good news the Fed’s core inflation indicators appear to remain under control as it hovers around the symmetrical 2% target.

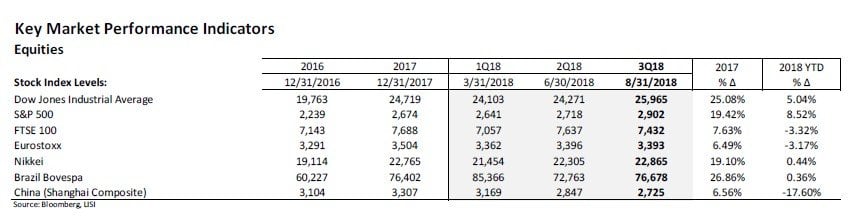

Given this backdrop, it is not surprising that US equities continue to outperform other developed markets as well as major EM indices. Among the major stock indices through 8 months of the year, only those in the US show appreciably positive returns. Europe is down, Japan flat, and China sharply negative (see table below).

Were the Fed's December interest rate hike to happen, the Fed Funds rate would reach about 2.5% and borrowing costs would increase across the board. The US Treasury 10-year note yielded 2.86% as of the end of August, and we do expect it to rise with short-term rates. Yet, as we have pointed out before, the level rests uneasily close to shorter term yields, which increases the risk of a yield inversion that could point to impending recession in the US. Still, most economic and market indicators suggest continued strength so that signal, if it occurs, could be a very early predictor (as another recession will inevitably arrive someday in the future). US sovereign yields exceed those of other developed markets, and given central bank rhetoric abroad we expect that gap to continue for some time.

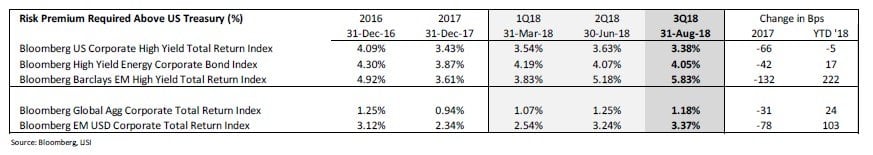

Risk premia for corporate debt have diverged considerably during 2018, as the yield on the Emerging Markets High Yield index increased by over 200 basis points since the end of 2017 to end August at 5.8% (see table below). Meanwhile, US high yield saw a 5 basis point tightening since December 2017, reflecting the strength of the US economy and good background for risky domestic debt.

Conclusion

In light of strong corporate performance and signs that both fiscal and monetary policy remain accommodative, the LISI Investment Committee at its late August meeting voted to maintain its current Tactical Asset Allocations, which reflect a positioning in equities overweight to the Committee's longer term Strategic Asset Allocations (Allocations by model are available upon request). Accordingly, across asset classes we favor the following:

- Fixed Income – We recommend shortening duration and accepting somewhat higher credit risk to mitigate effects of the anticipated rate hike cycle, while taking advantage of improving fundamentals

- Equities – We are positive on equities, particularly in the US, given improving EPS, support from US fiscal stimulus, and the Fed's slow and steady approach to hiking interest rates. We are cautious about the prospects for European equities and have shifted our stance somewhat toward the US and Asia

- Alternatives – We like the low correlation to core markets exhibited by alternative assets, and favor their inclusion as a small component of portfolios with moderate to higher risk profiles

- Cash – We recommend keeping a small allocation in cash to capitalize on any market dislocations

Contagion by any other name would sting just as sharply. Yet the virulence of isolated financial troubles among a handful of EM countries appears to be contained by stronger global financial institutions, a functioning early warning system, and willingness to permit quicker multilateral and bilateral interventions. The apparent retreat from interconnectedness shown by greater protectionism could result in a trend toward relative isolation that, corollary to the epidemiological model, would lead toward dampening the spread of ill effects when countries experience financial difficulty.