Very few filings last week as we while our way through the data desert in the first few weeks of the calendar quarter. In this period there is plenty of news as companies issue press releases and talk about their numbers but the details are where the value is.

The higher inflation rate and the higher interest rates associated with that has resulting in a decline in the value of assets. News headlines proclaiming the largest market decline in 54 years miss the most important element of that.

Q2 2022 hedge fund letters, conferences and more

Long term bond yields have risen from 1.7% to 3.25% since the low point in early December. The value of long treasury bonds has dropped 27%. That is the steepest drop in treasury bond prices ever!

Treasury Bond Haven

In every other stock market decline in history, treasury bonds acted as a haven. They were an opportunity for investors to defend their stocks portfolio against the decline and that became the basis for asset allocation.

Recently, asset allocation has failed causing great harm to retirement assets (and it’s not over!). In December when bonds yields reached their low point, inflation was 6.8% for a gap (real loss for investors) of 5%.

Now, with inflation measured at 8.6%, the real loss for investors in bonds remains above 5%. Interest rates will need to advance much further before any rational investor would buy long term bonds.

Can Inflation Fall?

Alternatively, inflation could fall. No doubt the virus wave has everything exaggerated now. The huge implosion in sales during the early quarters of the virus were followed by a huge explosion in sales in 2021.

The virus wave has crested now and growth is broadly falling. But, so far, not steeply falling. Broad stock indexes are down but less than long term bonds and industrial and energy stocks are up.

The wave in corporate growth set up by the virus will continue to confuse the growth picture for the next few years. We are shifting from an age of consumer dominance when free money encouraged people to take on debt, to an age of reconstruction after years of underinvestment in infrastructure.

Globalization has run its course and the benefits of that (low inflation and higher corporate profits) are likely in reverse depressing living standards in the US and making the baby boomer retirement miserable.

All About Oil

The timing of all of this comes down again to oil prices. The price of crude has moderated in recent weeks and by early next year, at current prices, the inflation effect of higher energy prices abates.

The energy sector was particularly jolted by the virus that depressed sales growth to -28% at the low point to bounce back to now 52%. During that period capital expenditures (investments in new production capacity) increased to 14% of sales from the low point last year.

This recent surge in energy development will contribute to supply growth in two years suggesting that energy costs will continue to advance.

Look For Rising Profit Margins

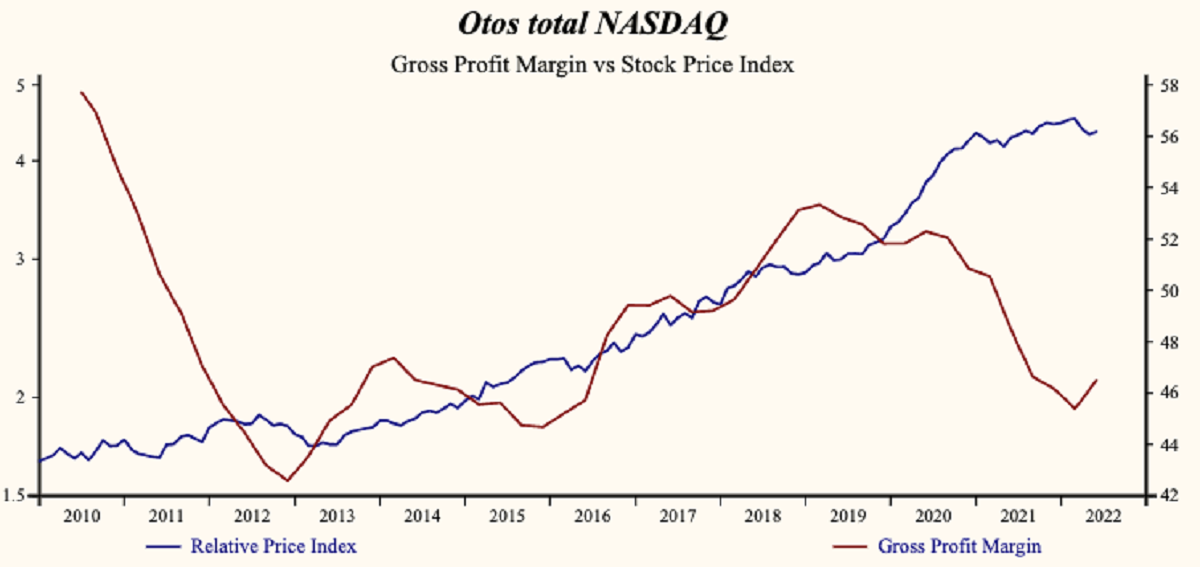

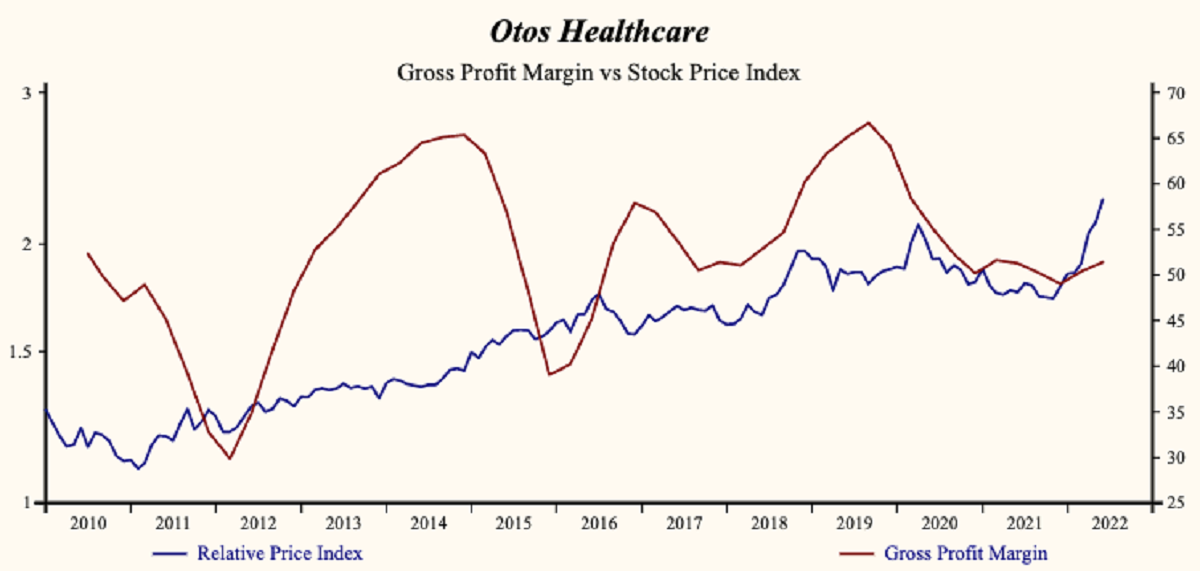

To protect our assets during this difficult period we must insist that all our portfolio companies achieve a rising gross profit margin. Only rising growth will protect our portfolio from the negative effect of rising interest rates.

The best-case outcome now will be a steep and broad decline in growth that might bring down inflation and lower the likelihood of higher interest rates. The decent on the virus wave, cutbacks in the face of inflation, the wealth effect, higher cost of money, all these could result in a steep fall off in growth.

Market Outlook

In the current update, Otos.io Securities & Exchange Commission (SEC) filing update is complete and all stocks decisions have been moved to hold. As we see companies report financial statement to the SEC in the next few weeks, we will be sure to provide sell decisions if growth falls

Recap, corporate growth is unusually high and falling more frequently. Inflation is likely to remain high and interest rates will advance further. Falling growth and rising interest rates is a terrible combination for stocks and asset values generally.

Maintain portfolio companies with high sales growth and rising profit margins (tall green MoneyTree in a golden pot)

Learn more and sign up for our Otos NOtos notifications at OTOS.io and experience your financial reality as FREEDOM AND EMPOWERMENT.