JDP Capital Management’s annual letter to investors for the year ended December 31, 2019, discussing their portfolio holdings such as StoneCo, Teekay Offshore, Spotify and XPO Logistics.

Dear JDP Partner,

Two thousand and nineteen was a strong year of profitable growth for all of our portfolio companies. The Partnership was up 24.6% (net) for the year despite prices of our holdings not catching up with their business progress. The S&P was up 31.2% driven by attractive valuations at the start of the year and surging profitability of the largest companies in the index.

Q4 2019 hedge fund letters, conferences and more

JDP’s goal is to do better than the market in most years, but we are not an investment in the broader market. Our portfolio is focused on a handful of companies that together we think is more attractive than the index itself.

This approach will work against us in some years and benefit us in others.

“It is a great time to be a public company investor”

This statement has been JDP’s theme since launching in late 2011. At that time, public companies were trading at wide discount to private peers out of fear of a double-dip recession. The recession never happened and instead asset prices had to go way up to keep pace with phenomenal earnings growth.

So how is it still a great time to be a public company investor?

For families trying to compound wealth over reasonable periods of time, public markets will always have an advantage over almost anything else because the best companies and management teams in the world are publicly traded.

Stock markets are home to the largest collection of the highest quality companies in the history of modern capitalism. Besides the $1+ trillion club at the top of the S&P 500, there are many smaller businesses that have embraced technology and changes in societal shifts to unlock new growth veins that did not exist a decade ago.

On the other hand, there is a sea of over-hyped, overvalued growth stories that are cashing in on the current euphoria. There is also a sea of zombie-like companies of yesterday selling “cheap” because they are overleveraged, can’t grow, or are simply losing to new competitors.

As a stock picker you get to choose where you focus.

JDP uses the stock market to become a co-owner of one-of-a-kind businesses that are the life’s work of the best entrepreneurs alive like Daniel Ek (Spotify) and Andre Street (StoneCo), and CEOs with incredible track records of creating enormous value against the odds like Andrew Anagnost (Autodesk), Brian Moynihan (Bank of America) and Brad Jacobs (XPO Logistics).

Many of our past mistakes came from an opposite approach: buying average or below average businesses based on price and hoping someone else would pay more for no real reason.

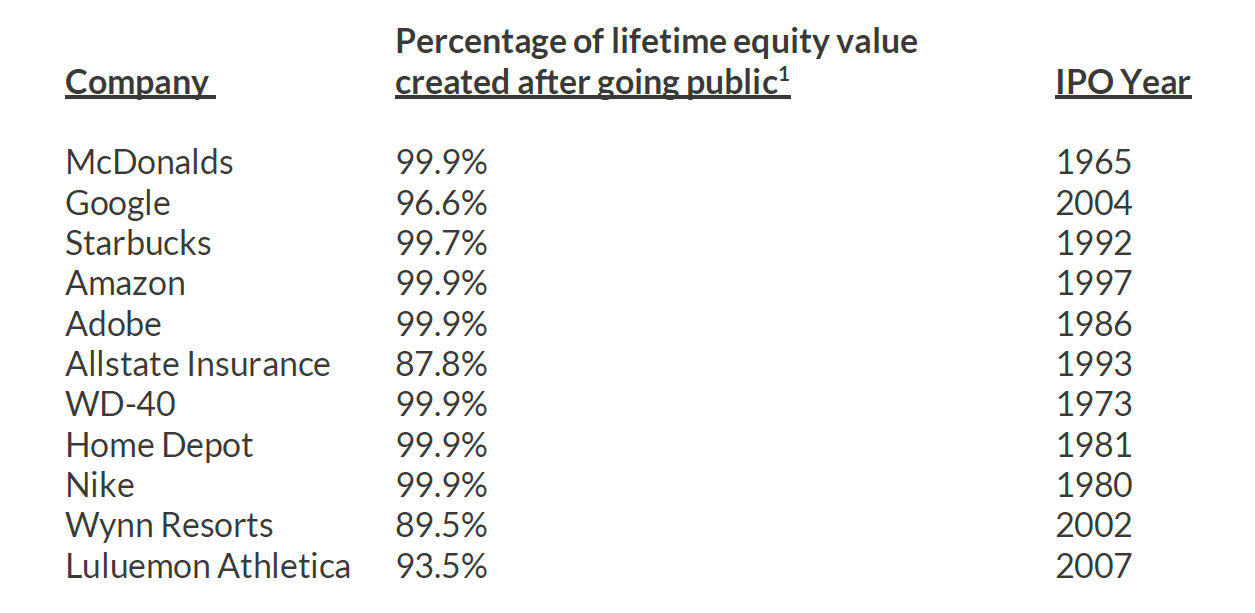

Public markets are a paradise for the business investor because nearly all of the economic value created over a lifetime of the most successful companies is done in the stock price.

Here are a few well known examples:

Investors rarely use the market as a tool to own a company for 5, 10 or 20 years because the emotional challenge of tolerating market noise is more than they can bear (think Coronavirus today).

Morgan Housel produced an excellent presentation on the topic of investor behavior titled What Other Industries Teach Us About Investing (link). The presentation is one of the better presentations on investing I have ever heard. The basis of Morgan’s talk is that our background, upbringing and life experience more heavily influences our investment behavior than the actual risk of the investment itself.

How JDP is invested today

The bulk of our portfolio is invested in companies that are early in their “compounder” journey. All of our companies have a cash flow stream that is funding an attractive growth runway, several are also sucking the heart out of old-economy competitors (JDP examples: Spotify, Autodesk, StoneCo, EchoStar, XPO).

The adoption of technology-first thinking by traditional companies of all sizes has unleashed a race to make everything more efficient, profitable and scalable. The current get-rich-or-die-trying

environment has attracted everyone to the party, including the winners that we hunt for.

The “quality spread” between good and incredible

During market stampedes (up or down) investors often overlook when individual companies are transitioning from a good business to an incredible business because valuations do not stand out from lower quality sector peers and macro headlines are distracting.

Warren Buffett is famous for taking advantage of this “quality spread” with public companies Berkshire has taken private, like Burlington Northern Railways and Precision Castparts.

Burlington Northern, now a wholly owned Berkshire Hathaway subsidiary, is the largest and best-in-breed railroad system in North America. During the depths of the financial crisis Buffett paid $44 billion for the company from public owners or 20 times after-tax earnings—a price that seemed “full valued”.

Shareholders quickly agreed to the deal while ignoring the surge in pricing power and earnings growth that would follow when the economy restarted again. The rail industry had been consolidating for years yet the benefits were just beginning to materialize.

Burlington has since flourished along with the broader rail industry. For example, Burlington’s much smaller public peer Canadian Pacific Railway is up 730% including dividends since Berkshire acquired Burlington on November 3, 20092.

For the lucky few, the flip from good-to-incredible is the most financially powerful leap a company can make in its lifetime. Admittance to this club usually means the ability to survive and thrive throughout cycles and compound cash flow faster than in the past.

Similar to Buffett’s rationale for Burlington Northern, my favorite metric to identify a precompounder is when a temporarily financially-mediocre company is on the cusp of achieving scale or market position that will unlock pricing power or monetization of “hidden” assets.

This sweet spot means two things: (1) the ability to self-finance growth without diluting shareholders with new capital raises and (2) cash flow growth that leads to a re-rating of the company’s financial profile (JDP examples: Autodesk, StoneCo, EchoStar).

Good-to-excellent success stories are made possible by a founder or special CEO with the will to proactively and aggressively spend to invest in a direction they believe their industry is going. It takes strong leaders like Scott Grimes and Lynne Laube (Cardlytics) or Daniel Ek (Spotify) to ignore the market’s pressure to demonstrate GAAP earnings until there is absolutely nothing more interesting to invest in.

JDP’s size and like-minded investor base allows us to own tomorrow’s compounders while they are still small(ish) and undergoing a valuable transition in their business model.

Special situation basket

Around the fringes of our core portfolio is a basket of special-situation stocks (~7% AUM) with 5x to 10x upside potential where a favorable outcome is in our favor.

Special situations come in all shapes and sizes and are linked to events that are specific to that company.

Examples include: lawsuits and geopolitical-driven workouts, balance sheet restructurings, asset sales or spinouts. In order to avoid confusion about our strategy I no longer discuss JDP’s special situations in public letters until after we sell.

In the past we had more exposure to special situations, but experience taught us that the opportunity cost of not owning great companies acts as a hurdle which is very difficult to overcome as time passes.

Last year our special situations group was a drag on fund performance and the reason we did not beat the S&P. There was no fundamental reason for our positions to rally with the market in 4Q based on the US-China trade deal news. The primary catalysts for unlocking these “coiled springs” are set for 2020 and I expect this group to have a positive impact on our full-year performance.

Survivors & Thrivers

A Survivor & Thriver is a term Seth coined to describe the type of company that can outperform the market over 5, 10 and 20-year periods.

The concept was a byproduct of a research project we started in 2016 called “Peak to Peak” to study the commonalities of outlier companies that beat the market when purchased at peak market times in history and held continuously to the next market peak.

Survivors & Thrivers share four common traits that, in our view, summarizes what has to be in place to drive outsized value over ultra-long periods of time.

The more a company trails behind in any one of these four traits, the worse the stock performs, regardless of price paid:

(1) Business model that is adaptable and relevant in tomorrow’s economy

(2) Durable pricing power protected by a growing competitive advantage

(3) Capital allocation and balance sheet strategy that supports the company’s moat

(4) Significant alignment of interest between management and equity owners

Finding all four traits in one company is harder than it might seem. This is why most companies either just survive (for long periods of time) or just thrive (for short periods of time).

JDP’s Survivor & Thriver filter is how we look at new ideas and manage existing holdings.

In fact, most of our time is spent monitoring the portfolio to ensure that our companies are firing “on all four cylinders”. This approach does not ensure we always pick winners, but it does keep us fishing the right pond.

In past letters I have discussed our Peak to Peak research; as time goes on and we update the screen, the commonalities shared among winners and losers become so clear and relevant to our goals that it is worth discussing again (with updated results).

Peak to Peak: What role does really terrible timing play in beating the market?

Imagine that you invested on the worst market day in modern history – October 8, 2007—the “peak” day of the US market before the Great Recession. You then held with a similar mindset towards a real estate investment or a family business, for the next 12 years to the next “peak”.

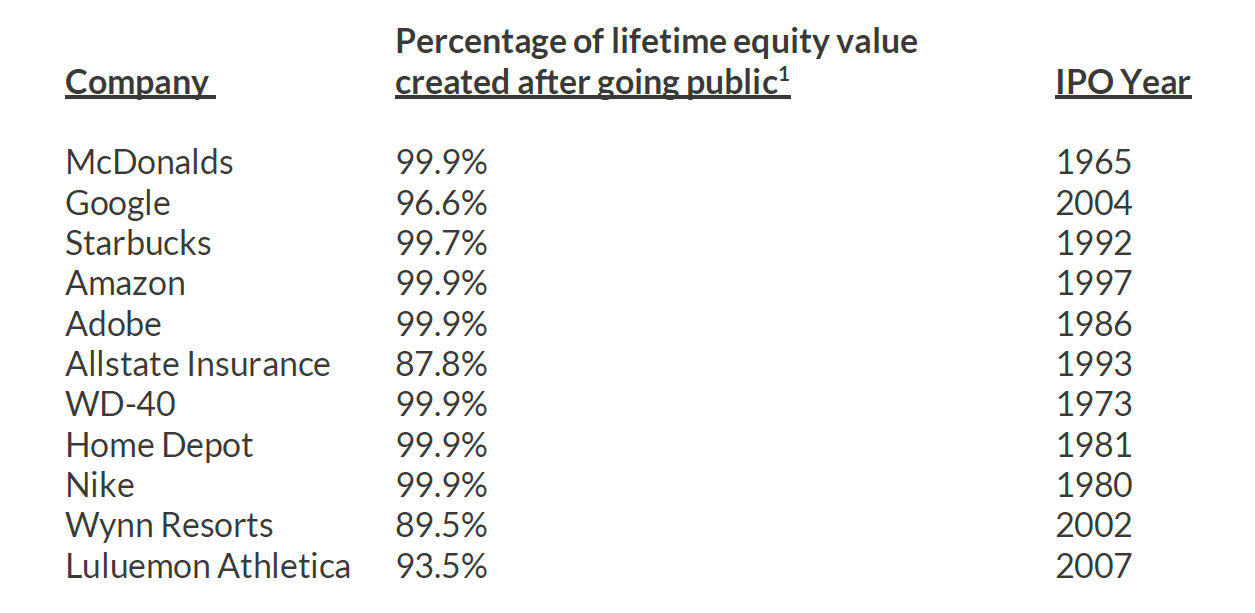

Screen #1: October 8, 2007 to October 8, 20193 (full Peak to Peak screen results)

Takeaway: Focus on finding companies with all four Survivor and Thriver traits, ignore the rest.

(a) The S&P outperformed most asset classes

(b) Simply avoiding the bottom 10% of the worst companies produced a total return of ~267% or 11.4% annualized which beat the S&P by 2.3% annually.

(c) Price cannot compensate for a lack of Survivor & Thriver traits as time passes. The worst performers would have screened statically cheap in late 2007, and cheaper 12 years later.

(d) The top 25% returned ~630% or 18% annualized which beat the market by nearly double.

The top quartile was not advantaged by a low valuation in 2007, or materially higher valuation twelve years later; stock prices just kept up with growth.

When is it a good time to add capital to JDP?

The most common questions I get from potential fund investors are around how to know when it is a good time add capital.

Although it is natural to think in terms of buying low and selling high, Peak to Peak shows us that market timing is unrelated to an individual stock’s ability to outperform (or underperform) the market over JDP’s typical time horizon.

The biggest mistakes investors make over their lifetime are mistakes of omission—missing out on returns of individual companies because they think they can trade around market sentiment.

Investment managers love to talk about volatility and “downside protection” but the real damage is caused by self-inflicted lapses in time not owning companies that are far from their full potential.

That said, it is a great time to add capital to JDP for three reasons:

(1) I am reasonably confident that our portfolio’s cash flow will grow by at least 25% in 2020 on a “look through” basis but have no clue where stock prices will end up.

(2) JDP’s holdings are market leaders with flexible cost structures that are feasting on structural shifts occurring in their industries. This tailwind acts as margin of safety in a

softer economy.

(3) We are advantaged by understanding our holdings well enough to decipher between day-to-day noise and nuanced updates that matter to the investment thesis.

Portfolio Commentary

Spotify

JDP acquired Spotify Technology (NYSE: SPOT) on a value basis between late 2018 and early 2019 for a price of roughly $110 per subscriber (FY 2019) and 2x 2020 revenue. Spotify also has a partnership with Tencent Music (China and Southeast Asia) through a 9% ownership stake that also looks attractive.

We think Spotify is a Survivor & Thriver with a high probability of being worth much more than its current $25 billion market cap within 5 years. Spotify is led and protected by co-founder Daniel Ek, one of the best entrepreneur-CEOs alive today.

Originally our Spotify thesis focused on the broader trend from radio to streaming and Spotify’s global market position and loved product. We also said that SPOT should be able to increase subscription prices in low-margin markets over time and grow faster in the US than the market thought. Not to mention the ~$20 billion market for radio advertising that will divided between the big streamers someday. All true.

But we are now most excited about the growing visibility into Spotify’s Two-Sided-Marketplace platform and plans to monetize the treasure trove of subscriber data that is growing exponentially. The platform brings together consumers, artists, content owners, content producers and advertisers to cross-sell within an ecosystem where SPOT charges fees.

The idea of Spotify as a marketing platform is not new, the company has consistently discussed its marketplace strategy since going public. Now with 248 million subscribers (4Q ’19) the idea is starting to see traction and should have a small yet positive impact on gross margins in 2020.

The Two-Sided-Marketplace is important because it means unlocking gross margin potential beyond the 26% today and moving the company beyond its original business model.

Spotify’s original music streaming model (now replicated in big tech bundles) is outdated and competition is growing. The model pays music content owners per song listened which is similar to pricing store rent as a percentage of sales. This cost structure only makes sense as part of bigger strategy because it is nearly impossible to gain operating leverage.

SPOT breaks down the Two-Sided-Marketplace into three areas: (1) Spotify for Artists, (2) Sponsored Recommendations, and (3) audio creation tools (Soundtrap and Soundbetter).

Spotify has not disclosed the specific product revenue opportunities by segment because many are still pre-beta.

Some of the marketplace products that have been introduced or just discussed by management include:

A) Enhanced marketing tools for record labels to influence the exposure of a specific undervalued song or artist. The tool would give the labels more control over targeted promotion for a fee. In the fourth quarter Spotify launched Sponsored Recommendations and mentioned “Average click-through rates and average listener conversion have been at consistently high rates (+30% for each).”

B) Direct marketing of concert tickets to fans based on proximity and interest. Spotify subscribers tend to be highly engaged with the app which offers the first opportunity to instantly offer access to a concert. High-margin ticketing and advertising revenue is up for grabs from old economy companies like LiveNation who cannot interact with fans on a daily basis. Spotify for Artists grew to 500,000 monthly active artists and creators in the fourth quarter (feeder for creator tool subscriptions).

C) In 2019, Spotify entered the podcast industry in a big way with the acquisitions of Gimlet, Anchor, Parcast and The Ringer. The rising number of Spotify subscribers listening to podcasts (16%) is driving increased retention and reducing churn. Spotify will sell highly targeted advertising within its owned podcast titles, and eventually place ads on thirdparty content accessed on Spotify.

Early data on the effectiveness of podcast advertising suggests that audiences tend to be more engaged and interested in the podcast topic than other formats. The podcast industry is on fire and the price of advertising within high value content will skyrocket off a low base today. Liberty Global CEO Mike Fries stated recently that the podcast industry has 90 million listeners in the US which is estimated to grow 45% by 2022. As of the 4Q 2019 Spotify had 700,000 podcast titles and consumption hours were up 200%.

D) Other revenue sources for the Marketplace include audio production tools for small and large artists. Spotify noted in its 4Q investor letter that Soundtrap had doubled its paying subscribers in the period.

Lastly, we like that Spotify continues to prioritize ARPU (average revenue per user) unit growth over revenue per user which is responsibly driving platform scale within cash flow. In 2019, ARPU was down 5% due to extended free premium trial period and geography mix.

Despite a 37% increase in the stock last year the market remains distracted by recent subscriber growth of big-tech bundled offerings that includes streaming access to a basic music catalogue.

Part of the industry’s growth is driven by a rapid transition that is happening from radio to streaming as mobile data prices decline. It is also not difficult for big tech to offer a simple streaming audio library that is part of a bundling strategy.

We believe the limited audio product features of big tech bundles will not keep up with Spotify’s ecosystem of features and benefits to both listeners and the broader audio industry.

By our estimates Spotify, Apple, Amazon and Tencent Music subscribers represent only 14% of worldwide smartphone users (3.5 billion) and 11% of total mobile phone users (4.6 billion).

Competition that introduces people to streaming for the first time is hugely beneficial to Spotify as awareness of the different services becomes an opportunity to win subscribers.

Spotify is a core JDP holding and we are excited about the company’s future earning power that is currently under-appreciated by the market. We are also excited to add to the position as new capital is contributed.

StoneCo

JDP bought StoneCo (NYSE: STNE) in May 2019. The stock has gone up a lot since, but zooming out we see a much larger company in a few years.

StoneCo is a Brazilian fintech company that provides card processing, business software and other banking services to small, medium, and starting in 2020—micro-merchants.

StoneCo is a core JDP holding but will be capped as a percentage of AUM because of Brazil-specific challenges that are difficult to handicap such as currency, sector regulatory change, political risk, etc.

How we found StoneCo and a trip to Brazil

We discovered Stone in a news clip that reported that Berkshire Hathaway owned 10% of the company pre-IPO. We put the stock on our watch list and started researching it after it went public. The company stood out as a profitable high growth company undergoing an upgrade in its business model from good to excellent, led by a world-class entrepreneur, and probably misunderstood by US and European investors.

Between April and May 2018, the stock fell from $42 to $25 over concerns about competitor pricing. We felt that the concerns were way overblown, so we took a position at $27 per share.

StoneCo was founded in 2012 by Brazilian fintech entrepreneur, Andre Street. Stone went public on the New York Stock Exchange in 2018 and is controlled by Andre Street, his financial partners 3G Capital, Berkshire Hathaway and the Walton family office.

Since 2016 revenue has compounded at 78% per year and pre-tax income has gone from negative, to a positive 40% of revenue (big jump).

StoneCo gushes free cash flow and, like Spotify, has the opportunity to reinvest all of it back into highly accretive product opportunities to grow its core business.

In November I traveled to Brazil with Dutch fund manager Georg Krijgh to visit Stone, one of its competitors PagsSeguro, and an unaffiliated large payments company. Georg and I made the trip because we had a unique invitation by StoneCo to spend time at a company “Hub” in Sao Paolo with about 20 ground-floor employees that included sales, customer service and a Green Angel IT team for the area.

The experience was remarkable because we got to see under the hood, chat with people on the ground floor about their work and get a glimpse into the StoneCo culture-driven secret sauce.

After spending the morning at the Hub, we traveled a half-hour by Uber to Stone’s headquarters to meet a few senior members of the corporate team. Our hosts were very generous with their time and treated us as if we were major shareholders.

The discussion was unusually open and relaxed for a company of Stone’s size. We covered a wide range of topics including the super driven entrepreneurial company culture, business challenges, mistakes, and the hands-on support they get from the Walton’s family office and 3G. We even talked about management’s preferred footwear at work—Swiss running shoes called On, also partly owned by 3G.

By the end of our trip it was clear why StoneCo’s is advantaged over its competitors and probably has many years of growth.

StoneCo’s business model and opportunity set is unique to Brazil, and maybe neighboring countries someday. It is difficult to understand StoneCo without going to Brazil and doing the work. As is usually the case—the numbers do not tell the full story.

StoneCo as a Survivor and Thriver

(1) Business model that is adaptable and relevant in tomorrow’s economy

StoneCo is a large scale fintec platform for small and medium sized businesses (SMEs). SMEs make up about 20% of Brazil’s GDP or $316 billion in 2019 and have historically been underserved, or not served at all, by the traditional banking system.

StoneCo’s first product for SMEs was a high-quality card terminal for processing credit cards and funding credit card receivables (Brazil’s central bank requires a 30-day waiting period on credit card receivables to settle) for an interest rate-like fee. Small businesses were quick to jump to StoneCo’s product because of a strong customer service culture in a sector where good service had been nonexistent for decades.

StoneCo then rolled out “free” business software for inventory management, accounting, payroll and financial planning to its subscribers. Stone’s unique relationship with its SMEs allowed it to patiently educate first-time users and demonstrate efficiency savings. The SasS software package has become integrated into millions of Brazilian small businesses but gets cut off if the client leaves for a competitor.

Transition to monetizing client data to underwrite loans. Now that Stone has access to the most intimate financial data for millions of SMEs it in a position to underwrite loans using daily sales and data linked to its software package. In 2020 StoneCo will begin underwriting small loans and employee credit lines backed by third-party investors for a fee (similar to Square’s model). Stone also plans to expand into personal financial products and utility bill pay services now dominated by traditional banks.

(2) Durable pricing power protected by a growing competitive advantage

StoneCo has demonstrated the ability to preserve gross margins, and even raise prices in the face of competitor price wars. Competitors are far behind and in our view and lack the culture to compete with StoneCo. Bank-backed competitors like Cielo seem to have pricebased sales models, no business software, and average customer service. They offer a basic factoring product and a terminal linked to a specific bank where they act as an agent. Larger SMEs with their own software and less need for outside service are a better fit for competitors, but the margins are thin at the top and StoneCo doesn’t compete there.

(3) Capital allocation and balance sheet strategy that supports the company’s moat

StoneCo’s growth plans are financeable with cash flow from operations. The company has no debt, plenty of cash and an opportunistic stock buyback program.

Management has stated multiple times that it does not plan to use its own balance sheet to fund SME loans other than small pilot program tests. The ability to self-finance a long growth runway will allow for retained earnings and equity value to compound.

A strong balance sheet with no debt ensures the company is able to make long-term capital allocation decisions without lender influence.

(4) Significant alignment of interest between management and equity owners

Founder Andre Street controls the company through a combination of common stock and super voting shares. Andre receives below average compensation and is clearly playing for “team equity”. StoneCo is the pinnacle of Andre’s career and he is surrounded by some of the greatest advisors and equity partners in the world.

The alignment of interest between StoneCo management and minority equity holders is excellent, maybe the best among all JDP holdings.

StoneCo is a smaller yet core JDP holding and we are excited about the company’s future earning power.

XPO Logistics

Update – JDP has owned XPO for nearly 3 years. During the market crash of December 2018, we tripled-down at just over $50 per share or approximately 7.7x 2020 free cash flow. XPO then bought back a third of stock for an incredible price. The leveraged buyback was a bossmove from CEO and controlling shareholder Brad Jacobs.

XPO is a top 10 global logistics provider that acts as an outsourced supply chain manager for large companies. XPO is not in the parcel delivery business (UPS, FedEx, DHL, Amazon). XPO’s global scale and fully integrated suite of owned logistical assets means the company can offer best-in-class service and efficiency for its customers that they could not achieve inhouse.

The company also has a strong technology culture and is obsessed with maintaining its market lead though tech spend and innovation. XPO is far from an old-economy business and has spent more on tech bets around efficiency and cost savings than any other public logistics company we have seen.

Strategic Alternatives announcement – January 15, 2020

In January XPO announced that it is exploring the sale of all the company’s subsidiaries except its crown-jewel LTL business (less than truckload). Brad Jacobs discussed his rationale for the move on the 4Q 2019 earnings call saying that he believes the stock will always trade for a discount to its breakup value.

Valuations of lower-quality logistics companies sell for 40% - 50% higher than XPO on a multiple of EBITDA basis.

We were disappointed in the announcement to sell most of the company in order to close the current valuation discount versus playing the long game that we signed up for.

As a result, we sold 2/3 of our XPO position for $95 per share until we have a clearer view of what a “new XPO” would look like after one or more subsidiaries are sold, if at all.

Despite macroeconomics fears, we like XPO and think the stock price massively undervalues both its private market value and long-term earning power.

Here are a few selected points from XPO’s January 2020 investor presentation (paraphrased by JDP) that highlight some of the reasons we still like the company:

- XPO has leading positions in the fastest growing areas of transportation and logistics. More than 60% of revenue comes from sectors that are growing at 2 to 4 times GDP

- XPO’s combination of scale, density, expertise and technology is critically important in ecommerce and omnichannel supply chains globally

- XPO has less than 2% share of the total addressable market opportunity (complements opportunities for further consolidation)

- XPO’s business model is optimized for free cash flow generation in all parts of the cycle: about 70% of revenue is asset-light and 77% of the cost-basis is variable.

- XPO serves customers in different verticals with diverse economic cycles. The vast majority of revenue is generated under long-term contracts (cash flow generation is more resilient in a downturn than it might seem).

- Maintenance capex is low, XPO can flex capex up or down and turn working capital into a source of cash in an economic downturn.

- LTL profit is expected to grow by $700 million to $1 billion by 2022

Teekay Offshore Partners

Teekay Offshore (now re-named Altera Infrastructure) was the most difficult and disappointing investment JDP has ever made. Altera was a case where we got the business and valuation right but missed on the fourth Survivor and Thriver trait: an alignment of interest between the controlling unitholders—Brookfield Business Partners (BBU), and minority investors.

This summer JDP lead an investor group lawsuit against BBU for breach of fiduciary duty, material misstatements and misrepresentation (among other things). Essentially BBU abused their power as General Partner of the Teekay Offshore limited partnership to force minority holders to sell their stake well below going-concern value, or even liquidation value of the business.

To recap the company—Altera is an infrastructure business with long duration contracts to move oil between offshore platforms and the shore in the North Sea and Brazil for deep wells that cannot be turned off easily. Altera’s shuttle tanker business is the largest in the world and operates within a duopoly protected by specific expertise in a small niche that keeps out larger infrastructure competitors.

Altera’s EBITDA does not move with oil prices and has remained consistent for many years.

Altera’s previous owner (Teekay Corporation) has a long history as a reckless operator and overleveraged the business to pay dividends that it could not afford. To avoid bankruptcy in 2016, BBU took control of Altera by injecting ~$1.5 billion to clean up the balance sheet, fulfill previously ordered shuttle tankers, and even order new ones. New vessels are attached to longterm contracts in the North Sea and Canada and partly financed with Green Bonds subsidized by the Norwegian government.

JDP initially invested in Teekay Offshore after the Brookfield recapitalization because the balance sheet risk was removed. The initial Brookfield-Teekay Offshore investor pitch was attractive and described a long growth runway to invest in new assets when competitors were tapped out; Teekay Offshore was positioned as the “last man standing” with plenty of capital in an attractive niche with pricing power.

JDP’s average price of roughly $2 per unit was less than Brookfield’s $2.50 cost of per unit for control of the company. Brookfield also received an attractive warrant package with a $4 strike that we felt was a homerun. Teekay was earning ~$1 per unit in cash flow “to the firm” that would slowly become available as BBU further de-leveraged the balance sheet.

After two years in, the stock continued to collapse due to terrible investor relations, BBU placing its own high-interest debt at the HoldCo level to earn interest and fees, and a minority shareholders base that was growing increasingly leery of Brookfield’s intentions. At the time we were optimistic that BBU was aligned with minority holders because of their 60% stake in the equity, and the 5 to 7-year time horizon of BBU’s private equity investment.

In the summer of 2019, Brookfield launched a hostile bid to buy out minority holders for $1.05 per share. JDP responded by leading a lawsuit with two other funds against Brookfield. Our effort resulted in BBU increasing the price by 47% to $1.55. But we strongly believed the company was worth well over $4 per share.

Our initial lawsuit was combined with another group, amended and re-filed on January 27, 2020. The goal is either to settle with BBU on additional compensation for all former Teekay Offshore holders as of a specific date before the tender or proceed with a class action lawsuit.

In summary, even the highest-quality assets bought at a great price can be a terrible investment if you cannot trust management to respect minority investors and not opportunistically profit at

their expense.

Closing comments

The most financially successful families in the world became that way by having two things in common:

(1) Concentration of their net worth in one or two businesses, or holding companies, often for decades

(2) A forward looking, multi-generational outlook

As an investor in JDP you are a co-owner in a handful of businesses that I would be comfortable owning much more of, as new capital is added. Our companies have some of best products, technology, teams, and earnings runway potential in their fields.

You will only know the next market “peak” with hindsight; it cannot be timed. When things do go crazy (up or down) it is how we behave that determines our success. As a result, markets will always be rich with opportunities for investors with a business owner mindset.

Heading into 2020 we are off to a great start. I am excited about our holdings including two new small positions that could become more important as due diligence evolves.

It is an exciting time to a public company investor and an exciting time to be alive.

Sincerely,

Jeremy Deal