This paper represents the latest research by AIMA to shed light on the relationship between GPs (fund managers) and LPs (investors), with the aim of identifying where the needs of investors are being met and the extent to which the priorities of both parties align.

We previously focused on this topic in 2019 in the report In Harmony and this paper offers a time series analysis of how trends have changed since then.

Q4 2022 hedge fund letters, conferences and more

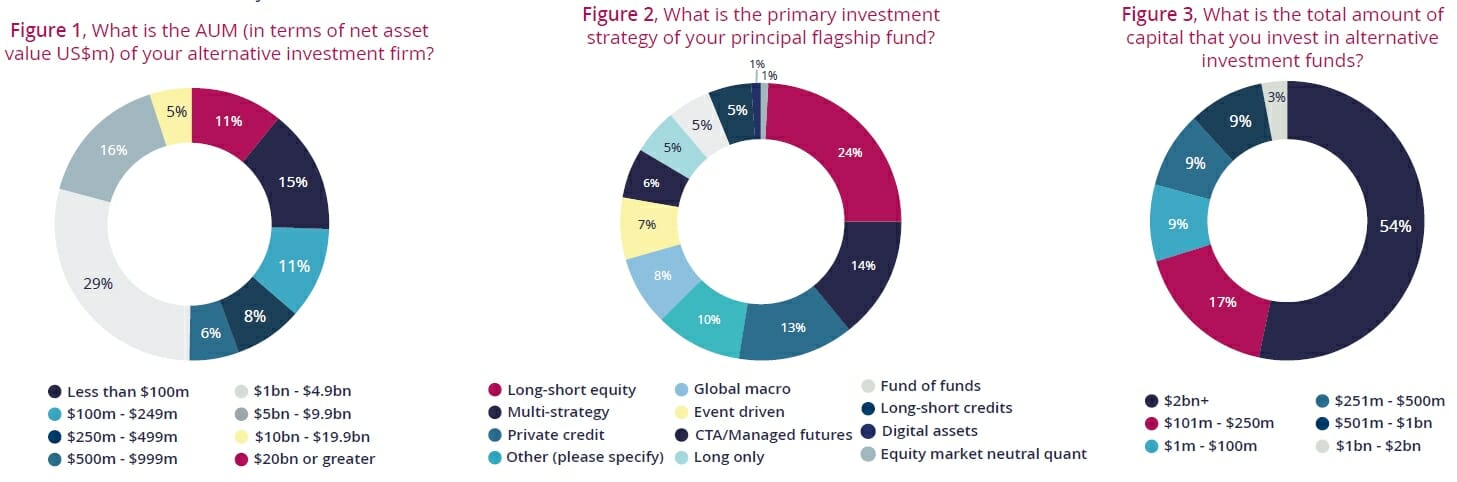

The paper is built upon the findings of a survey of 138 alternative investment fund managers with an estimated aggregate of $707 billion in assets under management.1 The average AUM of fund managers surveyed is $5 billion, up from $3.7 billion in 2019, (see figure 1).

Broken down by strategy, a quarter of all fund managers surveyed are long-short equity managers, with 14% multi-strategy managers and 13% are private credit managers, (see figure 2).

Respondents are divided by size (see figure 3). Where we refer to larger managers, these include managers with more than $1billion AUM and those with AUM of less than $1billion are referred to as smaller managers.

The fund manager survey is complemented by a separate survey of 35 institutional investors that allocate to alternative investment funds to get their perspectives on key opportunities for alignment of interests. More than half of these investors allocate more than $2 billion to alternative investment funds, while the average is $1.3 billion.

The conclusions drawn in this report are primarily based on the data from these surveys and enhanced by trend analysis by managers and investors who were interviewed after the survey closed.

Executive summary

Part I. Aligning interests: The fundamentals

For managers, having significant personal capital invested in their fund remains central to reassuring their investors that their interests are aligned. This strong foundation to the relationship is now being built upon the application of greater transparency around the portfolio to facilitate more granular attribution analysis by investors, as well as more flexibility around fees and expenses and other aspects of the business.

Part II. The modern fee model

After years of downward pressure on fees, many investors and fund managers have settled on a new fee model that emphasises rewarding fund managers that can consistently deliver strong performance, albeit with more stringent hurdles to clear.

In turn, managers have had to innovate how they charge fees and manage expenses through the use of new product structures and share classes that reward longer lock-up periods in exchange for fee discounts. While management fees remain below the historic 2% level, rising operational costs are being supplemented by more fees being charged to the fund pass-through to investors.

Part III. Innovating to maintain alignment

Fund managers are innovating their offering to win and retain investors with new fund structures and the launch of new products. Specifically, the increasing popularity of co-investment products in the hedge fund space may be providing the ideal vehicle for aligning interests.

Relationships are being further deepened through strategic knowledge sharing and sophisticated conversations around complex issues incorporating ESG and responsible investment to the investment experience to ensure investors and their managers are aligned.

Part IV. ESG: adapting to the changing landscape

Responsible investment has entered a new phase. The macroeconomic headwinds of the moment are demanding a more nuanced ESG strategy that transcends binary exclusion lists and is only applied where relevant.

Part I: Aligning interests: The fundamentals

Skin In The Game

The central pillar for securing a strong alignment of interests between managers and investors remains how much skin they have in the game (i.e., the personal capital invested in the fund by the principals).

Having skin-inthe- game is one of the key differentiators that align interests between alternative investment fund managers and their investors more closely than other fund types, such as mutual funds, which rarely share this characteristic.

When asked how they primarily align interests with investors, over three-quarters of fund managers surveyed said it was achieved through having a significant personal investment in their own funds, a trend that was also clearly visible in our 2019 report.

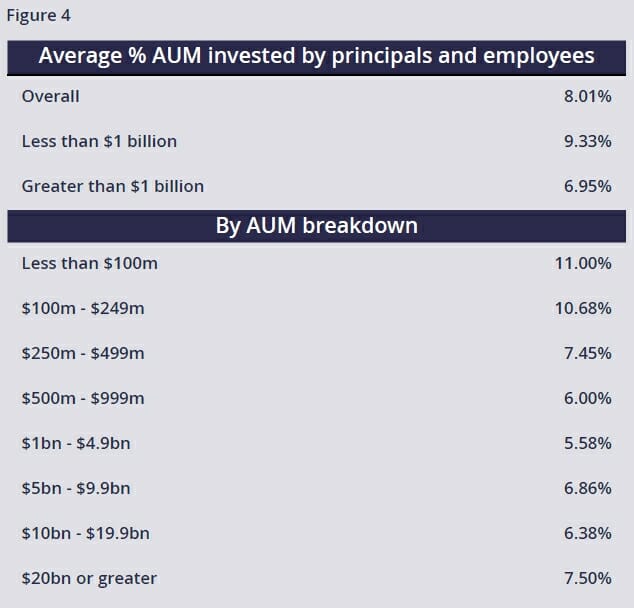

Interestingly, one might expect the average investment of principals in their fund to have decreased since 2019 given the average fund size (of fund managers that we surveyed) has before increased from $3.7 billion to $5 billion.

In fact, we observe the opposite.

Average investment is 8% this time, up from 6% in 2019, (see figure 4). Larger managers (with greater than $1billion in assets under management) have an average investment of 7% compared to 9% for smaller managers.

Read the full report here.