Hormel Foods (HRL) has a 52-year history of consecutive annual dividend raises, putting it in a group of select companies that can make such a claim. This track record allows Hormel to count itself among the elite Dividend Kings, a small group of stocks that have increased their payouts for at least 50 straight years. You can see the full list of all 25 Dividend Kings here.

ValueWalk readers can click here to instantly access an exclusive $100 discount on Sure Dividend’s premium online course Invest Like The Best, which contains a case-study-based investigation of how 6 of the world’s best investors beat the market over time.

Click here to download my Dividend Kings Excel Spreadsheet now. Keep reading this article to learn more.

Click here to access our Members Area where you can easily download all our Excel databases in one place.

Dividend Kings are the best of the best when it comes to rewarding shareholders with cash and this article will discuss Hormel’s dividend and valuation outlook.

Business Overview

Hormel sells a wide array of packaged food products that cater to consumers as well as foodservice customers. Hormel distributes its products directly to hospitals, schools and other commercial clients as well as through a robust network of grocery stores that allow it to reach consumers directly. The company specializes in meat products but has recently acquired its way to some degree of diversification away from a meat-focused set of offerings.

Hormel’s market cap is about $18 billion at present with the dividend yield at 2.3%, and expectations are for the company to do just under $10B of revenue this year. It sells its products in 80 countries around the world and has more than 20,000 employees, so this is a sizable enterprise. Hormel is organized into four distinct business lines: Grocery Products, Refrigerated Foods, Jennie-O Turkey Store, and finally International and Other.

Source: 2017 annual report, page 10

The Grocery Products segment consists of processing, marketing and selling shelf-stable food products for the retail market. Refrigerated Foods includes the processing, marketing and sale of branded and unbranded meat products for retail and foodservice customers. Jennie-O operates in the same manner as Refrigerated Foods but focuses only on turkey products. Finally, International and Other contains the company’s joint ventures as well as its small but growing non-US business.

Refrigerated Foods is the largest segment by far, accounting for 48% of total revenue and 45% of total operating profit in 2017. Grocery Products comes in second with 28% of sales and 29% of operating profit while Jennie-O is third with 18% of sales and 19% of operating profit.

International and Other accounted for 6% of sales and 7% of operating profit in 2017. Hormel’s product lines have diversified in recent years but as we can see, it is still beholden to its core market of shelf-stable and refrigerated meat products and of late, growth has been challenging to come by.

Growth Prospects

Hormel is in an industry that does not typically see a lot of growth. After all, meat products may be core to consumers’ buying behaviors but they aren’t exactly a new and exciting product line. Hormel is a consumer staple in the truest sense of the term and as a result of its dominance in the space, 35 of its brands are #1 or #2 in their respective categories. These core brands with strong leadership positions represent about 60% of Hormel’s total sales so they are critically important.

However, if you consider that the majority of the company’s revenue comes from product categories where it already has segment leaders, it is easy to understand why growth may be challenging; the opportunity to expand or improve is necessarily limited for an industry leader.

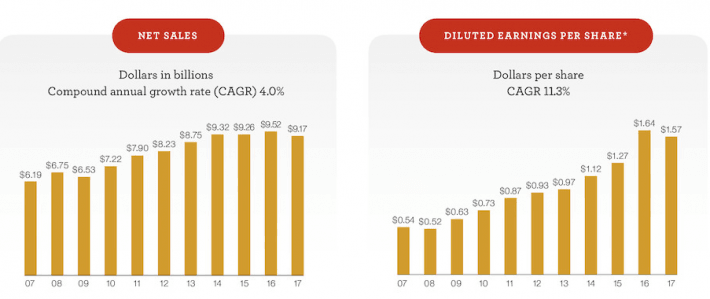

Source: 2017 annual report, page 12

Indeed, this chart from the company’s 2017 annual report bears this out as we can see that revenue growth has been challenging to come by to say the least. Last year’s revenue total was actually lower than that of 2014 and while part of that is due to divestitures – which Hormel does frequently – it has also been acquiring to offset those divestitures. The bottom line is that this is what growth looks like for Hormel and it isn’t particularly inspiring.

That’s not to say that management isn’t acutely aware of this problem, however, as Hormel has laid out six strategic priorities going forward. First, Hormel is going to continue to broaden its assortment. Hormel is heavily leveraged to the success of its meat lines and that’s understandable given that is the company’s core offering.

However, Hormel is moving into things like almond butter to get away from such a meat-focused line, but it is also enhancing that core line through acquisitions like Columbus Craft Meats. Hormel will never fully get away from being meat-centric but management is at least trying to expand its focus to spur some growth outside of its core categories.

Second, it is trying to expand in the foodservice channel and is doing that by improving its supply chain to be quicker and more responsive, but also in acquiring businesses like Fontanini Italian Meats. Bolting on already-successful foodservice providers allows Hormel to buy a little bit of growth here and there but also acquire expertise in servicing foodservice clients, allowing Hormel to get away from so much focus on grocery store distribution and into growth areas like hospitals and restaurants.

Third, Hormel wants to become a more global company because as I mentioned, it only derived 6% of its revenue from outside the US last year. One major step it has taken lately is to build a new SPAM production facility in Jiaxing, China, which will double its capacity to sell that product in the world’s largest consumer market. It also acquired Cidade do Sol and its Ceratti brand to get its first foothold in South American market for processed meat products. This is going to be a long process but focusing on building the non-US business is key if Hormel is to get back to growth.

Fourth, Hormel wants to reduce earnings volatility. What’s interesting about Hormel is that it actually does see a decent amount of earnings volatility despite fairly flat revenue. Jennie-O operating earnings fell markedly last year but were somewhat offset by strength in other categories; one of the goals of Hormel’s diversification push is to even out these swings over time.

Fifth, management is pushing to divest non-core assets. To this end, it divested the Farmer John and Saags brands last year as they were ancillary to the company’s core business. Hog processing is a high-volume but low-margin business and Hormel was therefore disinterested in continuing to operate it. Look for small, non-core pieces of the business to be sold off in the coming years as Hormel tries to elevate its growth and margin profiles.

Finally, Hormel is in the process of modernizing its supply chain. I mentioned work it is doing to improve its responsiveness to its customers based upon ever-changing demands but another part of it is replacing its outdated factories. A recent example is a new Jennie-O factory in Melrose, Minnesota, replacing an outdated existing Jennie-O facility. Improvements to the supply chain should yield improved margins over time, although investments in such things typically have long cycles and tend to be rather expensive.

While these initiatives are certainly noble pursuits and should help Hormel with its growth problem, it is likely that the bulk of the company’s growth going forward will continue to come from acquisitions. Hormel is a serial acquirer as it sees opportunities to pounce and takes them, and that strategy isn’t changing. Organic growth will likely remain tough to come by but the initiatives outlined above should help incrementally.

Competitive Advantages & Recession Performance

Hormel’s key competitive advantage lies in its leadership position in its core product markets. As previously discussed, it has 35 brands in the #1 or #2 slot in their respective markets; that is a segment leader in the purest sense of the term.

That sort of dominant position in those markets means Hormel not only has a lot of customers, but ones that are loyal as well, creating repeat sales. That in itself is a competitive advantage because Hormel doesn’t have to unseat some superior foe; it is the hunted rather than the hunter.

In addition, Hormel’s distribution network is an advantage against its competitors. Hormel has relationships with national grocery chains as well as countless foodservice providers, all of which help drive efficiencies in deliveries. It didn’t get to #1 or #2 in 35 brands by dealing with mom-and-pop shops; Hormel is playing in the big leagues.

Due to these reasons and the fact that Hormel competes in the consumer staples arena, it actually weathers recessions quite well. Obviously most businesses suffered enormously during the 2007 to 2009 period as consumer spending fell off a cliff but Hormel simply didn’t. Revenue actually grew in 2008 – but fell back in 2009 – while EPS dipped only slightly in 2008. But starting in 2009 it was right back to growth for Hormel.

Hormel’s competitive advantages provide the company with a recession-resistant business model. Hormel’s earnings-per-share during the Great Recession are below:

- 2007 earnings-per-share of $0.54

- 2008 earnings-per-share of $0.52 (3.7% decline)

- 2009 earnings-per-share of $0.63 (21% increase)

- 2010 earnings-per-share of $0.76 (21% increase)

That is the very definition of being recession-resistant and Hormel represents that concept quite well. Knowing that earnings really didn’t suffer during the Great Recession is of great solace for investors focusing on the dividend as we know a recession is coming again at some point; Hormel will be ready for it.

Valuation & Expected Returns

Hormel guided for $1.81 to $1.95 in EPS for this year after its Q1 earnings report. At the midpoint of guidance, the stock currently trades for a price-to-earnings ratio of 17.9. This is right on par with Hormel’s 10-year average price-to-earnings ratio of 18.4.

Source: Value Line

As a result, it does not appear that Hormel is significantly undervalued. Hormel has traded basically in the high-teens in terms of forward PE for years. That means multiple expansion isn’t likely given that would require some sort of fundamental catalyst and right now, there doesn’t appear to be one on the horizon given its weak growth profile.

In addition, Hormel doesn’t look particularly cheap against its growth expectations, which aren’t impressive in their own right. EPS growth is going to be ~17% this year but that is mainly due to tax reform; going forward, we are looking more at 5% or so annually. That means Hormel’s price-to-earnings-growth ratio is in excess of 3, a very high value indeed.

For reference, value stocks are generally around a PEG of 1 and growth stocks are closer to 2; Hormel far exceeds both of those values so it certainly looks expensive on that basis.

There is also the important matter of the dividend. Hormel managed to raise its dividend in the depths of the Great Recession by a very respectable 20%, moving from 15 cents in 2007 to 18 cents the next year. Since that time we’ve seen steady and strong increases in the payout amounting to a 16.3% CAGR over this time frame.

There aren’t many companies that can claim such a strong dividend record in this period of time given how damaging the Great Recession was to many enterprises; Hormel’s dividend record is impeccable.

Hormel is able to maintain and extend this stellar record because its free cash flow is so strong. Last year’s free cash flow came in at nearly $800M, more than double the $346M it spent on the dividend. The numbers for 2015 and 2016 look very similar; Hormel’s ability to finance its current dividend and that 16% growth rate are very strong despite the fact that growth has been somewhat of an issue in the recent past.

Hormel, then, is a case of a stock that isn’t in value territory by any means, but it is a stock that has a world class dividend record and lots of room for additional growth in the payout in the years to come.

From a total return perspective, Hormel leans more towards dividend growth than stock price growth. EPS expansion is going to remain in the mid-single digits for the foreseeable future barring a huge acquisition or something similarly meaningful, so dividend growth will take center stage. Hormel investors should not expect multiple expansion for the reasons outlined above so if we assume 5% annual EPS growth and a current yield of 2.3%, we’re at 7% or so in total expected returns.

However, the dividend should continue to grow by sizable amounts each year as Hormel has lots of excess free cash flow it can use to do so and thus, total returns may average a bit higher than 7% annually once dividend growth is factored in.

Final Thoughts

Hormel’s current yield of 2.3% is respectable to be sure, but it is not a high-yield stock. Still, the company’s dividend record is one of the best in the entire market. And, given that management has shown the willingness and ability to raise the payout by leaps and bounds, Hormel’s payout is going to continue to move much higher over time. That’s the value in buying Hormel today.

Earnings growth could remain in the mid-single digit range for the foreseeable future, but the dividend has lots of room to grow relative to free cash flow. Hormel is not a deep-value stock here, but as a dividend growth story that already has a decent current yield, investors could do much worse.

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].

Article by Josh Arnold, Sure Dividend

ValueWalk readers can click here to instantly access an exclusive $100 discount on Sure Dividend’s premium online course Invest Like The Best, which contains a case-study-based investigation of how 6 of the world’s best investors beat the market over time.