With a new study showing smaller hedge funds tending to outperform, why do most of the assets under management gravitate to the more considerable funds? Asset gathering success is about more than returns performance, says hedge fund marketer Don Steinbrugge. For pension fund investors, it is about deep research capability, risk management heft, fund manager pedigree and the ability to clearly explain a unique point of differentiation.

While new tools and services are continually being developed that assist smaller hedge funds with a quality product compete, penetrating the confined world of significant asset allocators remains a challenge for those not recognized and endorsed. But successful funds are breaking past these barriers and getting their message past the traditional institutional filters to communicate their message, in part, using social media and new research platforms to level the playing field.

A recent Preqin survey revealed that 90% of investments were directed towards hedge funds with over a $1 billion in assets under management, while 75% are targeted towards the largest of the large, fund managers with over $5 billion. The problem is, the more massive funds do not generate the best performance, according to several studies.

“Many of the larger firms receiving assets don’t have the best performance and are not necessarily the best hedge funds,” Steinbrugge noted in a recent report. “They are growing because of their strong industry brand.” In part, hedge funds are using social media to accomplish this, bypassing the traditional gatekeepers who frame a fund’s reputation to the institutional allocator.

The notion that brand image is trumping performance in investment decisions took center stage in a recent academic report. The April 2018 study titled “Size, Age and Performance Lifecycle of Hedge Funds” showed that smaller funds outperform their larger brethren more often than not. While the issue is nuanced – study bias and even the definition of a “large” hedge fund remain in question – the core concept smaller funds outperform is buttressed by other studies.

The performance differential can be observed in Hedge Fund Research indices. For instance, the HFRI Fund Weighted Index, which equally weights all funds in their performance formula, has been consistently beating the HFRI Asset Weighted Index, which gives more weighting to the largest hedge funds, by nearly 2.5% over time. Over the last 12 months, the fund weighted index is up 5.77% while the asset-weighted index is trailing at 4.55%.

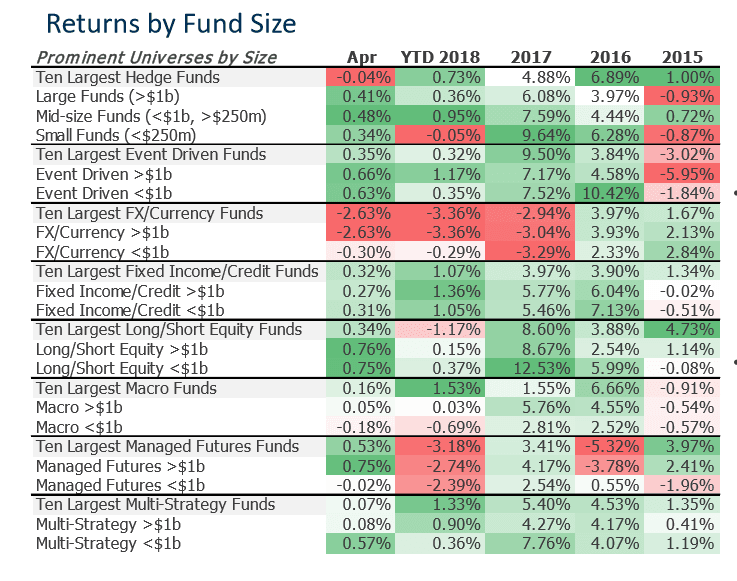

Evestment, likewise, had historically calculated returns based on hedge fund size and it showed smaller hedge funds outperforming, albeit with brief periods of more considerable hedge fund outperformance. The recent Evestment report indicates that mid-sized funds, with assets from $250 million to $1 billion in assets, are performing best 2018 year to date as well as outperforming in the larger funds in 2017 and 2016. In 2015, however, more substantial funds had experienced periods out outperformance, particularly during the era of central bank quantitative stimulus.

When looking at the recent outperformance of smaller funds, Steinbrugge told ValueWalk he wasn’t surprised. “Very large hedge funds are limited in the universe of securities that are investible,” he said. “There is an inverse correlation between size and returns.” He noted that “small funds outperforming has to do with nimbleness and security selection.” Large funds are limited in their stock selection to large-cap stocks, a sector that receives a bright spotlight of research coverage, making finding unique ideas a challenge.

So why do the larger funds nonetheless receive the lion’s share of institutional allocation? Steinbrugge noted the issue is deep and complex. Success at asset raising means understanding the delicate sensibilities of institutional allocators who can be on guard for making career mistakes.

“Larger pension funds gravitate to larger managers because they feel comfortable in large research teams (of firms in which they invest),” Steinbrugge said, also pointing to risk management and operational systems as points of consideration.

Several new products are attempting to level the playing field. Street Contxt, a Toronto-based research management firm, launched a new “Exchange” product Tuesday that allows smaller hedge fund managers the ability to access unique research to which they might have been previously constricted.

“By combining the buying power of all smaller managers, we can create efficiencies of scale, and create a pool of commissions that will rival the biggest funds in the world – small managers, when brought together, become very formidable,” noted Street Contxt CEO Blair Livingston. Not only can smaller managers use the platform to access a wide variety of research from primary providers, but they can find niche opportunities that might not be practical for larger firms to invest. Steinbrugge noted concerns about more substantial funds moving market prices in smaller markets, ensuring that most niche investments don’t move the performance needle in large firms.

Research is one component that fund managers must master, but to be effectively raising money in the hedge fund industry Steinbrugge says it is about a multi-pronged approach. “It’s not all about performance,” he said. “Performance is a hurdle, but one of several factors.”

He said the investment team needs credibility with “good bios and specific expertise,” pointing to making an impression on the institutional allocator. The fund managers need to do an excellent job of articulating their investment process and clearly explain the inefficiency they are exploiting along with their differential advantage in capturing the alpha.

Product quality is essential, but this is not defined merely by substantial returns. “Most hedge fund managers don’t know how to evaluate their own product,” according to Steinbrugge. “No one gives them appropriate feedback.”

Chesapeake Capital Management founder Jerry Parker agrees. He notes that when his systematic hedge fund sought investors, there was seldom an explanation as to why the fund did not receive an allocation. “There is very little communication,” he said.

When explaining the investment, Steinbrugge recommends linearly telling the hedge fund story and recognizing that the person with whom they are speaking in the initial presentation must re-tell the story to other people in the firm, often using a standard template in an informational presentation that ensures that managers “check the boxes.”

Beyond product quality, Steinbrugge said the organization and even the fund’s service providers matter when making an impression. “Fund managers must use top-shelf service providers who are known,” he said. “They cost more, but fund managers should pay up, it is worth it.”

Yes, smaller hedge funds might outperform under certain market conditions, but the quest to obtain membership in the club of primary institutional allocators takes more than that pedestrian detail alone.