New S&P Analysis: Telehealth companies push healthcare IPO activity past $10B mark in Q3’20

Q3 2020 hedge fund letters, conferences and more

Healthcare IPO Activity Crossed The $10 Billion Mark

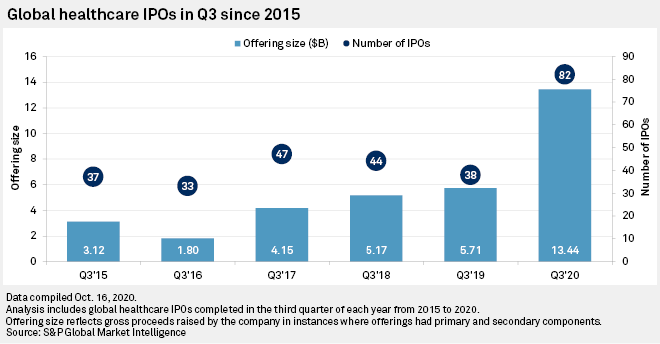

IPO activity in the healthcare industry crossed the $10 billion mark for the second time in a row this year after companies attracted $13.44 billion in investment during the third quarter of 2020, data from S&P Global Market Intelligence showed.

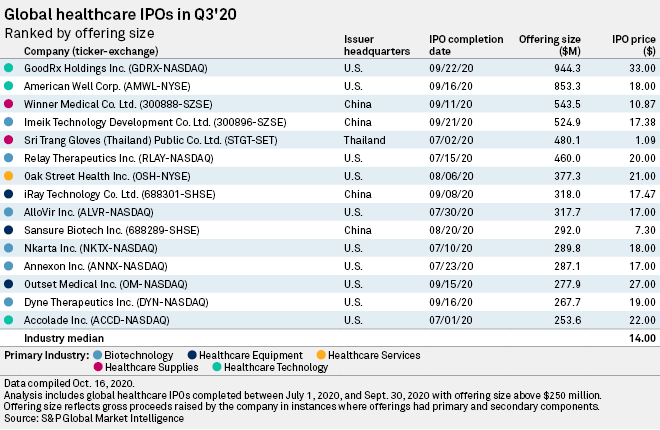

A total of 82 companies went public during the three months ending Sept. 30, with one coming close to raising nearly $1 billion. Most companies going public were based in the U.S., with a handful headquartered in Asia.

Key highlights from the analysis include:

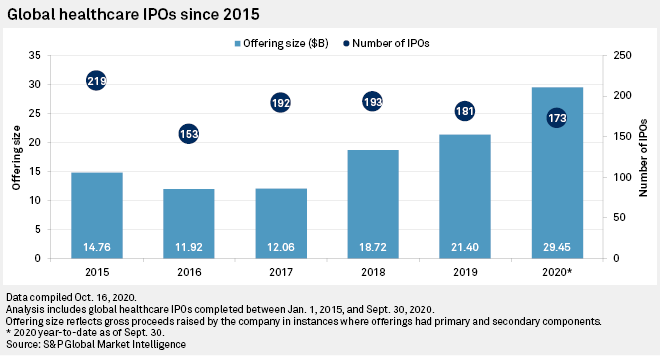

- Healthcare companies have raised about $29.45 billion from IPO activity this year alone, the most in at least the past five years.

- Third-quarter IPO proceeds were also the most for any single quarter of 2020.

- Third-quarter IPO activity was dominated by U.S. telehealth companies GoodRx Holdings Inc. and Amwell, which raised about $944.3 million and $853.3 million, respectively.

Healthcare companies have raised about $29.45 billion from IPO activity this year alone, the most in at least the past five years. Third-quarter IPO proceeds were also the most for any single quarter of 2020.

U.S. Telehealth Companies Dominate 3Q IPOs

Third-quarter IPO activity was dominated by U.S. telehealth companies GoodRx Holdings Inc. and Amwell, which raised about $944.3 million and $853.3 million, respectively. GoodRx is the sixth digital health company to go public so far in 2020, according to digital health investment firm Rock Health, trailing telehealth provider Amwell and healthcare IT company Accolade, Inc., which also went public during the quarter.

While only 14 digital health companies went public between 2012 and 2016, Rock Health estimates that if all goes as planned, there will be 13 digital health IPOs in the past two years alone.

The COVID-19 pandemic has caused telehealth and digital health usage to increase significantly as people have been staying at home. "When you take a step back, across the space there's a bit of an arms race happening. There [are] lots of small Teladoc and Livongo look-alikes out right now raising money as fast as they can to broaden their platforms and scale-up," RBC Capital analyst Sean Dodge said in a interview with S&P Global Market Intelligence earlier this year.

Read the full analysis here by S&P Global Market Intelligence