Hayden Capital performance update for the third quarter ended September 30, 2020.

Q2 2020 hedge fund letters, conferences and more

Dear Partners and Friends,

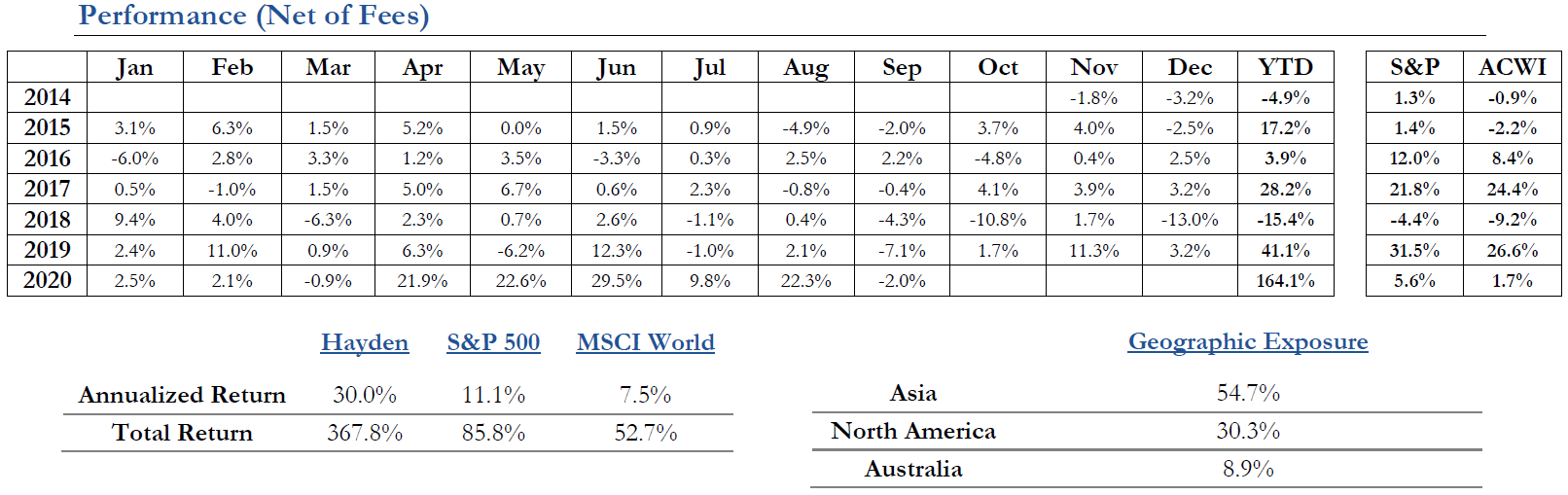

Please see the following table for Hayden Capital's quarterly performance update.

During the third quarter of 2020, Hayden's partners realized a +31.6% return on their investments, compared to +8.9% for the S&P 500 and +8.4% for the MSCI World indices.

This brings our 2020 year-t0-date returns to +164.1%, versus the S&P 500's +5.6% and MSCI World's +1.7%. We have generated a +30.0% annualized return for our partners, since inception.

I continue to be impressed by our collection of businesses, especially the skillful execution of our management teams who do the heavy-lifting day-t0-day. The full extent of this skill only becomes evident during dynamic periods like this year, and it's these "cultural-qualities" that allow our companies to accelerate even further ahead of the competition.

Our performance this year reflects that scenario. While I'm happy with the results, and it's impossible to know where the markets will go in the near-term, I truly believe the best opportunities still lie ahead of us. Over the next 3 years, 5 years, 10 years, and beyond, I know we will continue adding value to our partners and aim to produce superior returns on their capital.

Our Q3 2020 investor letter will be published next month. In the meantime, please reach out with any questions.

Best,

Fred Liu, CFA

Managing Partner

Hayden Capital

Hayden Capital's Strategy Description

Hayden Capital LLC (“Hayden Capital” or “Hayden”) is a value-oriented investment firm that follows a research-intensive, concentrated strategy. The strategy invests globally, seeking to leverage insights from developed business models in one geography, and applying those learnings cross-border to similar businesses in other regions. This stems from the belief that doing so provides an insight advantage into future business model development and consumer behavior.

Hayden implements this by investing in market-leading companies, with durable competitive advantages, and incentivized management teams. We believe the best indication of a high-quality, growing company is one that has a long-runway to invest capital internally at attractive rates of return. The strategy aims to purchase such businesses at attractive valuations.

The strategy is “long-biased” and generally concentrated in 6 – 15 core positions. Portfolios may hold large cash positions and may use derivatives to hedge broader market tail-risk during periods of excess market exuberance.