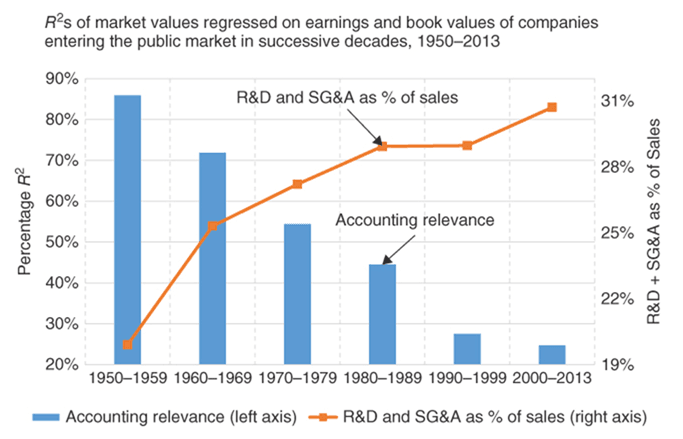

Several weeks ago three professors from the Columbia and Dartmouth business schools recapped some of their work on accounting for intangible investment in a Harvard Business Review article. Their key finding, which builds on Professor Baruch Lev’s analysis in The End of Accounting, is that, “accounting earnings are practically irrelevant for digital companies”. Along with Professor Lev, Professors Govindarajan, Rajgopal and Srivastava found that earnings matter less for younger companies than for older companies because of the different way in which younger companies tend to invest. In fact, they find that, “earnings explains only 2.4% of variation in stock returns for a 21st century company — which means that almost 98% of the variation in companies’ annual stock returns are not explained by their annual earnings“. These claims correlate nicely with those published in The End of Accounting, in which Lev found that variations in financial metrics like earnings and book value can explain 90% of the variations in stock prices for companies that came public between 1950-1959, compared to around 20% for companies that have come public since 2000 (chart below).

[REITs]Check out our H2 hedge fund letters here.

Why is this? Younger companies tend to be less tangible capital intensive and more intangible capital intensive than older firms, which creates a big problem for financial analysts because accounting rules explicitly treat tangible and intangible capital investments differently. When a firm engages in R&D, advertising, software development, employee training, database development, and so on, it must account for those expenditures in the same way a firm accounts for office space rents. That is, all those productive investments (the orange upward sloping line in the chart above) are treated as expenses and counted against current period earnings, which depresses earnings significantly for highly innovative companies. The same mechanism distorts the balance sheet by making assets and equity look artificially low (because if something is expensed it never makes its way to the balance sheet as an asset). These researchers found that, “intangible investments have surpassed property, plant, and equipment as the main avenue of capital creation for U.S. companies”, and yet all these intangible assets are absent from the balance sheet, which significantly impairs analysts from forming correct opinions about firms’ earning potential. Interestingly, this lack of information is what Professor Lev identified many years ago as the source of a market anomaly that causes highly innovative companies to systematically outperform their less innovative peers. We have termed the anomaly the Knowledge Factor, and have taken steps in our proprietary process to identify and correct for the accounting shortcomings in a way that improves the accounting relevance of financial statements. In fact, we’ve written our own white paper on the topic.

Article by by Bryce Coward, CFA – Knowledge Leaders Capital