Grey Owl Capital Management’s commentary for the first quarter ended March 2021, disucssing their long position in Jefferies Financial Group Inc (NYSE:JEF).

Q1 2021 hedge fund letters, conferences and more

“Right now I’m having amnesia and déjà vu at the same time. I think I’ve forgotten this before.” - Steven Wright

Dear Client,

The reflation trade continued in earnest during the first quarter of 2021. Commodities were up another 13.3% from January to March, following a 14.7% move in the fourth quarter of 2020. Equity markets were also strong, though not to the same extent as commodities and equities’ growth slowed from the rapid pace of 2020’s fourth quarter. The S&P 500 was up 6.4% and the MSCI All-Country World Index was up 4.9%. “Risk-off” asset classes suffered significant losses during the quarter. Gold was down 12.7%. Long-dated US Treasury bonds were down 13.9%.1

Grey Owl’s All-Weather strategy was up 6.9% for the quarter, keeping pace with the broad US equity index and outperforming a global 60/40 benchmark up 1.6%.2 An encouraging start to the year.

Growth and Inflation

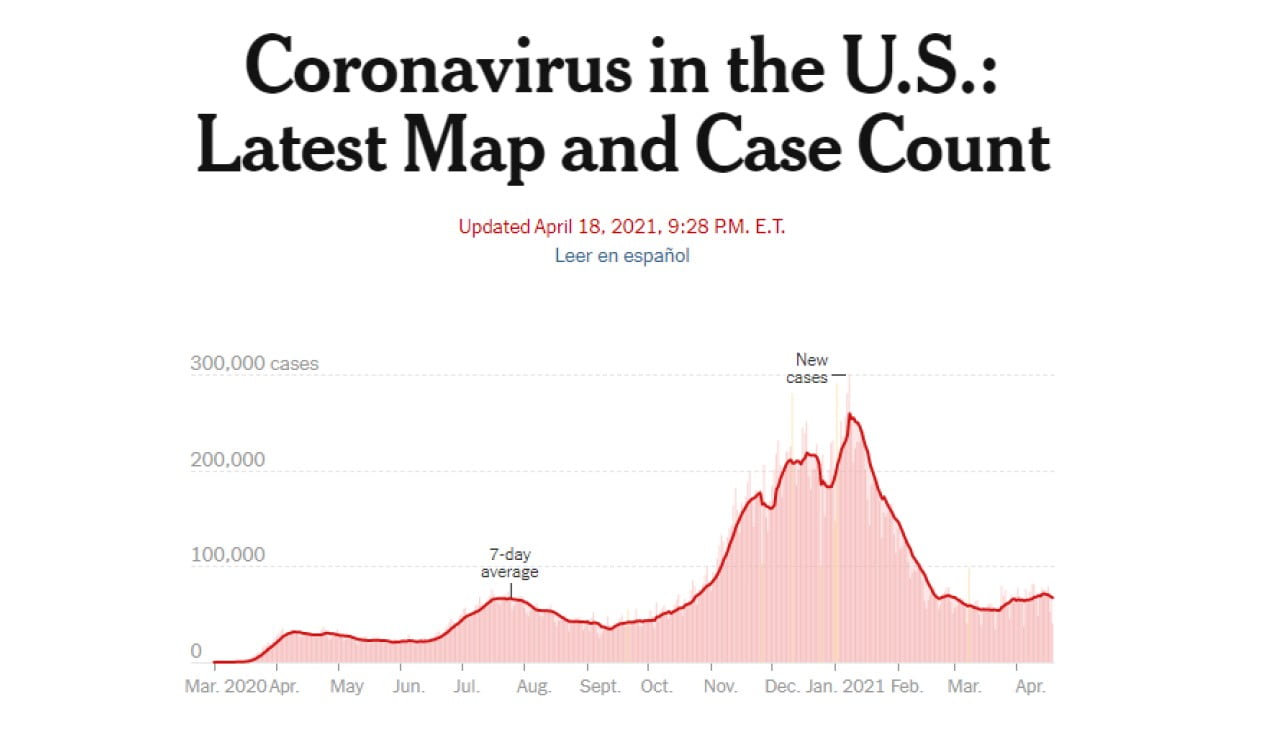

Markets are assertively forecasting the end of the Coronavirus pandemic and the associated government actions that stifled economic activity. Daily new Coronavirus case counts in the US have plummeted from their early January highs.3

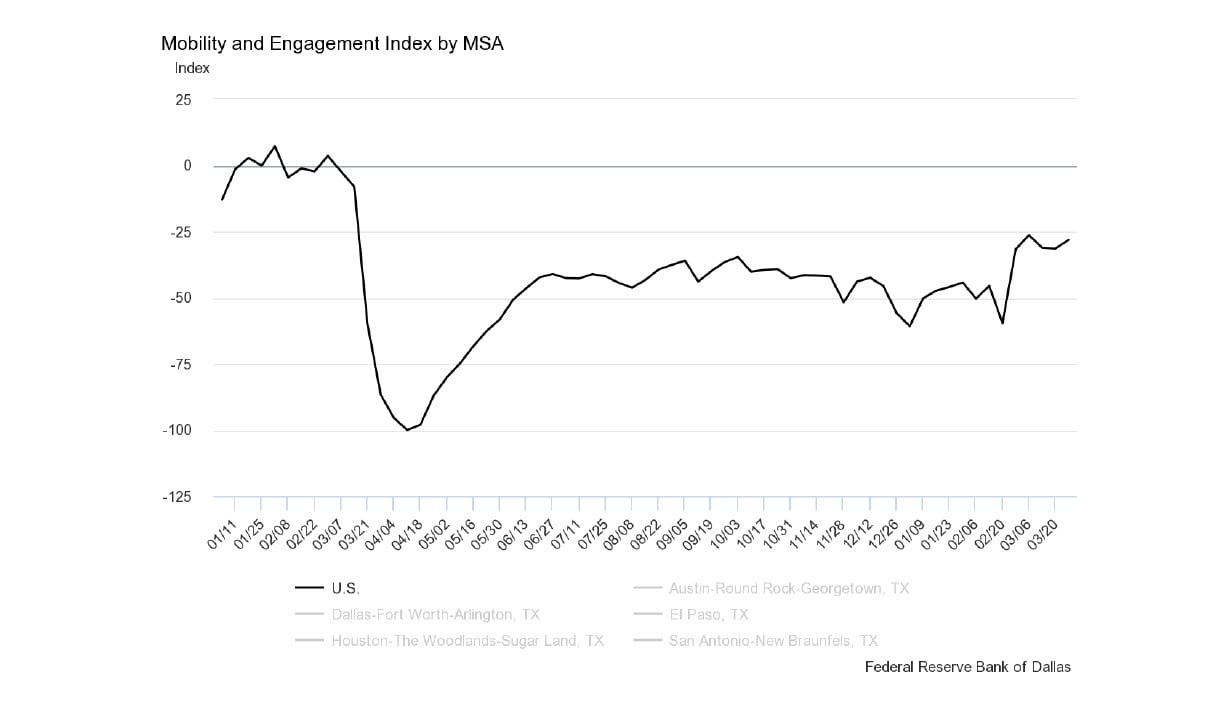

As such, the Dallas Federal Reserve Bank’s Mobility and Engagement Index for the whole US shows March 2021 activity at the highest level since “lockdowns” were first implemented just over one year ago.4

With that backdrop (not to mention a massive digitization effort by businesses both large and small during the past twelve months AND significant government payments to both business and consumers), retail sales are surging.5

As economic conditions become more favorable, market volatility continues to “norm-revert” to the mid-teens level where it historically spends most of its time.6

As strong as the trends have been, with very easy year-over-year comparisons continuing through at least May, second quarter data will likely come in even stronger. Bloomberg consensus estimates for second quarter GDP growth is a staggering 11.5%. For headline consumer price inflation, the estimates are 2.9%. With that backdrop, risk assets (equities and commodities) have a clear path to higher price levels.

Resiliency (and Favorable Tail Winds)

In addition to the reflation and recovery trade, many companies are benefiting from favorable structural setups that enabled them to thrive during the past year. Jefferies Financial Group Inc (NYSE:JEF) is a long-term Grey Owl holding. To outsiders, it appears to be a complicated combination of a trading-centered investment bank with a diverse collection of operating businesses (a legacy of the 2013 merger with Leucadia National Corporation). In reality, the company is slowly revealing itself to be a top-tier investment bank with a significant amount of growth coming from the most lucrative advisory banking segment.

The numbers speak for themselves. Despite the Coronavirus pandemic, Jefferies grew revenue 30% in 2020 compared to 2019! Further, in the first quarter of 2021, Jefferies revenue was up an absolutely staggering 79% over the first quarter of 2020. The momentum continues.

To be fair, we note that the economic environment is quite favorable for all financial services. Broadly financial firms are performing well and their stock prices are rising. Interest rates drive financial firms’ profitability and interest rates are the inverse of the poorly performing long-dated bonds mentioned at the front of this letter. The chart below (also from TradingView) shows that bond yields, the financial index (XLF), and Jefferies have all thrived in unison since rates bottomed in May of 2020.

Jefferies is but one of many examples of companies that flourished during the pandemic, but worth highlighting as it is one particularly relevant to Grey Owl and our clients.

Positioned for Continued Growth

Our All-Weather portfolio remains tilted toward cyclical investments that should continue to thrive as growth and inflation measures maintain their acceleration. We have sector exposure to cyclicals via energy (XLE), basic material (XLB), industrial (XLI), and commodity (PDBC) index funds. We also own a series of individual securities that are particularly leveraged to economic reopening: Boyd Gaming (BYD), Carnival Cruise Lines (CCL), Designer Brands (DBI), Dufry duty free stores (DUFRY), and Spirit Airlines (SAVE).

We currently hold no gold or long-dated Treasury positions as portfolio ballasts but have maintained an “all-weather” structure by incorporating inflation-linked bond and bond-structures via iShares TIPS Bond ETF (TIP) and Quadratic Interest Rate Volatility and Inflation Hedge ETF (IVOL). Likewise, the Hussman Strategic Growth Fund (HSGFX) provides a “hedged” exposure to equity markets and should outperform during periods of “risk-off.”

Deja vu All Over Again

The easiest thing to do right now is to look at a long-term chart of any valuation metric and argue “the market” is overvalued. Many pundits also point to price charts from the last month (from about mid-March to mid-April) and say the reflation/reopening trade is done: energy is down a bit, bond yields have flattened out, etc. Further, it would be equally easy to say that none of this makes sense as it is purely a creation of government fiscal largesse and easy money from central banks. But that common refrain predated Covid. All of this MAY be true, BUT big moves need to be consolidated and a month of sideways price action alone does not mean the reflation and reopening trade is over. Markets rarely work like that. It is not unusual for investors to get nervous as weak hands are shaken out before a trend persists. Or, the trend does not persist, more evidence develops (both economic and market internals), and we adjust.

The sense is really déjà vu. Feeling like you have been here before is ok, but don’t suffer from amnesia too. Remember that markets rarely suffer significant setbacks during periods of accelerating growth and inflation. A balanced approach is fine (in fact that is what we both advocate and implement), but despite the sense of frothiness, caution may well be warranted, but excessive conservatism could likely prove too costly here.

As always, if you have any thoughts regarding the above ideas or your specific portfolio that you would like to discuss, please feel free to call us at 1-888-GREY-OWL.

Sincerely,

Grey Owl Capital Management, LLC