On February 7, 2023, Goldman Sachs downgraded their outlook for Tyson Foods, Inc. (NYSE:TSN) from Buy to Neutral.

Analyst Price Forecast Suggests 25.86% Upside

As of February 8, 2023, the average one-year price target for Tyson Foods is $77.29. The forecasts range from a low of $58.58 to a high of $99.75. The average price target represents an increase of 25.86% from its latest reported closing price of $61.41.

Q4 2022 hedge fund letters, conferences and more

Find A Qualified Financial Advisor

Finding a qualified financial advisor doesn't have to be hard. SmartAsset's free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

If you're ready to be matched with local advisors that can help you achieve your financial goals, get started now.

The projected annual revenue for Tyson Foods is $55,465MM, an increase of 3.46%. The projected annual EPS is $6.54, a decrease of 3.61%.

Tyson Foods Declares $0.48 Dividend

Tyson Foods said on November 14, 2022 that its board of directors declared a regular quarterly dividend of $0.48 per share ($1.92 annualized). Shareholders of record as of February 28, 2023 will receive the payment on March 15, 2023. Previously, the company paid $0.46 per share.

At the current share price of $61.41 / share, the stock's dividend yield is 3.13%. Looking back five years and taking a sample every week, the average dividend yield has been 2.31%, the lowest has been 1.58%, and the highest has been 3.73%. The standard deviation of yields is 0.39 (n=237).

The current dividend yield is 2.12 standard deviations above the historical average.

Additionally, the company's dividend payout ratio is 0.28. The payout ratio tells us how much of a company's income is paid out in dividends. A payout ratio of one (1.0) means 100% of the company's income is paid in a dividend. A payout ratio greater than one means the company is dipping into savings in order to maintain its dividend - not a healthy situation.

Companies with few growth prospects are expected to pay out most of their income in dividends, which typically means a payout ratio between 0.5 and 1.0. Companies with good growth prospects are expected to retain some earnings in order to invest in those growth prospects, which translates to a payout ratio of zero to 0.5.

The company's 3-Year dividend growth rate is 0.14%, demonstrating that it has increased its dividend over time.

Aristotle Capital Management holds 10,413,822 shares representing 2.91% ownership of the company. In it's prior filing, the firm reported owning 10,339,367 shares, representing an increase of 0.71%. The firm decreased its portfolio allocation in TSN by 18.92% over the last quarter.

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 8,623,566 shares representing 2.41% ownership of the company. In it's prior filing, the firm reported owning 8,584,323 shares, representing an increase of 0.46%. The firm decreased its portfolio allocation in TSN by 19.78% over the last quarter.

VIMSX - Vanguard Mid-Cap Index Fund Investor Shares holds 6,679,419 shares representing 1.87% ownership of the company. In it's prior filing, the firm reported owning 6,712,022 shares, representing a decrease of 0.49%. The firm decreased its portfolio allocation in TSN by 20.29% over the last quarter.

VFINX - Vanguard 500 Index Fund Investor Shares holds 6,565,668 shares representing 1.83% ownership of the company. In it's prior filing, the firm reported owning 6,454,323 shares, representing an increase of 1.70%. The firm decreased its portfolio allocation in TSN by 19.41% over the last quarter.

Geode Capital Management holds 6,013,751 shares representing 1.68% ownership of the company. In it's prior filing, the firm reported owning 5,947,768 shares, representing an increase of 1.10%. The firm decreased its portfolio allocation in TSN by 19.74% over the last quarter.

Fund Sentiment

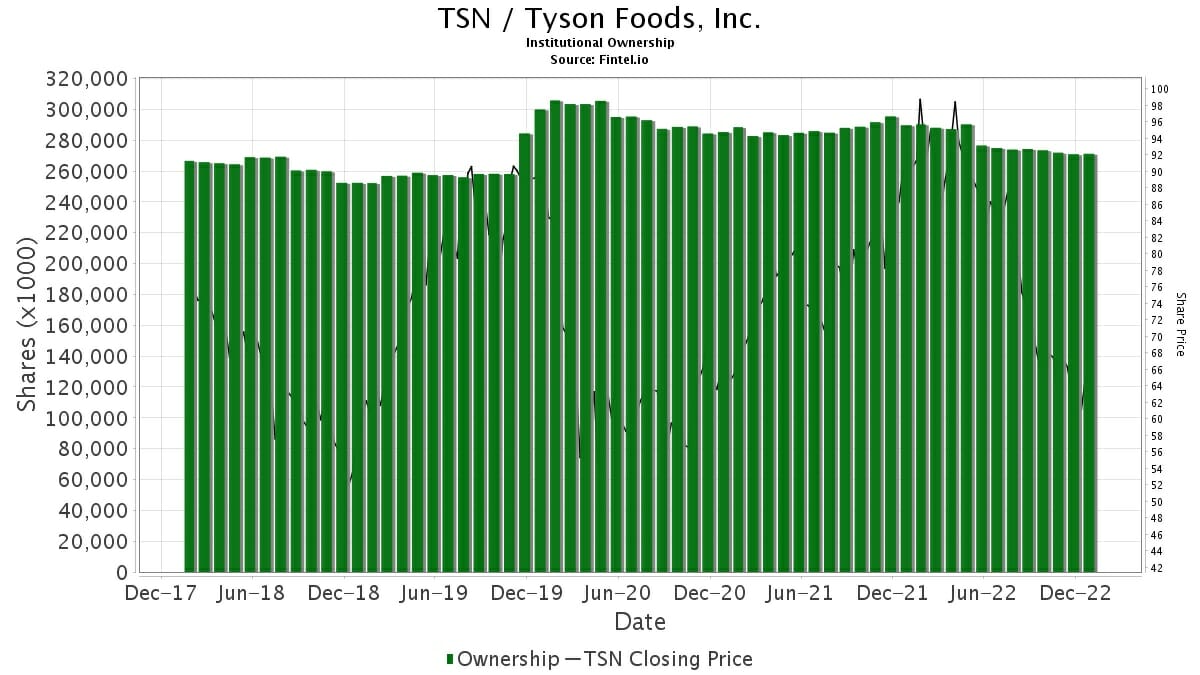

There are 1697 funds or institutions reporting positions in Tyson Foods. This is a decrease of 44 owner(s) or 2.53%.

Average portfolio weight of all funds dedicated to US:TSN is 0.2664%, a decrease of 17.6244%. Total shares owned by institutions decreased in the last three months by 1.48% to 268,440K shares.

Tyson Foods Background Information

(This description is provided by the company.)

Tyson Foods, Inc. is one of the world's largest food companies and a recognized leader in protein. Founded in 1935 by John W. Tyson and grown under three generations of family leadership, the Company has a broad portfolio of products and brands like Tyson®, Jimmy Dean®, Hillshire Farm®, Ball Park®, Wright®, Aidells®, ibp® and State Fair®.

Tyson Foods innovates continually to make protein more sustainable, tailor food for everywhere it's available and raise the world's expectations for how much good food can do. Headquartered in Springdale, Arkansas, the Company had 139,000 team members at October 3, 2020. Through its Core Values, Tyson Foods strives to operate with integrity, create value for its shareholders, customers, communities and team members and serve as a steward of the animals, land and environment entrusted to it.

Article by Fintel