Alpine Capital Research’s short write-up underscores the investment returns challenge of “getting to 7.2% in a 5.0% world”.

Q2 2021 hedge fund letters, conferences and more

We recently came across a research paper that was authored by the endowment & foundation consulting team at Mercer Pavilion entitled: “Top investment ideas for endowments and foundations in 2021.”1

Like many of their consulting peers in the industry, the Mercer Pavilion team is lamenting future public equity and fixed income investment returns that are widely expected to be insufficient to meet the minimum return hurdles of institutional investors.

For example, they write:

Getting to 7.2% in a 5.0% world

Perpetual endowment portfolios distributing 5% a year and facing 2.2% inflation need to earn 7.2%. But our expectation for the 10-year return of a 60/40 mix of global public equity and core US fixed income is 5.0% — a 2.2% shortfall.1

Low Investment Returns

“A 5.0% world” implies a future comprised of dismally low investment returns below the minimum necessary threshold of 7.2%. The curse of persistently low returns will be widespread funding shortfalls, a reduction in eleemosynary activities, pension benefits, among other likely cutbacks.

Standard methods of obtaining public-market equity beta with commonly used, long-only, benchmark-relative outcomes are now likely to be ineffective at generating adequate absolute return results.

If the preponderance of 7-10 Year Capital Market Assumptions reveals an industry consensus that we’re embarking on an extended period of low investment returns, it stands to reason that:

- Equity indexes will likewise deliver low returns.

- Standard, benchmark-relative passive and active equity strategies will likewise deliver low returns causing public-market equity allocations to be an albatross in an overall portfolio’s asset allocation.

- Institutional investors in need of 7.2% (in a 5.0% world) will experience protracted periods of funding shortfalls.

As yet, very few investment industry practitioners are considering innovative public-market equity solutions to the underfunding challenge that institutional investors with minimum absolute return hurdles are likely to endure.

Given this predicament, ACR advocates for a fresh perspective on public-market equity portfolio construction in “a 5.0% world.” We recommend a de-emphasis of relative return orthodoxy.

Logically, standard public-market equity strategies with beta characteristics that are similar or comparable to broad-market equity indexes will likely produce investment returns comparable to low-returning equity indexes, and they will fail to fulfill their institutional investors’ minimum funding thresholds.

A Different Kind Of Public-Market Equity Strategy

With the nexus of high equity valuations and low fixed income yields, ACR believes institutions will benefit from a different kind of public-market equity strategy. One that limits the number of investments in its portfolio, and that underwrites each of its portfolio companies’ expected go-forward idiosyncratic returns—similar in concept to private-market equity strategies that likewise limit the number of investments, strive to earn a multiple of invested capital, and only deploy capital when compelling opportunities are available.

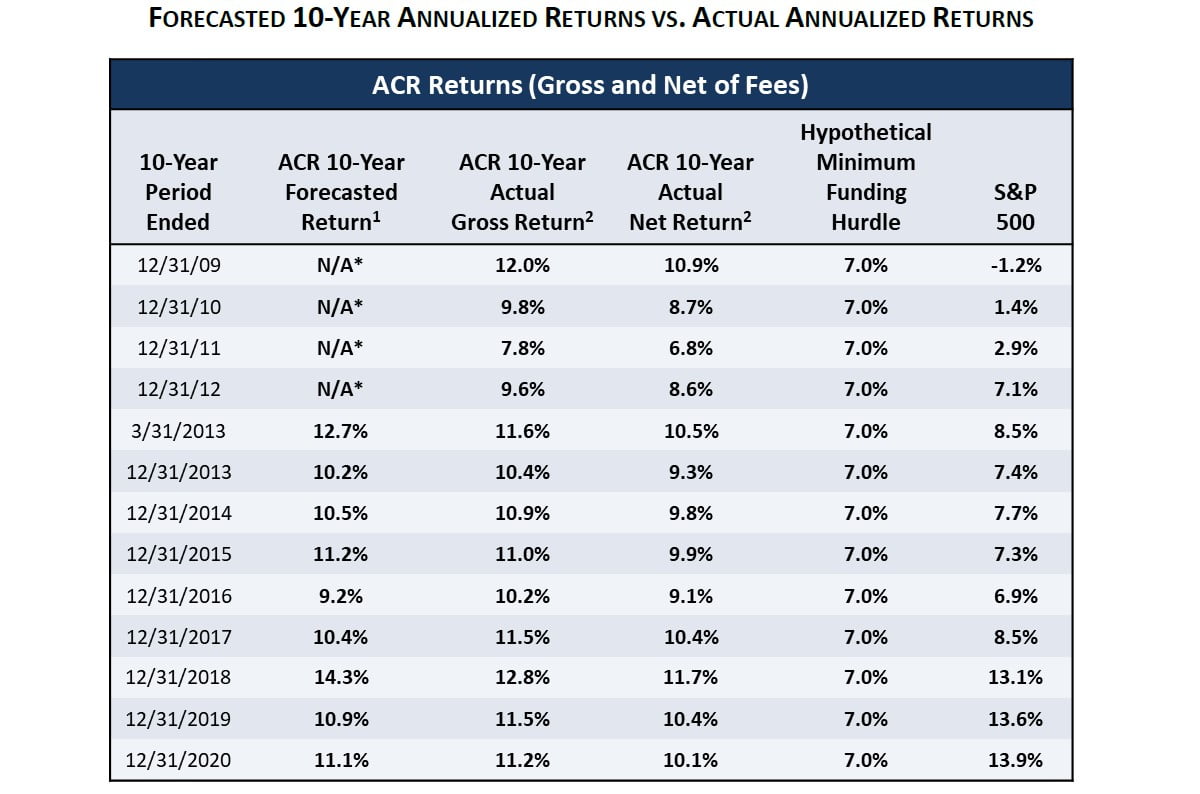

The ACR flagship equity strategy (known as Equity Quality Return) is very selective. In 21 years of operating, we’ve invested in a sum total of 69 portfolio companies. That’s a miserly average of 3.3 new investments per year since ACR’s inception. Each one was underwritten and then purchased at a discount to its intrinsic value with an expected minimum future return. To our knowledge, not many long-only equity managers can make that claim, and even fewer still have a 21-year history of comparing their portfolio’s actual results with their underwritten forecasts.

If the profusion of dismal Capital Market Forecasts derived by many industry practitioners has you worried about your organization’s investment program fulfilling its financial mission, it’s time to consider a fresh approach to public-market equity investing.

Chris Scibelli

ACR Alpine Capital Research

About ACR Alpine Capital Research:

St. Louis-based ACR has been underwriting the expected 10-year absolute returns of its own concentrated, long/cash, public-equity strategy (EQR) since the firm’s inception 21 years ago.