Whitney Tilson’s email to investors dicussing Mark Spiegel’s January letter on Tesla; General Motors is counting on your loving electric cars, announces plans to go all-electric by 2035; a friend’s take; Piper Sandler report; bull-bear debates.

Q4 2020 hedge fund letters, conferences and more

Spiegel Jan Letter

1) Attached is Mark Spiegel’s January letter, which his usual bearish take on TSLA.

General Motors Is Counting on Your Loving Electric Cars

2) An op ed in yesterday’s NYT: General Motors Is Counting on Your Loving Electric Cars. Excerpt:

General Motors’ announcement last week that it will stop making gas-powered cars, trucks and sport utility vehicles by 2035 and become carbon neutral by 2040 is even bolder than it sounds: The repercussions will ripple broadly across the economy, accelerating the transition to a broader electric future powered by renewable energy.

The pledge by the nation’s largest automaker to phase out internal combustion engines puts pressure on other auto companies, like Ford and Toyota, to make equally ambitious public commitments. It follows an earlier announcement by G.M. that it would invest $27 billion in electric vehicles over the next five years.

G.M.’s decision is a sea change.

GM’s Announcement To Go All-Electric By 2035

3) A friend’s skeptical take on the GM announcement:

Regarding GM’s “going all-electric by 2035” press release, let’s actually read said press release first:

This is “an aspiration to eliminate tailpipe emissions from new light-duty vehicles by 2035.”

— Amazing. My aspiration is to lose 13% of my weight by 2035, starting perhaps with 1% or so in 2022 or 2023, if I’m still alive by then.

In related news, Mary Barra won’t be CEO of GM by 2035 either, so this current talk is just as cheap as my 15 year weight loss plan.

But wait, there is more!

“To account for the expected remaining carbon emissions, GM expects to invest in carbon credits or offsets.”

— Of course. If people still want to buy a regular GM car after 2035, they may still be able — except they have to pay (indirectly) for carbon credits, which means more pesos for Bezos, or at least more Krugerrand for Musk.

In any other industry or time, a company such as GM would not telegraph 15 years in advance what its strategic product plan is. Why reveal that otherwise super-secret plan to its competitors? Even the automakers themselves are usually extremely secretive about everything that’s not coming out within the next six or so months. In order to maximize sales, don’t tell people about what you’re planning to offer one or more years down the road.

Then again, perhaps GM is playing 4-D chess here: By telling consumers (who don’t read the caveats in the fine print) that its product portfolio will be all-electric by 2035, perhaps consumers will hurry up and stock up on extra-many regular General Motors vehicles before 2035. That will help GM’s sales in the next few years! Genius!

All kidding aside, it ought to be obvious what GM is doing here: It is nothing related to the actual consumer, because of course in this day and age the consumer’s preferences don’t matter.

-

- Tell Wall Street what’s fashionable: All-electric equity valuations. It’s clearly working — for now.

- Tell Washington DC whatever politically correct theory it wants to hear: It needs to be colder outside, basta!

Speaking of kidding, the best satire (Babylon Bee) is the one that intersects with reality: Just inject “GM” into the main subject of this hysterical satire story:

WASHINGTON D.C.—For a long while now, the climate has been undergoing a change to become more like the climate it feels it should be. While many have embraced this, a number of intolerant people just won’t accept this change. This includes 78-year-old President Joe Biden, who, in another example of executive overreach, signed numerous executive orders to try to stop the climate from evolving.

“I remember how the climate was back when I was a kid and going to the movies only cost a nickel,” Biden rambled to the press, “and that’s the way it always should be!”

Piper Sandler Report

4) Piper Sandler on Sunday released a 104-page report and upped its price target to a Street-high $1,200.

A skeptical reader commented:

Was there something in that report that we hadn’t read before?

For example, Elon promised in October 2016 that all Teslas manufactured from that point on had hardware capable of Level 5 autonomy. That’s why you should pay thousands extra for that software. When can those Teslas purchased starting October 2016 be operated under Level 5 autonomy? Does the report answer this question?

Because it seems to me that the promise of Level 5 for every Tesla made October 2016 onwards was not true — and Tesla knew that it wasn’t true at the time that it made the promise.

As was the whole “1 million robotaxis by 2020” and “Teslas will appreciate 4x by 2020” and all that other nonsense that no other company could have gotten away with promising,and then not fulfilling.

Can you imagine if Apple had come out with a computer for which it charged $5,000 extra for software that it promised would enable it to drive the computer from Los Angeles to New York in a snowstorm by 2017, and then not delivered on it, while still keeping the $5,000 extra software fee? The government would have come down on the company with a ton of bricks.

Or that Apple would have said “Buy this computer right now, and within 18 months from now it will be worth four times as much.”

Those are the kinds of questions to which I want to read answers in a Tesla report. If this were any other company making those kinds of false promises, it would be full-time employment for people at the FTC, SEC and DOJ.

5) One reader wrote:

Re. the convenience of charging vs buying gas. Of the many, many things I love about the electric vehicles I’ve owned over the past 8 years (Nissan Leaf and BMW i3) right in the top 2 is never having to go to a gas station and fill up the tank ever again. I have always just plugged in the car at home, in my garage, with a normal outlet in the wall, easy peasy.

As to the repairs / maintenance, it is not my experience that the EV’s have “less” they have zero. Zero repairs needed on either car in the years that I’ve driven them. All I do is wash them and rotate or replace the tires as needed.

Also not mentioned in this persons list, who has clearly never so much as temporarily leased an EV, is the FUN. I was never a car person and didn’t care what make or model I drove as long as it was comfortable to sit in and I could see out. The i3, with its automatic breaking when the acceleration pedal is released, makes this car so easy and super fun to drive. I also feel much safer in a car with such rapid acceleration.

Another responded:

Let’s take those things in turn.

Yes, some people can plug in at home — if you have a house, with private parking and reliable electricity. I think that describes about 18% of the world’s population. Most people live in apartment buildings, and/or don’t have private parking, or anywhere else to charge reliably.

The world simply does not look like 50% of The United States. The average person in Cambodia, Peru or Zaire laughs at the proposition of an electric car at this point. It may happen some day — with enough time, almost everything is possible — but it’s not a priority for the next decade.

Speaking of priority, I don’t understand this whole “convenience of charging at home” thing. Let me first say that I have owned multiple plug-in cars, including a Tesla, and I have driven almost every other plug-in car that has come to market.

If you plug in at home, it takes time to fill, and almost half the time I forget to plug it in when I come home anyway.

In contrast, how do you beat the convenience of simply not having to think about charging, and just wait until the yellow light comes on — and then stop at the next street corner or road stop? It takes 3 minutes to fill, and then you have another 500 miles of range, which will last you on average two weeks. This has to be the most convenient way of filling up a car — nothing to think about, nothing to worry about, ever. No pain, no problem, no up-front investment, and it’s dirt cheap.

In regards to maintenance, I have always said that BEVs have an advantage here. There’s typically a lot less — almost zero for the first several years — for a BEV. But here’s the thing: Modern ICEs also have a lot less regularly scheduled maintenance than they used to. Remember 20-30 years ago, when you needed to change oil every 3,000 miles? On newer cars it went to 5,000 miles, then 10,000 and some cars are now at 12,000 or even 15,000. Many people stop by for that 20 minute oil change once a year. Hardly a significant burden. Granted, not zero — but we are deep into the 99.99% zone here.

In regards to the fun, this is true. The short-range BEV experience is indeed fun. They drive great. For regular around-town driving, they are the best. However, there are three counter-arguments:

-

-

- Regular cars are also fun. Until last March, I drove almost 100 new cars per year and some 95% of them drove very well, thank you. Go forth and back between BEV and ICE cars and guess what? You’ll find that almost all new cars drive very well, fun, whatever the adjective. They’re all good. So, any BEV advantage in the “fun to drive” department is… non-zero but modest in the big scheme of things.

- What is *not* so much fun is if you leave the house in the morning realizing that you forgot to charge it last night. Whoops.

- Go on a road trip. The BEV is supposed to have 250 or 300 miles of range or whatever. However, it’s Winter and you’re criss-crossing The Rocky Mountains or The Swiss Alps. It’s 20 below zero and it’s uphill. Now your range is down to 175 miles and how close do you really want to cut it? Your knuckles are white and you’re in a bad mood because you’re watching the meter and hoping that you’ll make it to the next station where you have to wait 30-45 minutes. Meanwhile, everyone around you has 500 miles of range even in the cold, and can pull over anywhere to add another 500 miles of range in 3 minutes, with nothing to worry about. They can take a voluntary or involuntary detour at any moment and not have to think “So, how will this go?”

-

Bull-Bear Debates

6) My analyst Kevin DeCamp, who’s made more than 100x on TSLA, wrote:

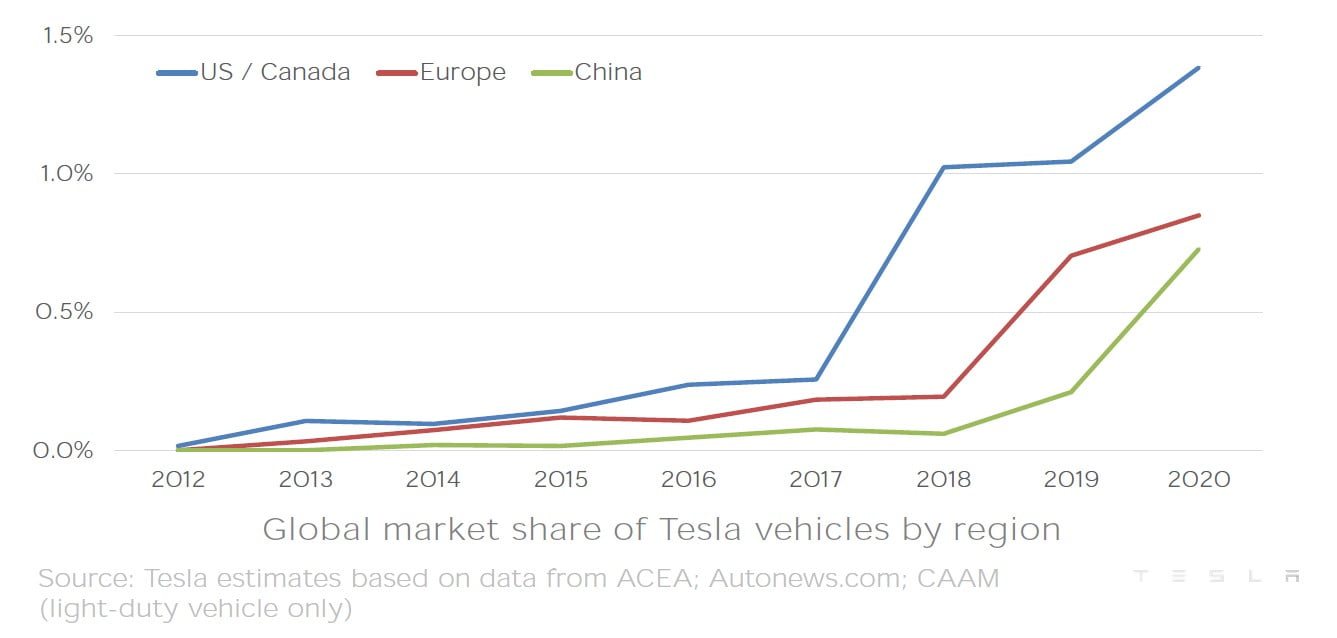

The most important chart from Tesla’s earnings report is its market share of TOTAL vehicles below. Bloomberg reporter Liam Denning’s comment that “even the most bullish” of his colleagues don’t see EVs “taking even half of new car sales until 2037″ is laughable. I think ICE vehicles will be pieces of scrap metal by 2030 – except the classic/collectibles which will probably be even more valuable than now.

As you can see from the chart, once Tesla establishes local production, market share gains accelerate – see China in 2019. The same will happen in Europe in 2021.

Having autopilot for over a month now reinforces my view that cars that are not electric and don’t have a comparable, OTA improving, ADAS system are essentially the “dumb phones” of this decade and this will become more apparent over the next year or two. Where’s the competition? GM’s Super Cruise which you can only get with the Cadillac and use on certain roads?

Look at how small of a slice Tesla has of the total auto market. I know many think this “is as good at it gets”, but it’s only the beginning…

The only limiting factor to this growth is battery production which Tesla has finally showed its cards here and demonstrated that they have a solution with the lowest cost per kWh. The FSD software that Tesla bears think is vaporware actually exists, has many happy paid customers (I am one!!), and the take rate will only increase as functionality increases and the subscription option opens up within the next few months. This will allow Tesla to continue cutting prices of their hardware and taking market share.

Also, did you see Tesla’s energy storage deployment of over 3 gWh for 2020? This is growing at about 100% CAGR and will continue to grow faster than EVs. Still a small percentage of revenues now, but what will their distributed energy business look like in 5-10 years? Any view on that?

In response, a bearish reader wrote:

Naturally building a new/additional factory will increase Tesla’s sales. News flash: This goes for any and every automaker in history. Build a new/additional factory -> sales go up. If it were otherwise, no automaker would ever build a new factory!

As for ICEs being scrap metal after 2035: That is entirely possible. We are, after all, talking about a market that is driven by regulatory fiat. If the government wants to cancel all outstanding dollars and replace them with some new currency, say adding a decimal point or so for good measure, it can. If the government bans ICEs, then – surprise, surprise – there won’t be any ICEs left, other than a theoretical black market.

By the way, ICEs will have a longer life in many parts of the world. Not sure if you’ve been traveling in Latin America, Africa or much of Asia (Pakistan, India, etc.) in recent years, but I don’t think it’s realistic that people will be able to “charge from home” in a majority of the world anytime soon.

Even in Puerto Rico, there are only a few people who have homes where it’s realistic to “charge at home.” Most people park on the street or have very unreliable electricity. I don’t know if the information is reliable, but I first punched up Google Maps for Puerto Rico and then searched for “electric car charging station.” 18 of them come up — 13 in San Juan and 5 for the rest of the island. That’s for 3 million people.

In contrast, there’s a gasoline station on every other street corner, and it’s dirt cheap at around 65 cents per liter, or $2.46 per gallon (cheaper than milk or mineral water). Fill up the car in 3 minutes or less, then drive somewhere between a week and a month until the next time the light is flashing yellow. Hardly a problem that needs any solving. The average Puerto Rican is laughing at the proposition of having to pay more for the total hassle of having to deal with an electric car. Where’s the upside? And if more people in some parts of the world convert to BEVs, then that will just lower the gasoline price for the ones who are still driving ICEs!

That’s the situation for most people in the world. Electric cars will do better in some very wealthy geographies, where they’re subsidized or people live in fancy homes with garages, and access to reliable electricity.

As for “Autopilot” — here is the reality:

-

-

- Tesla is not approved for eyes-off or hands-off driving. By law and by Tesla’s user agreement, you must have your hands on the wheel at all times and keep your eyes on the road. So, Tesla is no more autonomous today than a $20,000 Mitsubishi. None of these cars is allowed to drive itself on any public road. At least GM has been selling “hands off” cars for several years already. That would be cars where you are legally allowed to take your hands off the wheel.

- In California, automakers are required to apply for a permit to test self-driving cars. Then, they have to log the miles driven and report any disconnects. Can you remind me what permits Tesla has in this regard, and how many miles of testing it has reported to the California state authorities — and how that compares to other companies?

-

As for the energy storage business, I looked at the financial report Tesla published a few days ago:

Look at the income statement, on page 29. I see “Energy generation and storage” under Revenue — $752 million for the quarter that just ended, December 2020. Then, under “cost of revenues” — “Energy generation and storage” at $787 million. Hmm, that’s a *negative* gross margin of 4%.

A business that’s running at a 4% negative gross margin does not look good. What would Ben Graham, Warren Buffett or Charlie Munger say about a business that’s running at negative 4% gross margin? What would it be worth?