GDS Investments letter to investors for the year ended December 31, 2020, discussing their biggest performance contributors Berkshire Hathaway, BYD Company, First Solar, QUALCOMM, Roku, Twitter, and Zillow Group.

Q4 2020 hedge fund letters, conferences and more

“If you’re going through hell, keep going.” - Winston Churchill

“Only if you have been in the deepest valley, can you ever know how magnificent it is to be on the highest mountain.” - Richard Nixon

Testing The American Mettle

Prime Minister Churchill knew that the only way out of strife and struggle was to continue to push forward. Perhaps more than any other leader, President Nixon knew that the times we spend experiencing life’s low points are essential to allowing us to enjoy and value the wonder and majesty of life’s high points.

Over the past twelve months, Americans have pushed forward through some of the lowest points in our history. We are experiencing a raging pandemic, civil discord, and we witnessed the most serious threat to the survival of democracy to occur in more than 155 years. Worse yet, none of those challenges are in our “rear view mirror.” Rather, they shape our political, economic, community, and family experiences on a daily basis.

Last year was proof that stock prices can go up while the news cycle is extremely negative. We risk forgetting, of course, that the opposite happens routinely. There is no guarantee at all that stock markets will continue their meteoric rises while the winds of pandemic, hyper-partisanship, and the deep and dark specter of civil unrest swirl around us.

Surely, 2021 will further test American mettle and resolve in a way unknown since our grandparents and great-grandparents responded to heinous and murderous aggression in World War Two. That resolve will be on full display as the Biden Administration and Congress (at least attempt to) work together to build a more equitable economy.

Creation of that more equitable economy, of course, is essential if we are to overcome our political instability. As history invariably proves, when many people live in a system which does not allow them to feed their families, afford decent housing and realistically allow for upward mobility, their inclination is to tear that system down and rebuild in purportedly more egalitarian, but always radical, ways.

Recovering To A Different Economy

Here, the words of Federal Reserve Chairman Jerome Powell are instructive. As Chairman Powell recently acknowledged, the United States is "recovering, but to a different economy[.]" Even after the unemployment rate goes down and there is a vaccine, there is going to be a substantial group of workers who are going to need support as they find their way in the post-pandemic economy, because it is going to be different in some fundamental ways.

While high-income, white-collar employees and professionals are working from home with little more than a laptop and an Internet connection, working-class truck drivers, nurses, home health aides, and grocery store and warehouse workers are on the front line in the war against COVID-19. In other words, the pandemic is only accelerating the widening of a wealth and healthcare gap that has been growing for decades. We expect that the Biden Administration and Congress will pursue policies to arrest and, perhaps, reverse that widening.

For our part, GDS Investments will continue to deploy a three-pronged approach.

We will enhance our focus on secular growth opportunities, which can “survive and thrive” in virtually all economic conditions. The environment in which we evaluate those positions is one where market changes that were already underway before the pandemic will continue to accelerate. We will, as always, ignore weak companies which are being kept alive only by access to cheap money. For example, though the government might try to stimulate (or save) the airline and hotel industries, the days of domestic air travel and overnight lodging for a single 90-minute business meeting are diminished.

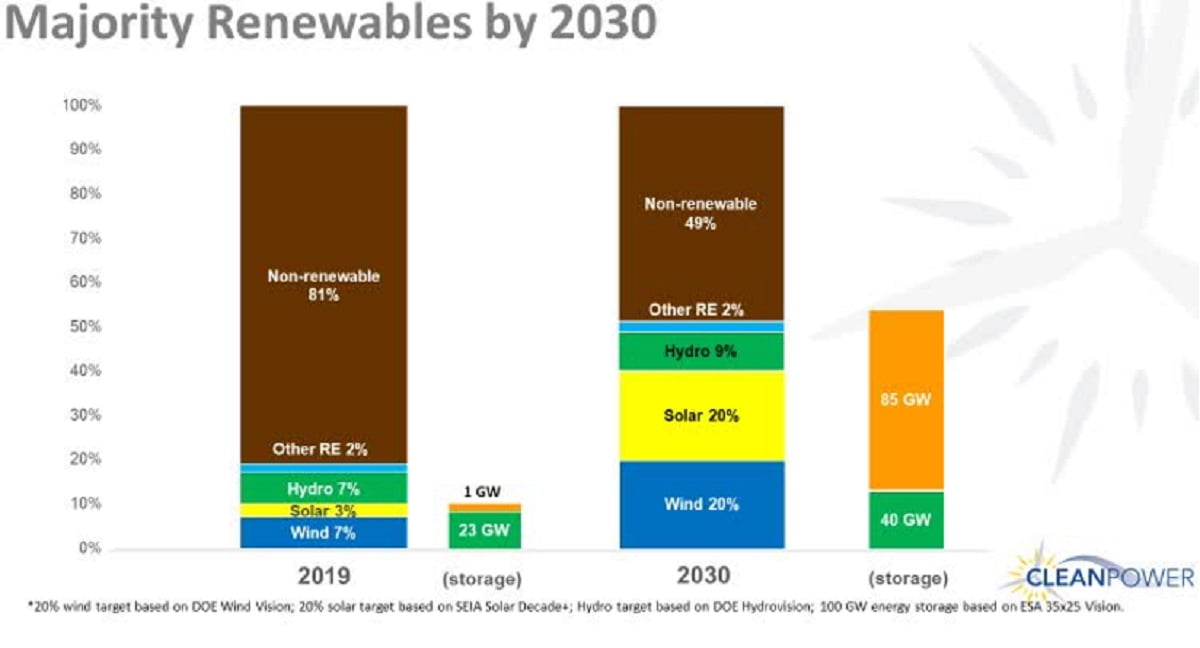

We also will continue our focus on disruption... areas where traditional business models and products are simply incompatible with life in the 21st Century. Here, we are particularly interested in the energy sector where renewable sources are achieving cost parity with traditional generation and are creating more (and better) jobs. We expect this to be a huge area of emphasis for the Biden Administration. Additionally, we maintain investments in companies that are on the right side of rapid change in content delivery (e.g. cord-cutting), telemedicine, and commercial real estate.

We will focus, also, on companies which should be able to absorb the potential for rising inflation and reduced monetary policy options in a future where quantitative easing and increased national debt are no longer available tools for policy makers.

GDS Investments' Portfolio Overview

First Solar

Against that framework, we report here on a select few of GDS Investments’ positions and start with First Solar, Inc. (NASDAQ: FSLR). First Solar recently announced blowout results for its last fiscal quarter with earnings and revenues handily beating estimates. The Biden Administration should only accelerate the inevitable shift away from fossil fuels toward renewable energy as the costs associated with solar energy production reach parity with coal and oil production. As the following chart by the International Energy Agency makes clear, demand for oil should plateau in the 2030’s and, by the 2040’s, would account for less than 20% of global energy consumption.

Zillow Group

Another great example of a market disruptor enjoying secular growth is Zillow Group, Inc. (NASDAQ: ZG). During last summer, Chief Executive Officer Richard Barton observed the “great reshuffling” in the real estate market where people are “spending an average of nine hours or more per day at home.” The pandemic only made clearer what most people already recognized: a traditional real estate broker is, in many instances, not necessary for buying and selling residential real estate. Rather, buyers and sellers are using digital platforms and, recently, two-thirds of home purchases on Zillow Offers closed in that manner.

Roku

We also continue to have great confidence in Roku, Inc. (NASDAQ: ROKU). In a perfect illustration of a secular trend, fully one-third of U.S. households have eliminated traditional pay TV in favor of digital streaming platforms. As a “cord-cutting” beneficiary, Roku, Inc. recently reported huge revenue (up 73% year-over-year) and, having added 2.9M active accounts in the last quarter, now stands at 46M. Chief Executive Officer Anthony Wood last year described a virtuous cycle for The Roku Channel, stating that the company “promote[s] it, we onboard more content, we get more users, we get more advertisers, then we get more content, we do more promotion, we get bigger titles." As the company becomes ever more ubiquitous, it will continue to leverage its active accounts to win more content and take stronger positions in negotiations with large content providers. Lastly, Roku, Inc.’s operating system is second-to-none and allows the company to sell to the advertising supply chain valuable targeted marketing opportunities.

BYD Company

Likewise, BYD Company Limited (OTCMKTS: BYDDF) enjoys secular tailwinds which have a profound impact on its business. The electric-car manufacturer, which used to be part of our “basket of Chinese companies,” is now our only holding from that country. After an impressive run-up in its share price, the company recently issued new shares to build-up its war-chest and is well-positioned for future growth. In addition, Berkshire Hathaway, Inc. continues to be one of BYD Company Limited’s largest shareholders at an approximately 10% stake.

GDS Investments’ portfolio still includes Twitter, Inc. (NYSE: TWTR). This major participant in the on-line communications space should accelerate its creation of long-term value with user growth, improved monetization per user, and enhanced governance through the stake which Elliot Management and Silverlake Partners now hold. Though the former Tweeter-in-Chief is now silenced on the platform, with Average Revenue per User of approximately $25.00 (but with sizeable opportunities to increase) and recent user growth of more than 29%, the company’s future is bright. The gathering all in one space of leaders from multiple sectors (sports, politics, business, education) allows the company to serve as a hub for information exchange while exploring and realizing its full potential.

QUALCOMM

As noted in our 2020 Mid-Year Letter (where we focused on competitive moats and companies which can thrive in a changing economy), we also continue to hold QUALCOMM, Inc. (NASDAQ: QCOM). The chip set maker enjoyed a great fourth quarter and is very well poised for a big year in 2021 where the growth in 5G is set to accelerate and every major handset manufacturer pays licensing fees to QUALCOMM, Inc.

Berkshire Hathaway

In 2020, we initiated our position in Berkshire Hathaway, Inc. Class B (NYSE: BRK.B) as a “survive and thrive” anchor to the portfolio. During the third quarter, the company repurchased $9B worth of shares (bringing it to $16B in repurchased share value year-to-date). Having started our ownership at a deeply discounted price of approximately $180.00 per share, the company recently closed at approximately $232.00 per share. We anticipate continuing to hold this stock which should do well in any economic scenario.

General Electric

After struggling for much of the year through the pandemic and the Boeing 737 Max debacle, General Electric Company (NYSE: GE) is trending higher after reporting better-than-expected third-quarter results. The company’s Power and Renewable Energy businesses showed modest growth and, overall, there are encouraging signs of stabilization as we forecast the next two to three years. We will monitor this long-term position and look forward to this American icon continuing its return to greatness.

SPACs

Finally, a word about SPACs: Special Purpose Acquisition Companies, which rose to prominence in 2020. These vehicles exist to raise capital in an IPO which they must then use within two years to fund the merger into (or acquisition of) target companies. Importantly, those target companies are usually businesses which would otherwise be unavailable to retail investors. The target company enjoys the benefits of becoming a public company without going through the traditional IPO process. Additionally, the company can tap into the deep management expertise of the SPAC’s sponsors. As with many positions, the key determination of what makes a SPAC a good investment is rooted in identifying those with strong management sponsors.

The Biggest Performance Contributors And Biggest Detractors

During 2020, the GDS Investment portfolio’s biggest performance contributors (listed alphabetically) included Berkshire Hathaway, Inc. Class B (NYSE: BRK.B), BYD Company Limited (OTCMKTS: BYDDF), First Solar, Inc. (NASDAQ: FSLR), QUALCOMM, Inc. (NASDAQ: QCOM), Roku, Inc. (NASDAQ: ROKU), Twitter, Inc. (NYSE: TWTR), and Zillow Group, Inc. (NASDAQ: ZG).

Conversely, our biggest detractors included American Airlines Group Inc. (NASDAQ: AAL), DuPont de Nemours, Inc. (NYSE: DD), and Exxon Mobil Corporation (NYSE: XOM). We exited those positions at losses in March and used the proceeds to invest in other companies with vastly superior risk-return profiles. We also have an unrealized loss in a security tied to the CBOE Volatility Index (VIX), which we put in place in the second half of 2020. This volatility hedge is inversely related to the performance of equities; it should perform better, of course, if volatility again rears itself in the equity markets.

Some of us endured more over the past twelve months than any person should in a lifetime. None of us will ever forget this time or the deep and difficult trials through which we all are persevering. We hope you all continue to invest in your families’ health and well-being. At GDS Investments, we will continue to value our relationship with each of you as we build upon the portfolio’s 2020 financial successes.

I remain grateful to you and humbled by your ongoing support.

With warm regards,

Glenn Surowiec