Gator Financial Partners commentary for the second quarter ended July 2021.

Q2 2021 hedge fund letters, conferences and more

Dear Gator Financial Partner:

We are pleased to provide you with Gator Financial Partners, LLC’s (the “Fund” or “GFP”) Q2 2021 investor letter. This letter reviews the Fund’s second-quarter investment performance. We also discuss the opportunity we see in small banks and our investment thesis in Esquire Financial Holdings.

Review of Q2 2021 Performance

For the second quarter of 2021, the Fund lagged both the overall market and the Financials sector benchmark. Navient, Realogy, and Victory Capital were top contributors to performance. The largest detractors were our hedges, Fannie Mae preferreds, PennyMac Financial Services.

Opportunity in Small Banks

Regional bank stocks had an epic run from last September through mid-March. During this time, the SPDR S&P Regional Banking ETF (“KRE”) returned 101%. After this large move, we believe regional banks shifted from extremely undervalued to fairly valued. However, we think there is still a very good opportunity in small banks due to their low valuations.

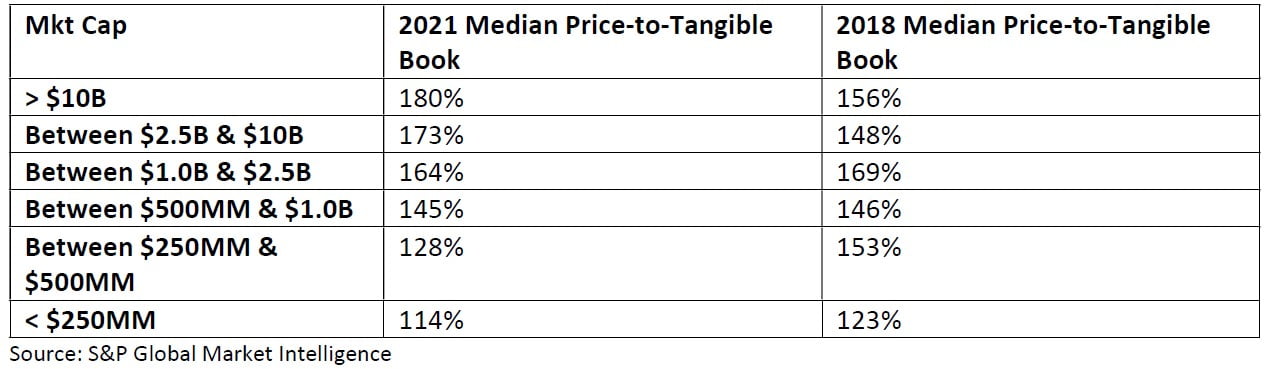

Here is a table showing the median Price-to-Tangible Book Value (“P/TBV”) of banks grouped by market capitalization. As you can see, the median P/TBV declines as the market capitalization declines.

Not only are the median values higher for larger banks, but we can see larger banks outperformed small banks.

The current distribution of bank valuations has important implications for bank mergers and acquisitions. With larger banks trading for higher valuations, they can use their stocks as currency in mergers and acquisitions, and the “merger math” will be attractive to investors. Here is a table comparing the distribution of bank valuations in 2021 to valuations in 2018.

As shown in the table, in 2018, valuations were more consistent across different-sized banks. The similar valuations made mergers more difficult because the financial benefits of mergers were less compelling.

We see two main reasons for the large banks to have outperformed small banks recently: investors’ desire for liquidity and the annual Russell rebalancing. We believe that investors have been purchasing exchange-traded funds and stocks of the largest, most liquid bank stocks to participate in the recent bank stock rally. This is normal in a rally but has led to the largest banks having higher valuations. Usually, small stocks will catch up to their larger peers later in a rally as investors search for values and acquisitions raise interest in smaller stocks.

The Russell rebalancing was different this year and was a likely reason for the lower valuation of banks with market capitalizations below $250 million. Each June, the Russell indices are rebalanced as stocks and shuffled in and out of the Russell 1000 and Russell 2000. This year was unusual because of the strong stock market rally and the large number of initial public offerings. This resulted in the minimum market capitalization for companies in the Russell 2000 increasing to about $250 million compared to June 2020’s market capitalization of approximately $90 million. This means 79 small-cap banks were deleted from the Russell 2000 index on June 25, 2021. We believe this was widely known by small bank investors, therefore small-cap bank stocks are trading at lower valuations.

Currently, we believe the best opportunity in bank stocks is among small banks because they trade at lower valuations.

Esquire Financial Holdings

One of the new small bank positions that we purchased for the Fund is in Esquire Financial Holdings Inc (NASDAQ:ESQ) (“Esquire” or “ESQ”). Esquire is a bank headquartered on Long Island, focused on serving the banking market for attorneys. By the nature of their business, attorneys often have control of money in escrow accounts for the benefit of their clients. These escrow deposits are attractive to banks because they tend to be sticky and not rate sensitive. Attorneys also have borrowing needs that haven’t been wellserved by traditional banks. In addition, Esquire has an attractive merchant acquiring business. Esquire has developed a good track record of earnings growth in the few years since its 2017 IPO. We believe there is a disconnect between Esquire’s growth and its valuation. It trades at 8.4x 2022 consensus Wall Street estimated earnings, but the bank’s earnings per share (“EPS”) is growing at 20%.

We believe the major reason for this disconnect stems from Esquire’s removal from the Russell 2000 index this past June. Index funds that track the Russell 2000 had to sell their Esquire shares. We believe prospective buyers of Esquire’s stock waited to buy until the Russell deletion date had passed. We think Esquire should trade at 15x or greater, which is in line with other high-growth banks.

We believe the most attractive part of the Esquire investment thesis is Esquire’s deposit franchise. Esquire’s deposits have a very low cost. Esquire also has more deposits than it needs. It has a low loanto- deposit ratio and sweeps more than $300 million of other customer funds off its balance sheet to other banks or money market mutual funds. Esquire gets these attractive deposits by:

- Getting the law firm operating checking accounts when they extend credit to the law firms and

- Capturing escrow deposits from law firms for funds and settlements that the law firm's attorneys control.

These deposits are not rate-sensitive, as the attorneys place ease of use above the rate paid in choosing their banking relationships.

Esquire is growing its loan portfolio at an attractive rate because it is attacking several opportunities. First, Esquire is making loans to attorneys for two different purposes. One is to provide working capital to law firms for managing their cash flow. The second reason is to provide funding for law firm expenses in contingency cases. Law firms regularly have expenses in cases that they take on contingency, which are then reimbursed when the client’s case is settled. However, attorneys cannot charge their clients a financing fee if they self-finance these up-front expenses. If the attorneys borrow money from a bank, they can get reimbursed for the interest paid to the bank when the client’s case is settled. Esquire doesn’t bear the contingency risk in these loans. Instead, the law firm’s overall cash flow is the security for these loans rather than the settlement proceeds from any particular case.

Esquire built a merchant acquiring business over the last 10-years, which generates a good amount of fee income and enhances the bank’s value. We are happy that Esquire’s management is focused on growing a fee income business. We are hopeful that the management team will expand into other feegenerating businesses such as trust & investments, insurance, and/or mortgage banking.

Esquire’s focus on the attorney market leads to wider margins than typical banks. As Esquire scales, we believe the wider margins will lead to higher returns and eventually a higher valuation. Esquire Bank has better net interest margins (“NIM”) than a typical bank. The bank’s focus on attorneys leads to higher than average loan yields and low deposit costs.

We admire the management team at Esquire. Andrew Sagliocca has been the CEO of Esquire for the past 13 years, but he is still relatively young for a bank CEO at 53 years old. Sagliocca previously worked at KPMG and North Fork Bank before joining Esquire as the CFO in 2007. We believe Sagliocca has focused the bank on an attractive niche. He understands how to create value as a banker. We look forward to how much value he can create at Esquire over the next 15 to 20 years.

The main risk with Esquire is the typical credit risk of any small bank. In addition to loans to law firms, Esquire also makes real estate loans in the New York City metro area. Through our research, we don’t have any outsized concerns about Esquire’s credit quality.

We think Esquire is a cheap small bank with attractive growth in a unique niche. We believe the bank has a long runway for growth and should have a valuation significantly higher than the current valuation.

Portfolio Analysis

Largest Positions

Below are the Fund’s five largest common equity long positions. All data is as of June 30th, 2021. We have decided to stop disclosing short positions in our quarterly letters.

Long

Navient (NASDAQ:NAVI)

PennyMac Financial Services (NYSE:PFSI)

First Bancorp PR (NYSE:FBP)

OneMain Holdings (NYSE:OMF)

OFG Bancorp (NYSE:OFG)

Sub-sector Weightings

Below is a table showing the Fund’s positioning within the Financials sector4 as of June 30th, 2021.

The Fund’s gross exposure is 196.6%, and its net exposure is 57.7%. From this table, we exclude fixed income instruments such as preferred stock. Preferred stock positions account for an additional 17.2% of the portfolio.

Conclusion

Thank you for entrusting us with a portion of your wealth. We are grateful for investors like you who believe and trust in our strategy. On a personal level, Derek Pilecki, the Fund’s Portfolio Manager, continues to have more than 80% of his liquid net worth invested in the Fund.

As always, we welcome the opportunity to speak with you and discuss the Fund.

Sincerely,

Gator Capital Management, LLC