Today we’ve published our second Sentiment Analysis Report, which summarizes last quarter’s top keyword searches and provides detailed sentiment analysis across all industries. We used Sentieo’s brand new Transcript Sentiment Analysis feature to analyze earnings call transcripts and discover which topics companies discussed the most last quarter, versus the same quarter in 2017. (See our previous report here).

We also compared the sentiment of management and analyst sections of transcripts, and graphed these data points so you can easily see trends or discrepancies between the two. We publish these reports every quarter, so you can stay updated on information that could impact your investment decisions this year. Here are some interesting themes that came up in our research:

Sentiment Analysis

Management versus investor sentiment is diverging.

Our sentiment analysis on transcripts shows that a decoupling is taking hold between the language from company management and market participants. Management continues to be upbeat during earning calls and presentations, while sell-side analysts and investors are taking a more cautious stance. To learn more, download the full, free report.

Keyword Mentions

Two substantial highlights from the various themes we cover in this report are related to cryptocurrency and Trump.

While mentions of crypto have continued to ramp up, two companies in particular had a surge in references: IBM and Overstock.com.

IBM, with its Watson program and early involvement in the emerging fintech scene, is a recurring leader in the category. What’s new is that as concepts are maturing, bigger and more influential ecosystem players are now making moves: IBM recently revealed that it has been meeting with executives from commodities trading platforms, large corporations, and perhaps most importantly, central banks, to explore cryptocurrencies and blockchain in their operating models. (CoinDesk)

Overstock.com also made the headlines as possibly the first $1bn+ listed company dipping into crypto funding with an ICO (Initial Coin Offering). The stock fell sharply year to date (-40%), in part in reaction to the Securities and Exchange Commission starting an investigation on Overstock.com’s subsidiary that did the ICO. (Investopedia)

With this report, we are starting down the path of quantifying linguistic data. This report is a real use case of the exciting new features we recently released, like our Transcript Sentiment Report function, which is part of Sentieo Document Search.

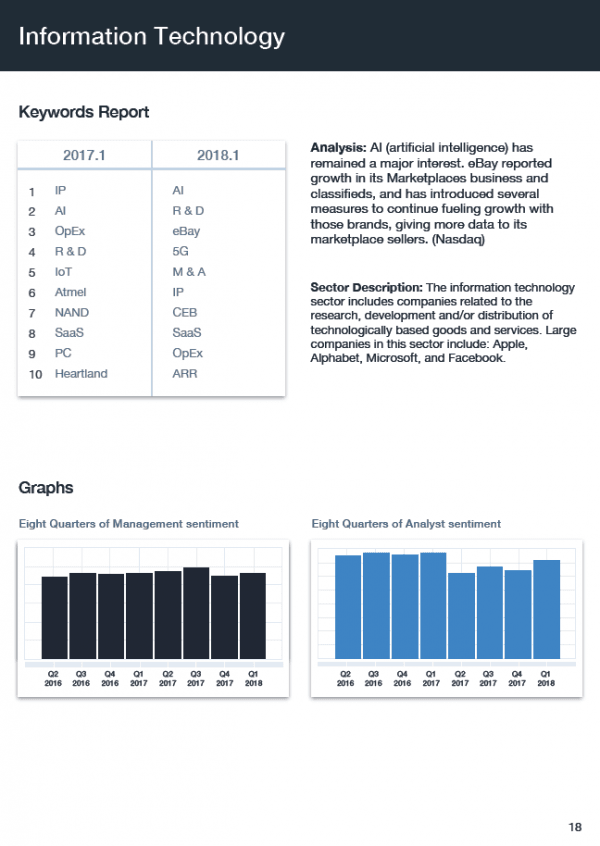

Below is a sneak peek of the report: a sample page about the information technology sector.

To learn more about the companies, industries, and regions where crypto and other themes are being most discussed, download the full report, which covers this sector and many more. To find out more about how to run your own sentiment analysis with Sentieo, sign up here for a free trial.

Article by Denise Martinez Sentieo