Forge First Funds commentary for the month ended September 30, 2018.

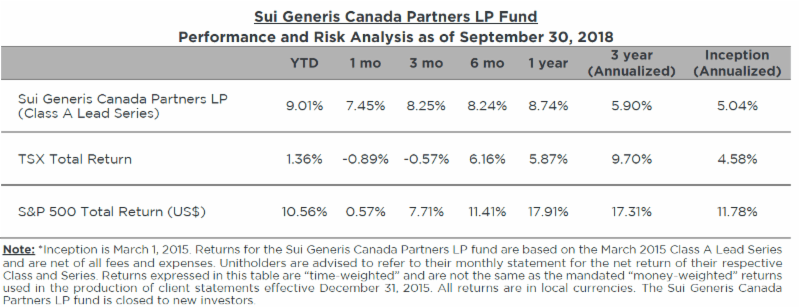

The Sui Generis Canada Partners LP fund was up 7.45% for the Class A Lead Series during September 2018, resulting in a year-to-date net return of 9.01% and since inception (March 1, 2015) cumulative net return of 19.25% (5.04% annualized).

Forge First Funds Commentary

“When it rains it pours” is one of the more common expressions in our vernacular. Its near ubiquitous meaning implies that situations often occur in rapid succession or even all at once. In our line of work we strive for consistent, predictable net returns, by mapping out the coming months and quarters for markets (macro) and catalysts (micro) for the individual securities in our portfolios. We then allocate capital in the manner that most appropriately balances the risk & reward potential from our opportunity set.

Q3 hedge fund letters, conference, scoops etc

But sometimes when it rains, it pours, and September was one of those times. Our funds posted their best month in recent times and the success we achieved to close out the third quarter can be attributed to a confluence of events impacting positions that ironically played out within the same 30 day period. So before tabling our view on market prospects for the fourth quarter of 2018 let’s review what contributed to September’s performance.

During September 2018, the Forge First Long Short LP Class F Lead Series (“FFLSLP”) generated a net return of 6.56%. This advance increased the year to date and rolling 12 month net returns to 12.36% and 15.02% respectively. The annualized five year net return sits at 12.27% while the since inception annualized net return is 17.35%. The Sharpe ratio of FFLSLP is 2.06 with alpha of 13.74%. Our lower volatility fund, the Forge First Multi Strategy LP (“FFMSLP”) also posted a strong month, with a net return of 4.49% for the Class F Lead Series, boosting its year to date net return to 7.24%, consistent with its rolling 12 month & 5 year annualized net returns of 7.91% and 7.80% respectively. The Sharpe ratio of FFMSLP is 1.85 with alpha of 10.16%.

Two of the key contributions of this performance came from the sector that we have written about several times during the past year and that’s energy. We remain constructive on oil and are now bullish on natural gas and our capital allocation to the energy sector corroborates these two uncorrelated views.

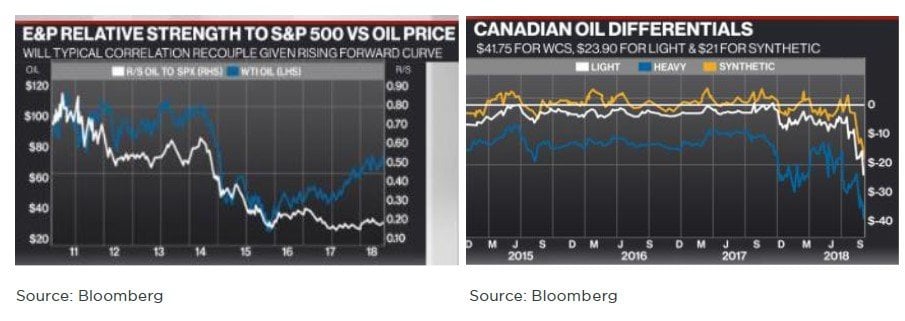

The first and perhaps more simplistic of our two energy themes is the continued tightness in the oil market and our strong belief that not enough oil is being produced to meet demand. The graph on the below left illustrates that shares of oil producers have yet to get ‘up off the mat’ from the perspective of relative performance versus the S&P 500 despite the US$25-$30 per barrel YTD increase in the price of oil. Of course stock performance in Canada’s patch has been further exacerbated by the price differentials, shown on the below right, that has been forced on Canadian producers due to the lack of egress.

Consequently, at current strip prices, Canadian heavy & light oil producers are experiencing field and all-in corporate per barrel netbacks approximating C$10/$0 (yes, just breakeven) & C$35/$25-$30 respectively. Hence the only ‘true’ oil stock in our portfolios is Parex Resources Inc. (PXT.CA). A Canadian domiciled company with a $3.3B market capitalization, 100% of its oil production is in Columbia, and their barrels fetch Brent-based pricing. We estimate the company’s current netbacks approach C$75/$55 per barrel such that using forward strip pricing, next year’s free cash flow could exceed $750M, more than 25% of the company’s current enterprise value.

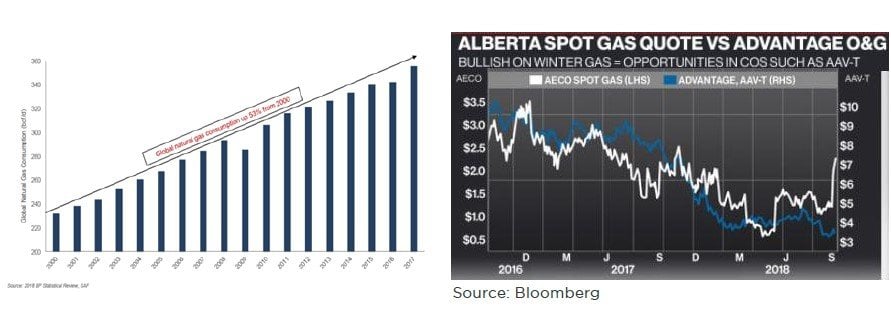

Our second energy theme, and the one that’s allocated the majority of the energy book’s exposure, is natural gas, for both cyclical and structural reasons. Natural gas has long been left for dead as an investible commodity, particularly in Canada. However, our primary research has given us a strong conviction that the long bear market that has punished gas investors for the better part of a decade is coming to an end, thanks to the wicked combination of underinvestment which has yielded stagnant supply, and strong rising global demand. While zinc’s bull-run during 2016-2017 was driven by the closing of legacy mines that pinched the supply side of the equation, the end of most commodity bears is catalyzed by growing demand.Gains

Structurally, the figure on the below left highlights the very strong demand growth we’ve seen for gas since 2000. We believe demand is set to accelerate materially over the next decade as both China and India attempt to wean their countries away from coal. All of this is to say, the strong investor interest in the Canadian gas space should only be just beginning with the recent announcement of LNG Canada’s positive final investment decision. Names associated with the LNG (liquefied natural gas) theme contributed strongly to September’s performance, including core long term positions such as Tourmaline Oil Corp. (TOU.CA) and Enerflex Ltd (EFX.CA). The funds also profited from opportunistic trading in companies including Horizon North Logistics Inc. (HNL.CA).

Meanwhile, North America is entering the winter 2019 gas season with natural gas inventories that are below their five year average with egress issues continuing to mar the ability of producers to top up storage. Hence, cyclically or perhaps I should say seasonally, as implied by the graph on the above right, we see opportunity in companies such as Advantage Oil & Gas (AAV.CA) (blue line, right axis) whose shares offer significant upside potential to improvements in AECO spot pricing (white line, left axis).

A second key contributor to September’s performance was the cannabis sector, where we identified an opportunistic trading idea. This segment of the market has become a frenzied sector that rightly or wrongly we have generally not been involved in during the past couple of years. While arguably this lack of exposure is not surprising given that the principle focus of our funds is to own companies generating free cash flow and short companies that burn cash, there’s little question there’s been money to be made. Our tactical entry to the sector during September was initiated by the readily apparent & serious interest of global consumer brand companies to engage producers in partnering ventures. This fact, combined with our belief that the momentum behind the space would continue through the legalization date in Canada, caused us to trade the sector during September 2018.

While the majority of the profits in each of our funds were derived from the securities we owned, each of our two funds also made money from their short books. In fact, during the 25 months that the total return for the TSX Composite Index has been negative, since we launched our funds 74 months ago, our short book has generated positive returns in 21 (84%) of those months for FFLSLP. That’s why our funds have exhibited negative downside capture of -51% for FFLSLP and -45% for the FFMSLP. Negative downside capture means that historically a fund has made money when the market is down. In the case of our Funds, since inception, FFLSLP and FFMSLP, have generated positive returns of 0.51% & 0.45% respectively when the market has suffered a total return loss of 1%.

With one quarter to go, we admittedly don’t see a great deal of change coming when considering the macro backdrop. That is to say we believe US equities should continue to muddle along, with reasonable dispersion between the winners and losers, while global equities are likely to continue to struggle for footing. The combination of rising interest rates, trade wars, a return of Italian political and economic noise vis-à-vis its place in the EU (we prefer Italeave but could be convinced on Quitaly), Brexit and now the very real threat of rising oil prices acting as a tax on the consumer, there are any number of issue that will keep our attention to close out the year. Consequently, our gross exposure levels are relatively low at this juncture, specifically 107% and 99% in FFLSLP and FFMSLP respectively.

That said, it’s not all bad out there as the USMCA, while more evolutionary that the revolution it’s advertised as, should clear the decks for less “trade war” noise between the north and south side of the 49th. And while nobody appears to be declaring “mission accomplished”, emerging markets have quietly begun to rebound with China notably bouncing a solid 7%+ from its mid-September bottom. We aren’t emerging market investors but we certainly aren’t naïve enough to think we are sheltered from them either, so stability from the likes of China, Turkey and Argentina is welcome. However, should weakness re-emerge overseas we have a good roster of short sale candidates to not just play defence but offence too, in the event markets shift.

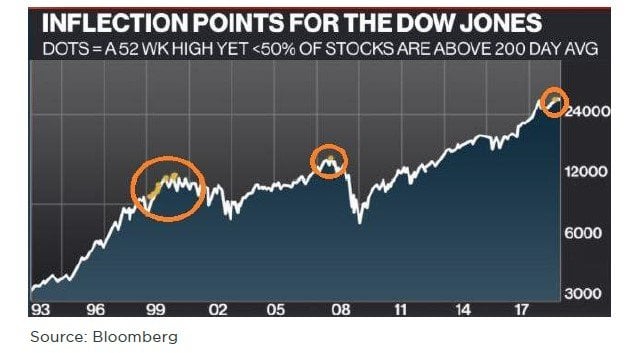

Given the above, we don’t necessarily believe that broad market exposure will yield particularly strong risk-adjusted performance at this late stage in the cycle. For example the above graph suggests that the combination of a closing 52 week high on the Dow Jones Average with less than 50% of NYSE stocks being above their 200 day moving average has often been a turning point in markets during the past 25 years. Meanwhile, measures of breadth remain in better shape on the Dow Jones than any of Nasdaq or the Russell 2000 or 3000. Remember, the economy and the stock market have basically gone straight up for ten years. Hence in looking towards 2019, it’s important to consider whether it’s appropriate to continue to have the same level of risk in your portfolio as you have had the past several years.

At Forge First, we will continue to pick our spots on both the long and short side of the ledger so as to provide our investors with unique exposures that we believe will play out independent of broader market movements and this should enable our funds to exhibit low beta and correlation to the broader indices. And remember the tortoise beats the hare.

Please do not hesitate to reach out to us if you wish to learn more about how our strategies can complement and lower volatility in your investment portfolio. As always, we welcome any feedback, and for more information please visit our website at www.forgefirst.com.

Thank you,

Daniel Lloyd Portfolio Manager

Andrew McCreath, CFA President and CEO