Eschler Recovery Fund commentary for the year ended December 31, 2020.

Q4 2020 hedge fund letters, conferences and more

Dear Partners,

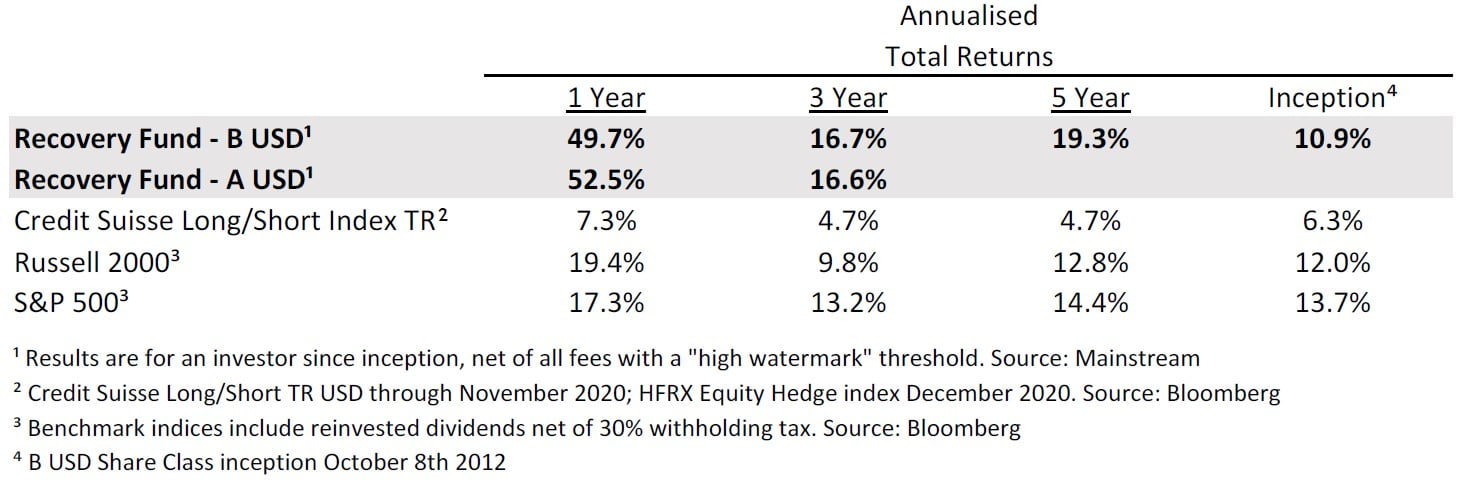

Eschler Recovery Fund Performance

In 2020 Eschler Recovery Fund rose over 50% on an asset-weighted basis, net of fees and expenses. This was the best annual tally since inception. This strong result belies a sometimes uneven flight path over the past eight years (and I have the grey sideburns to prove it!). The 37 year-old who set up Eschler in 2010 may have had second thoughts had he enjoyed perfect foresight. Markets exist to destroy one’s ego and it didn’t take long for mine to be cut down to size. Before launching Recovery Fund I received valuable early experience running third-party capital for 18 months which helped to inform and hone my investing approach. Armed with these lessons learned, surely great things were in store? Not so fast. Despite the best laid plans, Recovery Fund was less than breakeven after three years! With no income from the business (Eschler’s day one investors paid no management fees) and a 6% compounding hurdle, quitting would have been easy. Instead, I left the warm bosom of employment and doubled down on Eschler. The past five years, most of it running the fund full-time, have now begun to justify this decision.

What is the moral of this expose? The challenge for stewards of perpetual endowments is to identify investment managers, with whom they can deploy capital over very long periods of time, thereby minimizing the risk of interrupted compounding and maximizing the benefits of longterm partnership. Such managers must necessarily be driven not solely by financial rewards but also by a genuine interest in the craft, learning from setbacks, building enterprise resilience and seeing a project through. To finish first, as they say, you must first finish. I am certainly humbled by the endurance of my investing partners who provided me with encouragement at the low points and truly embody partnership. They deserve much of any credit due for results to date. I would like nothing more than to manage this fund for decades. If collective decisions in the first eight years are anything to go by, we may have a shot at it.

............................................

If one needed any proof that the stock market is not the economy, 2020 provided it in spades. The source of this dichotomy, in my view, was pervasive government meddling in private enterprise. Blanket lockdowns brought exceedingly tough economic conditions on many citizens who could afford it least, while protecting the wealthy. Fiscal and monetary largesse was then indiscriminately showered on those who, in many instances, needed it least. These policies have accelerated inequality and spawned social unrest and a breakdown in trust. Is it any wonder that gold returned 25% last year? I have not been investing in precious metals in recent years out of some obsession with what is a tough business over a full cycle. Rather, I have invested out of necessity, believing the asset class to be a refuge from government policy gone mad. For better or worse, the investment case appears as strong as ever.

Review

The following elements combined to produce what was a standout year: A large cash position prior to the pandemic onset (peaking at ~33% in late January) allowed us to stay on the front foot through March and April and act on our conviction that the lows were in (see the Q1 2020 letter). Our core exposure to precious metals equities in the first half of the year provided more rapid momentum uplift off the lows than did exposure to many cyclical industries whose fundamentals stayed deeply impaired (see the Q2 2020 letter). An incremental shift toward more economically sensitive value stocks in the second half of the year (pre-U.S. election) paid off in November and December. Minimal short exposure throughout the year ensured the portfolio felt the full benefit of the recovery off the lows.

Last but not least, stock picking last year was extremely successful. For example, our largest royalty holding EMX Royalty rose 104%, over 3x the industry average. Our largest uranium holding Paladin Energy rose 152%, over twice the industry average. Our largest silver holding Fortuna Silver Mines rose 102%, over twice the industry average. Our largest energy holding Antero Resources rose 91% in a negative energy market. Our largest financial holding Affiliated Managers rose 20% against a negative sector return. Losing investments were modest in comparison. Tailored Brands, a formal wear retailer hurt by the pandemic, was our largest single stock detractor shaving 1.3% off the portfolio return. We also lost smaller amounts primarily in energy holdings. Shorts detracted 1.4%, with losses arising primarily from two holdings (Tesla and Plug Power) both of which we immediately stopped out of. The macro hedge, primarily long index puts and straddles, detracted 3% but helped us to stay invested during the initial recovery.

............................................

Parallels with '99-'00

2020 saw the return of the silly season in financial markets. Bubbly conditions in 2020 set records in IPOs, SPACs, high yield bond issuance, negative yielding sovereign debt, ETF flows, retail call buying, margin debt, short-squeezes and more. For those of us who had a front row seat during the internet bubble, drawing parallels with ‘99/’00 is tempting.

After raising $396 million from VCs, online grocery delivery business, Webvan, came public in November 1999 raising another $375 million. The shares doubled on the first day of trading. At its stabilised $5bn market cap the shares traded at 28x 2000 revenues. As we distributed these coveted IPO shares to lucky institutions on the US shares desk at Goldman Sachs, it was no secret that this deeply loss-making, unseasoned, capital intensive enterprise was destined to stumble. Shares fell 95% in 2000 and bankruptcy followed in March 2001. In my view, Webvan was one of the more egregious poster children for internet bubble excess.

Is the recent batch of freshly minted IPOs by new entrants in the same risk category? I would say no. They tend to be seasoned businesses with sales traction which are investing heavily to satisfy customer demand spawned by a genuine value proposition. For example, Airbnb is one of the most disruptive businesses ever in my view, with tremendous long-term opportunities to grow. Where the internet bubble framework does provide a roadmap, though, is in the price investors are paying for future growth and the shameless analyst cheerleading. At a $45bn market cap, investors in loss-making Doordash are paying 53x 2026 estimated earnings per share. Leave aside the improbable growth in earnings that multiple implies. Even if the company is successful, ultimately meets this earnings target and trades at 50x earnings in five years, investors will lose money paying today’s price. This encapsulates the risk in today’s growth investing market. I’m keen to observe how it all plays out—from the sidelines.

Risk Management

Commodity cyclicals, a segment of the market in which we have been active, also showed some signs of life last year, though the complex lagged in aggregate. But I am under no illusion that a pervasive speculative impulse contributed mightily to the Fund’s 60% gross return last year (despite cash holdings averaging 14% of fund equity). It is foolish to believe that telltale signs of excess will not have predictably bad consequences for the entire market at some point and our holdings would not be immune. Hence I have been focused on maintaining a small balance sheet (holding more cash), greater position liquidity (generally >$1m daily trading volume for each of our top 10 holdings) and greater than normal position diversification (4-6% position sizing for our top 10 holdings). The short book has been mostly dormant for the past couple years but the ability to activate it at any time is a big advantage in today’s environment. I foresee once again deploying a small short book while adhering (ruthlessly!) to a hard stop-loss rule which has served me very well recently.

Outlook

I continue to believe the Fund’s precious metals holdings offer excellent risk-reward. The whole sector is in rude health while capital spending and M&A remain restrained. Yet the gold stock indices barely matched gold’s return last year despite rapid fundamental improvement. Forward growth rates in earnings are the best in the stock market while forward P/E ratios are amongst the lowest. Normally, low P/E ratios in a cyclical industry would have me concerned. For now, though, I await further enthusiasm from mainstream investors leading to a robust investment and M&A cycle and a revaluation of the smaller businesses we tend to own.

My best guess is that the performance of the gold mining industry in the past couple years is a leading indicator for the broader commodities complex. This would be consistent with steep global GDP recovery and a wave of fiscal spending coming up against supply constraints across most natural resource subsectors. If this hypothesis is correct, energy, uranium and base metal prices should see upward pressure soon and the fund has geared exposure to this via common stock investments.

Business Update

I’m pleased to say Eschler is now a full-scope AIFM and has submitted an application to register with the SEC. We have also on-boarded an experienced investment advisor with a wellestablished fund onto our platform. These initiatives will facilitate both internal growth and growth of our investment advisors, as well as provide financial and operational ballast. In November, we also hosted our inaugural Emerging Manager Symposium. Lastly, I’m excited to announce that we will be launching Eschler Partnership SP on April 1st 2021, a feeder fund counterpart to Recovery Fund for US taxable investors.

Against an unpredictable backdrop, a lot of good things happened at Eschler last year, only made possible by the support of our clients, service providers and friends. Heartfelt thanks to all of you for your enduring support.

Theron de Ris

Portfolio Manager