November 23, 2020 Update: The dollar to yen trade remains choppy and has been for about two weeks. However, Credit Suisse analysts say with the trend, price and moving average resistance capping, the risk remains lower on balance for a sustained move below 104.00 for a fall back to 103.20. The next important level to watch is 101.59.

During Monday’s trading session, the U.S. dollar did almost nothing against the yen, continuing to hover near the lows of the last couple of trading sessions. FX Empire reports that there is a great amount of downward pressure in the trade at this point, which is why the setup looks the same as it has for a while. The site also sets the resistance level for the trade at 104, but it could be a noisy couple of days going into the Thanksgiving holiday.

Dollar/ yen remain in a tight range

October 30, 2020 Update: The U.S. dollar and the Japanese yen are both considered safe-haven currencies, but a weakening global economic outlook has currency traders and other investors uneasy. The dollar has been all over the place this week, although it remains within a 100-point range again.

Chart technicians point out that the ¥105 level has been holding as a resistance level for the yen against the dollar. Meanwhile, ¥104 has served as support, highlighting just how tight of a range the two currencies are in.

If the trade falls below ¥104, then it could drop as low as ¥102, although this level has seen strong support recently. On the other hand, if the trade rises above ¥105, it could even test ¥106.

Japanese yen could strengthen against the dollar soon

September 29, 2020 Update: Societe Generale analyst Jason Daw said recently that he expects the yen to rally against the U.S. dollar. He predicts that the yen will “naturally drift” toward 100 against the dollar. He also describes the yen as “interesting,” noting that it has strengthened during the recent weakness in the stock markets.

Daw believes the yen’s value against the yen is closer to 100, and it’s been his view for quite a while, he told CNBC recently. So-called “safe haven” currencies like the yen have strengthened due to the recent jump in coronavirus cases worldwide.

He gave several reasons for his view of the yen and the dollar. He noted that the Bank of Japan isn’t easing as quickly as the Federal Reserve, so the yen could strengthen. He also said some market watchers are concerned that policy in Japan “might not be as easy or as coordinated as it was before” under the new prime ministry. Tighter policy could mean a stronger yen.

While he sees strength in the yen, he sees plenty of barriers for emerging market currencies even though the U.S. dollar has weakened against other currencies in the Group of 10.

The Relationship between the Dollar and Yen and How it Affects Gold

As more and more evidence shows a significant and increasing relationship between the U.S. dollar, the Japanese yen, and the price of gold, we have come to believe that this relationship will push gold even higher in the next few weeks than the previous peak hit in 2016. Over the last 15 years, one or two of these three assets were looked at as a protective asset against worst-case scenarios such as economic or geopolitical crises.

It is our belief that in the long-term, there will be more and more realizations that among global fiat currencies, there are zero that can truly be considered as protective assets. This will stem from a change in global thought processes, the foundation of which is already settled.

These thought processes are more applicable than the settled foundation when attempting to determine where the market is headed over the course of a relevant timeframe. An example of this would be the 45% decrease in gold prices that occurred between 2011 and 2015, as silver simultaneously decreased by more than 70%, all occurring while central banks around the world, including the Federal Reserve, debased their currencies. This calls into question basis arguments regarding the precious metals market and its movement.

If you want to be on the right side of this movement, it is important to understand these basic arguments, but it is also important to fully understand how the market is moving, and here is where our technical analysis comes in.

The Relationship between Yen and Gold

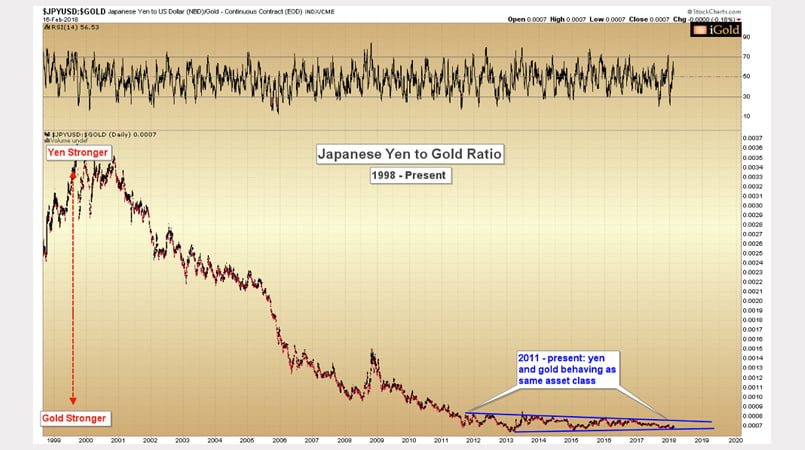

History has shown that whenever the Japanese yen is doing more strongly than the dollar and starts being used as a protective asset, gold is generally also doing well. If you take a look at the graph below, you can see a look at this positive correlation between the yen and gold, shown starting in 2011. The shape of the yen to the dollar on top is almost exactly the same as that of gold.

Additionally, this shows that the yen and gold have stayed side by side over the course of the last seven years, excluding the area shown in red which shows gold breaking its downtrend last August, as the yen has just broken its own in the last two weeks. From this, we can conclude that gold and the yen are in a definite positive correlation.

This information can be confirmed by looking at the amount of gold needed to buy yen. Take a look at the blue below to see how their movements have stayed close over the past seven years.

The Relationship between the Yen and the Dollar

With all of this said, the most important thing that happened this past week was not, in fact, the end of the correlation between the yen and the dollar, which is still in place. Once we see signs of that occurring on the horizon, we will make sure to report it to you. The most important thing this week to pay attention to is the significant breakdown in yen’s favor, as seen here:

This consolidation of the yen and the dollar created a perfect triangle, seen in blue, from 2015 until just last week. Its amplitude was 27 points, and if you take this number from its apex of 111 you can see a long-term goal of 84 yen to one dollar. We expect this goal to be reached between the next 12 to 18 months.

The piece of information here that is most important to you as a precious metals investor is the fact that gold is still making strong inverse moves with the two. So this confirms that a large increase in gold prices is on the way. There will be a time in the future that gold will move outside of the movements of the yen, but for now, their movements are in correlation. Further, the dollar’s break from this formation shows an upcoming period of weakness for it and growth for the yen that will be occurring over the course of the next 12 to 18 months, if not longer.

Gold’s Wrap-Up

Gold is making moves to overtake its peak reached in 2016 of $1378/ounce. Although the yen and gold correlation remains firm, we expect that over the course of the next 12 to 18 month that we will see an increase in gold price on the way to the minimum target zone of $1485 - $1535/ounce.

Bullion Exchanges is located at 30 West 47th Street in New York City’s Diamond District and is open Monday through Friday 9 A.M. to 5 P.M. or online anytime at BullionExchanges.com.

All market review articles are provided as a third party analysis and do not represent the views of Bullion Exchanges and should not be considered as financial advice in any way.