Richard Pearson of Moxreports recently published a 10 page report detailing why he thinks that low float Dillard’s, Inc. (NYSE:DDS) has the potential to quickly double despite (or because of) a short interest in excess of 80% of the float. Below is ValueWalk’s Q&A session with Mr. Pearson in which he discusses his bull thesis on Dillard’s, why he calls Dillard’s an ‘accidental short’, incentives for the buybacks, earnings expectations, and the significance of Wedbush’s update. Pearson is long Dillard’s.

In a nutshell, what is the bull thesis on Dillard’s ?

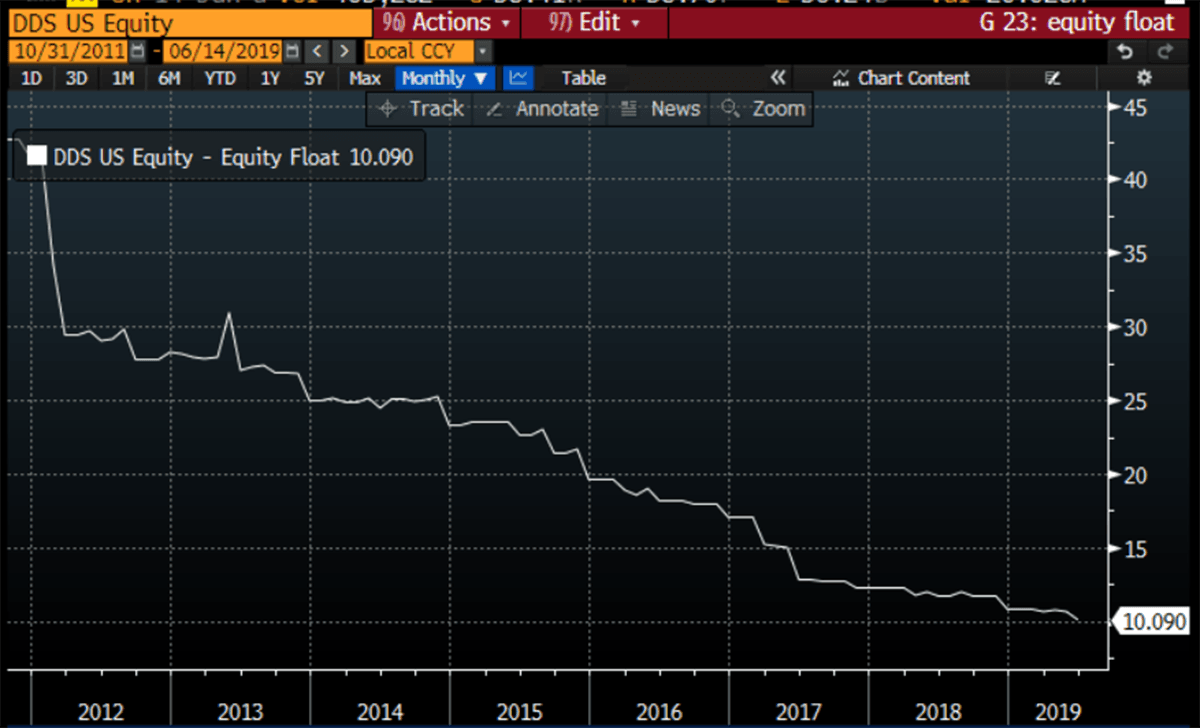

Dillard’s is in the lackluster business of bricks and mortar retail, but the company is sitting on several billion dollars of real estate that is still recorded on its books largely based on decades old purchase prices. The company has very strong cash flow which it is using to aggressively buy back the outstanding float, which will leave insiders owning that real estate. The stigma of “bricks and mortar retail” has kept the share price low and the short interest high, while lack of interaction with analysts has kept positive developments largely under wraps as the company continues buying back shares.

Q2 hedge fund letters, conference, scoops etc

How can you be so bullish on a “bricks and mortar retail” play like Dillard’s ?

The brink and mortar space is grim, but Dillard’s is a niche player, completely different than JC Penny or Sears, or even Macy’s or Nordstroms. Dillard’s revenues have been continuously stable at $6-7 billion per year for more than five years. The company remains profitable and cash flow positive, with very little debt. The company’s aggressive share buyback is being funded with operating cash flow, not with debt. In fact, the company has been paying down debt even as it is buying back its shares. This is why Moody’s re-affirmed Dillard’s as investment grade just a few weeks ago. I am largely indifferent to Dillard’s performance in the retail business. The value is being driven by the buyback which is quickly consuming the remainder of the float.

So what is the endgame for Dillards’ with the buyback ?

Dillard’s has every incentive to buyback all of the outstanding float, and this is exactly the course they have been pursuing. Over the past few years, the company has already bought back more than half of the float and they accelerate their aggressive purchases every time the stock drops into the $50s and $60s.

The incentive for the buyback is that Dillard’s is sitting on over 44 million sq. feet of real estate, which is still recorded on the books based largely on decades old purchase prices. Third party estimates of market value tend to range around $4 billion, or roughly $200 per share. To be conservative, I haircut these numbers significantly, but even the most conservative values are still at least double the current share price in the $60s.

As of the most recent SEC filings in May, the reported float was down to just 10 million shares. But since that time, the company has almost certainly been an aggressive buyer at recent lows. Ultimately, as the outstanding float gets much lower, the value per share of this real estate gets much, much higher. For the final few million shares, Dillard’s will need to pay a much higher price. Paying a much higher price on the small remaining stub will have little impact on their overall basis.

Doesn’t an 82% short interest mean that there must be some major problem underlying Dillard’s ?

Not at all. Dillard’s is what I refer to as an “accidental short”. It appears that the short interest got to high levels mostly due to ETF and algo trading against the broader bricks and mortar retail space and not specifically against Dillard’s. The company’s aggressive share buyback has cut the float in half, amplifying the short interest sharply. In years past, it was a reliable rule of thumb that when we saw a stock with a high short interest, that “someone must know something” and that there must be some significant underlying problem. But as algo and ETF trading consumes a larger portion of the market, we are seeing more cases of “accidental shorts” like Dillard's where there is not any smart money on the short side of the trade.

What do you expect for upcoming earnings ?

Dillard’s will release earnings in about three weeks. It will likely be another surprise for investors, who have not figured out the patterns of apparent “earnings management” across alternating quarters. Here is the pattern I see: In the past we have seen Dillard’s report individual “kitchen sink” quarters that were very bad. Revenues seemed a bit delayed, and expenses seemed a bit pulled forward. Not surprisingly, the stock then tanked into the $50s on unexpected bottom line weakness. Dillard’s would then aggressively buy back shares in the $50s and $60s, which is also not surprising.

But in the subsequent quarters, those delayed revenues would now need to be recognized while those previously pulled-forward expenses would not. The stock would then sharply over-react to the upside in these surprisingly strong rebound quarters. Each time, the rebound quarters see nominal earnings which are “less bad than expected” and the per share impact is further magnified by the lower share count due to the buyback.

We have repeatedly seen this alternation between kitchen sink quarters and rebound quarters. In February 2019, this is what took the stock from $65 to $81, before the kitchen sink in May took the stock back down to the $50s and $60s again.

So I expect we will see the extra kitchen sink revenues materialize this quarter, and that we will also see a significant per share boost from sharply reduced share count.

How significant was the Wedbush upgrade this week ?

Not significant. Sell side consumer analysts continue to put out perfunctory coverage on Dillard’s as part of their retail coverage universe. But analysis has been minimal and price targets are generally set at arbitrary levels. As a low float stock, Dillard’s does not justify much effort for sell side analysts from a trading perspective and its strong cash flow means that it has no investment banking value (no need to raise money). So price targets are typically adjusted after the fact, and at set at levels of “slightly below wherever the stock is currently trading”. Take a look for yourself.

From day to day, Dillard’s share price often tracks around the XRT retail ETF. But the ups and downs of the retail business are not what will drive the share price. The company’s aggressive ongoing buyback is rapidly decreasing the float while simultaneously increasing the value per share on every meaningful metrics (earnings per share, real estate value per share, cash flow per share etc.). But this is not the sort of thing that the sell side is in the business of analyzing or covering.