Use Of Digital Technology To Build Resilient Portfolios. Going Beyond 60/40 Traditional Asset Allocation.

Q3 2020 hedge fund letters, conferences and more

60/40 Portfolios have been the safe harbour of institutional investors for decades, their steady state. For decades, they have exhibited much better risk-adjusted returns than both Equity and Bond pure-plays; displaying only marginally lower returns than pure Equity long-only, for a fraction of the volatility.

However, in the next 10 years, Bonds are unlikely to save the day during Equity market storms. After a 40+ year rally, Bonds hit the zero bound on interest rates, now even in the US, and any price increase from here is mathematically compromised. If another Dot-Com Bubble Burst, or if another Lehman, February 2018, March 2020 event were to occur, the loss for balanced portfolios would be far greater than back then. Largely, this is a by-product of the market fragility crafted by a decade of relentless interventionism from Central banks and forceful manipulation of price discovery on publicly traded assets. It spiralled positive feedback loops across the market system (from excess risk taking and leverage, to accept no covenants / no collateral when lending, to Buybacks mania, IPOs frenzy, retail trading fever pitch), sending the market into a far-from-equilibrium state. 2020 will go down in history as the supreme testament to Central Bank omnipotence over markets: financial markets performance VS performance of the economy.

At the same time, the risk of equity drawdowns is greater than ever, given (i) valuations at all-time record highs and (ii) a narrow market leadership where few stocks account for all of the gains and 30%+ of market cap. Drawdowns kept increasing in magnitude over the last few years, while shortening in tempo (flash crashes), to reach earthquake-sized-shaped moves in 2020. Further, faster, larger gap downs seem baked in the cake, owing to a chronic state of inherent, profound market fragility.

What can be done to protect portfolios in the decade to come and what can be added to the flawed 60/40 mix? Gold? Bitcoin? Private Assets? CTAs as crisis alpha? Long volatility as an asset class? Here below we propose Fasanara’s alternative asset class: the extensive use of technology in both Digital Lending and Digital Assets, which harnesses novel investment tools born out of technological progress and digital disruption in financial services and payments. Here’s to a promising Digital Future!

Table Of Contents:

The 60/40 Portfolio Steady State System Is Broken

- Bonds Are Obscenely Expensive, And No Longer Able To Hedge Equities

- Equities Are Obscenely Expensive, And Likely To Exhibit Large Drawdowns

- False Diversification Leads To Profound Portfolio Fragility

- What Can Be Done To Pursue Financial Resiliency In 2021

Digital Future

- Digital Lending:

- Platformification Of Credit & Banking

- FinTech Evolution Opening Up New Capital Markets For The Real Economy

- Embedded Finance & FinTech Ecosystems

- Digital Assets:

- The New Currencies, Private & Public

- Bankless DeFi Ecosystems

- Trading-wise, Volatility And Inefficiency Are Monetizable To Generate Uncorrelated Returns

The 60/40 Portfolio Steady State System Is Broken

After a long run spanning over several decades, the 60/40 default state has reached its terminus. It was followed by most participants of the institutionalised asset management world. It is now unsustainable. Empirical evidence for it is overwhelming.

The first forensic evidence for this is the sheer magnitude of money printing the system got addicted to, and the inability for it to perpetuate endlessly into the future. MMT theories think differently but, crucially, the marginal effectiveness of new units of credit is already at or below zero across major economies. Money multipliers and velocity of money have collapsed over time. No wonder many market participants – and people in general – have lost trust in the system, and seek supply-constrained, ownerless, open-source alternatives (no shortage of arguments and data points for this narrative).

Since the beginning of the COVID crisis alone, the G10 major econ0mies have injected a whopping $15 trillion overall in monetary and fiscal stimulus measures. This includes an increase in central bank balance sheets since the crisis erupted, new government cash injections and spending pledges, as well as about $7 trillion worth of quasi-fiscal loan and credit guarantees.

But the largesse predates 2020. Really it can be traced back to the Global Financial Crisis. In the US alone, the mothership of global financial markets, increases in the Fed’s balance sheet added to the US Government’s budget outlays, deficits, and US total debt. All increased in unison over the period to then blow up in 2020.

To those arguing that the equity rally is sustainable on strong economic fundamentals to materialise in the years ahead (as the vaccines take hold), the following overarching questions remain: what about the 20+ trillion that got us here? What about yields at zero, mechanically forcing investors into nearby asset classes? Is that real demand and real price discovery / fair value? How much of today’s prices of bonds and equities is attributable to that? How much of the 20+ trillion is replicable in the future? At what marginal effectiveness? If so, what breakeven escape velocity and inflation is needed to get us out of the deep hole?

Further excruciating dilemmas include: how do we know how much printing is enough? How much divergence between the real economy and financial markets is sustainable? And, what happens if we are near a tipping point in both?

The second piece of evidence is pure mathematics for the largest asset class on the planet: Bonds. The price of a bond is inversely correlated to its yield. The yield is (was) floored at zero. When the yield is zero, duration equals maturity, and is the longest possible. When the yield is below zero, the bond still pulls to par - inevitably - at maturity, meaning that the negative yield is nothing more than a tax – it did nothing to change the mathematics of the instrument. This means that bond prices cannot rally further when yields hit the zero bound of interest rates. They can have moments of glory and momentarily positive mark-to-markets; but those are fleeting gains, paper gains, to vanish as the bond approaches its legal maturity. Except if Central Banks buy those bonds at negative yields, before the pull-to-par. However, this is just a subsidy (and a needless paradox). In other words, a tax first, a subsidy later, the illusion of a profit, the mirage of an asset class, the wishful thinking of an entire investor base. All in all, a giant paradox. To heavily regulated investors, still a good return of capital (ROC); however, from a risk management perspective, the greatest failure of the theory, a catastrophe of a position with the largest negative convexity. An oxymoron to a rational investment decision.

None of this is new - we have drawn in zero and negative rates since 2016 - but it is always worth reminding ourselves of its lunacy and futility. None of this is to say that zero-ish rates will disappear tomorrow. In fact, they will likely last for years to come. The point is to stress the inadequacy of 60/40 balanced portfolios, unfit for today’s markets, reminding us how they have moved from being safe harbours of capital to time bombs. Akin to the anachronism of swords in modern warfare.

Source: IMF-Fiscal Monitor Oct 2020 (Data as of 11-Sep-20); World Economic Outlook Database - Oct 2020; World Economic Outlook Database - Oct 2020

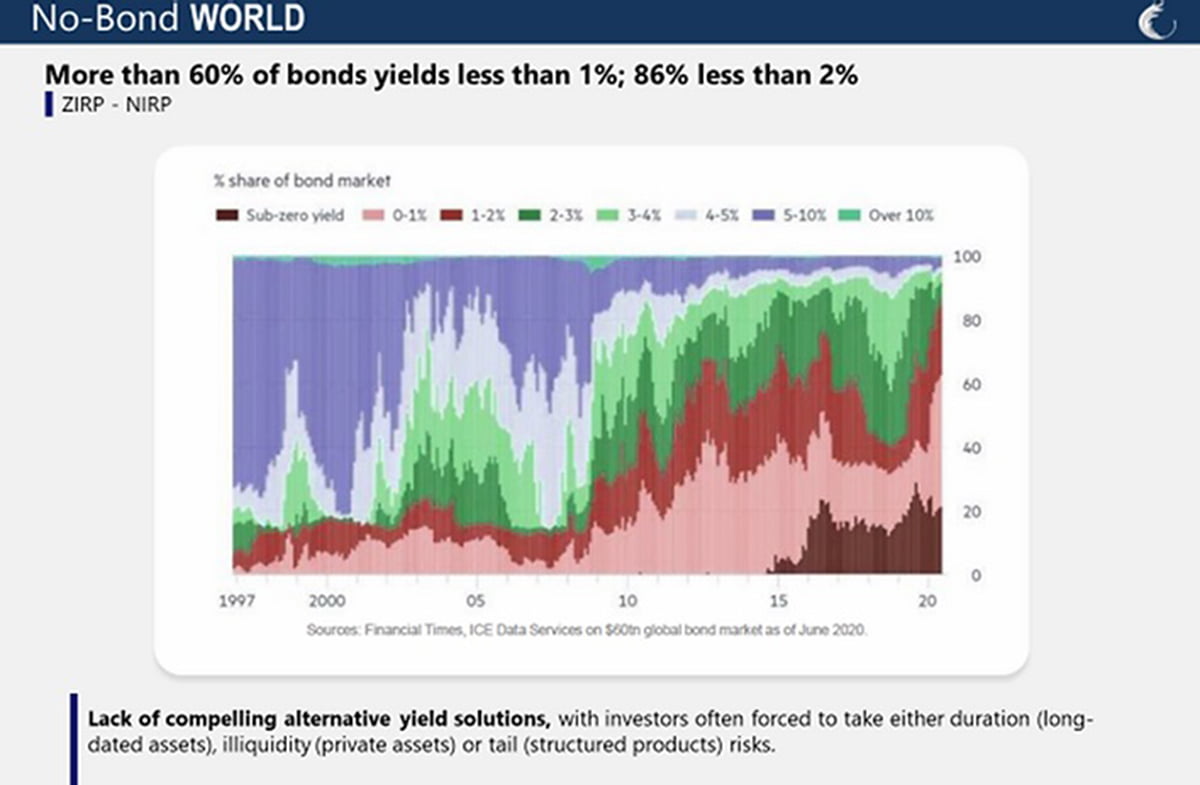

Globally, 90% of the bond universe yields less than 2%, 70% less than 1%. To a sober mind, these are dramatic figures.

If you are holding a long-dated Nestle bond as a safe haven asset, in the hope that it will help ameliorate portfolio performance during an equity drawdown, you are setting yourself up for a rude awakening. A simple 1% move up in interest rates will wipe out almost 20% of its value.

Possibly more than you lost on the equity part of the portfolio during that specific drawdown. Did you hold the bond for the income it generates then? Not really, the yield is zero-ish.

On equities, there is no shortage of evidence that current equity valuations are merely driven by Central Bank liquidity injections and government fiscal stimulus, both reaching biblical proportions in 2020. Valuations are merely ornamental, episodic: nobody cares, since long. Unsurprisingly, economic narratives at the margin are handy as always: (i) the technology revolution can justify 9x price performance in just a few months in a world ravaged by a pandemic (imagination factor / it is different this time), (ii) unlimited supply of money printing/MMT holds the promise of eternal bonanza (dream factor / sky is the limit axiom), (iii) hubris has no downside as Central Banks have your back (greed factor), (iv) don’t fight the FED (fear factor / FOMO / TINA).

We argue that the current state is not only fragile (built on the thin ice of liquidity momentum), but also unsustainable, as it gives rise to levels of income inequality which are incompatible with the status quo. Nowhere was it more visible than in 2020, where the divarication between stellar financial markets performance (concentrated at the top and with only a handful of players) and dismal real economy performance (affecting the bottom 60%) was in full display. A tipping point may be nearing, when a steep reset in prices and a realignment in societal cohorts becomes inevitable in an effort to stem off political revolution. As we get closer to reaching this redistribution, hefty volatility for markets should be a sober investor’s baseline scenario, with no line of defence in bonds to resort to. This is especially painful for institutional investors who must rely on regular income distributions and profit realisations over the lifecycle of the investment: the first are nil at zero rates, the second are uncertain if they are needed during drawdowns. False diversification across balanced portfolios has disseminated across, making overcompensation to the downside during downturns ever more likely ipso facto exacerbating the magnitude of those expected drawdowns. No wonder the size of drawdowns has been steadily increasing over recent years, while their tempo also fastened, e.g. August 2015, January/February 2016, Feb 2018, Q4 2018, March 2020.

One could say that both bonds and equities are in ‘Fugazi territory’. The market system has been degrading for years now, over-extending into a far-from-equilibrium state, where the dynamics of criticality apply. We have long argued that we are going through a critical transition, at the edge of chaos, and that during ‘phase transition zone’ chaotic conditions apply: markets move little and slowly at first, and then fast and big suddenly, the very definition of chaotic behaviour. Furious eruptions after intermittent periods of illusory peace, within a context of radical uncertainty. The magnitude of variations kept on increasing in recent years, like the patterns of seismic waves preceding an earthquake.

These outbursts of volatility are more structural than episodic. The next crisis is wrongly assumed to resemble the past ones: 1929’s Great Depression, 1987’s Black Monday, 2000’s Dot-Com Bubble Burst, 2008’s Global Financial Crisis. We believe it could be more of a transformational event, more comparable to a 1971’s End of Bretton Woods -type scenario: a deep break from the status quo, a transition into a new paradigm altogether. At present, the transformation is taking place in an evolutionary manner: some aspects of the financial system are being gradually tweaked, while other parts are changing exponentially. A point of fracture and non-linear discontinuity is easily imaginable.

In our recent piece The Market Economy In 2025: A Visualization Exercise | Emergence of New Capital Markets, we envisioned the novel capital markets (FinTech Ecosystems, Platformification) of the not so distant future as a radically different operating environment from the one we are accustomed to with a different reserve currency system from the US Dollar: a multiverse of fiat currencies (USD, CNH, XDR), and/or a different setting altogether with digital currencies at the helm, either non-government sponsored (Libra et al, Bitcoin et al, Altcoins) or government-sponsored (Central Bank Digital Currencies), or a combination of all of the above. Chaos will play a role in determining the end destination, the random walk of markets and economies past the tipping point / critical threshold of a system long gone into degradation, spinning through the loops of runaway effects.

Digital Future

As we travel towards market catharsis, what can institutional investors do to protect themselves against portfolio volatility in the next decade?

One antidote against transformative markets in disruption is to embrace the novelty itself, embrace the future now. Balanced portfolios can morph into future-proof, tech-enabled portfolios, using technology and innovation to seek resiliency, anti-bubble formation. The digital portfolios of the future are already implementable today and at scale.

We can think of two additions to a classic balanced portfolio that would make it fit for time travel:

- Digital Lending: Platform-ification of Credit & Banking / the New Capital Markets for the Real Economy / Embedded Finance / FinTech Infrastructure / FinTech Ecosystems; and

- Digital Assets: Now Institutional, No Longer a Fluke / Legitimate Scepticism Missed Two Key Points: (i) the Unmet Need / Lack of Alternatives in the Real Economy and (ii) the Availability of Sources of Alpha in Trading.

Digital Lending, FinTech Platformification

In the face of chaos and radical uncertainty, policymakers have resorted to throwing the kitchen sink at it, using monetary and fiscal singularity under the clout of COVID. This is unlikely to change any time soon, preventing normal market operations from resuming.

As money flows concentrate further into the largest stocks / asset managers, the by-product is that capital allocation into smaller worthy projects outside of market hype will have to happen outside public markets and the traditional institutionalised asset management industry, through alternative specialist funding channels (i.e. non-bank lenders and often non-asset managers as well). Novel and parallel capital markets will keep emerging, as a way for the system to rebalance itself, away from elitist market bubbles, plugged straight into the real economy.

We are on the cusp of the deepest, fastest, most consequential disruption to the financial system infrastructure in modern history. The emergence of new capital markets is upon us.

As outlined in our latest scenario report ‘The Market Economy In 2025: Emergence of New Capital Markets’, we foresee the emergence of a radically different financial system.

While in a not-too-distant future banks will likely be profoundly transformed, banking activity will remain at the centre of economic activity and value creation. A wave of non-bank lenders have already started to fill the funding gap left by traditional lenders exiting less profitable activities to retrench into mainstream markets, and will continue to do so to an ever-increasing extent once the value proposition becomes ever more apparent in the next few years. We are close to reaching a critical threshold in this process, leading to mass adoption of alternative lending solutions.

In this future environment, institutional investors should look beyond traditional, highly overvalued equity and fixed income markets to generate stable, sustainable returns. Everything is tradable and investable around us, in this new paradigm and Digital Lending will be the cornerstone of this structural shift.

With traditional capital markets failing to allocate capital efficiently, alternative sources of funding are being sought after by the real economy. This demand has already started to attract supply in the form of data-driven open ecosystems and marketplaces. These solutions substitute rigid, centralized top-down structures (such as banks) for meritocratic, bottom-up markets. New capital markets offer sustainable and especially resilient funding to the real economy. This is in stark contrast to the traditional focus on efficiency, ultimately leading to fragility, as seen during the COVID-19 outbreak. The new ecosystem will be accompanied by widespread adoption of the latest technologies and services such as Embedded Finance, FinTech Marketplaces, Tokenization, Cryptography, Decentralized Finance (De-Fi), and Blockchain.

These new capital markets, characterised by advanced technologies, new asset classes, and completely new investment opportunities make us excited for the future to arrive soon. In 2025!

Digital Assets

What a year it has been. More than a decade after birth, Digital Assets - the new currencies and their decentralised ecosystems - had a year for the books in 2020.

On the one hand, adoption and market penetration grew significantly, thanks to the vote of confidence from Big Techs and FinTechs. One watershed moment was in October, when PayPal embraced cryptocurrency by becoming a marketplace for Bitcoin transactions. The Bitcoin community, which had steadily grown to several millions over its 12 previous years, was suddenly increased by 350 million users, virtually overnight. PayPal also enabled 20 million active merchants in the US to accept Bitcoin. Square, a sizeable FinTech digital bank, saw an inflection point in 2020 on Bitcoin revenues, having started trading it in 2018. According to market sources, PayPal and Square clients have been buying most of the new Bitcoin supply entering the market each day: within three weeks of its launch, PayPal clients had bought approximately 70% of Bitcoin’s new supply, driving a sizeable surge in prices.

In the institutional asset management world, a few known names embraced the trend, with the notable entries of Ruffer and One River, on the grounds of seeking hedges against inflation and monetary disorder. Earlier on in the year, Insurance giant Massachusetts Mutual also ventured into the new asset class. MassMutual said that the investment gives it a "measured yet meaningful exposure to a growing economic aspect of our increasingly digital world." In our view, cryptocurrencies are not necessarily an alternative to gold, nor are they necessarily a harbour against monetary madness. It is our sense that their price likely benefited from the tsunami of Central Banks/Governments’ liquidity inundating financial markets indirectly on account of the laws of communicating vessels, in more ways than one. By the same token, not necessarily the price of cryptocurrencies must increase to celestial levels to prove adoption and success - it is likely but not a necessity. Interestingly though, at times where alpha is hard to extract, the new asset class exhibits traits which are uncommon in today’s traditional markets: inefficiency and volatility. More volatile than the EURUSD, more inefficient than US treasuries. Both monetizable to produce uncorrelated returns/income in liquid formats. A most scarce resource nowadays.

On the other side of the spectrum, regulation poses the toughest event risk ahead for the nascent asset class. 2020 saw regulators tackle Ripple (XRP) and BitMEX, after meddling with Facebook’s Libra in 2019 and it will likely affect other cryptocurrencies, especially the stablecoin ecosystem, in addition to exchanges and altcoins in the months ahead, and it is definitively a trend to watch most closely for operators in the sector. In parallel, Central Banks are looking to launch their own versions of digital currencies, the CBDCs (Central Bank Digital Currencies): Live tested by China on a large scale experiments, theorized and tested by the European Central Bank, the Fed, the Swiss National Bank and the Riksbank, to name a few examples.

Year 2021 will give a clear sense of direction in the race between adoption rates and proposed regulation.

As we argued in a previous piece, Digital Currencies are not removed from the context of an over-arching global trend of De-Dollarization that will likely gather momentum in the years ahead thanks to the double hit of China’s conflicting interests and the advent of digital technologies. Soon enough, the US Dollar will be dethroned as the sole global reserve currency, making room for other currencies, either fiat national (CNH, XRD), digital national (CBDCs), digital non-national (Bitcoin et al, Libra et al), or a blend.

Furthermore, a major shift is taking place from centralized finance (Ce-Fi) to decentralized finance (De-Fi). Ce-Fi is traditional, middle-man orchestrated, finance. De-Fi is the new world of decentralised finance a new digital operating system offering an alternative to the traditional banking infrastructure. Here, financial actors interact directly under the overarching rules of cryptographically enforced computer software. Last summer, we saw a first display of what this ecosystem can offer. In the short span of 3 months, the industry drowned market participants in new lending protocols, derivatives trading, insurance, mom-and-pop market-making liquidity pools and asset management solutions (actively managed by a community voting on investment strategies). This market is currently trading a billion dollars per day, generating millions in fees daily .

Alessandro and Nikita, from Fasanara’s Digital Assets team, wrote a review of the crypto market in 2020, available on our portal at this link: READ HERE.

All in all, as FinTech platforms, Embedded Finance, Digital Currencies, Blockchain/De-Fi arise and evolve, the liquidity gap between public and New Age private markets will keep on shrinking, grabbing the full attention of institutional investors in the process.

Digital Speed, Digital Access

Data, storage, algorithms, cloud computing, open-source software are now accessible at scale and at low cost. The era of Artificial Intelligence has begun. If the asset management industry join in, adopting new technologies to remain relevant, they stand to achieve big gains in quality, speed, autonomy, cost efficiency, transparency and inclusion.

The rapid migration to digital technologies driven by COVID will continue well into the recovery period. But are the portfolios of institutional investors able to keep pace?

The combination of exponential technologies - AI/Machine Learning, FinTech ecosystems, Blockchain/DeFi, computational processing power, sensors, Internet of Things, Robotics, AR/Virtual Reality, 3D printing, Web 3.0 - is what enables small teams to experiment and aim at moonshots, democratising access to building the foundations of the market systems of the future. The landscape is changing exponentially and wholeheartedly, and these inventive tools are now available to teams with evolutionary ideas to help shape the Digital Future. Financial markets are at the epicentre of the earthquake.

60/40 Digital-Enhanced

Traditionally, alternative strategies are added to classic 60/40 portfolios to improve risk-adjusted performance. Ideally, a true diversifier is a fixed-income type addition, providing income while minimising volatility, in reasonably liquid formats. At Fasanara, we try to do exactly that. Future-proofing institutional portfolios for the next decade, helping to surrogate today’s largest deficiency: fixed income.

Before we leave, a cheeky model of a 60/40 portfolio after the inclusion of Digital; Fasanara's special recipe of Digital, of course. The slide shows the improvement in performance per units of risk over the past 6 years. Admittedly, the period covers one big crisis moment only: February/March 2020. We have yet to see how it will navigate the next few, lying in wait.

Thank you for all your support last year.

Wishing you and your loved ones a happy and healthy New Year.

Here’s to a promising 2021.

Fasanara Capital