David Einhorn’s 2022 letter to investors.

The full PDF can be viewed here and at the bottom.

Dear Partner:

The Greenlight Capital funds (the “Partnerships”) returned 36.6% in 2022, net of fees and expenses, compared to an 18.1% loss for the S&P 500 index. Since the inception of Greenlight Capital in May 1996, our Partnerships have returned 2,358.3% cumulatively or 12.8% annualized, both net of fees and expenses.1 Over the same period, the S&P 500 index has returned 864.0% or 8.9% annualized. Greenlight’s investors have earned $5.2 billion, net of fees and expenses, since inception.

Q4 2022 hedge fund letters, conferences and more

Our successful performance on the short side was extremely diversified and broad based. There were two individual single-name shorts that had caused losses in earlier periods that were material winners in 2022. We also had gains in a sector ETF, equity index shorts and several different baskets of bubble and “innovation” stocks that we implemented in 2021 and 2022. We had no material losers in the short portfolio.

While we will continue our current policy of not discussing individual shorts, we will review the performance of our long-standing bubble basket short strategy. Historically, we have avoided so-called valuation shorts, because valuation by itself is rarely a catalyst. After all, twice a silly price isn’t twice as silly.

However, during the 1998-2000 bubble, we recognized that shorting bubbles can be quite profitable when they burst. Though we didn’t expect to ever see another bubble like that one again, we were wrong. When we saw a second mega-bubble forming, we wanted to participate in the subsequent decline.

Q4 2022 hedge fund letters, conferences and more

We define a bubble stock as one that if we look at the company’s current and projected financials – counting stock compensation as an actual expense – and perform a traditional valuation analysis, it could fall at least 80% and still not appear cheap to us. The goal is to short when the bubble appears to have popped.

2013 was a year of enormous gains for a number of speculative stocks. In early 2014, the bubble appeared to be breaking and we created our first bubble basket. This proved to be very premature.

In our bubble baskets, individual positions are small and names come and go. There were sixtyeight stocks in the original 2014 bubble basket, which we built up to 13.8% of capital at cost.

During our holding period, forty-two were profitable shorts while twenty-six were unprofitable. Though eleven of the stocks fell more than 50%, thirteen rose more than 50% and eight of them doubled or more. To our surprise, several of these names did in fact grow eventually into their 2014 valuations.

Through the end of 2016, the basket was profitable. But 2017-2019 was a different story. We had covered a number of the winning bubble stocks and concentrated our risk on the names that had not yet worked. This was a mistake.

Ultimately, we covered the remaining stocks from this basket during the COVID crash in March 2020. This basket lost money, with cumulative negative impact to our returns of 11.3% of capital spread over several years.

We believed that during COVID the re-inflated bubble began to pop in September 2020. We instituted a second bubble basket with fifty-eight names totaling 20.7% of capital.

Unfortunately, the bubble had one more leg up. Convinced that we were again early, we covered our 2020 bubble basket in early January 2021. The losses on this basket were 2.1% of capital.

Looking back on these names, six were subsequently acquired at an average price that was 45% over our entry. However, of the other fifty-two names, the average stock at the end of 2022 was down 42% from our entry price, with only nine up from our entry price, while nine fell more than 80%.

We are nothing if not persistent. In March of 2021, we again believed that the bubble had popped… this time correctly. We created our third bubble basket with thirty-one names totaling 6.5% of capital. This bubble basket remains in the portfolio, though we have covered some names.

All but one of these stocks are down through year-end from our entry, with an astounding twenty-four of them down more than 70%. The cumulative positive impact on our returns has been 3.0% of capital.

In early 2021, we also identified an actively-managed ETF of so called “innovation” stocks that appeared to us to have significantly similar characteristics to our bubble names. We shorted a basket comprised of the components of that ETF in February 2021 that we ramped up to 9.0% of capital. It has declined by 76% from our first entry. The cumulative positive impact on our returns has been 6.4% of capital.

Finally, in January 2022, we turned from cautious to bearish. We identified our fifth bubble basket of thirty-one names, and instituted a 6.0% combined short position. This basket also remains in place. As of year-end, twelve of the stocks have fallen at least 50% and only one stock is positive with a 23% gain. The cumulative positive impact on our returns from our 2022 bubble basket has been 2.4% of capital.

Q4 2022 hedge fund letters, conferences and more

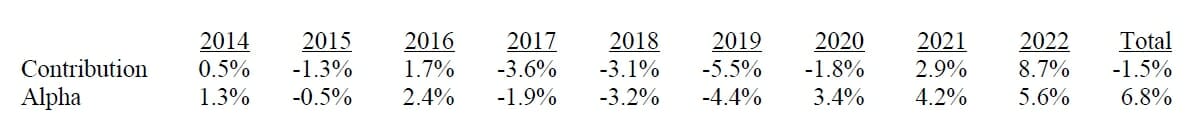

To bring it together this is the contribution of the bubble basket strategy to date:

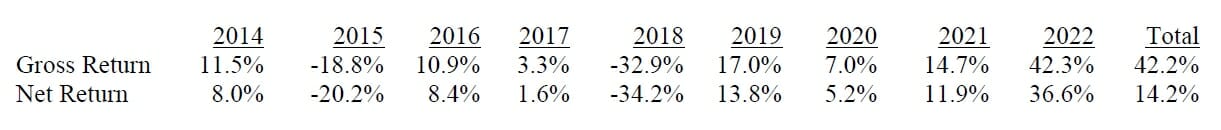

The SEC’s new marketing rule has prescribed disclosure requirements. So, we are forced to interrupt our narrative to show you this additional data of the Partnerships’ gross and net returns for the same time periods even though we think it is superfluous to the discussion:

We now return to what we were trying to say.

All told, while this isn’t the exciting result that we expected at the time of each basket’s creation, the bubble basket strategy hasn’t been as bad as it seemed a couple of years ago. It’s hard to know when a bubble is actually popping. This one went on for much longer than we expected. Considering that we were early by a ridiculous seven years, this feels like a good outcome.

If we ever think we see a bubble again, we expect to be right sooner. From 2014-2022, the NASDAQ index is up 12% per year (176% compounded). It’s clear that our bubble basket short strategy has outperformed an index short. We estimate that the cumulative alpha against the NASDAQ to be 6.8%.

We also had our best year in our Macro portfolio. The two substantial winners were interest rates, where we wagered the U.S. Federal Reserve would tighten more than the market expected, and inflation swaps, where we speculated that a combination of reported inflation and inflation expectations would increase more than anticipated.

Though we believe we are in the middle stages of a bear market, we did establish a new medium-sized long position in Tenet Healthcare Corp (NYSE:THC) during the fourth quarter.

THC is an operator of hospitals and ambulatory surgery centers (ASC). In recent years, the company has grown and transitioned its business mix towards its higher-margin ASCs. This shift has enabled the company to generate significant, and what we believe to be sustainable, cash flows.

During 2022, the company lowered its guidance due to COVID and inflationary headwinds, resulting in its shares declining by more than 50% year-to-date through late October. We believe this pullback offered an attractive opportunity to participate in the company’s transformation, as we expect its ASC growth to remain strong and its now smaller hospital portfolio to improve from both a cost and volume perspective.

Q4 2022 hedge fund letters, conferences and more

We acquired our shares from late December through the beginning of January for an average price of $48.61, or 8.7x 2023 consensus earnings. THC recently announced and began its plan to repurchase about 20% of the outstanding shares by the end of 2024.

Best Regards,

Greenlight Capital, Inc.

Read the full letter here.