Covid causes property values to drop in these areas, despite the boost of a SDLT holiday

Q1 2021 hedge fund letters, conferences and more

Drop In UK's Property Values Due To COVID

The latest research from Warwick Estates has revealed where Covid is continuing to cripple the property market, despite the positive impact the current stamp duty holiday has had.

The latest Rightmove House Price Index revealed this week that UK house prices have hit a record high, as buyers scramble to secure a stamp duty saving before the extended deadline expires. However, an analysis of house price data from the Land Registry, conducted by Warwick Estates, shows that not all homeowners are benefitting from the current market heat.

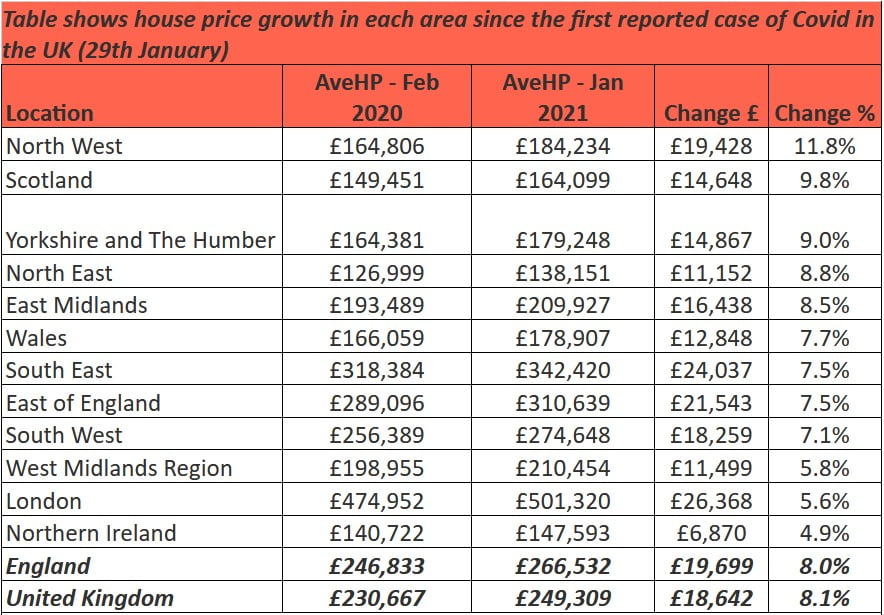

Warwick Estates looked at how the average house price in each local authority of the UK has changed since the first reported case of Covid in January 2020. Across the UK as a whole, the average house price has climbed by 8.1% with every region of the UK enjoying positive movement.

The North East has seen the largest increase during this time, up 11.8%, followed by Scotland (9.8%) and Yorkshire and the Humber (9%). With the exception of Northern Ireland, London has seen the lowest level of house price growth since January of last year, although property values are still up 5.6% in that time.

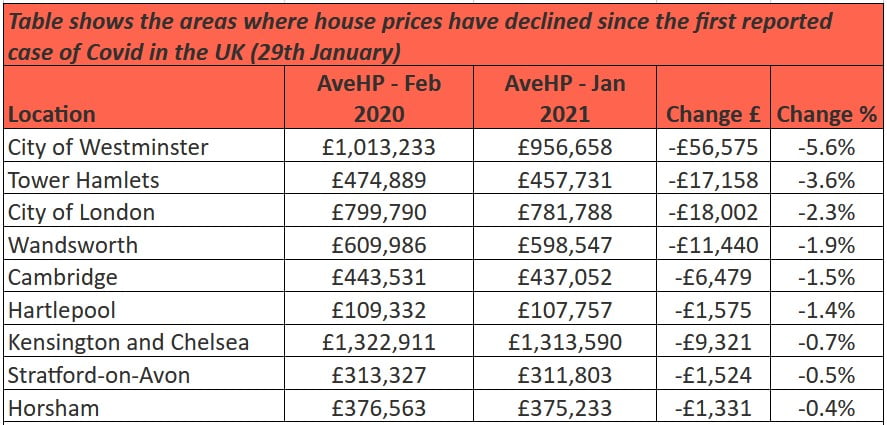

Not every area of the capital has fared so well though and Westminster is home to the biggest price decline since Covid reached the UK, with the average house price down -5.6%; a drop of £56,575.

Tower Hamlets has also seen one of the biggest reductions in property values, falling by -3.6% (-£17,158), as has the City of London (-2.3%) and Wandsworth (-1.9%).

Kensington and Chelsea also makes the list with a drop of -0.7%, while outside of London, Cambridge (-1.5%), Hartlepool (-1.4%), Stratford-on-Avon (-0.5%) and Horsham (-0.4%) have also seen a drop.

Introduction Of The Stamp Duty Holiday

COO of Warwick Estates, Emma Power, commented:

“The UK property market has been running red hot since it reopened last year, with the introduction of the stamp duty holiday boosting buyer demand and helping to bypass any major pandemic-induced decline in values.

As a result, we’ve seen some notable jumps in property prices pretty much across the board as buyers continue to enter the market at mass.

Unfortunately, the diverse nature of the UK property market means that not everyone is likely to benefit to the same extent, and in some cases, there’s actually been a decline in values.

However, given the prolonged uncertainty that has hung over us for over a year now, it’s quite remarkable that these declines in house prices are restricted to just a handful of locations.”

Data sourced from the Land Registry House Price Index (Feb 2020 to Jan 2020 - latest data available)

Data sourced from the Land Registry House Price Index (Feb 2020 to Jan 2020 - latest data available)

- Warwick Estates was founded in 2007, and acquired by Aldridge in 2017 with the ambition to grow and strengthen the business.

- The goal of growth is one that unites the Aldridge family today across the diverse range of commercial and philanthropic activities in which it operates.

- Over 40,000 properties are managed for freeholders, asset funds, housebuilders and housing associations - a combined value of over £9bn.

- Annual revenues exceed £10million

- Warwick Estates is run by a newly strengthened management team of industry heavy-weights with decades of combined industry experience - chaired by Adrian Ringrose, former CEO of Interserve

- Current head-count is 186 staff at seven office locations throughout England