The coronavirus is just not stopping, with the number of cases rising throughout the world. Economists and financial experts continue to slash their growth estimates, and the latest to do is Nomura. Analysts have again reduced their global GDP growth estimates, and it now stands at -4% from 2.3% about two weeks back. This negative growth rate is very concerning, but what is even more concerning is Nomura’s “bad” scenario where the coronavirus “beats us.”

Q4 2019 hedge fund letters, conferences and more

Global GDP growth forecast revised again

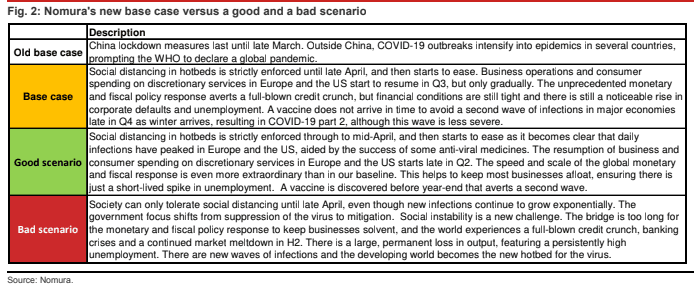

Nomura in a report dated March 27 and titled COVID-19’s impact on the world economy: Update 2 has discussed three scenarios regarding the impact of COVID-19 on the financial world. Of the three scenarios – base, good and bad – it is the last one that one needs to pay attention to. Since it is the worst case scenario, it is bound to be the most negative, but given the uncertainty regarding the outbreak, such a scenario is not completely out of the question.

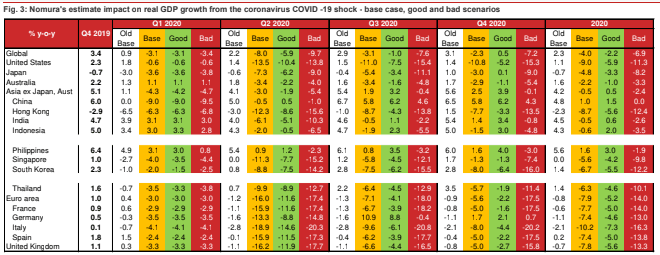

Before we detail the bad scenario, let’s take a look of Nomura’s global GDP growth estimates and the other two scenarios. On February 17, Nomura slashed its global GDP growth forecast for 2020 from 3.3% to 3.1%, and then on March 5, they lowered the estimate further to 2.7%. Then on March 13, the analysts dropped the estimate to 2.3%, and now their GDP growth forecast is -4.0%.

Explaining the reason for the steep drop in the estimate, the analysts say that earlier they only considered “one-sided risk to our base case (i.e., to the downside), but we have reached the point where we now see two-sided risk.”

Talking of the scenarios, their new base case assumes that “social distancing eases gradually after April” and that the fiscal and monetary measures are successful in “keeping companies afloat.”

In the good scenario, the analysts assume that the “virus is quickly beaten through strict compliance with social distancing, technological innovations and medical breakthroughs.” Even in this scenario, analysts expect a “short, deep recession” but “followed by a sustained recovery.”

In the bad scenario, where the coronavirus “beats us,” the analyst assumes that the cash flow support policies are unable to save companies and jobs, resulting in “high unemployment, company liquidations and financial crises.”

Talking of the oil prices, the analysts expect the price to drop further considering the large oil inventory buildup. In their base and good scenarios, the analysts expect the oil price to remain at around the current levels for the rest of the year.

Detailing the bad case scenario, the analysts say that the focus of the government would shift from virus suppression to mitigation. The number of new infections would continue to grow exponentially and social instability would emerge as a new challenge. Also, the analysts expect the developing world to become the “new hotbed for the virus.”

In terms of financial loss, the analysts say that the “world experiences a full-blown credit crunch, banking crises and a continued market meltdown in H2.”

Talking of the worst case scenario for individual countries, for the U.S., the analysts expect the recovery in the second half of the year to be “more lackluster and the recession to last longer.” In this scenario, Nomura analysts expect a year-on-year growth of -11.3% in 2020.

Bad case scenarios for countries

In the worst case scenario for Europe, the analysts expect a collapse of GDP in the second quarter. Though this is similar to their base case, but in the worst case, the GDP fails to recover in the second half of the year due to the failure of fiscal and monetary policies. Further, the analysts say that controlling the yield curve may get difficult in Europe, but for the UK it might be possible as the Bank of England may announce unlimited purchases, something that the Fed has done.

“We do not believe that either the BoE or especially the ECB will go down the route of helicopter money – even in the worst case scenario” the analysts say.

In the worst case scenario for China, the analysts expect the first quarter growth to dive further to -9.5% y-o-y. For the second quarter, the analysts estimate a growth of -1.0% “as the second wave of infections proves much more damaging and the slump in external demand has a more significant impact.” For the third and fourth quarter, the analysts expect the growth to rise to 4.6% and 4.3%, respectively on the back of “pent-up demand” and an even “larger stimulus package.”

Talking of Japan’s bad scenario, the analysts expect Japan's exports would continue to drop toward the second half of 2020. Further, the labor market conditions would deteriorate and stagnation of household consumption would continue into the second half of the year as well. Overall, the analysts expect Japan’s real GDP to drop for four consecutive quarters through the third quarter 2020. For 2020, the analysts expect a growth rate of -8.2%, almost twice the contraction of their base case.