STARTING TO MOVE: Net zero commitments double, and one in five big emitters are now on track for Paris Agreement

Q1 2021 hedge fund letters, conferences and more

- State of Transition 2021, flagship report from the $25 trillion-backed Transition Pathway Initiative (TPI), reveals that 17% of high-emitting companies are now aligned with a pathway to keep temperature rises to 2°C or below by 2050.

- The number of companies with high quality, credible net zero targets, has more than doubled this year to 35.

- Among companies where multi-year data is available, there has been a 3 percentage points rise in companies aligned with the most ambitious ‘Below 2°C by 2030’ pathway.

- “The decade of transition has started, and equity and debt investors can now clearly identify those companies who are serious about taking action on climate change and those that are not. Although a significant development it still represents only a limited leadership group that needs to expand rapidly.”, Adam Matthews, Chair, TPI

Net Zero Targets Gaining Momentum

(13 April 2021, London). The $25 trillion-backed Transition Pathway Initiative (TPI) today publishes its annual flagship report: The State of Transition 2021: The investment community’s most prominent gauge on whether high-emitting sectors are on track to fulfil the goals of the Paris Agreement. From BP to BMW, Pepsico to Panasonic, it assesses 401 of the world’s biggest companies from the highest-emitting sectors on Management Quality (climate governance and management) and 292 companies on ‘Carbon Performance’ (analysis of actual and projected emissions intensity[1]).

The report is the first measure of progress in what has been called the ‘Decade of Transition’. It shows that 17% (50/292) of companies assessed on Carbon Performance are aligned with a pathway to keep temperature rises to 2°C or below by 2050.

The data also show growing momentum behind net zero targets, with the number of companies committing to credible net zero targets more than doubling in one year (from 14 to 35). These are companies whose targets include the most material emissions of their company (e.g. pledges from oil and gas would include emissions from the use of companies’ products and auto firms would include emissions from petrol used in cars), and many of which have intermediate targets for significant decarbonisation before 2050.

Adam Matthews, Chair of TPI and Chief Responsible Investment Officer, Churchof England Pensions Board said,

“The decade of transition has started, and equity and debt investors can now clearly identify those companies who are serious about taking action on climate change and those that are not. These are companies with long-term climate commitments accompanied by clear milestones that don’t kick tough decisions into the long grass, and a comprehensive scope that covers all material emissions in a firm’s supply chain.

“Although a significant development it still represents only a limited leadership group that needs to expand rapidly. As we enter the ‘decade of transition’ having only 17% of companies with credible net zero commitments is not enough. As investors we need to work with companies to ensure that they are aligned with a pathway to keep global warming at 1.5C.

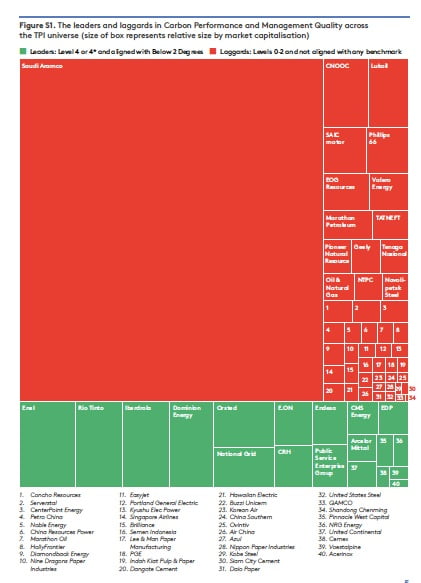

Figure S1 in Notes to Editor captures some of the leaders and laggards on both Management Quality and Carbon Performance across the TPI universe of over 400 companies.

Other key findings in the report include:

Management Quality

- Levels of climate governance stagnate: The average ‘Management Quality’ score remains largely similar to last year at 2.6 (compared to 2.7 last year)[2], indicating that on average companies have established climate policies but have yet to adopt strategic carbon governance and management practices.

- More than three in five companies have advanced governance: 62% of companies are on the top two levels of the staircase: 36% are on Level 3 and 26% of companies are on Level 4. By contrast 38% of companies record the lowest levels of Management Quality (levels 0-2) meaning they have not yet undertaken four basic climate management practices such as setting an emissions target

- 4* ratings: 14 firms achieved the top 4* level by meeting every Management Quality indicator, a rise of 6 companies on last year. However none of the 4* companies are aligned with a pathway of 2°C or below.

- Little progress: While 17% of companies assessed last year have moved up at least one level, 14% have moved down at least one level. It indicates that companies are as likely to move up as move down.

Carbon Performance:

- Only 1 in 6 on track: Only 15% of companies (44/292) align with a pathway to below 2C by 2050, and 2% align with a 2C pathway. Nearly half of assessed companies is not aligned event with the least ambitious pathway, the Paris Pledges.

- Some progress: There is a 3 percentage point rise in companies aligned with a ‘Below 2°C by 2030’ pathway, among firms where multi-year data is available.

- Electric utilities companies have reduced their emissions the most compared to other sectors. They are on track to meet their 2030 targets, but their ambitious 2050 targets are still well out of reach at current rates.

- Performance gap: No sector has been decarbonising at the rate required to achieve the 2050 targets companies have set themselves (whether net zero targets or less ambitious ones). Diversified miners (who have set emissions reduction targets) and aluminium producers have actually increasedtheir carbon intensities.

- Saudi Aramco: The report assesses recently-listed Saudi Aramco for the first time and finds that it is not aligned with a pathway to achieving the Paris Agreement and a low level (Level 2) of climate governance.

- Company targets across sectors are becoming increasingly long-term: The average target year for all sectors is now 2039, a meaningful increase on the average target year of 2032 last year showing that companies are thinking more long-term.

Catherine Ogden, Manager, Sustainability & Responsible Investment, Legal & General Investment Management said:

“This latest report provides both comfort and concern. With a doubling of companies setting genuine net zero targets, the ranks of corporate climate leaders are swelling. But the majority of the world’s companies are not aligning themselves with the Paris Agreement. Leveraging TPI analysis, LGIM will continue to hold such companies accountable through voting and investment decisions for their climate progress”

Eva Cairns, Senior ESG Investment Analyst – Climate Change, Aberdeen Standard Investments said:

“Investing in credible, ambitious transition leaders is critical on the path to net zero. The 2021 TPI State of Transition report provides extremely valuable input to investors as it helps identify transition leaders and laggards in a robust manner. This informs ASI’s research and stewardship activities. It is excellent to see an expanded scope in this year’s report with over 400 of the largest emitting companies assessed and new sectors such as diversified mining added. “

Helena Vines-Fiestas, Global Head of Stewardship and Policy at BNP Paribas Asset Management said:

“The TPI State of Transition report shows us how much is being achieved. We are seeing companies strengthening their governance and management of climate change, and an increasing number are committing to align with the goals of a net zero economy. But there is a long way to go with particular effort needed in two areas. First, too many high emitting companies have yet to publish a formal climate change strategy or even provide basic disclosures on their greenhouse gas emissions. Second, far too few companies are anywhere near achieving alignment with a 2 degrees benchmark, let alone the 1.5 degrees needed if we are to achieve a net zero economy.”

Methodology:

- The research for this report was carried out for TPI by the Grantham Research Institute on Climate Change and the Environment and the London School of Economics. Carbon Performance data includes climate targets published by August 2020 in the case of the energy sector, October 2020 in the case of transport and December 2020 in industrials and materials. The data presented in this report was originally published on the TPI Tool. The next annual update of the entire TPI database will be carried out in stages over the remainder of 2021 and the beginning of 2022.

- Current emissions reduction rates are based on most recently available data related to emissions 2014-2019.

- Management Quality covers companies’ governance of greenhouse gas emissions and the risks and opportunities arising from the low-carbon transition, using 19 indicators to map companies onto five levels: from Level 0 – Level 4. The list of indicators is available in the report. MQ assessments are based on company disclosures analysed by FTSE Russell.

- Carbon Performance assessment involves quantitative benchmarking of companies’ emissions pathways against three benchmark scenarios related to the 2015 UN Paris Agreement. These are:

- Paris Pledges, consistent with emissions reductions pledged by countries as part of the Paris Agreement (i.e. NDCs).

- 2 Degrees, consistent with the overall aim of the Paris Agreement, albeit at the low end of the range of ambition

- Below 2 Degrees, consistent with a more ambitious interpretation of the Paris Agreement’s overall aim

About TPI:

The Transition Pathway Initiative (TPI) is a global initiative led by asset owners and supported by asset managers. Aimed at investors and free to use, it assesses companies’ preparedness for the transition to a low-carbon economy, supporting efforts to address climate change. It is backed by over 100 investors with over $25 trillion of combined assets under management or assets under advice. More information: www.transitionpathwayinitiative.org