This week, global management consulting firm A.T. Kearney released their 2018 Foreign Direct Investment (FDI) Confidence Index®, an annual survey of global business executives that ranks markets likely to attract the most corporate investment in the next three years. The FDI Confidence Index provides unique forward-looking analysis of the markets investors intend to target for FDI in the coming years.

Q1 hedge fund letters, conference, scoops etc, Also read Lear Capital:

The 2018 FDI Confidence Index® found significant shifts among the leading destinations for FDI. In fact, China fell to the fifth position, its lowest-ever ranking in the Index. While investors are the most bullish about the economic outlook for the Asia Pacific region, investor preference for the region appears to have declined slightly, with only seven Asian countries appearing on this year’s Index.

This year’s FDI Confidence Index® shows most investors are increasingly localizing their operations, in turn requiring greater levels of FDI and predicts that changes to NAFTA would create significant churn in FDI flows within North America. Overall, the climate seems to be looking up as investors signal greater confidence in the global economy, with 66 percent more optimistic about the global economic outlook than they were last year.

See the full study below:

In an environment marked by stronger economic growth and elevated political risks, investors’ pursuit of localization raises the importance of FDI for business strategies.

Executive Summary

Message from Paul Laudicina, Chairman, Global Business Policy Council

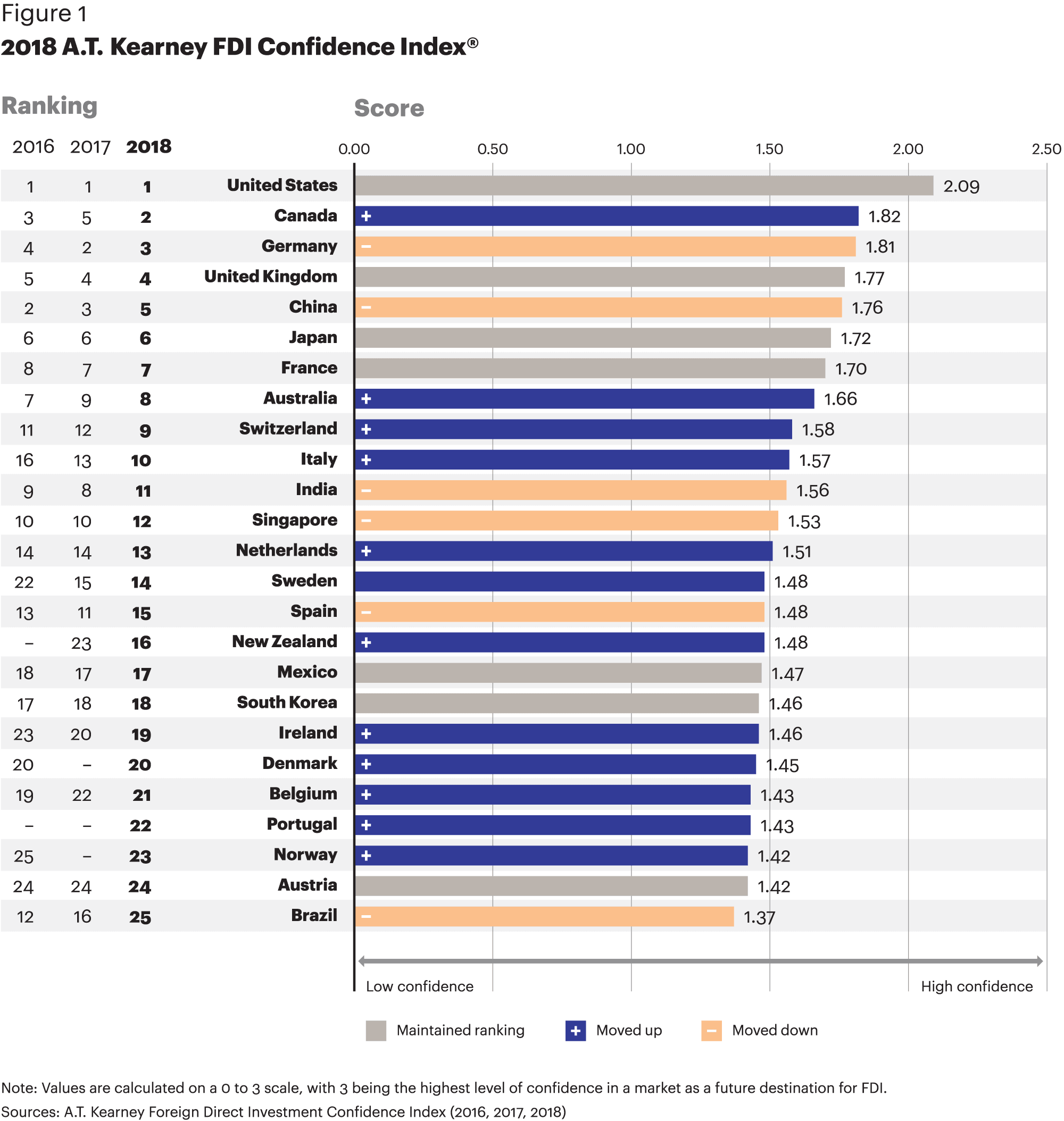

- The United States tops the Foreign Direct Investment (FDI) Confidence Index for the sixth year in a row. The continued attractiveness of the United States to foreign investors is likely a result of its large domestic market, improving economic performance, and new lower corporate tax rate. The government’s protectionist rhetoric and actions may also be motivating some companies to invest in the United States to maintain market access.

- There are significant shifts among the leading destinations for FDI. The top five countries on the Index have not changed in the past three years, but their relative positions have shifted. Most notably, Canada rises to second place this year, its highest-ever ranking in the Index, and China falls to the fifth position, its lowest-ever ranking in the Index. Germany also falls one spot to rank third, and the United Kingdom holds steady at fourth. While the top 10 likely destinations for FDI were the same in 2016 and 2017, there is a change in the composition of the list this year: Switzerland and Italy enter the top 10 for the first time in more than a decade, edging out India and Singapore.

- Investors are focused on opportunities in Europe. European markets have attracted significant investor attention on the Index in recent years, and this year is no exception. In fact, Europe stages a bit of a comeback in 2018 after its share of positions on the Index had declined in the two previous years. All in all, European markets account for more than half of the total positions on this year’s Index as well as half of the top 10. Furthermore, the three newcomers to the 2018 Index are all European markets: Denmark (20th), Portugal (22nd), and Norway (23rd).

- Developed markets reassert their dominance as FDI destinations.1 After ceding some ground to emerging markets last year, developed markets reach a new all-time high of 84 percent of the positions on the 2018 Index. Investors are interested in developed markets across all regions, including Europe, North America, Asia, and Australasia. This growth is likely a result of stronger economic performance across developed market economies, their competitive advantages in technological innovation, and the regulatory and competitive pressures to localize operations in core markets.

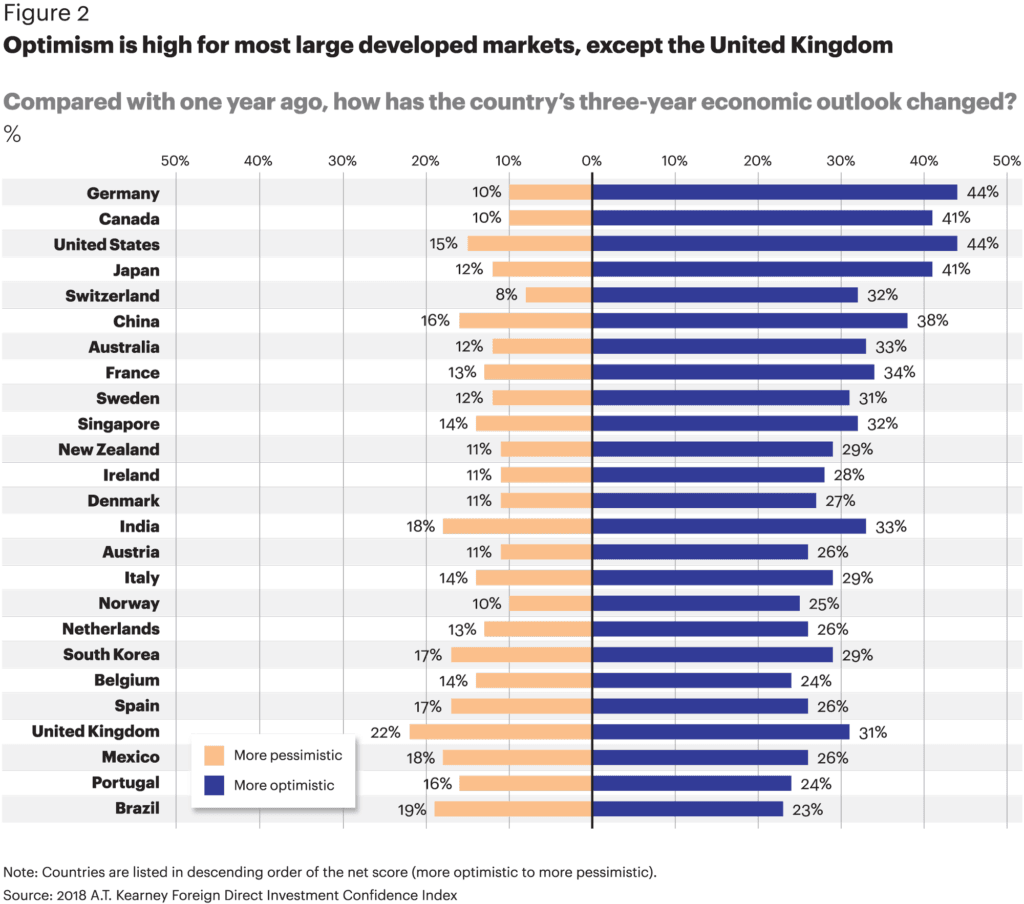

- Investors are very bullish on the global economy. Investors are more bullish on the global economy than they have been since 2014. Two-thirds of investors are more optimistic about the global economic outlook this year than they were last year. At the regional level, global investors are particularly optimistic about economic prospects in the Asia Pacific, Europe and Eurasia, and the Americas. In contrast, investors have mixed views on the outlook for the Middle East and North Africa and are somewhat pessimistic on sub-Saharan Africa, which may explain why these regions are not represented on the Index this year.

- Political risks are still front of mind for investors. An increase in geopolitical tensions tops investors’ list of likely wildcards for the fourth year in a row. Investors also view the likelihood of a political crisis in an emerging market as higher than last year, which may be contributing to the fact that fewer emerging markets appear on this year’s Index. And for the second year in a row, investors are prioritizing governance factors when choosing where to invest. They are particularly focused on regulatory transparency and corruption, tax rates and ease of payment, and the general security environment.

- Localization strategies are driving greater FDI. An overwhelming 80 percent of investors believe FDI will become more important for corporate profitability and competitiveness in the next three years. One reason for this consensus appears to be that almost 90 percent of companies are pursuing or considering pursuing localization strategies, and almost three-quarters of these companies are increasing their reliance on FDI as a result of localizing. As highlighted in this publication in recent years, FDI is seen as a business strategy intended to mitigate the effects of populism, protectionism, and the “islandization” of the global economy.

- Changes to the North American Free Trade Agreement (NAFTA) would shake up FDI flows. Fully 95 percent of investors’ companies conduct business in North America, and the renegotiation or termination of NAFTA would reshape FDI patterns. While modernizing NAFTA’s digital trade provisions would have the most positive net effect on FDI flows to member companies, terminating NAFTA would have the least positive net effect on FDI flows. Moreover, 60 percent of investors report that terminating NAFTA would raise their company’s cost of operations.

The United States tops the A.T. Kearney Foreign Direct Investment (FDI) Confidence Index for the sixth year in a row (see figure 1).2 This enduring attractiveness is likely in large part because the United States is the largest market in the world and because the country’s economy is on a pronounced upswing. The recent corporate tax rate cut likely also increases the appeal of investing in the United States in the near to medium term. And, as we highlighted last year, investors may be reacting in part to the government’s recent protectionist stances. FDI remains a crucial means for them to maintain access to this globally important market.

More broadly, all of North America performs well on the FDI Confidence Index this year. Canada rises three spots to second place—its strongest performance in the history of the Index. This extends Canada’s streak among the top five markets on the Index to six years. Furthermore, investors are very optimistic about Canada’s economic prospects, reporting greater net optimism for Canada than for the United States (see figure 2). Mexico is another strong performer, holding steady at 17th, even as all other emerging markets fall in the rankings.

China falls three spots to fifth place—China’s lowest ranking in the history of the Index. As investors remain relatively optimistic about the economy, these reduced FDI intentions may be a result of the perception that the business environment is becoming less favorable for foreign firms. The remaining two markets in the top five are large European economies: Germany falls one spot to third, and the United Kingdom holds steady in fourth place.

Beyond the top five, Europe also performs well. European markets account for half of the countries in the top 10 and more than half in the top 25 markets on the Index. This reflects substantial investor interest in establishing or expanding business operations in Europe. Furthermore, the number of European countries on the 2018 Index increases from 11 spots last year to 14—just shy of the region’s all-time high of 15 spots on the 2015 Index. In particular, France, Switzerland, and Italy are in the top 10, and the latter two of these countries each rise by a strong three spots. Moreover, all three of the newcomers this year are European countries: Denmark, Portugal, and Norway. This widespread intention to invest in Europe may be related to the region’s economic upswing after several years of subpar economic performance. In addition, as in last year’s Index, the looming reality of Brexit may be motivating some investor interest in the rest of the European Union (EU) member economies as companies seek to maintain their preferential access to the EU market.

Notably, all European countries on the Index are developed markets, as has been the case since 2016. This dominance of developed markets in Europe mirrors the dominance of developed markets more broadly on the Index since 2014. After a slight dip in investors’ focus on developed markets in last year’s Index, developed markets stage a resurgence to capture 84 percent of the top 25 spots this year—an all-time high. Developed markets are likely attracting such significant investor interest thanks to the synchronous upswing in economic growth across these markets—particularly in Europe—and their long-term favorable fundamentals, such as relatively transparent business regulations and high purchasing power.

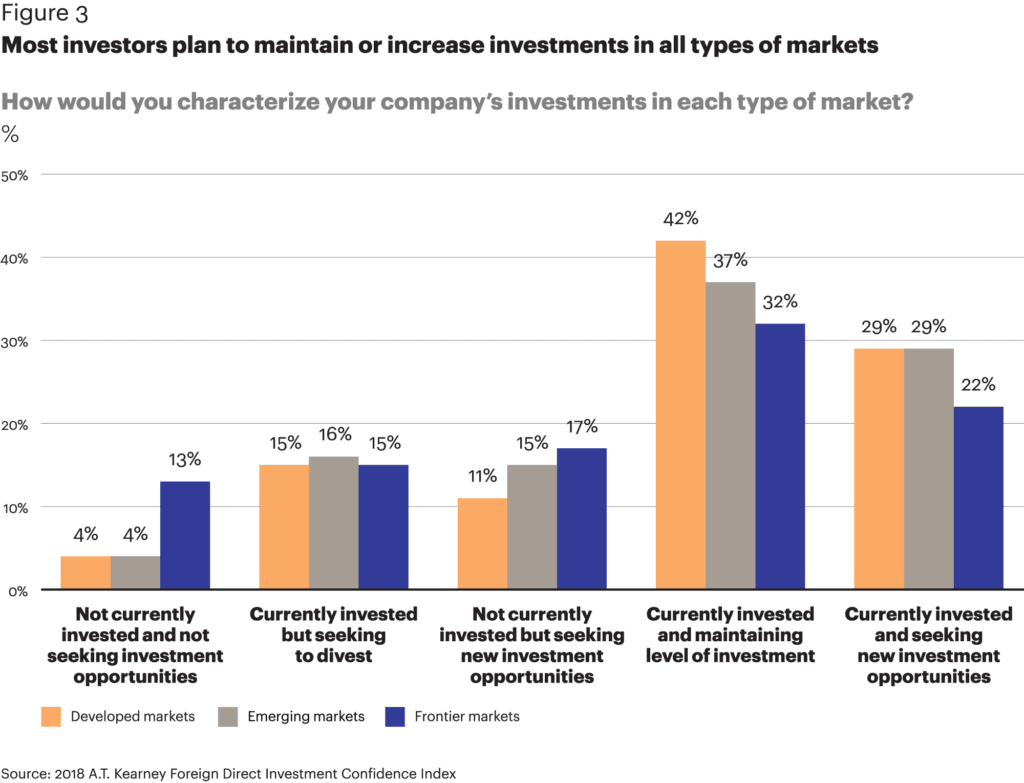

The flip side is that this year marks an all-time low for the share of emerging markets on the Index. Just four emerging markets appear among the top 25 countries for FDI intentions: China, India, Mexico, and Brazil. This suggests that confidence in investing in specific emerging markets has declined. However, investor interest in emerging markets writ large remains strong. While 44 percent of investors report that they are seeking to increase their investments in emerging markets, only 40 percent are seeking to do the same in developed markets and 39 percent in frontier markets (see figure 3). Investor intentions, then, may be spread more widely across the emerging market space, resulting in fewer individual emerging markets appearing on the Index.

In fact, the three countries that appeared on the 2017 Index but do not appear this year are all emerging markets: Thailand, the United Arab Emirates, and South Africa. And two of the three countries with the largest drops in rank are also emerging markets. Brazil, the country with the most significant drop, falls nine spots, continuing its three-year slide from sixth in 2015 to 25th in 2018. India falls by three spots, reversing its two-year streak of rising in the rankings. And among developed markets, Spain sufers the largest drop, falling four spots to rank 15th.

In contrast, the newcomers are all developed markets and, as previously noted, are all European countries. Denmark returns to the top 25 after a one-year absence, and Norway reappears after a two-year absence. And Portugal makes its debut appearance on the Index. In addition, the four countries with the largest jumps in rank are all developed markets. New Zealand makes the most substantial leap in rank, surging by seven spots to 16th. Three other developed markets rise by a notable three spots: Canada, Switzerland, and Italy.

Across the board, the overall level of scores in this year’s Index indicates slightly more uncertainty about where to invest. The average score of countries in the Index falls to 1.58 this year, between the 2016 average of 1.56 and the 2017 average of 1.61. While the share of high likelihood scores remains the same this year, investors identify fewer countries where they foresee a medium or low likelihood of investing in the next three years, and the share of no likelihood responses rises. There is also a larger gap between the highest and lowest scores among the top 25 this year. Altogether, these findings indicate that investors are uncertain about where to invest—beyond the largest, most obvious locations with the lowest perceived risks—even as they plan to increase their level of FDI. This uncertainty may explain the discrepancy in investors’ strong FDI intentions and declining FDI flows in recent years.

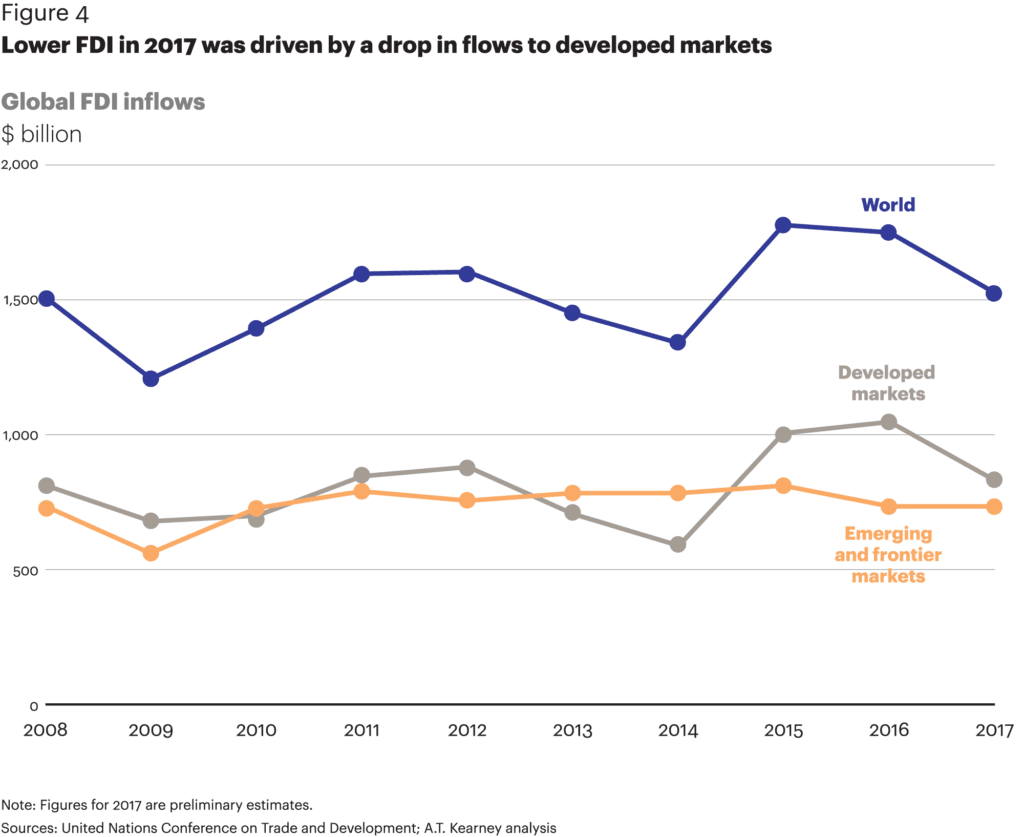

Lower 2017 FDI Flows May Mark a Return to Normalcy

Last year, an overwhelming three-quarters of investors reported that they were planning to increase their level of FDI over the medium term. Despite these intentions, however, the global flow of FDI fell in 2017 for the second year in a row, according to the latest United Nations Conference on Trade and Development (UNCTAD) estimates (see figure 4). While the decline in 2016 was relatively small and driven by a reduction in flows to emerging and frontier markets, the decline in 2017 was much more significant and driven by a dramatic reduction in flows to developed markets. In fact, the decline in FDI flows last year was largely a result of lower FDI inflows to just two markets: the United Kingdom and the United States. It is important to note, however, that a few large megadeals resulted in abnormally high FDI inflows in 2016 for the United Kingdom and in 2015 and 2016 for the United States. The level of FDI flowing to developed markets in 2017, then, may represent a return to normalcy.

This same observation applies at the global level. When the anomalous years of 2015 and 2016 are discounted, it becomes clear that the 2017 FDI flows represent a slight improvement from 2013 and 2014. Furthermore, these 2017 FDI flows show a return of the rough equivalence in the value of FDI flowing to developed markets versus emerging and frontier markets that has existed throughout most of the post-global financial crisis period.

Viewed in this light, the discrepancy between investors’ high level of intentions to increase FDI and the fall in FDI flows last year is less troubling. It may be that many companies did increase their FDI levels—or are doing so now—but the reduction in megadeals in large developed markets masked this activity. Or it may be that with so many companies seeking to increase their level of FDI, there were fewer M&A targets and greenfield projects to go around, dampening companies’ investment opportunities and resulting in lower than intended levels of FDI.

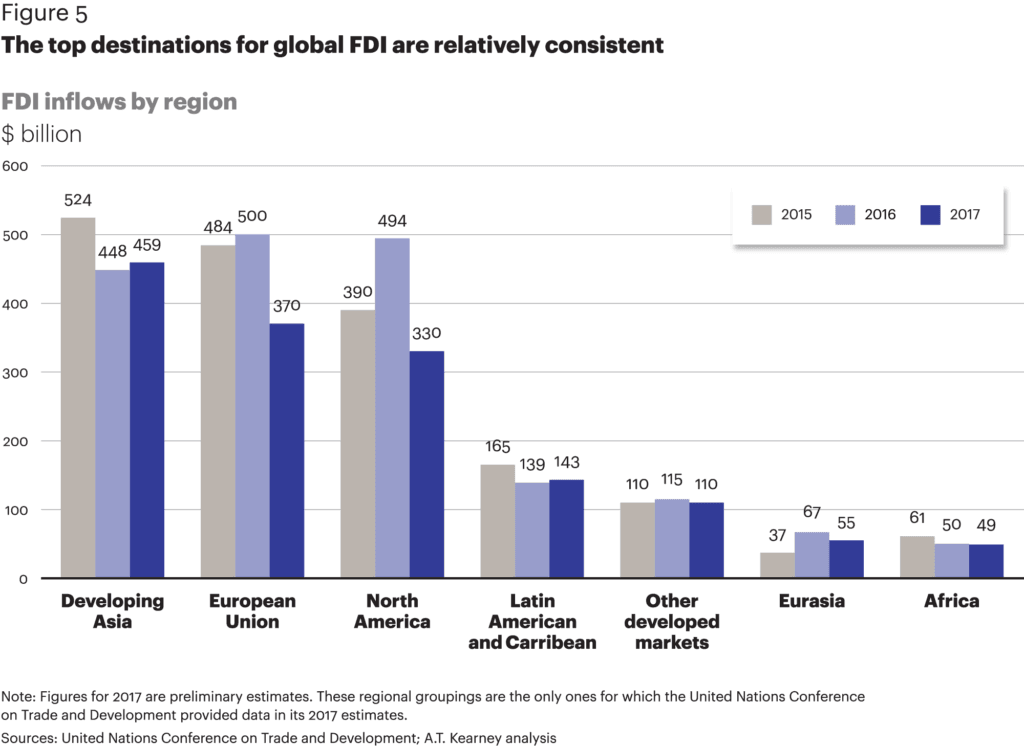

Despite these differences in overall FDI flows in 2017, the top three regional destinations for global FDI flows remain constant (see figure 5). Developing Asia was once again the region attracting the most FDI flows in 2017, after Europe and North America had edged past it in 2016. And consistent with global-level data, all developed market regions experienced a decline in FDI flows in 2017. The emerging and frontier market regions of Eurasia and Africa also received slightly less in FDI flows last year than in the previous year. The two regions to buck the trend were developing Asia and Latin America and the Caribbean. Our survey results indicate that these two emerging and frontier market regions will likely continue to attract FDI flows, as the only emerging markets on the 2018 Index are in Asia and Latin America.

Article by Courtney Rickert McCaffrey, Paul A. Laudicina, and Erik R. Peterson - A.T. Kearney

See the full PDF below.