Charlie Munger discussing how to outperform the market over the long-term. It is not about being smart like many fund managers try to be, it is about doing the right thing a few times in your life.

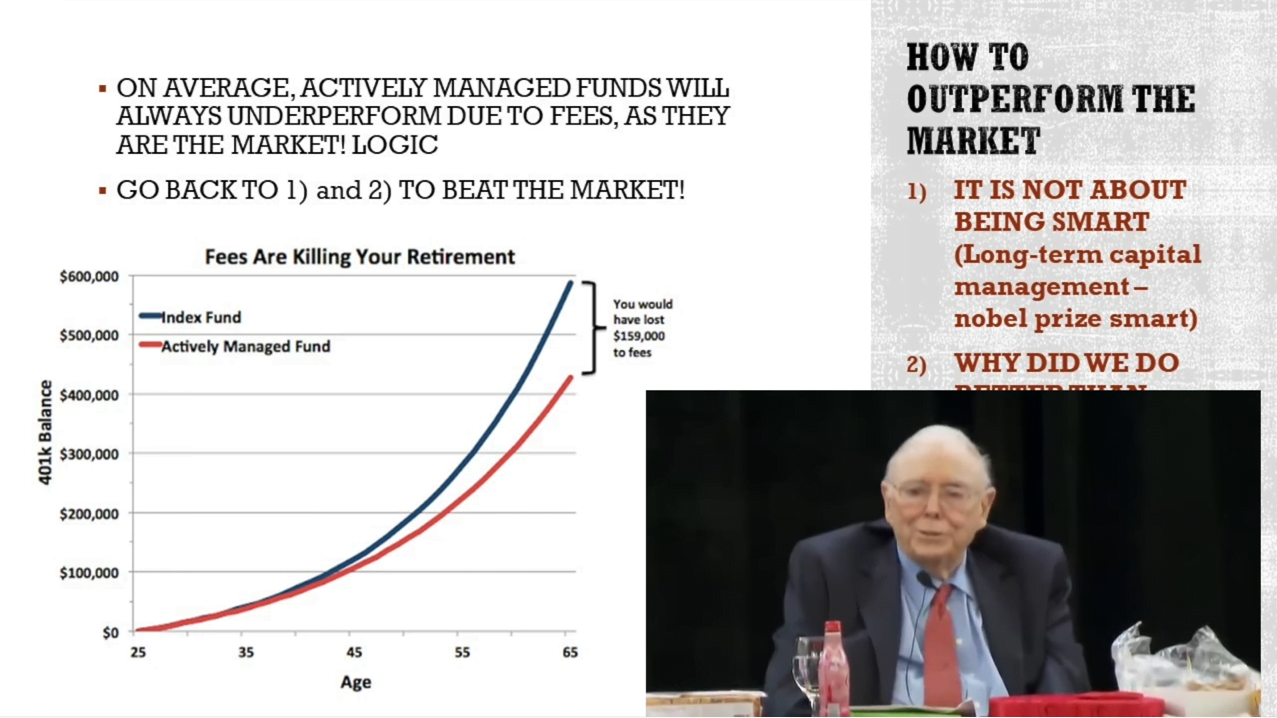

On why index funds outperform the majority, well that is statistics, don’t get confused by that. Index funds outperform active due to fees, active outperform individual investors when looking at averages. The key is that you do what is best for you!

Q1 2020 hedge fund letters, conferences and more

Munger on How To Outperform the Market & Index Funds

Transcript

In the investment world, people, enormous amount of high IQ people trying to be more skillful and normal. I cant imagine another activity that gets so much attention. And weird things have happened. And years ago, one of our local investment counselling shops a very big one. They were looking for a way to get an advantage over other investment counselling jobs. And the reason this follows we've got all these brilliant young people from Wharton and Harvard and so forth, and they work so hard trying to understand business and market trends and everything else. And if we just ask each one of our most brilliant men for their single best idea, then created a formula with this collection of best ideas. We would outperform averages by a big amount. And that seemed plausible, because they were ill educated. That's what happens when you go to Harvard and Wharton. And so they tried it out and of course, it failed utterly. So they tried it again, and it failed utterly, and they tried it a third time, and it also failed. And, of course, what they were looking for, is the equivalent of the alchemists centuries ago who landed the gold. They thought of it just buy a lot of lead waver magic wand over and turn it to gold, that would be a way to make money.

This counselling shop, was looking for the equivalent of turning lead into gold. And of course, it didn't work. I couldn't have told them that they didn't ask me. Now, the interesting thing about this situation, yes. This is a very intelligent group of people. What's coming from all over the world you've got, a lot of bright people from China, or people tend to average out a little smarter. And the issue is very simple. There's a simple question. Why didn't that plausible idea fail? Just think about it for a minure. You've all been to fancy educational institutions. I'm not sure there's hardly a one in the audience who knows why that thing failed. That's a pretty ridiculous demonstration I am making. How can you not know that? But that's when you should be able to answer it shows how hard it is to be rational on something very simple. How hard it is, how many kind of crazy ideas people will have? You don't even know why they don't work, even though it's perfectly obvious, they have never been properly educated.

Now a place like Berkshire Hathaway or even the Daily Journal. We've done better than average. And now there's a question why has that happen? Why has that happen? And the answer is pretty simple. We tried to do less. We never had the illusion, we could just hire a bunch of bright young people. And they would know more than anybody about can soup and aerospace, utilities and so on. We never had that dream. We never thought we could get really useful information on all subjects, like Jim Cramer, pretends to have. And and we always realised that we worked very hard, we can find a few things where we are right, and a few things were enough. And that was a reasonable expectation. That is a very different way to approach the process. And if you would ask Warren Buffett, the same thing that this investment counselling did, give me your best idea this year. And you just follow Warren's best idea. You would find that work beautifully. But he would try to know the whole he would give you one or two stocks. He had more limited ambitions.

I had a grandfather was very useful to me. My mother's grandfather and he was a pioneer and he came out to Iowa with no money, but use them help and took it away from the Indians. Before fought [unitelligible], he was a captain Blackhawk wars and he stayed there and he bought cheap land and he was aggressive and intelligent and so forth. And eventually he was the richest man on the town on the bank and highly regarded, huge family, very happy life. And he had the attitude having come out to Iowa when the land was not much more than $1 an acre and having stayed there until that blacktop. So, created a modern rich civilization and some of the best land in the world. His attitude was that a favourite live like his when you're looking at it in the right place, he just got a few opportunities if you lived to be about 90. And the trick and coming out well was a few of these that were your fair share that came along when they did. And he told that story over and over again to the grandchildren and hung around him all summer. And my mother who had no interest in money, remember this story and told it to me. But I'm not my mother's natural imitator. And I knew grandpa was right.

And so I always know from the very first, when Iwas a little boy, that the opportunities that were important that were gonna come to me were few. And the trick was to prepare myself for seizing the field that came. This is not the attitude that they have in the biggest Investment counselling thing. They study a million things, they can omit things. And, of course, the result isn't almost nobody can outperform an index. Whereas, I sit here with my Daily Journal stock, my Berkshire Hathaway stock, my holdings at Li Lu's Asian fund, my Costco stock. And of course I'm performing everybody 95 years old.

I probably never have a transaction. And the answer is I'm right and they're wrong. And that's what it's worth for me and not for them. Another issue of course, it's happened in the world of stock picking where all this money and effort goes into trying to be rational, is that we've had a really horrible thing happened to the investment counselling class. And that is these index funds have come along, and they basically beat everybody. And not only that, the amount by which they beat everybody is roughly the amount of cost of running the operation, and the even changes in investments. So we have a whole profession is basically being paid for accomplishing practically nothing. This is very peculiar. This is not the case with bowel surgery, or even the criminal defence bar law or something. That will whole profession where the chosen activity. They've selected they can't do anything.

Now in the old days, the people in the profession always had some of this problem. And they rationalised as follows. We are saving our clients from the insurance salesman and the stock broker. The standard stock broker, it serves the active trader. And they were saving people from the life insurance salesman and the hustling stockbroker who liked active trading. And I suppose in a sense that the investing class is still saving those people from an even worse fate. But it's very peculiar when a whole profession works so hard. And it's so admirable and the members of which we are delighted when they marry into our families, and they just can't do what the resident is really trying to do, which is get better than average results. How is that professional handling this terrible situation? As index investing gets more and more popular, and including a lot of fancy places. I guess very simple answer. They're handling with denial.

They have a horrible problem they can't fix. So they just [unintelligible] this is non-existent , this is a very stupid way to handle a problem. Now, it may be good when you're thinking about your own death, which you can't fix it, just denial all the way to the end. But in all the practical fields of life, this problem thoroughly understood this half solved or better cope with. So it's wrong to have all these people in just a state of denial and doing what they always did year after year, and hoping that the world will keep paying them for it even though I managed index is virtually certain to do matter. And I don't have any solution for this problem. I do think that index investing, if everybody did it won't work, but for another considerable period, index investing is going to work better than active stock banking where you can try and know a lot.