Alluvial Capital Management letter to investors for the fourth quarter ended December 31, 2019. Focusing on updates and why Crawford United (OTCMKTS: CRAWA) should focus less on its casino management business.

Dear Partners,

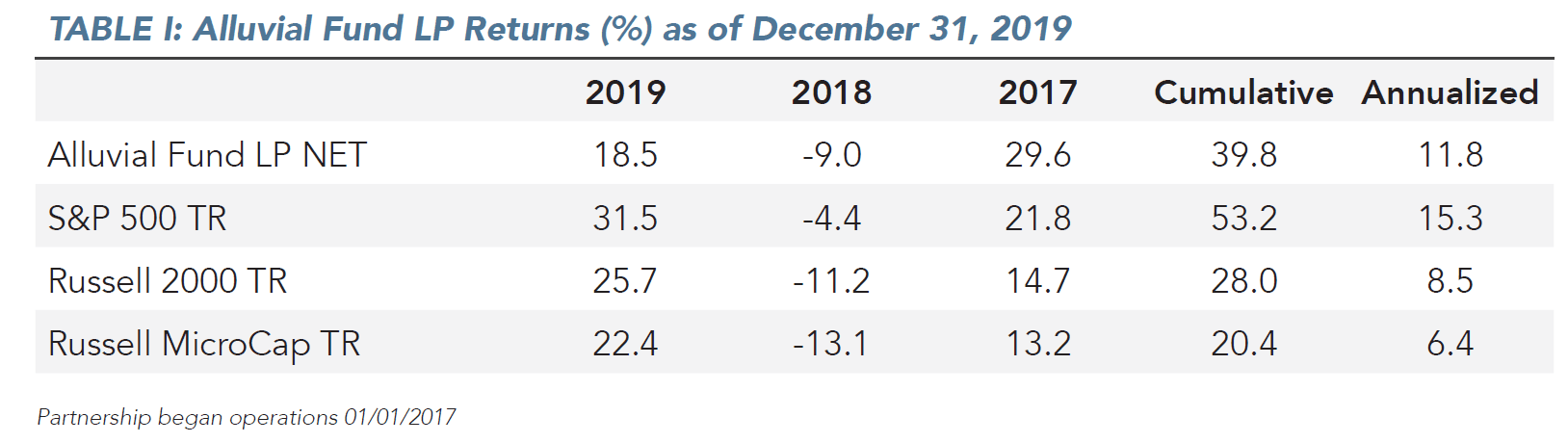

Alluvial Fund, LP climbed 5.8% in the fourth quarter, bringing our full-year return to 18.5%. For the year, the fund trailed most market indexes. Since inception, the fund remains well ahead of smallcap and micro-cap indexes, but behind the surging S&P 500 Index.

Q4 2019 hedge fund letters, conferences and more

Alluvial Fund has now completed three years of operations. On the whole, I am very satisfied with the fund’s results and progress. Our portfolio is truly differentiated, a collection of obscure and neglected securities that are priced to provide excellent returns in the medium-to-long term. Alluvial has done well in identifying under-the-radar situations and themes, and benefiting from the market’s eventual attention. That said, there have been a few stumbles and dead ends. I think a candid examination of what has gone well and what has not is a beneficial exercise.

Where We Have Succeeded...

Undiscovered Markets – Searching for value in little-known market segments with barriers to investment has been a profitable enterprise for Alluvial Fund. The Borsa Italiana AIM segment, for instance, goes unexplored by most funds because of the tiny size and limited trading liquidity of its constituents. We are already looking for the next treasure trove!

Corporate Events – The market can be extremely slow to price in the impact of major corporate developments like acquisitions, debt refinancings, and personnel/strategy changes when the company in question is very small or thinly-traded. It can take weeks or months for the market to comprehend the impact on a company’s worth. On many occasions, we have been able to accumulate positions before the market can react.

Obscured Value – Certain accounting conventions can obscure a company’s value. We have profited from identifying situations in which a company’s earnings power or asset value is not captured by its financial statements. Frequent scenarios involve non-cash, non-economic charges that obscure earnings power, or companies transitioning from complicated balance sheets and income statements into simple stories investors can more easily appraise.

The Truly, Truly Illiquid – Alluvial Fund accumulates shares of the market’s smallest, cheapest, and least liquid companies. We know that it may take years for these shares to trade at their intrinsic values, and some may never. However, we have already had several value realizations from catalyzing events like buy-outs, up-listings, or returns of capital.

Special Situations – From time to time, attractive arbitrage opportunities arise in our areas of focus. We have participated in multiple liquidation scenarios and merger arbitrage transactions, achieving healthy returns with little correlation to the market.

...And Where We Have Not

Cyclicals With Meaningful Financial Leverage – We have been over-optimistic in our projections for companies in deeply cyclical industries, particularly those with exposure to the prices of commodities like timber and coal. Our losses were compounded by the significant financial leverage some of these companies carried.

Secularly-Challenged Industries – We are not averse to investing in declining companies where the rate of decline is predictable and manageable, fixed costs can be reduced in tandem, and management reallocates cash flow intelligently. Unfortunately, this is not always the case. In a few instances, accelerating revenue losses cut into cash flows faster than had been expected. When a company must dedicate all its free cash flow to stem the decline, it winds up “running to stand still.” The opportunity cost of holding these sorts of companies is high.

Dishonest, Badly-Incentivized, or Inadequate Management – There is almost no discount large enough to account for the liability that bad or oblivious management represents. A company hamstrung by entrenched bad actors likely deserves every cent of that discount, no matter how alluring the figures on the financial statements may appear. The market has seen fit to remind us of this fact more than once.

The Road Ahead

I am proud of our successes, but appropriately humbled by our failings. As we enter a new decade, Alluvial Fund will continue to focus on the areas where I believe our research efforts are most productive and we enjoy the largest informational and temperamental advantages, and to proceed with extreme caution in areas that have proven challenging. I continue to believe the greatest opportunities for a small fund like ours lay in market niches that large funds with high liquidity needs cannot enter. I commit to learning from past mistakes and to using that learning to avoid future pitfalls. Our collective venture in Alluvial Fund is deeply personal for me, as my professional reputation and my family’s finances ride on the long-term success of Alluvial. Virtually the entirety of my family’s investable capital resides in Alluvial Fund and always will.

Portfolio Updates

Alluvial Fund has a new top holding thanks to the savvy dealmakers at P10 Holdings. In the third quarter letter, I discussed P10’s successful and scalable strategy and its prodigious cash flow profile. Now P10 has announced another incredible deal that will build the company’s scale, increase its free cash flow generation, and reduce its financial leverage. P10 is buying Five Points Capital, a North Carolina-based private equity manager founded in 1997. P10 is funding the deal with a combination of cash on hand and convertible preferred stock to be issued by a newly formed holding company which will own both RCP and Five Points. The convertible preferred carries a 1% coupon and is convertible into holding company stock at a valuation that equates to $3.00 per P10 Holdings share.

P10 was already cheap on a free cash flow basis before the Five Points deal. Following the deal (and even after the stock jumped 30%), P10 remains extremely under-valued. Once the deal closes, P10 can produce free cash flow of at least 30 cents per share assuming no change in assets under management for RCP or Five Points. P10 will not be a taxpayer for years to come due to its substantial tax assets, cleverly preserved in the Five Points deal. At under 6.5x forwardlooking free cash flow, I expect continued appreciation in P10 shares and I feel extremely comfortable with their top position in the Alluvial Fund portfolio.

Crawford United Corp, our burgeoning industrial conglomerate in Cleveland, is also playing the acquisition game, buying Marine Products International and adding $18 million in annual revenue. Marine Products manufactures hoses for the recreational boating segment, selling to boat builders around the world. The market began to catch on to the Crawford story in 2019, but shares remain extremely under-valued relative to the company’s earnings and free cash flow. Prior to the Marine Productions acquisition, Crawford United was on pace to produce 2020 cash earnings (reported net income plus intangibles amortization) of $2.28 per share or so. I believe this new purchase will boost cash earnings by 30 cents per share to $2.58. At a share price around $19.70, Crawford is going for under 8x 2020 cash earnings with plenty of earnings growth potential from additional acquisitions activity and organic growth at its subsidiaries.

Crawford is following a playbook that I am honestly surprised more small industrial companies are not using. There are thousands of reasonably good quality industrial companies producing operating income of $1-5 million. Many of these companies are too small to interest private equity firms. If a company can buy these businesses at 5 times operating income and fund 40% of the purchase with seller’s notes or bank debt at say, 6%, it can earn a pre-tax return of 29% on its cash outlay. All the better if these businesses require few fixed tangible assets and working capital and meaningful amortizable intangible assets can be identified. Crawford enjoys an annual tax deduction of $374,000 thanks to intangibles capitalized in its previous acquisitions. Depending on the character of Marine Products International’s assets, the deal may provide additional tax benefits.

A growth-by-acquisition strategy can be extremely effective, but there are pitfalls to avoid. As in most human endeavors, acquisitions be turn disastrous as a result of greed, impatience, or hubris (not to mention all of the other human vices!): greed, if the acquiring company takes on excessive leverage; impatience, if the company rushes into questionable deals to meet an arbitrary timeline or growth target; and hubris, if a company expands recklessly into industries and markets where it has no expertise or experience. Crawford’s acquisition program has been virtuous to date, but I will be watching closely to ensure it remains so.

Alluvial Fund’s newest holding of note is Butler National Corp. Butler is an odd little company with operations in two industries. The first is aerospace: the firm performs aircraft upgrades, modifications, and testing. The second is casino management: Butler has a majority stake in the entity that manages the Boot Hill Casino in Dodge City, Kansas. These lines of business have nothing to do with each other and there are no possible synergies gained from operating both. Thankfully, the company is aware of this and is exploring a disposition of the smaller, less profitable casino management business by way of a sale or spin-off.

I expect to see resolution around the company’s casino management business in the coming year. Prospects for this restructuring were greatly enhanced last month when the company was successful in signing a 15-year extension with the state of Kansas. Butler will now manage the Boot Hill Casino until 2039. Management contract extension in hand, the company is in talks to acquire the casino outright, ending the current lease arrangement. Butler is also exploring buying out its minority partner in the business. Both steps would make the casino management business more attractive to an acquirer or a more viable spin-off candidate.

My hope is that once the casino management business is gone, the market will recognize the extraordinary success of the company’s aerospace segment. Profits are soaring on the back of a robust aviation market and the company’s investment in securing approval to perform highly advanced modifications. The revenue backlog remains at historical highs, limited more by the company’s capacity to perform its services than the demand for those services.

Butler trades at a price-to-earnings multiple of just 6 and has substantial excess cash on its balance sheet. Currently trading around 70 cents, I believe shares are worth well over $1 today and potentially far more in coming years.

Rural Telecoms

Both Nuvera Communications and LICT Corporation appear poised for strong results in 2020. Nuvera’s integration of Scott-Rice Telephone has gone well and the company may look to acquire additional assets soon. In a recent conversation with Nuvera’s CEO, Glenn Zerbe, Mr. Zerbe mentioned acquisitions as a focus for the company. With small private telecoms selling for 3-5x EBITDA, funding these purchases with debt from CoBank at 4-5% is tremendously accretive to earnings and cash flow. So long as Nuvera acquires companies with strong competitive positions in attractive geographies, I wholeheartedly support this growth-by-acquisition strategy.

LICT Corporation has a new president and CFO, Daniel E. Hopkins. Mr. Hopkins seems eager to make his mark. In the past few months, LICT has taken steps to divest non-core and passive investments, exchanging its New Hampshire operations for shares in CIBL, Inc. and selling its stake in a Northern California wireless partnership to Verizon. LICT has zero net debt and a substantial cash position, so the possibilities are endless! Regardless of what direction they choose, I expect the company to continue buying back shares at a terrific pace, investing in 5G capabilities, and installing fiber in its service areas.

Partnership Updates

As always, thank you for entrusting your hard-earned capital to Alluvial Fund. I will continue spending each day seeking new opportunities in which to invest our capital and gaining a deeper understanding of the securities we already own. Alluvial Fund will not always outperform, particularly while the market soars ever higher. However, I am confident that by continuing to identify and purchase quality securities at deep discounts to intrinsic value, Alluvial Fund will deliver strong performance through the market cycle. And, we’ll keep it interesting! Alluvial Fund’s holdings will never look anything like an index fund nor any other fund I know.

Alluvial Fund’s annual audit is in progress. You will receive audited financial statements and tax documents from our administrator, NAV Consulting, as soon as they are available.

To date, Alluvial Fund has traded mainly through Interactive Brokers. Interactive Brokers has recently decided to make life difficult for funds trading in small and/or illiquid securities, so I am actively interviewing new firms to receive the bulk of our trading business. I am evaluating these firms on their costs, market access, and security and stability. Once I have identified our new primary broker, I will inform partners of the change.

I will be hosting another webinar portfolio review for limited partners in late February. Look for details in your inbox before long. I’ll also be able to tell you about a few interesting projects that Alluvial has in the works!

I hope the new year is off to a good start and I look forward to writing to you again in April. Please feel free to reach out any time with any questions or comments you may have.

Warm Regards,

Dave Waters, CFA

Alluvial Capital Management, LLC