My stock market crash strategy is simple, I don’t know what will happen so I am not going to be greedy and try to time the market or look smart or whatever. A little bit here, a little bit there and that is what makes a good investor. We put the crash into perspective by discussing your comments on margin, buying now, selling everything, panic, being greedy, being long-short etc.

Q4 2019 hedge fund letters, conferences and more

Stock Market Crash Investing Strategies - Buying On Margin, Buying Now, The Bottom etc..

Transcript

Good day, fellow investors. Well, we all see what's happening on the stock market. And in this video, I really want to discuss seven very important topics that come from your comments. So thank you for your comments. And tomorrow I'll make a video about the economy, the recession, the impacts on that. And then on Sunday, I won't analyse a stock this time, but I'll focus on gold which is a very hot topic now so please subscribe, click that notification bell and whenever you watch my video, click that like button for the YouTube algorithm.

Let's dig into the content immediately. I had a lot of questions about my strategy where I mentioned buying on margin, long/short hedging, long term investing, when is the bottom, when to buy, so let's dig in. The first comment, a very good comment so from business genius, of course my cash position is now 20% lower than a few weeks ago, will go even lower if things continue to go down and eventually are said sell other assets and go on margin, if the decline is large enough. That is also my strategy, this is what I said. And then there were a lot of really good comments how how that's very dangerous.

That's how people get wiped out in the depression, unless you know what you are doing. And here I have to be really careful and re emphasise what I was saying about margin because all these comments are completely right.

How to avoid getting wiped out

On margin seriously, wow, we don't know where we'll hit the bottom seems foolish. It's correct. But only a fool perhaps can become rich. And these are the same people that tell you that they don't know what will happen in the future, yet they are willing to go in debt to buy stocks. So these are excellent points. And here I really have to be really dig deeper into what I mean when I discuss this. It's all about my strategy. We are seeing what's happening now when I said going on margin is something that I will do over the next months, years perhaps. So this is the emphasis. Plus, I'm doing it with a business account. So I have other safety precautions there that might prevent me from getting a margin call.

So it's really as always, when it comes to me really limiting risk to the maximum, I will not do foolish things. Thank you for your worries, excellent comments. But when it comes to margin is just a part of my strategy is just an option that I can use, depending on the opportunities on the market. And for me to go on margin to borrow to invest just for the portfolio that I managed to increase the returns long term, there must be absolute bargains. So I just wanted to clear that out.

Absolute bargains, no risk of a margin call, absolutely no risk, enough protection, enough this and that, enough stability, and then I might increase that on leverage to income increase my returns long term to buy the real bargain assets. This allows me on the other hand to be 80% invested in a normal market environment. Then there was another comment on long term investing. I mentioned you have to invest for the next 50 years but then starting says who lives another 50 years you need to find businesses for the next 20 years, not 50. And he is completely right.

Valuation levels

What I see the market not pricing in or wrongly discounting is already just a few years ahead. If you take five years, the market is focused on the next few quarters maximally two years, is what the analysts focus, the rest is completely not priced in. So if you focus on three to five years, you're already ahead of the market.

Hyperbolic discounting, we'll discuss in a video but we'll make a new video detailed about there that in any case when I say 50 I just mean okay forget about it. Because 3-7 years might seem a long time. And that's why I emphasise the 50. But it's usually 3-7. But if you say 50, if you think 50, whenever it happens, whenever the return, the reward comes, it's okay for you. If it comes in 3 years, in 7 years, if something triples in 3 years, or in 7 years, their return difference is huge, but 44% per year, or 16-17% per year, are both great returns, and depends on the market what I'll get.

So that's when I that's what I think when I say 50 years, and then the business continues to compound over and over and I don't see better opportunities than yes, 50 years. But 3-7 years is my long term horizon. And when I say 50, I just let it be if it's 10, if it's 12. That's a very important factor for psychology. And therefore I say 50 excellent comment.

Market bottoms

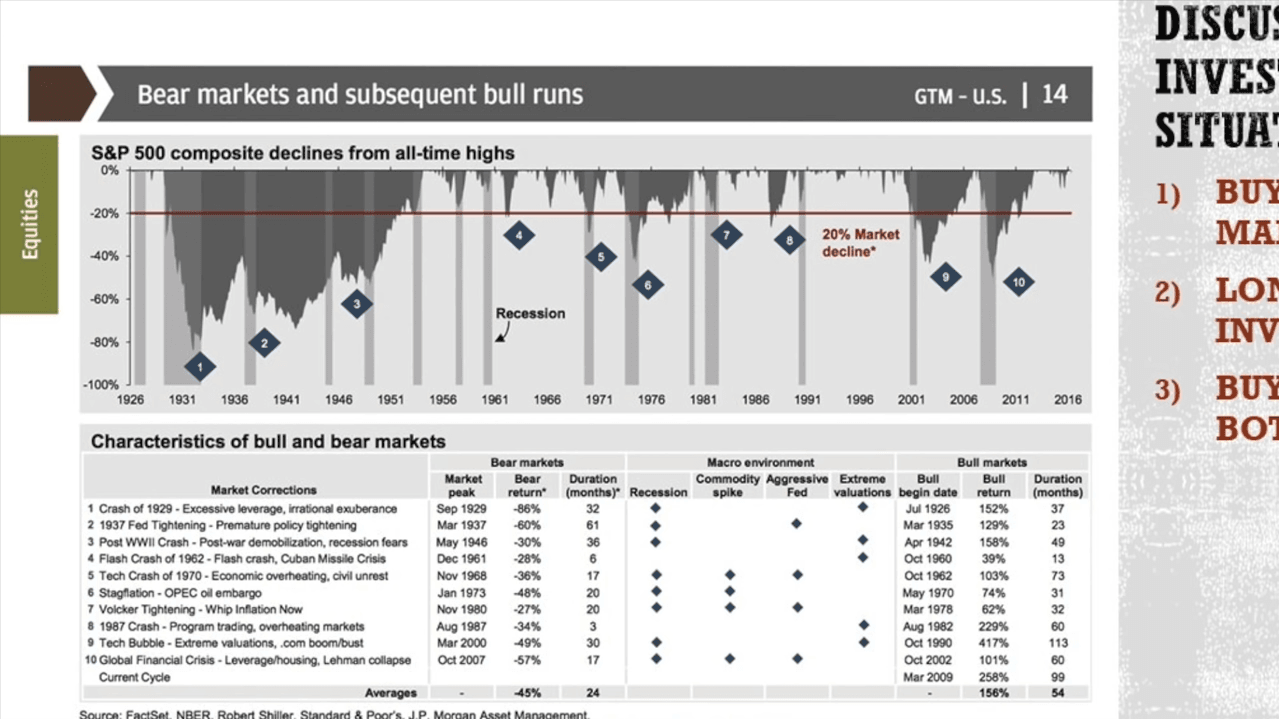

Now on buying the bottom, we are still far from the bottom of this buying into falling market without a clear reversal is for idiots. Cow poop is cheap too. Here let's dig into the previous stock market crashes the bottoms and what's very clear that you never know how big will the market crash be. Will it be a 20% decline like we have seen in 1987? Like we have seen 1982, 1970, 1966, 1962, etc or will it be a crash like 2002 50%, 2009 50 something percent, or their Great Depression of the 1930s? But nobody knows and therefore, you can't really time the market.

So the key is to try to buy value when you have it and then stage your purchases over time. But one message I have here is that nobody knows how long the bear market will last but the average bear market market over the last 100 years was 24 months, the average bull market was 54 months. So bear markets on average will last between what six months?

Three months from 1987 and 61 months 1947 Okay, but on average it will be a year-two years now there isn't so much connection interconnection media and everything that the bear markets and information allows things to last shorter. The Great Recession 2009 the bear market lasted much shorter than many expected. So it is panic, yes, but it won't last long and it will pass this too.

Dangers of buying on margins

Now another comment. If you know stocks will go down, why not sell everything. Let's go again to the bear market situation. I don't know what's the bottom I can time markets. Nobody can. So selling everything might be again, depends on your situation in life. If you are well off with what you have in you don't tolerate any risk then yes sell everything if you want to invest if you like the businesses, if you like owning businesses, then keep them and keep doing what you are doing accumulating wealth and you will be fine. Are stocks risky? Stock markets are very volatile thing that's the problem. They can crash big time in a matter of days. So basically they're very risky.

Now, here it depends on what you are what kind of investor you are. Are you a gambler? Are you betting I need to make some money on stocks go up and down? Yes, then you're riskier 99% you lose your money. Are you an investor buying the businesses? Will you still go to tomorrow to your store? Or will you still buy online or will you still watch this video if you are watching this video now it means you still have electricity. It means the utility is still pumping electricity or sending electricity to your home. You're still using the bathroom is assume you showered today, etc, etc.

So life goes on in many, many places. And it's normal. It's cyclical, the economy's always cyclical, and that's life up and down, but the world will probably be a better place in 5 to 10 years from now.

Panic selling

So keep that in mind when panicking about selling everything and thinking how stocks are risky. Yes, if you need to make money in three months, then stocks are riskier than a casino. But if you want to invest for the long term, accumulate wealth, then stocks are one of the best vehicles apart from setting up your own business.

And then again, it's all about this sentence and it's so hard to be fearful when others are greedy and be greedy when others are fearful. It's hard to buy stocks when those are down. And then another topic here being long short. I think long short portfolio wins out during times like this by hedging myself out the value of my portfolio. slightly up from where it was before all the panic started and excellent point by Rob, but having a long/short portfolio implies a constant cost. So, my strategy is simply different, but if you can tolerate volatility, then okay you can have puts you can have a long/short portfolio and then you will minimise but you will minimise also the ups and the downs investing is a positive sum game.

Therefore, over the long term, it's up 27 times, therefore, I'm not in the short game because yes, it will limit my volatility, but it has a long term costs that will limit my long term return. So see how this fits your strategy, nothing to be smart about it there.

Buy stocks on margin?

And then on prices. On the recent video, Kelvin said everyone think lower prices better just that 95% define lower prices means lower than 11 February price and it's an excellent point, you have to see not about lower prices, but lower prices on value, on value, on what you're already buying. Because if you look at the S&P 500, it's just where it was 10 months ago, so nothing special happened there just to raise the gains of 2019, which were incredible, but it's about the value you are buying. And you are seeing, investing is simply about buying value, buying long term value, value that will be there, over the ups and downs of viruses, of economies, of politicians, of whatever. Value will remain value and that's what this channel is all about.

When there is a bargain, I buy it or the mindset is when there is a bargain, you buy it, and ups and downs, stocks risky, prices going up and down, stocks crashing. You reinvest, you accumulate wealth over time, so you'll become richer and richer. And that's the point of everything we do here on this channel. So subscribe, click that notification bell, and I'll see you in the next video tomorrow about the economy and then probably a Sunday about gold. See ya.