The Ascent recently updated their buy now, pay later research which revealed BNPL’s recent growth as well as the associated downfalls among its users, especially those in younger generations.

Q1 2021 hedge fund letters, conferences and more

The Ascent, a Motley Fool service, conducted a survey of 2,000 Americans in July 2020 and issued updated survey results in March 2021 which revealed the following:

The number of buy now, pay later users grew nearly 50% from July 2020.

In 2021, 56% of Americans have used a buy now, pay later service -- a 48% increase from last year. Consumers aged 18 to 24 (Gen Z) represent the largest group of users in 2021, with 61% reporting having used the service -- a 62% increase from last year.

Late payments increased 41% in 2021.

Nearly a third (31%) of BNPL users have made a late payment or incurred late fees, up 41% since last year. Consumers aged 18 to 24 are the most likely to make a late payment, with 47% being late and/or incurring a late fee.

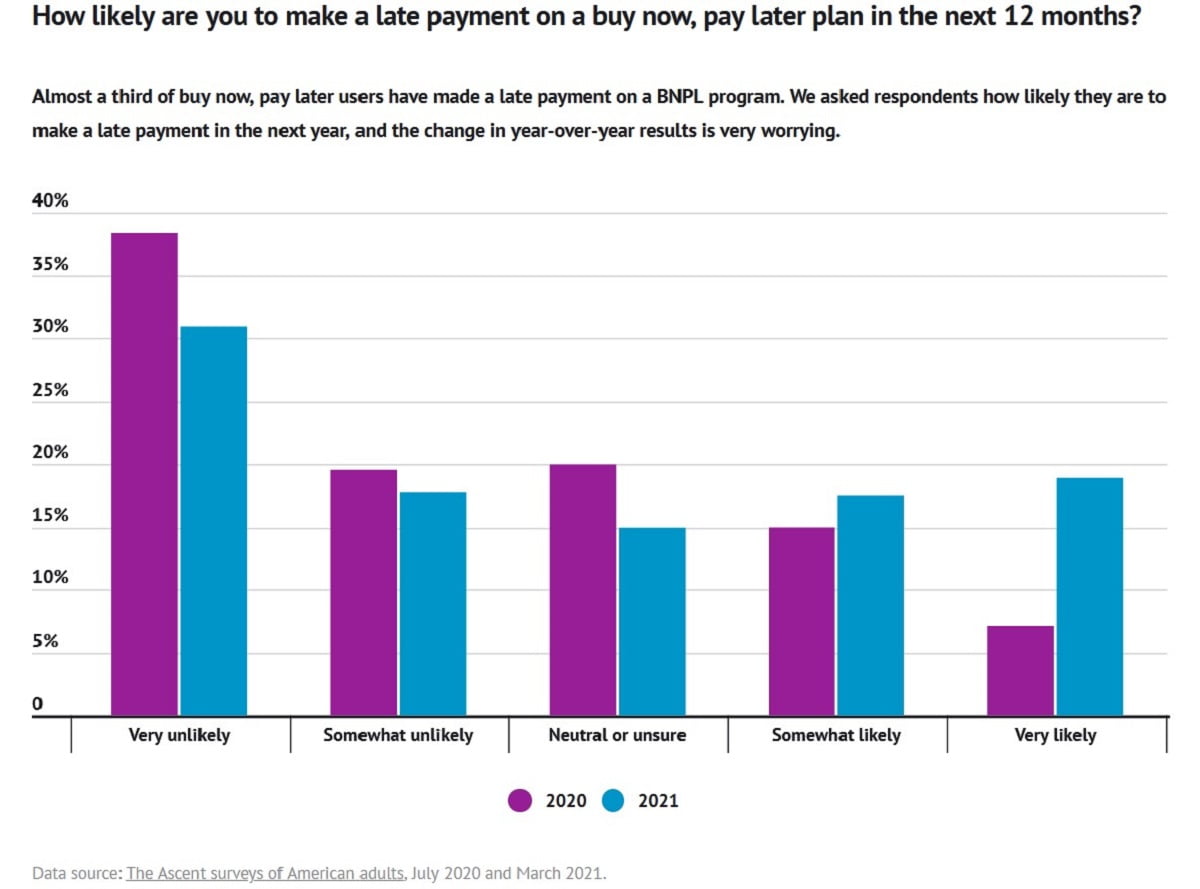

Americans expecting to make a late payment increased 65%.

In 2021, more than one-third (36%) of BNPL users say they are at least somewhat likely to make a late payment within the next year -- up 65% from last year. Gen Z respondents are the most likely to miss a payment with 44% saying they are "somewhat" or "very" likely to do this in the next 12 months.

More than 1 in 4 BNPL users don't consider BNPL to be a form of debt.

28% of all BNPL users don’t consider buy now, pay later to be a form of debt. That percentage increases to 40% when asking Gen Z respondents.

The full comparison of BNPL data from 2020 to 2021, along with additional insights into why consumers use BNPL, and the companies charging the highest interest rates/late fees can be found at https://www.fool.com/.