Blue Tower Asset Management commentary for the fourth quarter ended December 31, 2017.

Also check out their top picks in ValueWalk’s HiddenValueStocks

The Global Value strategy composite returned 10.42% gross (10.11% net) for Q4 2017 and 25.28% gross (23.93% net) for the year.

Our previous letter outlined our reasons for increasing our portfolio holdings of Japanese equities. This move continued in Q4 and into the first few weeks of this year. Currently, we have positions in 8 Japanese equities, all of which are “small caps” and 5 of which lack sell-side analyst coverage. The fact that the majority of these companies have no analyst coverage is related to how stocks with small market capitalizations can fly under the radar in Japan and thus carry cheap valuations.

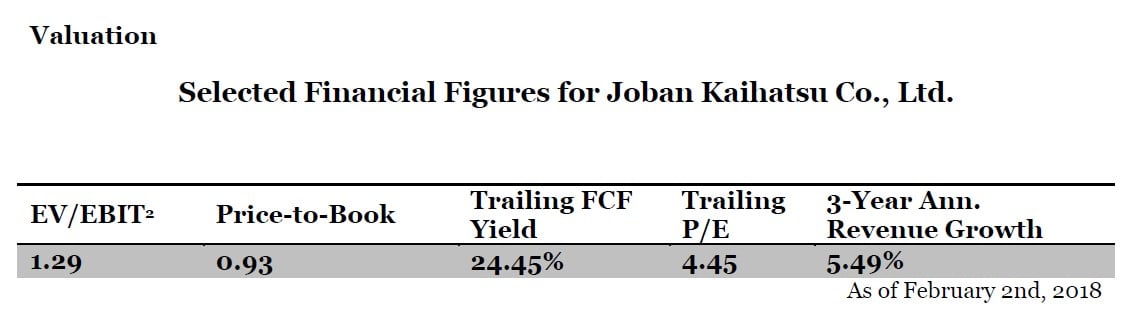

In this letter, we will explore our investment in Joban Kaihatsu Co. Ltd., a construction and civil engineering firm based in Iwaki, Fukushima Prefecture, Japan. Our thesis is based on the valuation of Joban Kaihatsu and our assessment that the market is being overly pessimistic on the Japanese construction sector as a whole. At a market capitalization of US$62 million1, this company is an under-the-radar bargain. As our investment thesis is fairly simple and straightforward, this will be a fairly short letter.

Overview of Company

Joban Kaihatsu was founded in 1960 in Fukushima. Despite being in Fukushima prefecture, Iwaki is south of where the tsunami hit hardest and located over 40 miles away from the Fukushima Daiichi nuclear power plant, so there are currently no dangers to the city from radiation. The increase in reconstruction work in the Tohoku region of northern Japan has benefited the company.

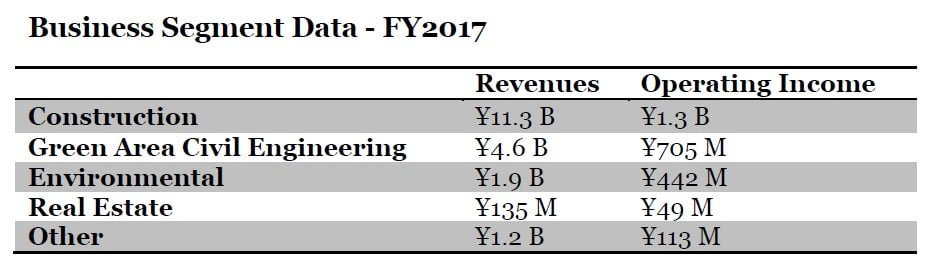

The company has three business segments: construction and civil engineering, environmental engineering, and real estate.

The construction segment has been very active with the recent construction boom in the Fukushima prefecture. Joban Kaihatsu has undertaken a diversified portfolio of projects including everything from civil engineering projects like roads and tunnels, single family and multifamily residential construction, and commercial projects. A major project constructed by the company was the Spa Resort Hawaiians water park and resort in Iwaki.

The environmental engineering is important for the company as environmental safety has been a major concern for the public since the tsunami and nuclear disaster. Business activities in this segment include environmental testing for toxins, general analytical chemistry services, waste disposal, construction of water treatment plants, the ongoing operation of those plants, and construction of parks and green spaces. An example of its green space work is its management of the Iwaki City Flower Center.

The company’s real estate segment is minimal and involved in the sale and leasing of properties constructed by the company.

The revenues and operating income of the business segments are shown below to give a sense of their relative importance to the business. The operating income of the company is less than the sum of the segments due to corporate expenses and intersegment transactions.

An important factor to consider in any equity investment is the sustainable business advantage of the company. Just because a company is currently earning high margins does not mean that this will continue into the future. The competitive nature of the free market pressures companies that are earning a return on equity higher than the cost of capital for that business, unless that company has economic moats protecting it. High-quality businesses will often compete on factors other than price. A benefit of the construction industry of Japan is that it is not as price sensitive as in the United States. Customers place a greater weight on reputation and customization flexibility. For a company of its size, Joban Kaihatsu has very diverse sources of income. These specialized environmental and chemistry niches will have more pricing power than a more commoditized business.

In addition to its strong earnings, the company also has a large cash cushion with ¥5.35 billion in cash and cash equivalents at the end of the most recent quarter. This is equal to 79% of their current market cap. The current debt of the company stands at ¥1.44 billion with most of it having a maturity of less than one year. This relatively huge amount of cash allows the company to self-finance many of its projects. If we assume the market would not allow the company to trade at a discount to its net cash, this provides a support floor for the share price.

This extremely cheap valuation is the core of our investment thesis. Even at double its current share price, this stock would deliver a healthy forward rate of return.

Bear Thesis

The main risk to this investment is the possibility of a construction industry slowdown as the reconstruction boom from 2011 Tōhoku earthquake and tsunami winds down. Operating margins are currently higher for Joban Kaihatsu and other construction/engineering firms than they were before the disaster, and it would be a hit to earnings for them to return to where they were previously. I am not particularly concerned about this risk as there are still several major government construction projects underway that will take years to complete. Additionally, the company is not completely reliant on government construction projects. Japan is currently experiencing strong economic growth and this will lead to increased demand in private-sector residential and commercial construction.

I hope our clients have enjoyed this letter and better understand Blue Tower’s view on Joban Kaihatsu.

Sincerely,

Andrew Oskoui, CFA

Portfolio Manager