Blue Tower Asset Management commentary for the fourth quarter ended December 31, 2019.

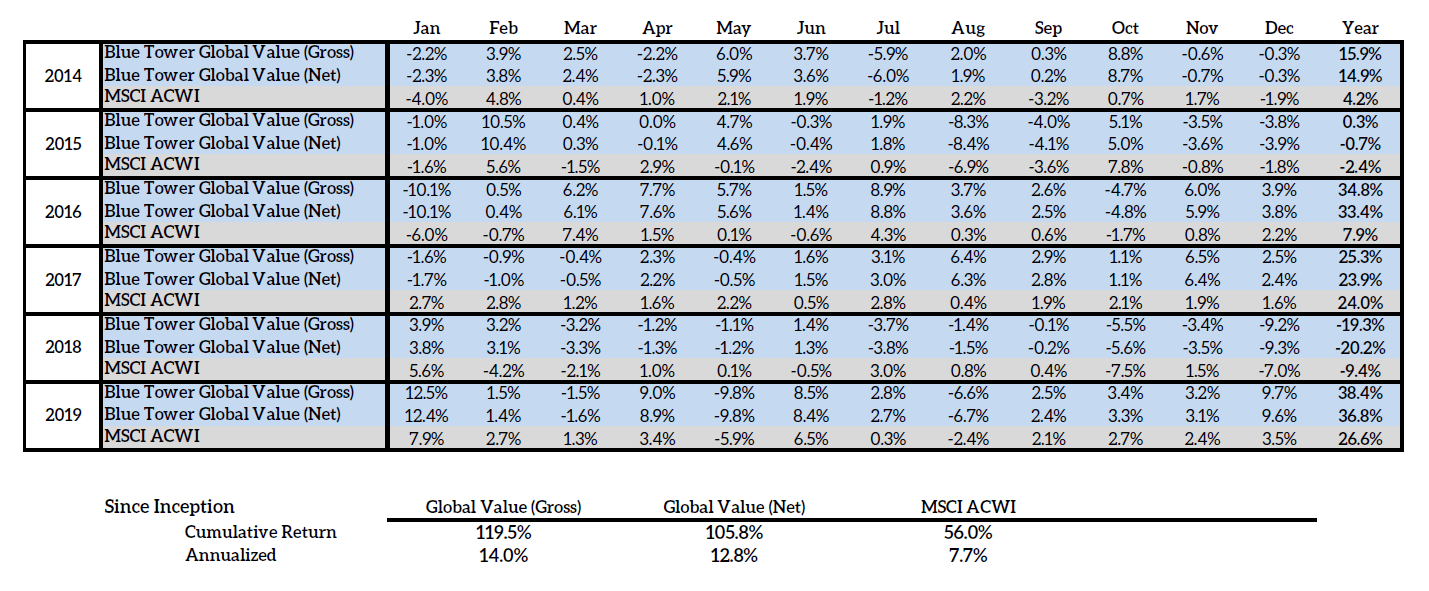

The fourth quarter of 2019 has been the strongest single quarter performance and strongest annual performance for the Global Value composite since the beginning of our strategy with a quarter return of 16.70% net (17.04% gross) and a 2019 return of 36.81% net (38.40% gross). We have had a great year despite a headwind of continued relative underperformance of value strategies, small cap strategies, as well as underperformance of international equities relative to the US. Our quarterly performance was led by gains in Cornerstone Building Brands (CNR) which we discussed in our Q2 2019 letter, as well as appreciation in our Japanese equities. Some of these same Japanese equities were responsible for our poor returns in Q4 of 2018. Short-term moves in security prices are more influenced by investor sentiments while long-term performance is driven by fundamentals. Therefore, when we see price movements that are not supported by underlying fundamentals, such as what occurred with our Japanese holdings in 2018, we would expect them to reverse course in due time.

Q4 2019 hedge fund letters, conferences and more

In this letter, I will explore the issue of private equity’s increasing role in the allocations of institutional investors, focusing on buyout funds. As developed market interest rates continue to be depressed globally, public pensions funds have increasingly turned to alternatives in order to attempt to achieve their return objectives. There have been of increasing amounts invested in private equity since the start of the decade, and 2019 saw the total amount of capital allocated to private equity reach near-record levels with a total raised of $595 billion within funds closing that year1. This record was only surpassed by 2017 and 2018.

Price is one of the most important drivers of return in investing. Competition between private equity funds is increasing the prices they pay for their targets. At the current prices paid, I find it unlikely that 2019 vintage buyout funds will be able to match the net returns of investors in publicly traded equities.

Despite the tremendous returns of the S&P 500 in recent years, we are still finding excellent opportunities in global equities, especially internationally and in small capitalization stocks. The bargain prices we are paying in some of our positions will help us achieve great results in our strategy for the coming years.

Institutional allocators bet on private equity

Pension funds have been increasing their allocations to private equity as part of a larger strategy of dealing with the pension shortfall facing many pension systems within the United States. Even with optimistic return projections by many pension funds (average discount rate of 7.2% by public pensions in 2018), 27.5% of public pension systems currently lack the assets necessary to meet the liabilities of their beneficiaries2. The increasing amounts of capital to private equity in these allocations, which can be seen in the chart below, have consequently led to multiples paid by buyout funds also being near all-time highs as well as acquired target size increasing.

Despite private equity marketing claiming excellent operational improvement and investments in long-term growth, the traditional method that most buyout funds in private equity have used to achieve returns is through buying small companies at cheap valuations, dramatically increasing the leverage of their balance sheets, and cutting SG&A and capital expenditures. While there have been some large purchases of companies made such as the 2015 purchase of Kraft and Heinz for $50B or the 2014 purchase of Safeway for $9.6B, most target companies have been small and would qualify as small caps or microcaps if they were public. The median purchase price of buyout target has varied between $64M to $250M over the last ten years with an increasing trend as can be seen in the above chart. Historically, this has been a winning strategy and has achieved extremely lucrative returns in the period of 1990-2010. In more recent years, the performance has not held up as well. The ten-year performance of private equity has been 15.4% annualized compared to 15.9% for the S&P500 and 16.0% for the Russell 3000. The inability to outperform publicly traded stocks is deeply surprising when one considers that private equity has achieved this while having much higher leverage exposure to equities. This environment of record low interest rates globally and a bull market economy should be ideal for them. The performance of private equity may be a victim of its own past success as the new capital flying into the sector spurs ruinous competition for deals.

Arguably the most important factor for leveraged buyout returns is the prices paid for the acquisitions. Since 2014, buyout purchase multiples have been holding at highly elevated levels with PitchBook reporting the median 2019 multiple at 11x EV/EBITDA. A study of private equity returns have demonstrated that returns were inversely correlated to purchase prices and were far lower in the 1990s and ‘00s than they are today as can be seen in the below table.4 The authors found that it was also possible in this period for private equity firms to, on average, buy companies at a steep discount to comparable companies on the public market.

The recent competition for private equity deals has been fierce, and it appears that this will likely be the norm for the foreseeable future as the amount of dry powder, uninvested committed capital held by private equity funds, has reached a record year-end high of $1.43 trillion.

The Tax Cut and Jobs Act of 2017 will also have a large impact on highly leveraged companies. Under the law, starting in 2018, a company can only deduct interest expense of up to 30% of its EBITDA. Any amount in interest expense beyond it will no longer be deductible. Starting in 2022, companies will only be able to deduct interest expense of up to 30% of its EBIT.

Too much capital into any outperforming strategy can destroy returns due to the limitations of capacity and declining marginal returns to new dollars. This is part of the beauty of value investing and why it has outperformed over the long term. The behavioral biases of humans around loss aversion and quick low probability gains as well as the periodic periods of underperformance value strategies face make it difficult for many investors to allocate capital to value investing. If value investing never underperformed, there would be so much capital allocated to it that the returns would degrade.

Career Risk in Institutions and the Principal Agent Problem

Considering the aforementioned factors, it seems unlikely that private equity will assist the return objectives of institutional allocators and may instead be a catastrophic drag on returns. A question should be asked about why institutional allocators are behaving in this way. I believe that considering the principal agent problem of the employees involved may be instructive.

The principal agent problem is a conflict in priorities between a person or group and the representatives authorized to act on their behalf. An agent may act in a way that is contrary to the best interests of the principal. It can occur in any situation where the owner of an asset delegates control of that asset to another party. These agency issues apply across economics and political science and are the reason why studying incentive structures is so important. As Charlie Munger once said, “Show me the incentives and I will show you the outcome.”

Employees at institutional firms feel pressure to avoid the appearance of underperformance with their investment decisions as underperformance may jeopardize their continued employment. With an allocation to a closed end fund like private equity, all of the value of the firm’s investments between the fund close and the exit is based upon the internal accounting of the private equity firm. Having the private equity firm perform their own NAV valuation as opposed to having them marked to market gives the PE firm the flexibility to smooth out values and have overly optimistic assessments of their underperforming holdings. Therefore, after the institutional employee makes the allocation to a private equity firm, the governing committee of the allocator will need to wait until the liquidation of the PE fund to judge if the investment allocation decision was a wise one. That may be a decade or more after the decision, by which point the employee may have moved onto another institution. By contrast, if the employee made the allocation to a portfolio manager in publicly traded stocks, that portfolio could have a drawdown due to a short-term decline in the holdings.

As further evidence of the career risk explanation of pension allocations, we can look at the comments of public pension employees themselves. At a December 2019 public broadcast of their investment committee meeting6, the investment officers of a large public pension stated that private equity has an advantage over allocating to public stock investments because in private equity, investments are valued infrequently and based on models as opposed to being marked to market continuously. As a result, the listed valuation changes less frequently and on a delay, which the investment officers describe as “time diversification”. This less frequent change in the appraised price means there is less volatility in the assets and therefore less risk. In other words, according to one of the largest pension funds in the USA, having their investments in an opaque black box, valued infrequently based on appraisal models as opposed to priced in an open market reduces their risk.

This explanation of risk being reduced by essentially not looking at your investments seems ridiculous but it is a conclusion drawn from the modern portfolio theory definition of risk equaling price volatility. One could easily reduce the apparent volatility of a publicly traded stock portfolio if one only examined the change in per share book value of the stocks on an annual basis as opposed to looking at the daily price changes. These absurd conclusions are one reason why we at Blue Tower look at risk as being comprised of the probabilistic dangers to the fundamentals of the businesses in our portfolio. Avoiding risk is always desirable, but taking risks is necessary to achieve returns. Multiple businesses can be affected by the same underlying risk. For example, the regime risk of an unstable government could affect two portfolio businesses if both are dependent on the stability of that geography. Following this definition of risk (which is more similar to the definition used in other fields) leads to more sensible portfolio decision making.

I hope this letter has clarified our views on private markets. Private equity has had an excellent track record in past markets, but too much competition can destroy the outperformance of any investment style. Thank you for your entrusting your capital with Blue Tower. I always enjoy the questions I receive from investors and look forward to receiving more. Additionally, the prospective returns we see in our current opportunity set makes us excited for 2020 and beyond.

Best regards,

Andrew Oskoui, CFA

Portfolio Manager