Black Bear Value Partners LP commentary for the second quarter ended June 30, 2018.

Q2 hedge fund letters, conference, scoops etc

“The greatest shortcoming of the human race is our inability to understand the exponential function.” -Albert Bartlett

To My Partners and Friends:

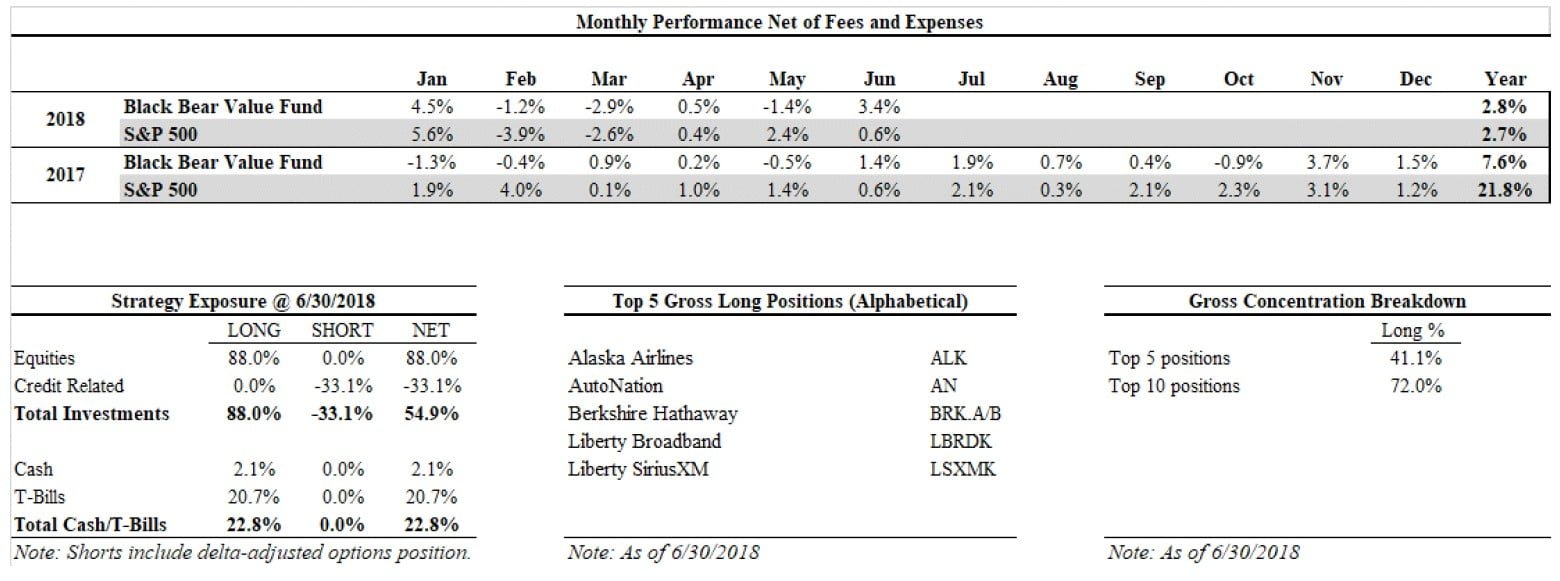

Black Bear Value Fund, LP (the “Fund”) returned approximately 3.4% in June and 2.5% in the 2nd quarter of 2018 (1) bringing the YTD net return to 2.8%. This compares to 0.6% in June and 3.4% for the S&P 500 in the quarter, bringing its YTD return to 2.7%. We own a concentrated portfolio that will not mimic the S&P 500 and will deviate both to the up and down. We entered the 3rd quarter of 2018 with an approximate cash balance of ~12% and an average short position of ~33%.

Starting July 1st, the management fee was reduced to 50 bps from 100 bps. I have communicated to both current and potential LP’s my intention to lower the fees as the fund scaled. Ultimately, there was no sense in waiting and wanted to further align our interests and be paid to perform., not simply to manage.

While the initial fee setup of 1% management/15% incentive is better than current marketplace offerings, investors deserve more of the pie. Lower fees will benefit our partnership and further increase our alignment.

As mentioned in previous letters my family has a significant investment in the Fund. Time and energy are focused on compounding our capital together over the long-term. At Black Bear, every LP’s dollar is treated with the utmost consideration and care. Together, we are building a partnership with deep and long-lasting roots.

Shorts (Securities we are betting against)

This past June, I presented on our credit shorts at ValueX Vail. There are elements of this investment that bear similarities to the ABX short from the mid to late-2000’s. The presentation is attached to this letter. Investors have unrealistic expectations of their Credit ETF holdings. There is extreme bond illiquidity underlying an assumption of daily ETF liquidity. Asset-liability mismatches can lead to painful endings.

Referencing the earlier quote from Bartlett, humans have a very hard time with the concept of non-linear outcomes. Sometimes, the Fund can take a view that is non-consensus and could result in a semi-exponential payout, so we do not have to be right too often. We have various shorts structured via the options market that fit this description.

We are short a variety of bond ETF’s (exchange-traded funds). These structures were not created for illiquid bonds in the event of a large sell-off. The underlying assumption is the market-marker will stand in the middle to prevent the structures from breaking. It is hard to predict how things play out if the market makers lose confidence in the liquidity of the underlying bonds.

History has shown us multiple examples of how a good idea can be taken to extremes resulting in excessive risk-taking and catastrophic outcomes (see 2007 financial crisis). Indexing illiquid junk bonds with limited legal protections is asking for trouble if the waters start to get rocky. Note these “high yield” bonds have a current ~5-6% annual yield with a loss-adjusted yield closer to ~3-4% and possibly 1-2%. When high yield prices inevitably decline and there is a need for liquidity these structures may fall apart.

Unless something dramatic changes, I would expect these shorts to be a meaningful part of our portfolio. The payoff could be quite asymmetric and give us a unique way to profit outside the norms of typical long-investing.

Longs (Businesses we Own)

Brief descriptions of the top 5 long positions follow in alphabetical order. Business fundamentals do not change that much from quarter to quarter. If something meaningful has popped up I have included it at the top of the description. Otherwise, the previous description is included with some minor updates or changes. These positions comprise ~41% of the portfolio at quarter-end.

Alaska Airlines

Black Bear has invested in a number of companies whose headline business obscures “hidden” or undervalued sticky businesses beneath the surface. ALK fits the bill. Upon closer inspection, ALK has 2 businesses: a transportation/seat-distribution business which has cyclicality and a sticky cash-flowing credit-card business with limited cyclicality. Large amounts of cash are generated by the airlines selling miles to banks irrespective of airline capacity or ticket prices. There is limited disclosure by the airlines so the sell-side focuses on predicting the unpredictable. This translates into volatility and opportunity.

ALK is a cheap, well-managed airline that possesses a cost advantage versus the network carriers (American, Delta and United). ALK also benefits from significant top-line and bottom-line synergies from their recent acquisition of Virgin America. While they have historically focused on traffic in the Pacific Northwest, their semi-recent acquisition of Virgin America results in more transcontinental exposure and a balanced network.

Historically airlines have been a brutal category of investment, with cut-throat competition, huge fixed costs, too much debt and too much capacity. Management teams have acted like overzealous developers who see a hole and want to build (in this case “SEE CLOUDS, BUY PLANES”). The industry appears more rational today as bankruptcies and mergers have resulted in a reduced number of airlines serving customers. I guess enough bankruptcy filings can bring religion. It appears management teams have learned from history but only their actions will prove this. In the meantime, the investment community holds their breath and gives limited credit. At a high-level I think we own Alaska at ~9-10x earnings and ~10-12x free-cash-flow.

AutoNation

Attached is a slide deck from a presentation given on the auto dealers last summer. Feel free to look it over if you want more detail but not much has changed. There is also a 1-slide update in the “Credit ETF” presentation that is attached.

AutoNation is exceptionally well run with a lumpy and opportunistic capital allocation strategy. Unpredictable share buybacks are great for investors if done at cheap prices. Mike Jackson and team have done this repeatedly and we applaud their patience and willingness to act when the opportunities come.

A lot of auto investors spend energy trying to predict the auto cycle. It seems like a tough and futile exercise and would not own AN if it was based on a precise auto-sales prediction. Ultimately selling cars is a way to attract customers, but the dollars are made elsewhere. As used volumes pickup, cars last longer and are driven more, the expanding and higher margin parts & services businesses should benefit. These are stickier and more predictable cashflows than the cyclical side of the auto business. AN seems cheap, should grow it’s higher-margin businesses and opportunistically buy in stock if it remains cheap. I hope Mike Jackson keeps his buyback plans quiet and can pounce if the stock sells off again. It may not make the sell-side happy but as an investor this is a good thing for our partnership.

Berkshire Hathaway

Describing Berkshire in a simple manner is a challenge. Allan Mecham did an admirable job describing BRK as a “meat grinder that relentlessly piles up value year over year (and decade over decade).” Berkshire is trading ~1.4x book value which underestimates its true intrinsic value. We own BRK at a ~20+% discount to the combined value of their stock portfolio and their operating businesses (at a 10x multiple). Add in the benefits of investing free money (the float from insurance) and a business compounding at high single digits with wide moats and you get the aforementioned meat grinder.

Liberty Broadband

Liberty Broadband is the tracking stock for Liberty’s investment in Charter Communications (CHTR). We are able to purchase shares in CHTR via the tracker at a ~10% discount to current market value.

We have covered media names before and much of the thesis is similar here. There are abundant fears of cord-cutting and declining media consumption. In reality, customers are cord-shifting and consuming increasing amounts of media and data thru alternate means (i.e. through the internet). Looking out 10 years from now it seems likely that people and businesses will be consuming more data. Charter provides the pipes to get the data to consumers and businesses and notably at much higher margins than video distribution.

When one pays their video bill, much of it is passed thru as a cost to the content providers. Think ESPN or Discovery. Those costs have continued to go up both increasing the customer’s bill but also the cost to the cable distributor (CHTR). So even though your cable bill is going up, it does not necessarily translate into more dollars for Charter. For data, the central cost is laying the fiber which is akin to laying a toll-road down. Think of the data as being like a car driving across that newly constructed toll road. The road costs about the same no matter if anyone is driving on it. Each incremental driver increases the toll (revenues) with minimal incremental cost. In other words when you or I call our cable company and raise our speeds much of the incremental price is pure profit to the internet provider.

Every quarter and even intra-quarter there are often large swings in the price of the security. It’s a nature of investors using the latest data point to extrapolate a long-term trend. Of late, some of the new data points have been taken negatively and resulted in large sell-offs. This has been an opportunity for us and we have meaningfully added to the position in Q2. It seems more reasonable to look out years versus looking out quarters.

Charter also stands to benefit from synergies from their consolidation of 3 large cable companies. They are exiting some large-scale capital projects and should begin to harvest some of the gains of those initiatives over the coming years. They have an excellent management team who owns a ton of stock and are thoughtful capital allocators. We are happy to be partners with Tom Rutledge, John Malone and Greg Maffei as well as the rest of the team at CHTR and Liberty.

Liberty SiriusXM Holdings

This investment was covered in Q3 2017. We added to the position on weakness as the discount to the underlying SIRI stock widened to ~30%. The business continues to perform well. An increase in royalty rates (their content costs) went up and spooked some investors. It will be a near-term headwind to margins but over the next 2 years the impact should roll off as new pricing is rolled out through their customer base. The management at Liberty has indicated an interest in buying back the stock at these discounts but as of this writing nothing has been finalized or communicated.

Liberty Sirius XM Group is a tracking stock for Liberty Media’s ~70% stake in SiriusXM. We own SiriusXM at a ~30% discount to where the underlying SIRI stock trades. Sirius operates satellite radio in the US providing 140+ channels to their 31mm subscribers for monthly subscription fees. SIRI is a sticky subscriber model with high margins (high 30’s) trading ~6% free-cash-flow yield. At our discount, it is closer to ~8.5% free-cash-flow yield. Management has used free-cash-flow to shrink their share count by ~20% over the past few years. This investment suffers from multiple avenues of negative investment sentiment.

- Tracking stock: Tracking stocks are hard to understand

- Auto: We are at peak auto so there will be less of these systems sold every year

- Technology: Who needs satellite radio when people have all sorts of ways to listen to music

From a high level, it seems like the headlines/concerns ignore or lose focus of some key points.

- Tracking stock: John Malone and Liberty have been terrific partners across a variety of businesses and intend on closing the 30% gap between the tracker and the underlying stock

- Auto: We are likely at peak auto but there are opportunities for increased volume from used cars and increased price due to unique content (Howard Stern, ESPN, CNBC etc.)

- Technology: Terrestrial radio is their biggest competitor and while new technology is easy to use, so far, they lack the content the Sirius listener wants. This is something to keep an eye on.

Changing Your Mind and Bayesian Inference

Bayesian inference is a method of updating probabilities for a hypothesis as more evidence or information becomes available. Let’s use a sports analogy and keep things simple. You believe your team has a 70% chance to win the game because a) they are playing at home, b) your team is better coached and c) you have the best player. In the 1st quarter, your star player goes down with an injury and will not return. Bayesian analysis would have you revisit your hypothesis considering the injury and reassess the probability of victory.

Sometimes these decisions are easy as in the case above but not always. What if you have developed a personal rooting interest in the team and/or spent many days and weeks analyzing the outcome only to see your analysis be worth less than before? Could you walk away from the bet? This is easier said than done. We have to fight our internal bias with an investment as we may want to believe in our original thesis. It is important to care about your investments without being emotionally invested in them. This fights much of our human nature and is something all investors struggle with and work on. Examining why you own something and adjusting your analysis to new information is critical.

On the flipside if you are constantly revisiting an idea with new information you risk trading too much and never seeing an investment thru, so equally critical is asking “what’s important” and the key 2-3 decision points. It is usually a good idea to identify them BEFORE encountering a challenge. This allows you to focus on what matters and what is noise when you encounter rocky waters.

So why am I bringing this up?

In early July, TiVo announced the immediate resignation of the new CEO, Enrique Rodriquez who began less than 1 year ago. As a brief reminder, the CEO was a central part of our investment thesis. His past relationship with the Chairman of the Board and experience with Tivo as well as his equity linked compensation, incentives and ownership were large factors in our investment. An early resignation was not an outcome I had given much thought or weight to. There is a good chance I would have passed on the investment at the outset if he was not at the helm with the above-mentioned attributes. While I still think the business could do well, from where I sit, the odds shifted and I would rather exit and reassess. Please note, the stock may go up and the business may get sold for a higher price. We can only make decisions based on information we know and probable outcomes we can infer from our work. While the outcome is a bit frustrating, I think this process works over time.

General partnership business

Starting July 1st, 2018, the management fee will be reduced to 50 basis points from 100 basis points. As I have communicated, I intended to lower the fees as the fund scaled. There is no sense in waiting to do this as I believe managers should be paid to perform, not to simply manage.

While the initial fee setup of 1% management/15% incentive is better than current marketplace offerings, investors deserve more of the pie. Lower fees will benefit our partnership and further increase our alignment.

Additionally, this past June I attended and presented at ValueX Vail. Vitaliy and his team put on an amazing few days of idea-sharing, networking and fun. Several of the people I met over the last 2 summers are big parts of my investment prospecting, discussion and sanity checks for ideas. It also helps that they are terrific people and am lucky to have them as friends. I wish everyone a great summer.

Thank you for your trust and support,

Black Bear Value Partners, LP