What’s New In Activism – Ackman Flips Netflix Bet

Bill Ackman flipped his Netflix Inc (NASDAQ:NFLX) bet, selling all of the shares owned by his firm Pershing Square Capital Management at an implied loss of roughly $400 million.

Netflix shares plunged more than 35% on April 20, their biggest one-day drop since 2014, after the streaming giant reported a 200,000 fall in subscribers in its latest quarter.

Q1 2022 hedge fund letters, conferences and more

"While Netflix's business is fundamentally simple to understand, in light of recent events, we have lost confidence in our ability to predict the company's future prospects with a sufficient degree of certainty," wrote Ackman in a letter to investors.

"One of our learnings from past mistakes is to act promptly when we discover new information about an investment that is inconsistent with our original thesis. That is why we did so here," the activist said, apparently hitting at his disastrous bet on Valeant Pharmaceuticals International, which cost Pershing Square roughly $3 billion.

To arrange an online demo of Insightia's Activism module, send us an email.

Activism chart of the week

So far this year (as of April 21, 2022), 46 U.S.-based consumer cyclical companies have been publicly subjected to activist demands. That is compared to 36 in the same period last year.

Source: Insightia | Activism

What’s New In Proxy Voting - DiNapoli praises Amazon

New York State Comptroller Thomas DiNapoli praised Amazon.com, Inc. (NASDAQ:AMZN) following the company's agreement to conduct and release an independent racial equity audit ahead of its May 25 annual meeting.

In an April 20 statement, DiNapoli and the New York State Common Retirement Fund then revealed their intention to withdraw a shareholder proposal seeking a racial equity audit.

"For Amazon, one of America's largest employers, to prioritize and examine its impacts on racial equity is a major step forward in ensuring equal opportunities and treatment in corporate America," DiNapoli said in a press release.

"We commend the company for listening to its shareholders who understand that fostering diversity, equity, and inclusion is good for business."

To arrange an online demo of Insightia's Voting module, send us an email.

Voting chart of the week

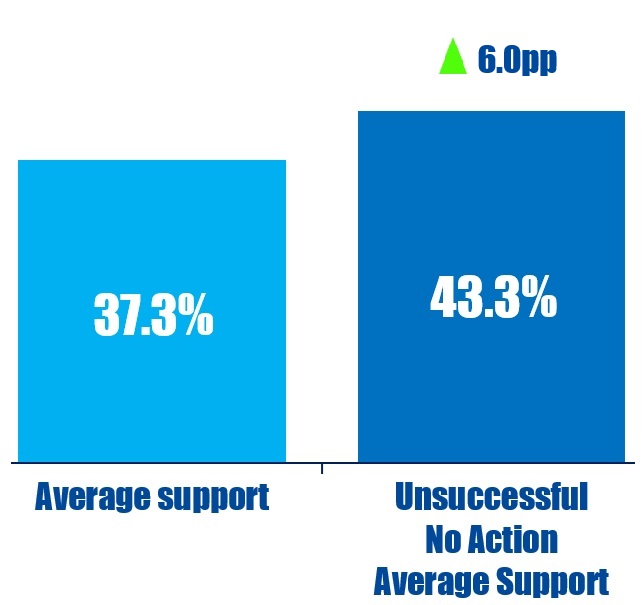

In the 12 months to April 21, 2022, environmental and social shareholder proposals at U.S. companies received an average of 37.3% support. When the company had unsuccessfully sought permission from the SEC to take no action on the proposal, support was noticeably higher at 43.3%.

Source: Insightia | Voting

What’s New In Activist Shorts - Kerrisdale v Digital World Acquisition

Kerrisdale Capital Management argued Digital World Acquisition Corp (NASDAQ:DWAC), the blank check company trying to merge with ex-President Donald Trump's new social media company, will "never" secure the necessary regulatory approval to close the deal.

In an April 20 report, Kerrisdale said that Digital World, valued at over $8 billion on a pro forma basis, will likely see pressure from authorities over its registration report, which the short seller believes is filled with "materially false and misleading" statements.

Kerrisdale said the SEC could kill the merger for such deficiencies and noted that the regulator is already investigating Digital World over its negotiations with Trump Media & Technology Group.

Digital World's stock has had a rough time in recent weeks as Truth Social, Donald Trump's new network, has faced security breaches, lengthy system outages, and several glitches since its beta launch in February.

To arrange an online demo of Insightia's Shorts module, send us an email.

Shorts chart of the week

So far this year (as of April 22, 2022), White Diamond Research has publicly subjected four companies to an activist short campaign. That is up from one in the same period last year.

Source: Insightia | Shorts

Quote Of The Week

This week's quote comes from As You Sow's CEO Andrew Behar as part of an in-depth story on Insightia's Activism module.

“It’s hard for an oil company that has been losing money for 10 years and saying, ‘don’t look at the short-term,’ to say it’s all rosy now. Investors are smarter than that too.” – Andrew Behar